Modular home and building manufacturer Skyline Champion (NYSE: SKY) met Wall Street’s revenue expectations in Q3 CY2024, with sales up 32.9% year on year to $616.9 million. Its non-GAAP profit of $0.93 per share was 16.4% above analysts’ consensus estimates.

Is now the time to buy Skyline Champion? Find out by accessing our full research report, it’s free.

Skyline Champion (SKY) Q3 CY2024 Highlights:

- Revenue: $616.9 million vs analyst estimates of $618.8 million (in line)

- Adjusted EPS: $0.93 vs analyst estimates of $0.80 (16.4% beat)

- EBITDA: $74.24 million vs analyst estimates of $67.83 million (9.5% beat)

- Gross Margin (GAAP): 27%, up from 25.1% in the same quarter last year

- Operating Margin: 10.8%, in line with the same quarter last year

- EBITDA Margin: 12%, in line with the same quarter last year

- Free Cash Flow Margin: 7.4%, down from 9% in the same quarter last year

- Sales Volumes rose 31.3% year on year (-33.4% in the same quarter last year)

- Market Capitalization: $5.07 billion

“I am pleased to report that Champion Homes delivered another strong quarter, generating healthy margins and cash flow," said Mark Yost, President and Chief Executive Officer of Champion Homes.

Company Overview

Founded in 1951, Skyline Champion (NYSE: SKY) is a manufacturer of modular homes and buildings in North America.

Home Builders

Traditionally, homebuilders have built competitive advantages with economies of scale that lead to advantaged purchasing and brand recognition among consumers. Aesthetic trends have always been important in the space, but more recently, energy efficiency and conservation are driving innovation. However, these companies are still at the whim of the macro, specifically interest rates that heavily impact new and existing home sales. In fact, homebuilders are one of the most cyclical subsectors within industrials.

Sales Growth

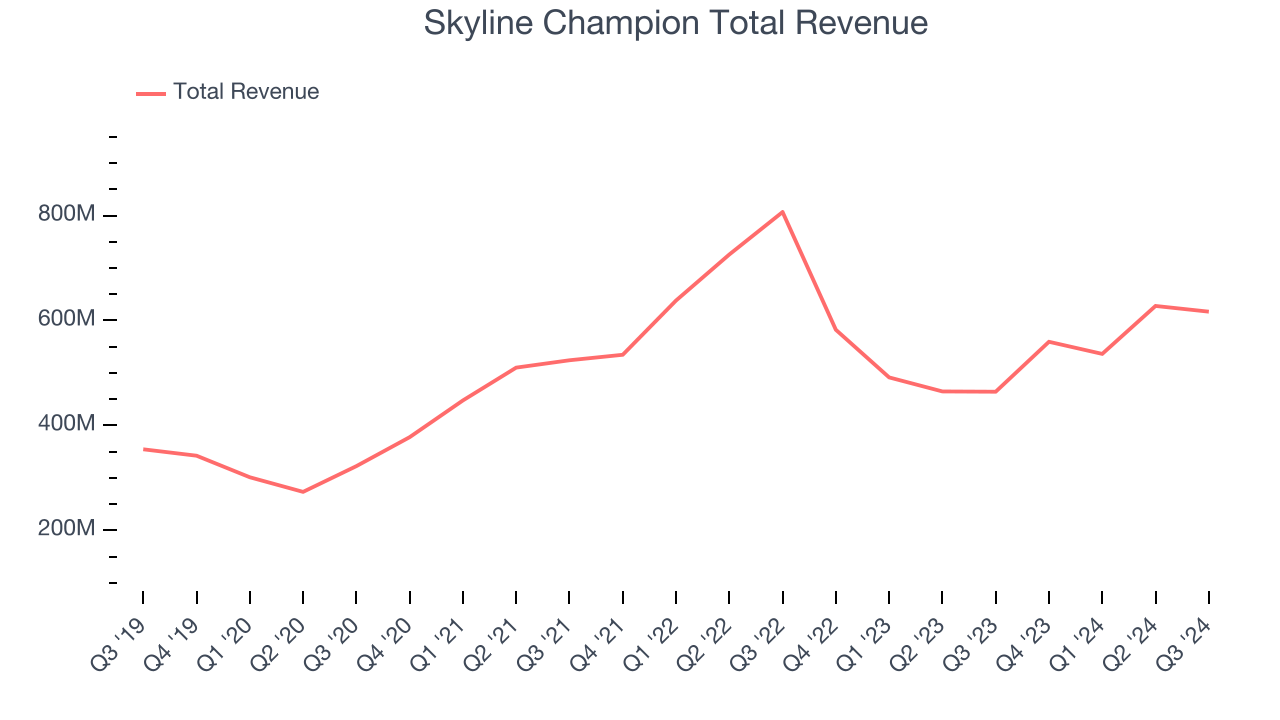

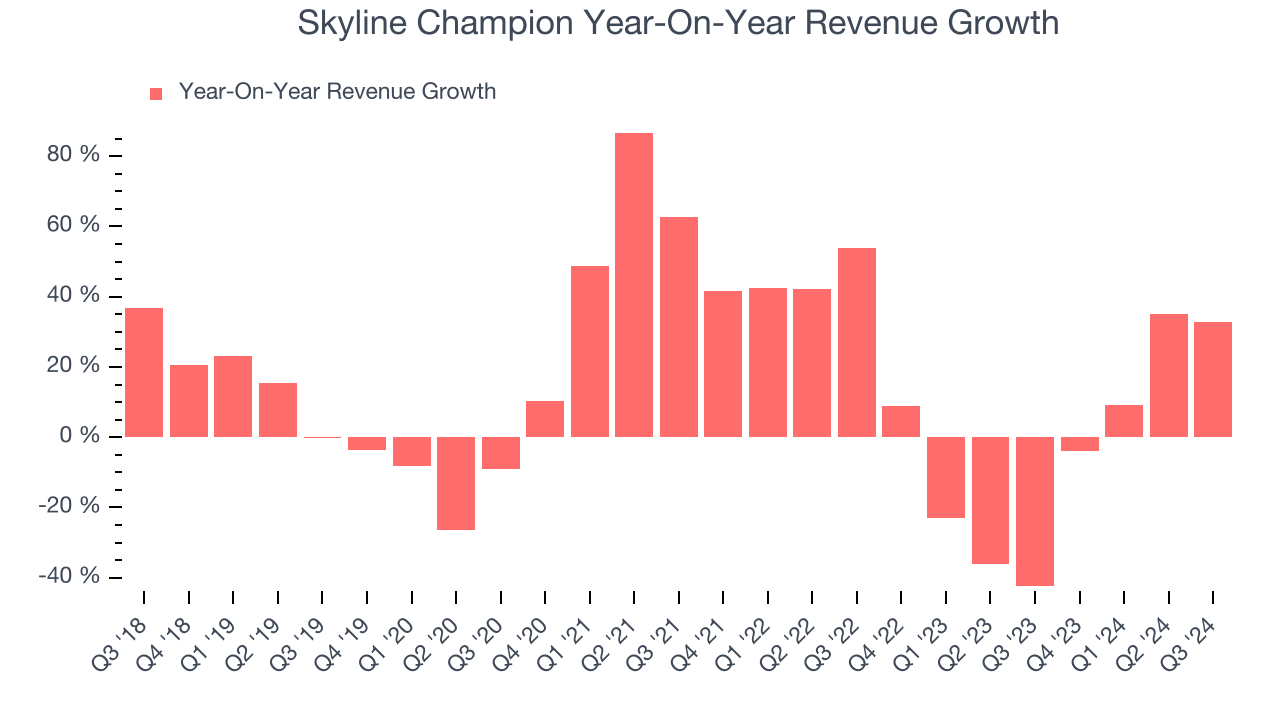

Reviewing a company’s long-term performance can reveal insights into its business quality. Any business can have short-term success, but a top-tier one sustains growth for years. Over the last five years, Skyline Champion grew its sales at an impressive 10.7% compounded annual growth rate. This is a useful starting point for our analysis.

We at StockStory place the most emphasis on long-term growth, but within industrials, a half-decade historical view may miss cycles, industry trends, or a company capitalizing on catalysts such as a new contract win or a successful product line. Skyline Champion’s recent history marks a sharp pivot from its five-year trend as its revenue has shown annualized declines of 7% over the last two years.

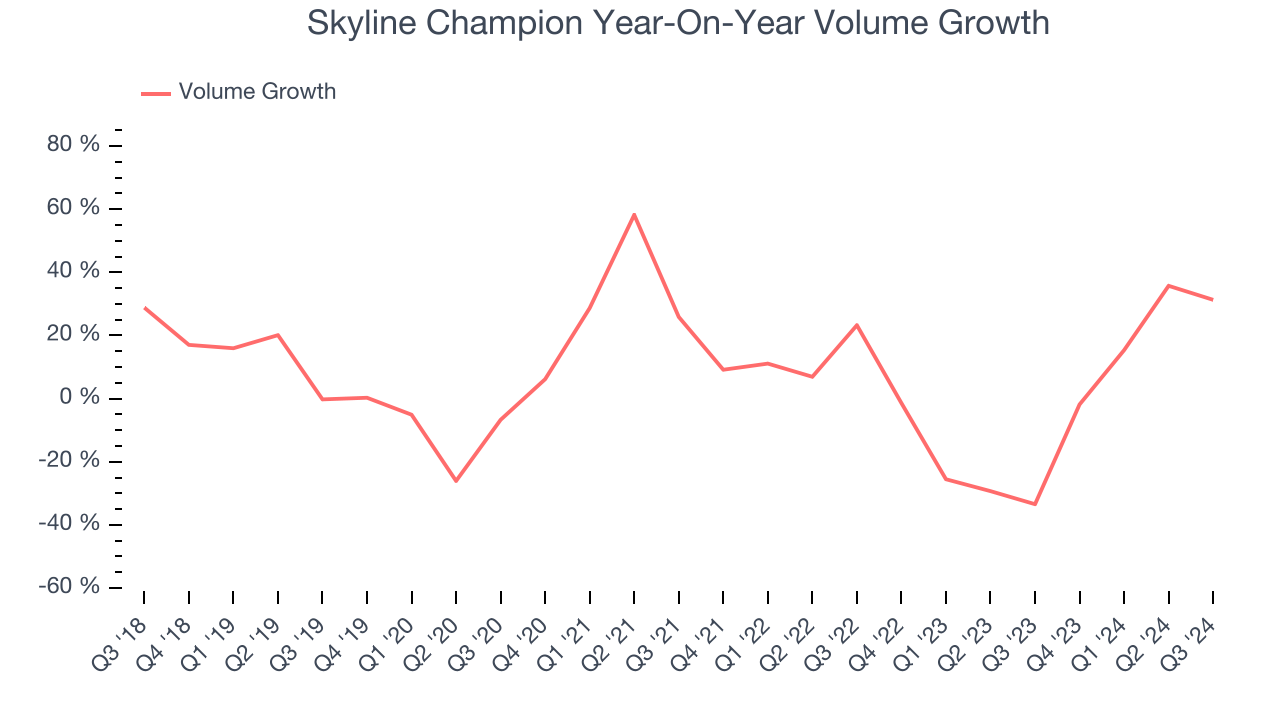

Skyline Champion also reports its sales volumes, which reached 6,357 in the latest quarter. Over the last two years, Skyline Champion’s sales volumes averaged 1.1% year-on-year declines. Because this number is better than its revenue growth, we can see the company’s average selling price decreased.

This quarter, Skyline Champion’s year-on-year revenue growth of 32.9% was wonderful, and its $616.9 million of revenue was in line with Wall Street’s estimates.

Looking ahead, sell-side analysts expect revenue to grow 8.9% over the next 12 months, an improvement versus the last two years. This projection is above average for the sector and indicates the market thinks its newer products and services will fuel higher growth rates.

Unless you’ve been living under a rock, it should be obvious by now that generative AI is going to have a huge impact on how large corporations do business. While Nvidia and AMD are trading close to all-time highs, we prefer a lesser-known (but still profitable) semiconductor stock benefitting from the rise of AI. Click here to access our free report on our favorite semiconductor growth story.

Operating Margin

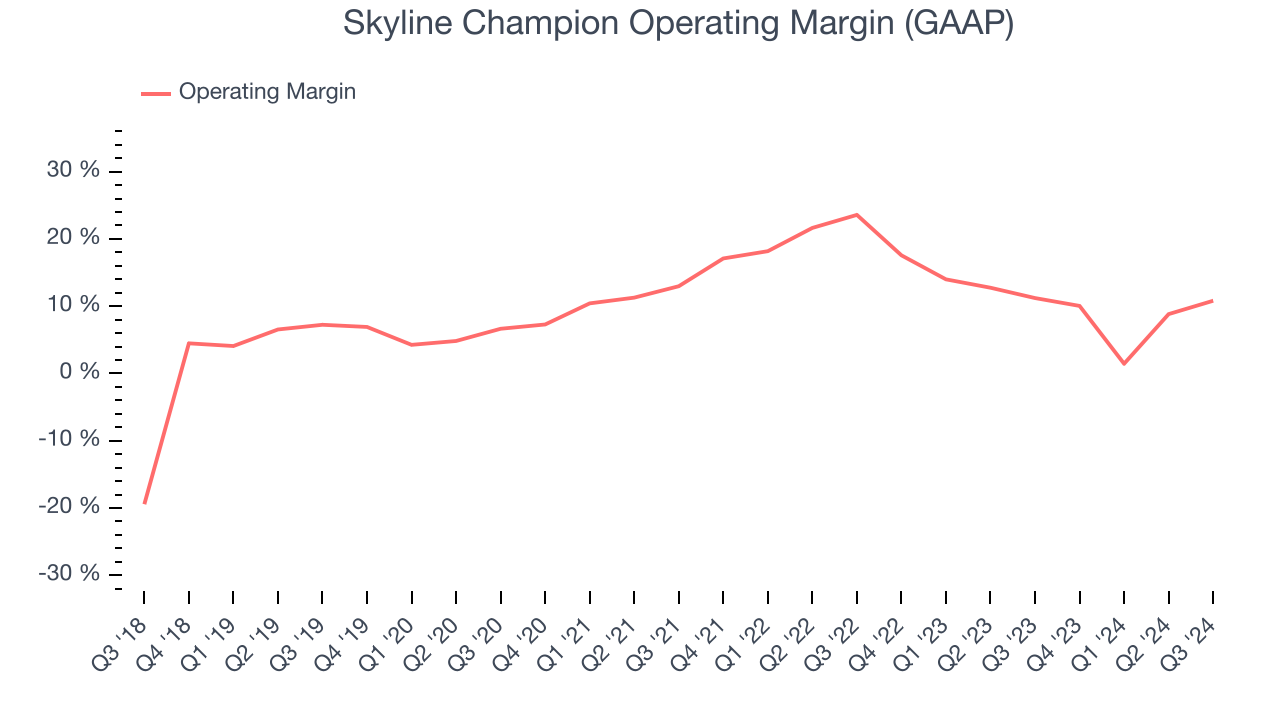

Skyline Champion has been an optimally-run company over the last five years. It was one of the more profitable businesses in the industrials sector, boasting an average operating margin of 12.7%. This result was particularly impressive because of its low gross margin, which is mostly a factor of what it sells and takes huge shifts to move meaningfully. Companies have more control over their operating margins, and it’s a show of well-managed operations if they’re high when gross margins are low.

Looking at the trend in its profitability, Skyline Champion’s annual operating margin rose by 2.2 percentage points over the last five years, as its sales growth gave it operating leverage.

This quarter, Skyline Champion generated an operating profit margin of 10.8%, in line with the same quarter last year. This indicates the company’s cost structure has recently been stable.

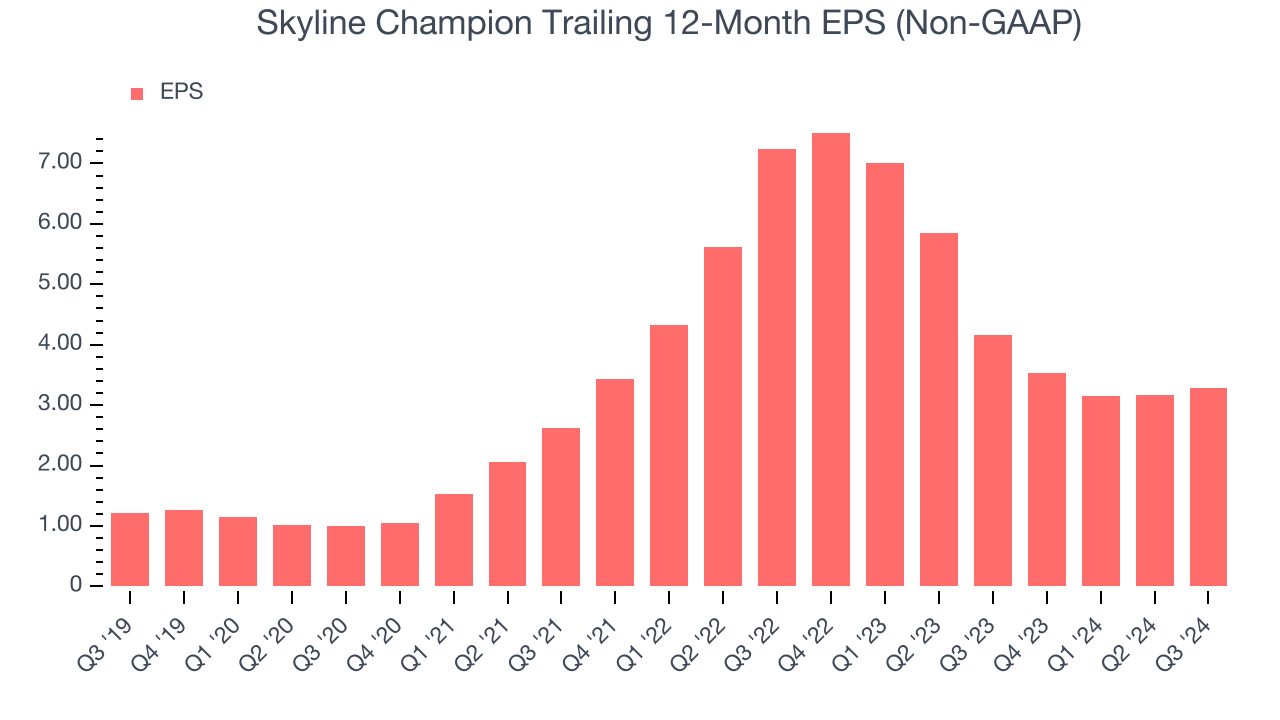

Earnings Per Share

We track the long-term change in earnings per share (EPS) for the same reason as long-term revenue growth. Compared to revenue, however, EPS highlights whether a company’s growth was profitable.

Skyline Champion’s EPS grew at an astounding 21.9% compounded annual growth rate over the last five years, higher than its 10.7% annualized revenue growth. This tells us the company became more profitable as it expanded.

Diving into the nuances of Skyline Champion’s earnings can give us a better understanding of its performance. As we mentioned earlier, Skyline Champion’s operating margin was flat this quarter but expanded by 2.2 percentage points over the last five years. This was the most relevant factor (aside from the revenue impact) behind its higher earnings; taxes and interest expenses can also affect EPS but don’t tell us as much about a company’s fundamentals.

Like with revenue, we analyze EPS over a shorter period to see if we are missing a change in the business.

For Skyline Champion, its two-year annual EPS declines of 32.7% mark a reversal from its (seemingly) healthy five-year trend. We hope Skyline Champion can return to earnings growth in the future.In Q3, Skyline Champion reported EPS at $0.93, up from $0.82 in the same quarter last year. This print easily cleared analysts’ estimates, and shareholders should be content with the results. Over the next 12 months, Wall Street expects Skyline Champion’s full-year EPS of $3.28 to grow by 7.5%.

Key Takeaways from Skyline Champion’s Q3 Results

We were impressed by how significantly Skyline Champion blew past analysts’ volume expectations this quarter. We were also excited its EBITDA outperformed Wall Street’s estimates. On the other hand, its revenue unfortunately missed. Zooming out, we think this was a mixed quarter. The stock remained flat at $90.85 immediately following the results.

Should you buy the stock or not?The latest quarter does matter, but not nearly as much as longer-term fundamentals and valuation, when deciding if the stock is a buy. We cover that in our actionable full research report which you can read here, it’s free.