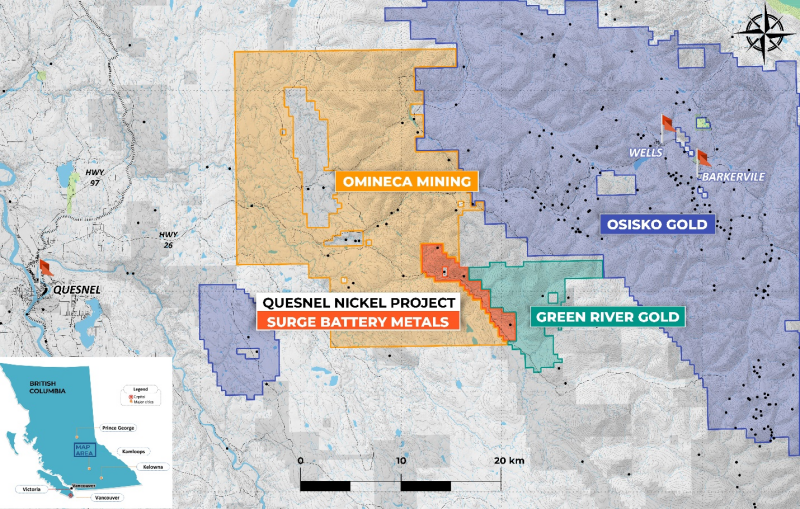

Vancouver, BC - TheNewswire - April 26, 2021 - Surge Battery Minerals Inc. (the “Company” or “Surge”) (TSXV:NILI) (OTC:NILIF) (FRA:DJ5C) is pleased to report it has negotiated an Option Agreement with Green River Gold Corp. (CSE: CCR) for the acquisition of an 80% interest in a large contiguous block of 8 mineral claims comprising 2,219.34 hectares. The property is located 25 km east of the town of Quesnel in the central interior of British Columbia and is accessible year-round via provincial highway 26 and various well-maintained forestry roads.

Greg Reimer, Surge’s President & CEO comments “The Quesnel Nickel Project is at an early exploration stage with a very good possibility for hosting nickel alloy mineralization (awaruite) similar to the Decar District of FPX Nickel (TSXV: FPX). The project area covers a favorable linear NW-SE striking geological unit approximately 15km by 3km hosting nickel mineralization in serpentinite and sheared ultramafic rock, a similar geological host as the Trembleur ultramafic rocks found at Decar. With 2,434,965 tonnes of contained metal at a grade of 0.12% Ni, Decar has been recognized by www.mining.com as the third top nickel project in the world.” (See article here)

Government aeromagnetic data over the Quesnel Nickel Project indicates the presence of highly magnetic rocks co-incident with the interpreted surface exposure and down-dip projection of the favorable geologic unit. This is similar to the aeromagnetic response in the area of nickel-alloy mineralization found throughout in the Decar District.

Within the Quesnel Nickel Project area there are 4 BC MINFILE occurrences as follows:

-

- 093A 013 – Sovereign Creek – developed prospect containing talc and magnesite, and co-incident showing containing nickel sulfides.

- 093A 130 – Sovereign – showings containing talc and nickel sulfides.

- 093A 139 - Fontaine Creek – showing containing asbestos.

- 093H 061 – R.T. – showing containing nickel, chromium, and cobalt.

The four BC MINFILE occurrences are based on exploration work documented in 16 BC ARIS and 12 BC Property File reports, as well as various government agency reports and maps.

Within the property, limited rock sampling and analyses indicates nickel grades of 0.1 to 0.2% have been found in ultramafic rocks, comparable to those in the Decar District. Preliminary metallurgical work completed in 1971 has suggested the presence of nickel sulphide or nickel alloy minerals, but no Davis Tube analyses appear to have been conducted on any of the samples to confirm the presence of nickel alloys minerals, such as awaruite.

A September 10, 1971 report by Findlay Consultants Limited of Morrisburg, Ontario, publicly available in BC Property File stated the following in a report to Cypress Exploration: “Mr. Trifaux (owner) has submitted a list of 17 undocumented grab sample assays with nickel values ranging from 0.15 to 0.26 per cent and an arithmetic mean of 0.22 per cent to Dr. O.R. Eckstrand, Geological Survey, Ottawa”. Furthermore “the owner (Trifaux) has had a preliminary metallurgical (separation) study conducted by Ferromagnetic Laboratories, Montreal. This study indicated that up to 54 per cent of the total rock nickel was recoverable in -200 mesh grind magnetic separations – indicating that about half the nickel is in non-silicate (sulphide, F./Ni alloy, magnetite, etc.) matrix”. This information should not be relied upon since it has not been independently confirmed by the Company.

Mr. Reimer goes on to state: “The Quesnel Nickel Project is an exciting, early-stage nickel project with the correct geological and geophysical characteristics to host nickel-alloy mineralization, with many similar features to the Decar District. We intend to immediately file our work permits to be approved and to start work early this summer.”

Terms of the Option

To exercise the Option, the Optionee must issue shares to the Optionor, in the aggregate sums shown in the following table:

|

Date |

Shares to be Issued |

|

Upon signing the agreement |

500,000 |

|

1st Anniversary date of the effective date |

150,000 |

|

2nd Anniversary date of the effective date |

200,000 |

|

3rd Anniversary date of the effective date |

250,000 |

|

4th Anniversary date of the effective date |

300,000 |

In addition to the issuance of shares as described, the Optionee must incur no less than $800,000 in Mining Work expenditures on the Property by the end of the 4th Anniversary date of the effective date of the Option Agreement. Upon the Optionee exercising its 80% interest in the Property a joint venture shall be formed with each party to contribute their share of future development and production costs. In the event the Optionor does not choose to contribute their share of future costs then their 20% interest would convert to a 2% NSR.

The Company has also agreed to pay a finder’s fee in the amount of 200,000 shares in connection with the Acquisition. All finder’s fees are subject to Exchange approval.

All securities issued in connection with the Acquisition are subject to a four‐month and a day hold in accordance with applicable Canadian Securities Laws.

Jacques Houle, P. Eng., a qualified person within the context of NI 43-101, has reviewed and approved the contents of this news release.

About Surge Battery Metals Inc. surgebatterymetals.com

The Company is a Canadian-based mineral exploration company which has been active in the resource sector in British Columbia and elsewhere in Canada.

On Behalf of the Board of Directors

“Greg Reimer”

Greg Reimer, President & CEO

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release. This news release may contain forward‐looking statements which include, but are not limited to, comments that involve future events and conditions, which are subject to various risks and uncertainties. Except for statements of historical facts, comments that address resource potential, upcoming work programs, geological interpretations, receipt and security of mineral property titles, availability of funds, and others are forward‐looking. Forward‐looking statements are not guaranteeing future performance and actual results may vary materially from those statements. General business conditions are factors that could cause actual results to vary materially from forward‐looking statements.

Copyright (c) 2021 TheNewswire - All rights reserved.