Over the past six months, Papa John’s shares (currently trading at $34.24) have posted a disappointing 15.5% loss, well below the S&P 500’s 8.4% gain. This was partly driven by its softer quarterly results and might have investors contemplating their next move.

Is now the time to buy Papa John's, or should you be careful about including it in your portfolio? Get the full breakdown from our expert analysts, it’s free.

Why Do We Think Papa John's Will Underperform?

Even though the stock has become cheaper, we're sitting this one out for now. Here are three reasons you should be careful with PZZA and a stock we'd rather own.

1. Shrinking Same-Store Sales Indicate Waning Demand

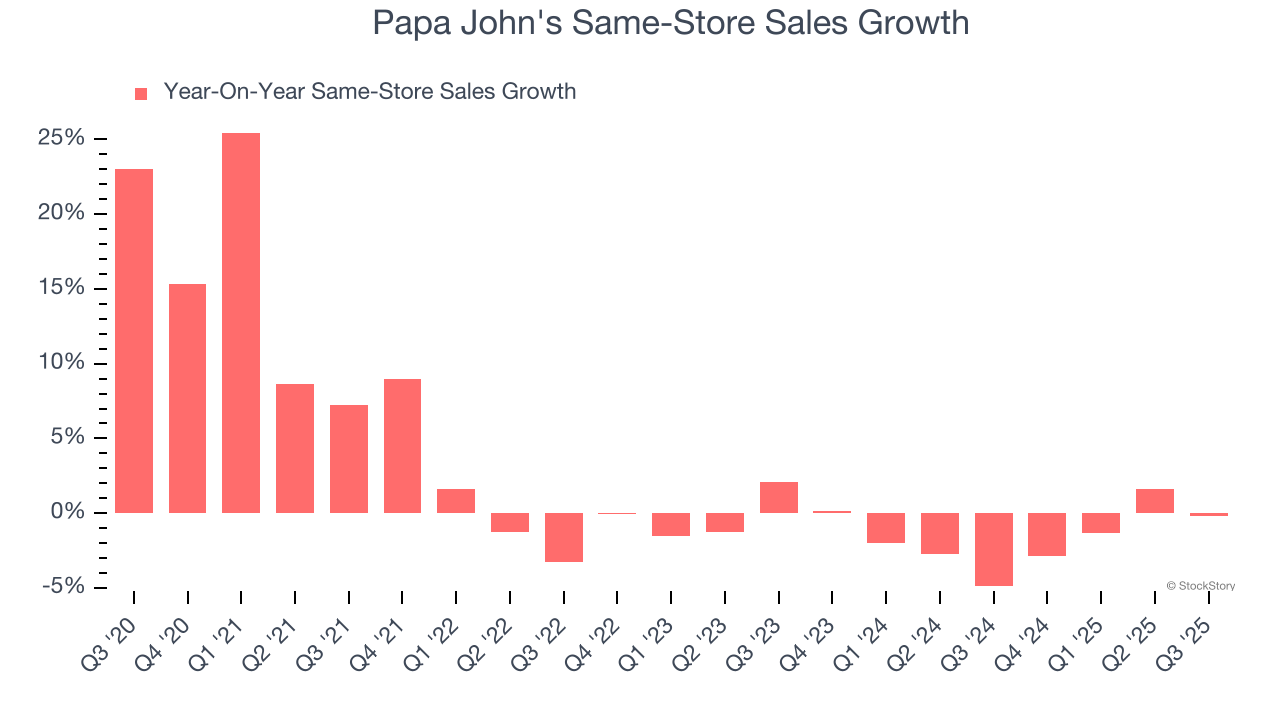

Same-store sales is an industry measure of whether revenue is growing at existing restaurants, and it is driven by customer visits (often called traffic) and the average spending per customer (ticket).

Papa John’s demand has been shrinking over the last two years as its same-store sales have averaged 1.5% annual declines.

2. Low Gross Margin Reveals Weak Structural Profitability

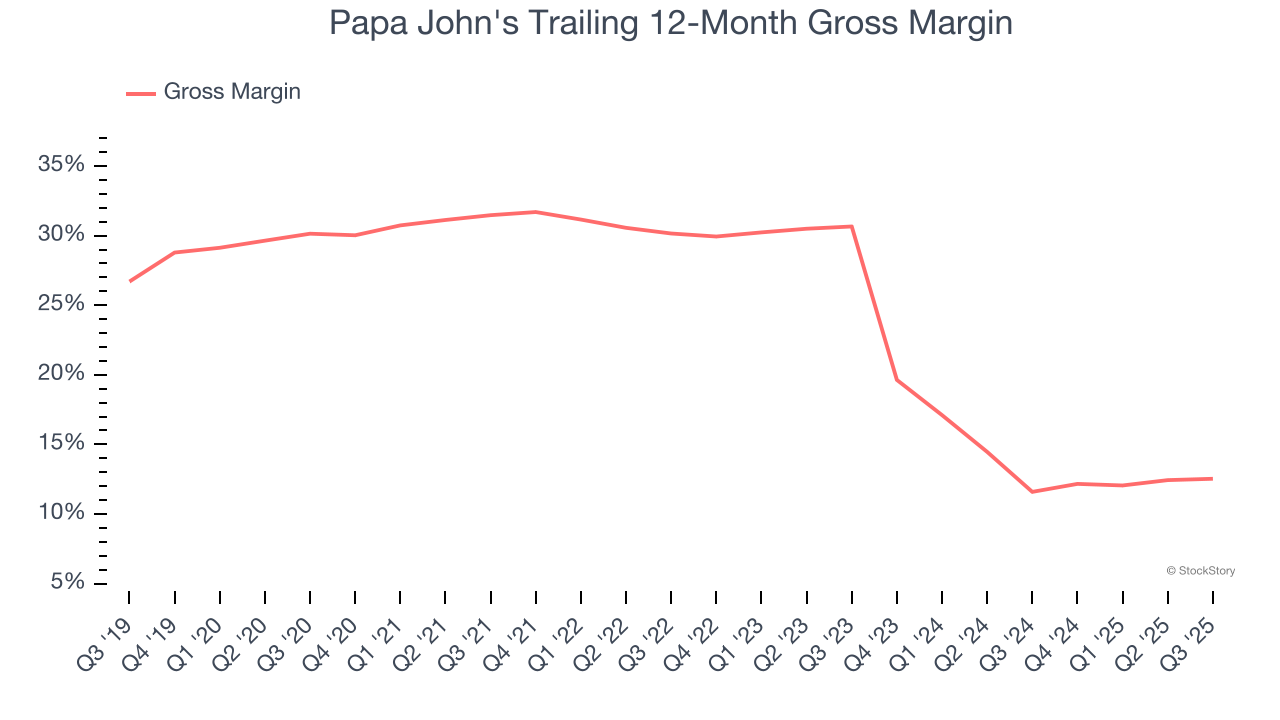

Gross profit margins are an important measure of a restaurant’s pricing power and differentiation, whether it be the dining experience or quality and taste of food.

Papa John's has bad unit economics for a restaurant company, signaling it operates in a competitive market and has little room for error if demand unexpectedly falls. As you can see below, it averaged a 12.1% gross margin over the last two years. That means Papa John's paid its suppliers a lot of money ($87.94 for every $100 in revenue) to run its business.

3. Shrinking Operating Margin

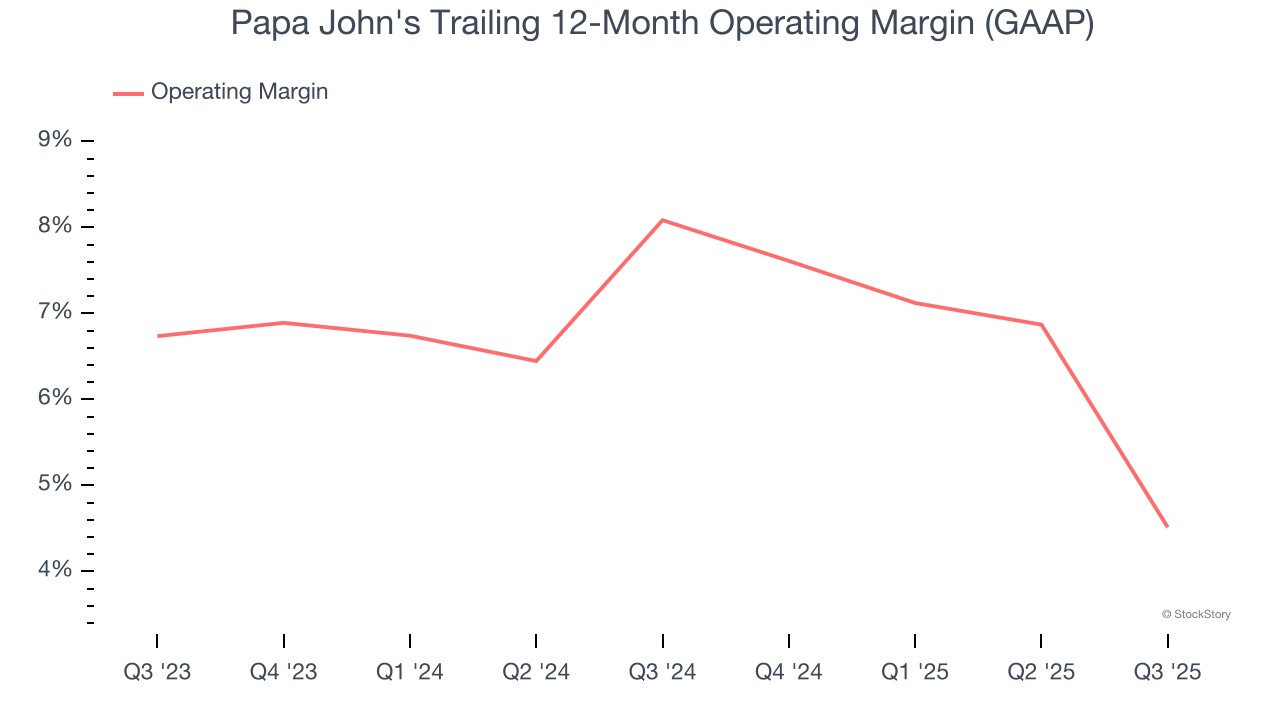

Operating margin is a key profitability metric because it accounts for all expenses keeping the business in motion, including food costs, wages, rent, advertising, and other administrative costs.

Analyzing the trend in its profitability, Papa John’s operating margin decreased by 3.6 percentage points over the last year. This raises questions about the company’s expense base because its revenue growth should have given it leverage on its fixed costs, resulting in better economies of scale and profitability. Papa John’s performance was poor no matter how you look at it - it shows that costs were rising and it couldn’t pass them onto its customers. Its operating margin for the trailing 12 months was 4.5%.

Final Judgment

We cheer for all companies serving everyday consumers, but in the case of Papa John's, we’ll be cheering from the sidelines. After the recent drawdown, the stock trades at 19.9× forward P/E (or $34.24 per share). While this valuation is fair, the upside isn’t great compared to the potential downside. There are more exciting stocks to buy at the moment. We’d suggest looking at a dominant Aerospace business that has perfected its M&A strategy.

Stocks We Like More Than Papa John's

The market’s up big this year - but there’s a catch. Just 4 stocks account for half the S&P 500’s entire gain. That kind of concentration makes investors nervous, and for good reason. While everyone piles into the same crowded names, smart investors are hunting quality where no one’s looking - and paying a fraction of the price. Check out the high-quality names we’ve flagged in our Top 9 Market-Beating Stocks. This is a curated list of our High Quality stocks that have generated a market-beating return of 244% over the last five years (as of June 30, 2025).

Stocks that have made our list include now familiar names such as Nvidia (+1,326% between June 2020 and June 2025) as well as under-the-radar businesses like the once-small-cap company Exlservice (+354% five-year return). Find your next big winner with StockStory today.