Alternative investment management firm Hamilton Lane (NASDAQ: HLNE) reported revenue ahead of Wall Streets expectations in Q4 CY2025, with sales up 18% year on year to $198.6 million. Its non-GAAP profit of $1.55 per share was 16.9% above analysts’ consensus estimates.

Is now the time to buy Hamilton Lane? Find out by accessing our full research report, it’s free.

Hamilton Lane (HLNE) Q4 CY2025 Highlights:

- Management Fees: $153.2 million vs analyst estimates of $147.5 million (21.3% year-on-year growth, 3.9% beat)

- Revenue: $198.6 million vs analyst estimates of $193.9 million (18% year-on-year growth, 2.4% beat)

- Pre-tax Profit: $120.1 million (60.5% margin)

- Adjusted EPS: $1.55 vs analyst estimates of $1.33 (16.9% beat)

- Market Capitalization: $6.22 billion

Company Overview

With over $100 billion in assets under management and supervision, Hamilton Lane (NASDAQ: HLNE) is an investment management firm that specializes in private markets, offering advisory services and fund solutions to institutional and private wealth investors.

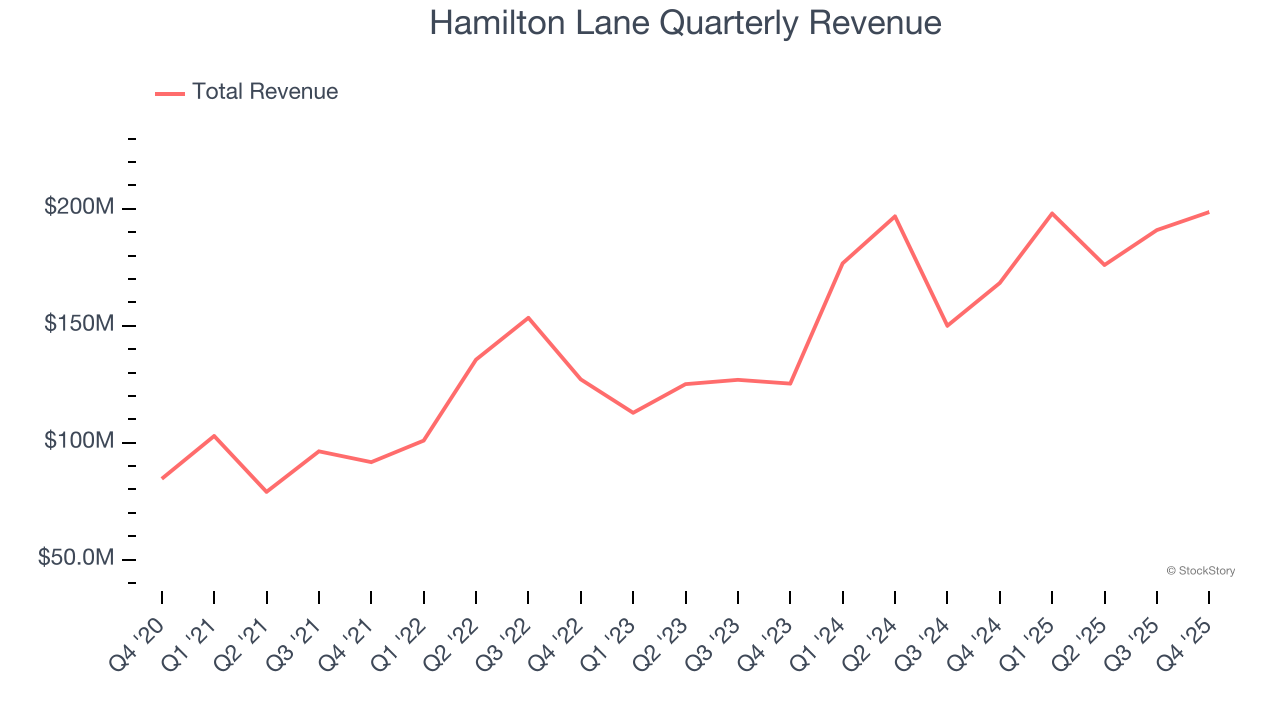

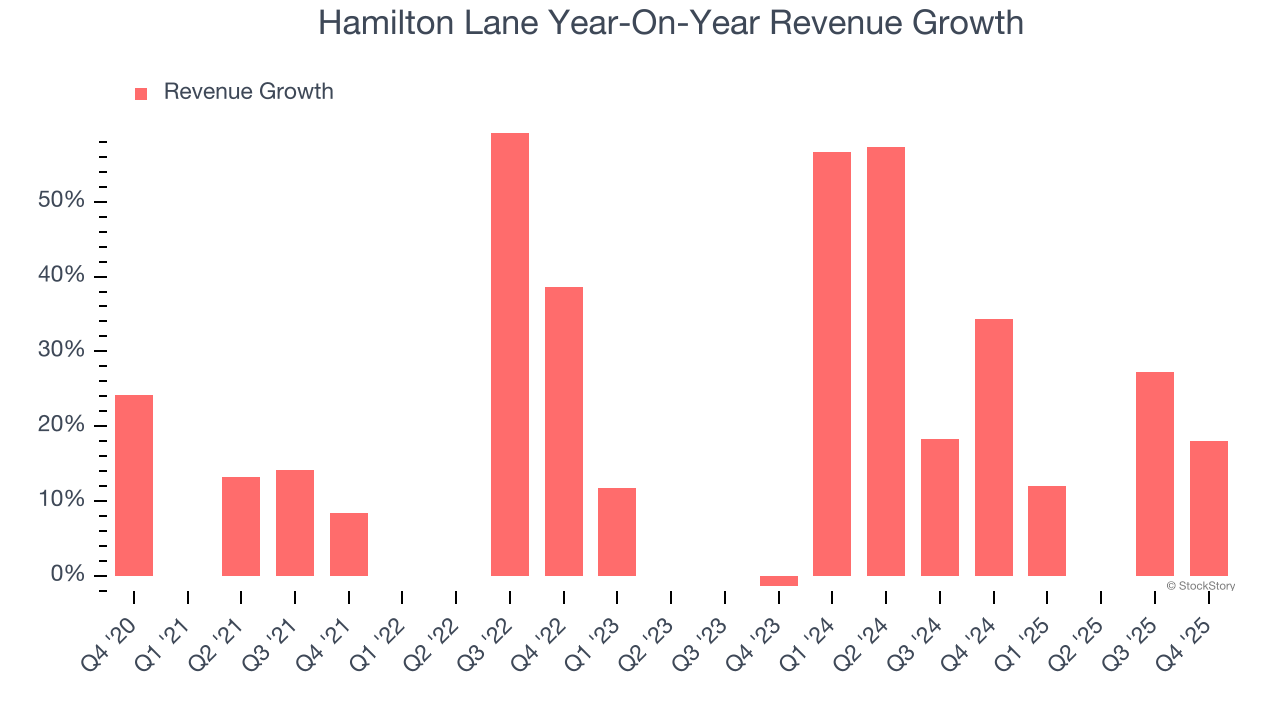

Revenue Growth

A company’s long-term sales performance is one signal of its overall quality. Any business can experience short-term success, but top-performing ones enjoy sustained growth for years. Luckily, Hamilton Lane’s revenue grew at an excellent 19.3% compounded annual growth rate over the last five years. Its growth surpassed the average financials company and shows its offerings resonate with customers, a great starting point for our analysis.

Long-term growth is the most important, but within financials, a half-decade historical view may miss recent interest rate changes and market returns. Hamilton Lane’s annualized revenue growth of 24.8% over the last two years is above its five-year trend, suggesting its demand was strong and recently accelerated.  Note: Quarters not shown were determined to be outliers, impacted by outsized investment gains/losses that are not indicative of the recurring fundamentals of the business.

Note: Quarters not shown were determined to be outliers, impacted by outsized investment gains/losses that are not indicative of the recurring fundamentals of the business.

This quarter, Hamilton Lane reported year-on-year revenue growth of 18%, and its $198.6 million of revenue exceeded Wall Street’s estimates by 2.4%.

While Wall Street chases Nvidia at all-time highs, an under-the-radar semiconductor supplier is dominating a critical AI component these giants can’t build without. Click here to access our free report one of our favorites growth stories.

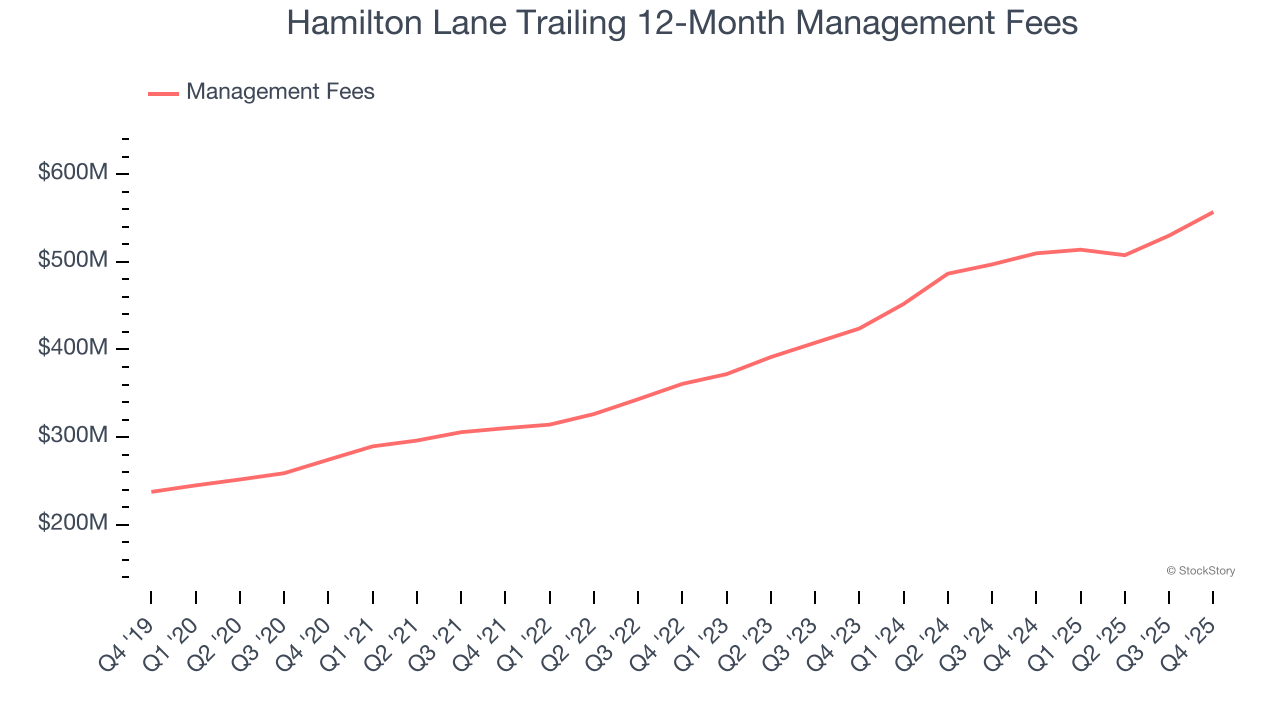

Management Fees

While assets under management are the committed capital by clients - not revenue itself - they directly influence how much firms can earn in the form of management fees, which are charged as a percentage of AUM.

Hamilton Lane’s management fees have grown at an annual rate of 15.2% over the last five years, better than the broader financials industry but slower than its total revenue. Ignoring performance fees that typically range from 10-20% of investment gains, this tells us its asset management division was a net detractor to the company. When analyzing Hamilton Lane’s management fees over the last two years, we can see that growth decelerated to 14.6% annually.

In Q4, Hamilton Lane’s management fees were $153.2 million, beating analysts’ expectations by 3.9%. This print was 21.3% higher than the same quarter last year.

Key Takeaways from Hamilton Lane’s Q4 Results

We were impressed by how significantly Hamilton Lane blew past analysts’ management fees expectations this quarter. We were also excited its EBITDA outperformed Wall Street’s estimates by a wide margin. Zooming out, we think this was a good print with some key areas of upside. The stock remained flat at $141.71 immediately following the results.

Hamilton Lane had an encouraging quarter, but one earnings result doesn’t necessarily make the stock a buy. Let’s see if this is a good investment. If you’re making that decision, you should consider the bigger picture of valuation, business qualities, as well as the latest earnings. We cover that in our actionable full research report which you can read here (it’s free).