Funeral services company Service International (NYSE: SCI) met Wall Street’s revenue expectations in Q4 CY2025, with sales up 1.7% year on year to $1.11 billion. Its non-GAAP profit of $1.14 per share was in line with analysts’ consensus estimates.

Is now the time to buy Service International? Find out by accessing our full research report, it’s free.

Service International (SCI) Q4 CY2025 Highlights:

- Revenue: $1.11 billion vs analyst estimates of $1.12 billion (1.7% year-on-year growth, in line)

- Adjusted EPS: $1.14 vs analyst estimates of $1.14 (in line)

- Adjusted EBITDA: $331.7 million vs analyst estimates of $365.2 million (29.8% margin, 9.2% miss)

- Adjusted EPS guidance for the upcoming financial year 2026 is $4.20 at the midpoint, missing analyst estimates by 1.3%

- Operating Margin: 24.8%, in line with the same quarter last year

- Free Cash Flow Margin: 7.8%, down from 13.9% in the same quarter last year

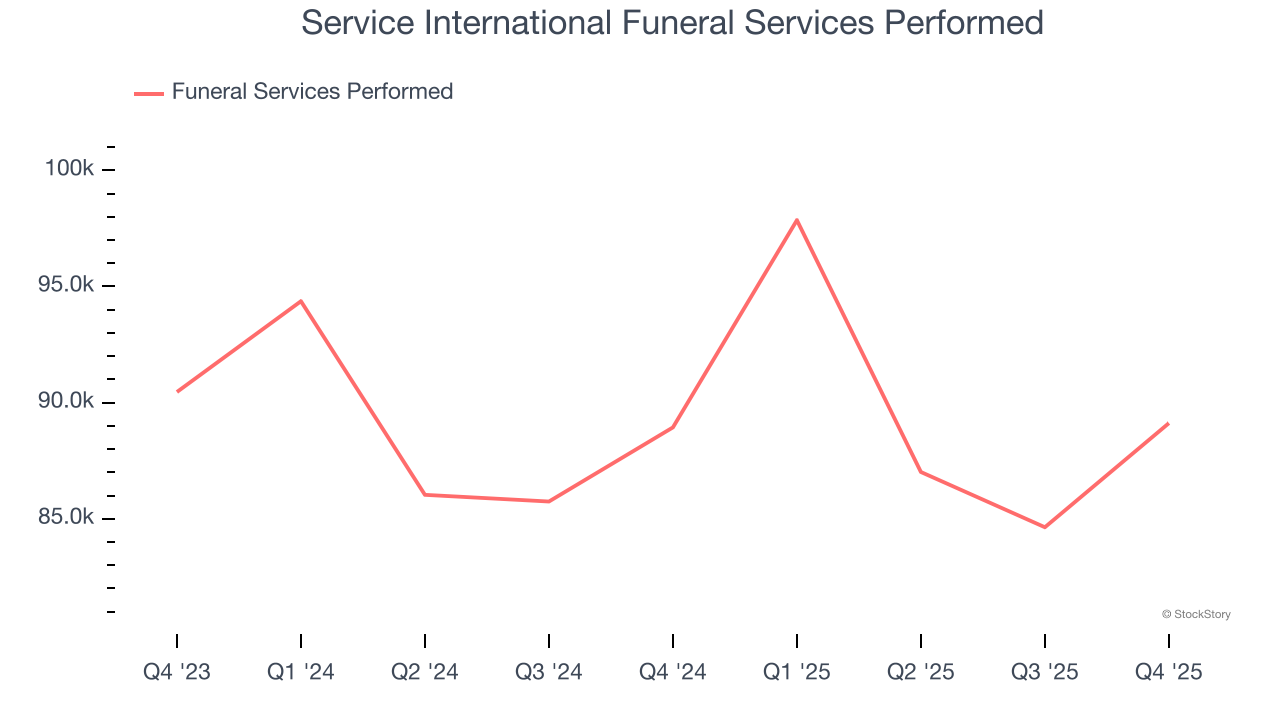

- Funeral Services Performed: 89,117, in line with the same quarter last year

- Market Capitalization: $11.69 billion

Company Overview

Founded in 1962, Service International (NYSE: SCI) is a leading provider of death care products and services in North America.

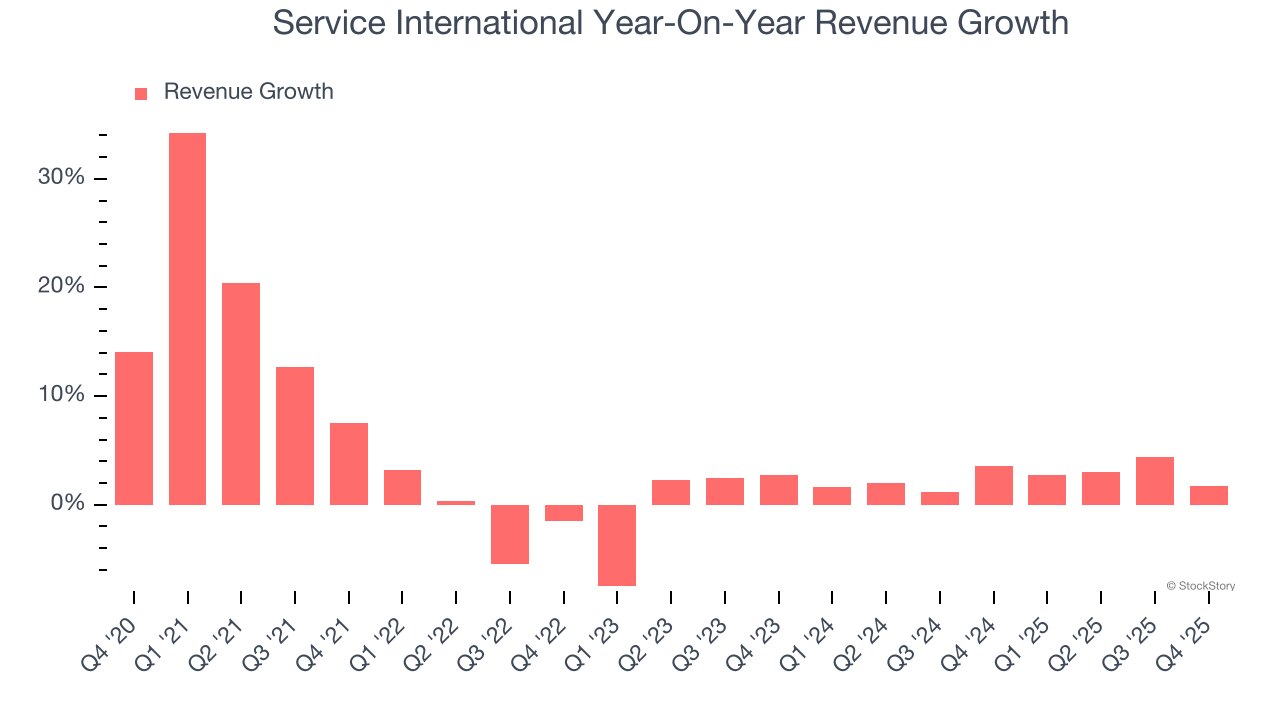

Revenue Growth

A company’s long-term sales performance is one signal of its overall quality. Even a bad business can shine for one or two quarters, but a top-tier one grows for years. Regrettably, Service International’s sales grew at a weak 4.2% compounded annual growth rate over the last five years. This fell short of our benchmark for the consumer discretionary sector and is a poor baseline for our analysis.

We at StockStory place the most emphasis on long-term growth, but within consumer discretionary, a stretched historical view may miss a company riding a successful new product or trend. Service International’s recent performance shows its demand has slowed as its annualized revenue growth of 2.5% over the last two years was below its five-year trend. We’re wary when companies in the sector see decelerations in revenue growth, as it could signal changing consumer tastes aided by low switching costs.

Service International also discloses its number of funeral services performed, which reached 89,117 in the latest quarter. Over the last two years, Service International’s funeral services performed were flat. Because this number is lower than its revenue growth during the same period, we can see the company’s monetization has risen.

This quarter, Service International grew its revenue by 1.7% year on year, and its $1.11 billion of revenue was in line with Wall Street’s estimates.

Looking ahead, sell-side analysts expect revenue to grow 3.6% over the next 12 months, similar to its two-year rate. Although this projection indicates its newer products and services will fuel better top-line performance, it is still below the sector average.

The 1999 book Gorilla Game predicted Microsoft and Apple would dominate tech before it happened. Its thesis? Identify the platform winners early. Today, enterprise software companies embedding generative AI are becoming the new gorillas. a profitable, fast-growing enterprise software stock that is already riding the automation wave and looking to catch the generative AI next.

Operating Margin

Operating margin is a key measure of profitability. Think of it as net income - the bottom line - excluding the impact of taxes and interest on debt, which are less connected to business fundamentals.

Service International’s operating margin might fluctuated slightly over the last 12 months but has generally stayed the same, averaging 22.4% over the last two years. This profitability was lousy for a consumer discretionary business and caused by its suboptimal cost structure.

In Q4, Service International generated an operating margin profit margin of 24.8%, in line with the same quarter last year. This indicates the company’s overall cost structure has been relatively stable.

Earnings Per Share

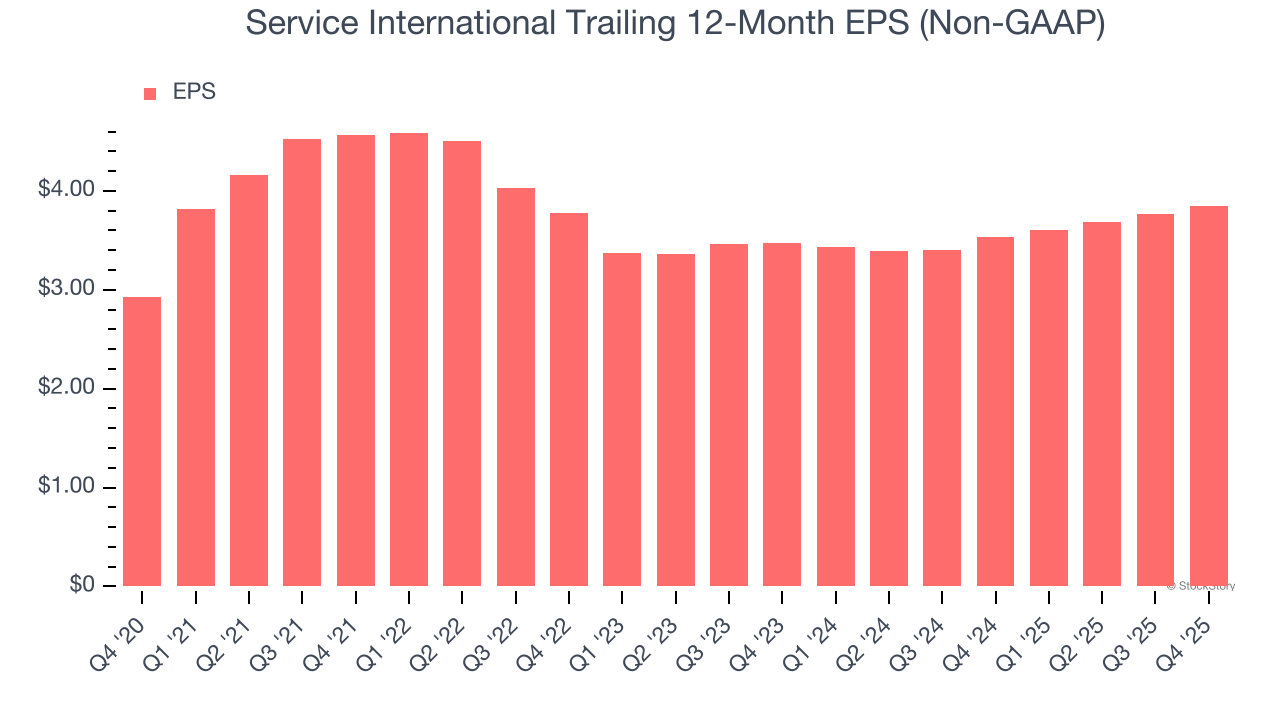

Revenue trends explain a company’s historical growth, but the long-term change in earnings per share (EPS) points to the profitability of that growth – for example, a company could inflate its sales through excessive spending on advertising and promotions.

Service International’s weak 5.6% annual EPS growth over the last five years aligns with its revenue performance. This tells us it maintained its per-share profitability as it expanded.

In Q4, Service International reported adjusted EPS of $1.14, up from $1.06 in the same quarter last year. This print was close to analysts’ estimates. Over the next 12 months, Wall Street expects Service International’s full-year EPS of $3.85 to grow 10.4%.

Key Takeaways from Service International’s Q4 Results

We struggled to find many positives in these results. Its EBITDA missed and its full-year EPS guidance fell slightly short of Wall Street’s estimates. Overall, this quarter could have been better. The stock traded down 3.6% to $81.42 immediately after reporting.

Service International underperformed this quarter, but does that create an opportunity to invest right now? If you’re making that decision, you should consider the bigger picture of valuation, business qualities, as well as the latest earnings. We cover that in our actionable full research report which you can read here (it’s free).