Pest control company Rollins (NYSE: ROL) missed Wall Street’s revenue expectations in Q4 CY2025, but sales rose 9.7% year on year to $912.9 million. Its non-GAAP profit of $0.25 per share was 6.6% below analysts’ consensus estimates.

Is now the time to buy Rollins? Find out by accessing our full research report, it’s free.

Rollins (ROL) Q4 CY2025 Highlights:

- Revenue: $912.9 million vs analyst estimates of $927.7 million (9.7% year-on-year growth, 1.6% miss)

- Adjusted EPS: $0.25 vs analyst expectations of $0.27 (6.6% miss)

- Adjusted EBITDA: $193.7 million vs analyst estimates of $209 million (21.2% margin, 7.3% miss)

- Operating Margin: 17.5%, in line with the same quarter last year

- Free Cash Flow Margin: 17.4%, down from 22.1% in the same quarter last year

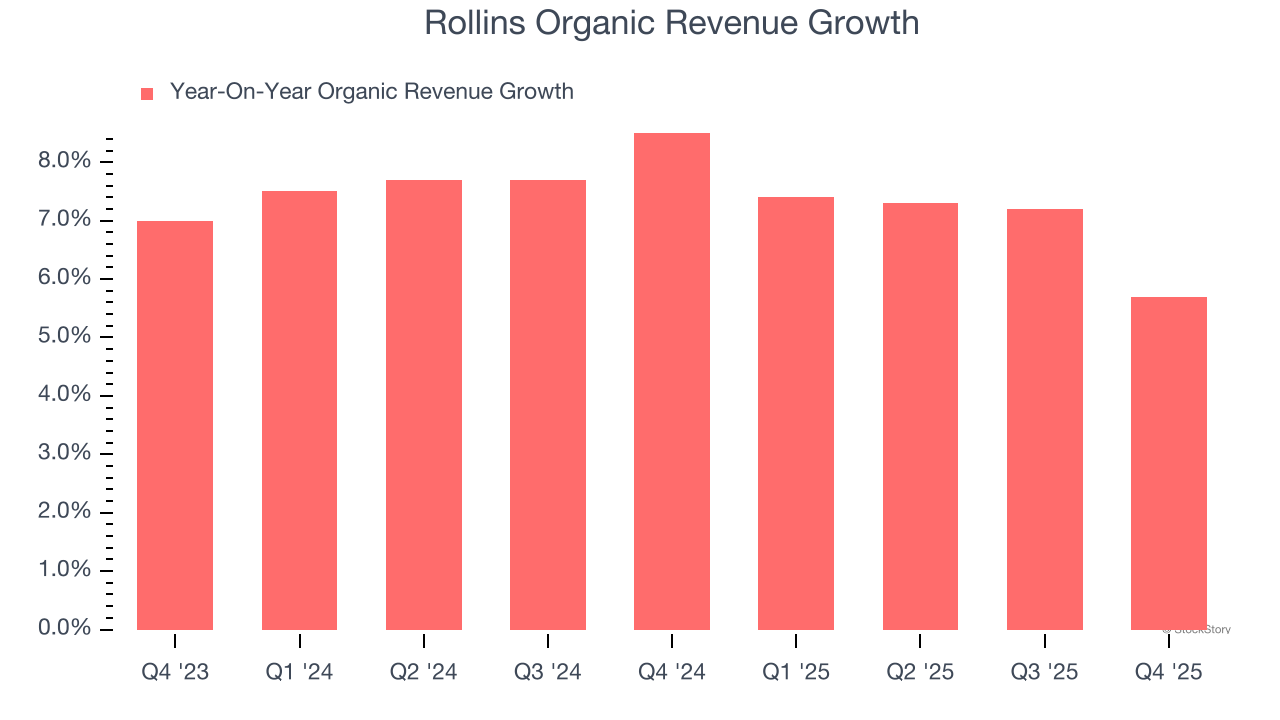

- Organic Revenue rose 5.7% year on year (miss)

- Market Capitalization: $31.26 billion

"We delivered solid financial results in 2025 and made important progress on a number of key initiatives. Our underlying markets remain healthy, customer and teammate retention rates are strong, and we are confident that nothing has fundamentally changed with respect to our consumer. We continue to invest meaningfully in our business and are well-positioned as we begin 2026. I'd like to thank our teammates for their hard work and dedication to our customers, as well as each other," said Jerry Gahlhoff, President and CEO.

Company Overview

Operating under multiple brands like Orkin and HomeTeam Pest Defense, Rollins (NYSE: ROL) provides pest and wildlife control services to residential and commercial customers.

Revenue Growth

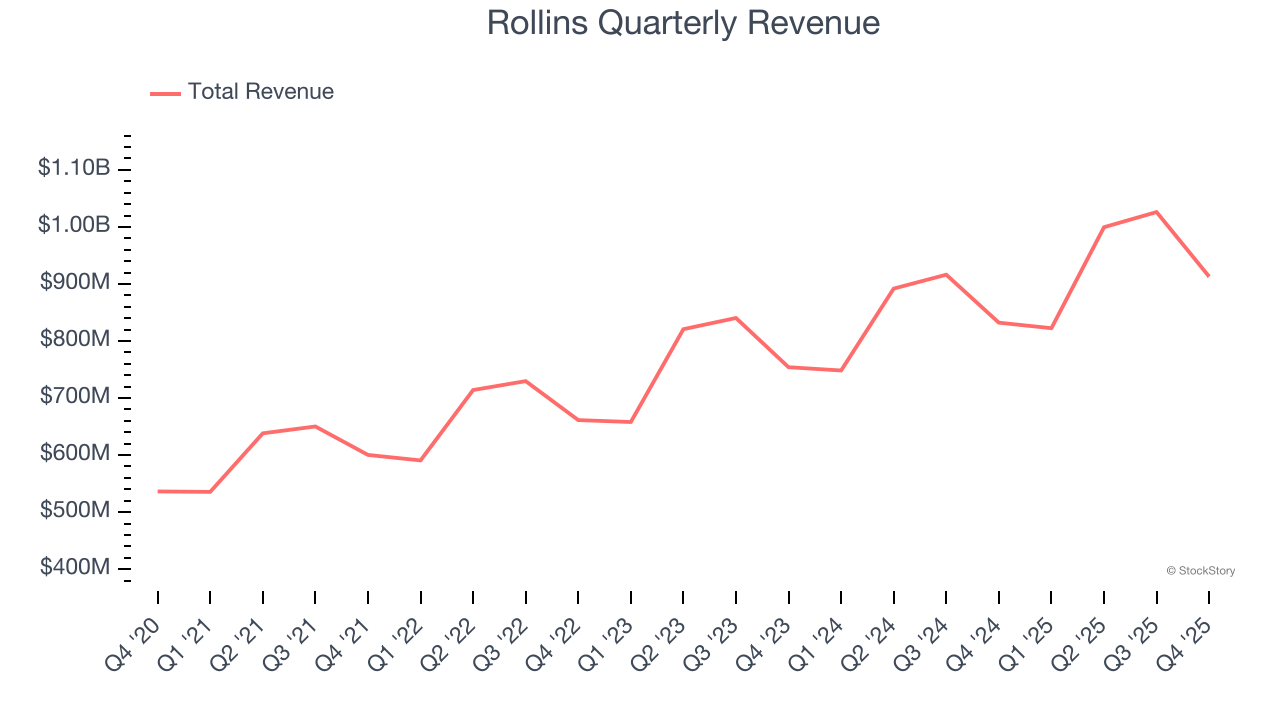

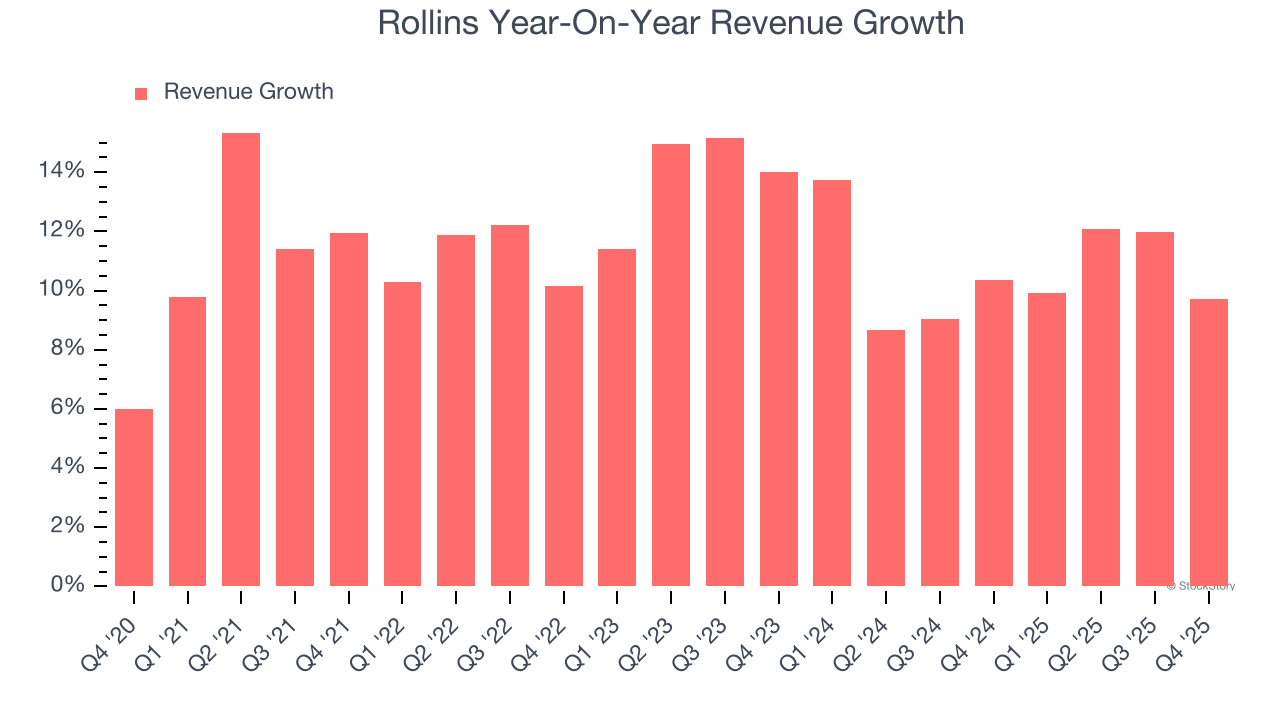

Examining a company’s long-term performance can provide clues about its quality. Any business can put up a good quarter or two, but many enduring ones grow for years. Luckily, Rollins’s sales grew at an impressive 11.7% compounded annual growth rate over the last five years. Its growth surpassed the average industrials company and shows its offerings resonate with customers, a great starting point for our analysis.

Long-term growth is the most important, but within industrials, a half-decade historical view may miss new industry trends or demand cycles. Rollins’s annualized revenue growth of 10.6% over the last two years is below its five-year trend, but we still think the results suggest healthy demand.

We can better understand the company’s sales dynamics by analyzing its organic revenue, which strips out one-time events like acquisitions and currency fluctuations that don’t accurately reflect its fundamentals. Over the last two years, Rollins’s organic revenue averaged 7.4% year-on-year growth. Because this number is lower than its two-year revenue growth, we can see that some mixture of acquisitions and foreign exchange rates boosted its headline results.

This quarter, Rollins’s revenue grew by 9.7% year on year to $912.9 million, missing Wall Street’s estimates.

Looking ahead, sell-side analysts expect revenue to grow 9.6% over the next 12 months, similar to its two-year rate. Still, this projection is healthy and indicates the market is baking in success for its products and services.

Microsoft, Alphabet, Coca-Cola, Monster Beverage—all began as under-the-radar growth stories riding a massive trend. We’ve identified the next one: a profitable AI semiconductor play Wall Street is still overlooking. Go here for access to our full report.

Operating Margin

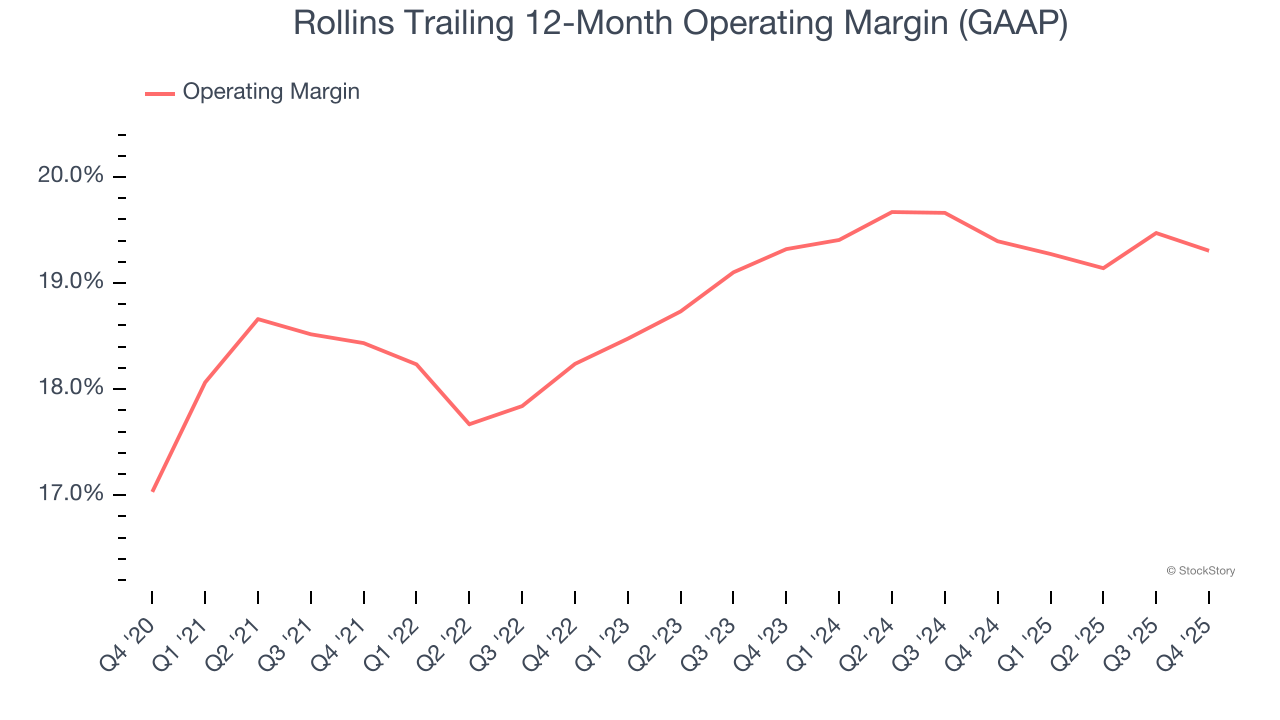

Operating margin is one of the best measures of profitability because it tells us how much money a company takes home after procuring and manufacturing its products, marketing and selling those products, and most importantly, keeping them relevant through research and development.

Rollins’s operating margin might fluctuated slightly over the last 12 months but has generally stayed the same, averaging 19% over the last five years. This profitability was elite for an industrials business thanks to its efficient cost structure and economies of scale. This is seen in its fast historical revenue growth and healthy gross margin, which is why we look at all three data points together.

Analyzing the trend in its profitability, Rollins’s operating margin might fluctuated slightly but has generally stayed the same over the last five years. This raises questions about the company’s expense base because its revenue growth should have given it leverage on its fixed costs, resulting in better economies of scale and profitability.

This quarter, Rollins generated an operating margin profit margin of 17.5%, in line with the same quarter last year. This indicates the company’s cost structure has recently been stable.

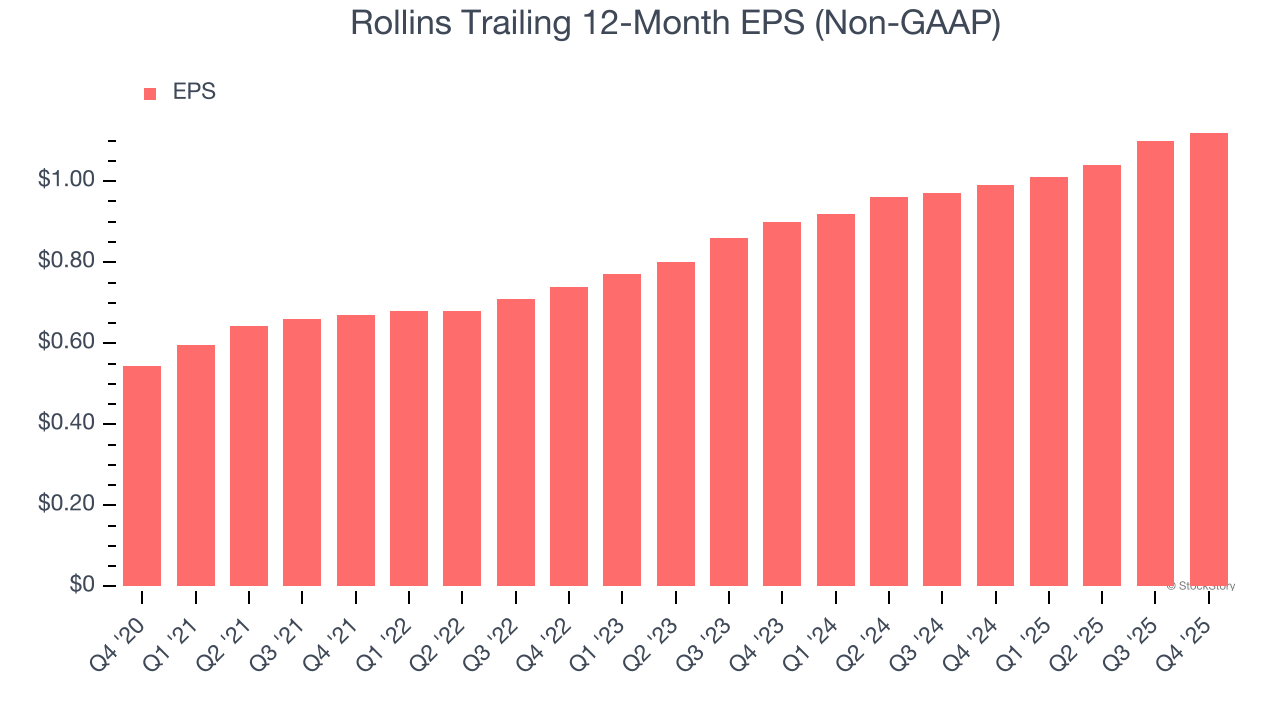

Earnings Per Share

Revenue trends explain a company’s historical growth, but the long-term change in earnings per share (EPS) points to the profitability of that growth – for example, a company could inflate its sales through excessive spending on advertising and promotions.

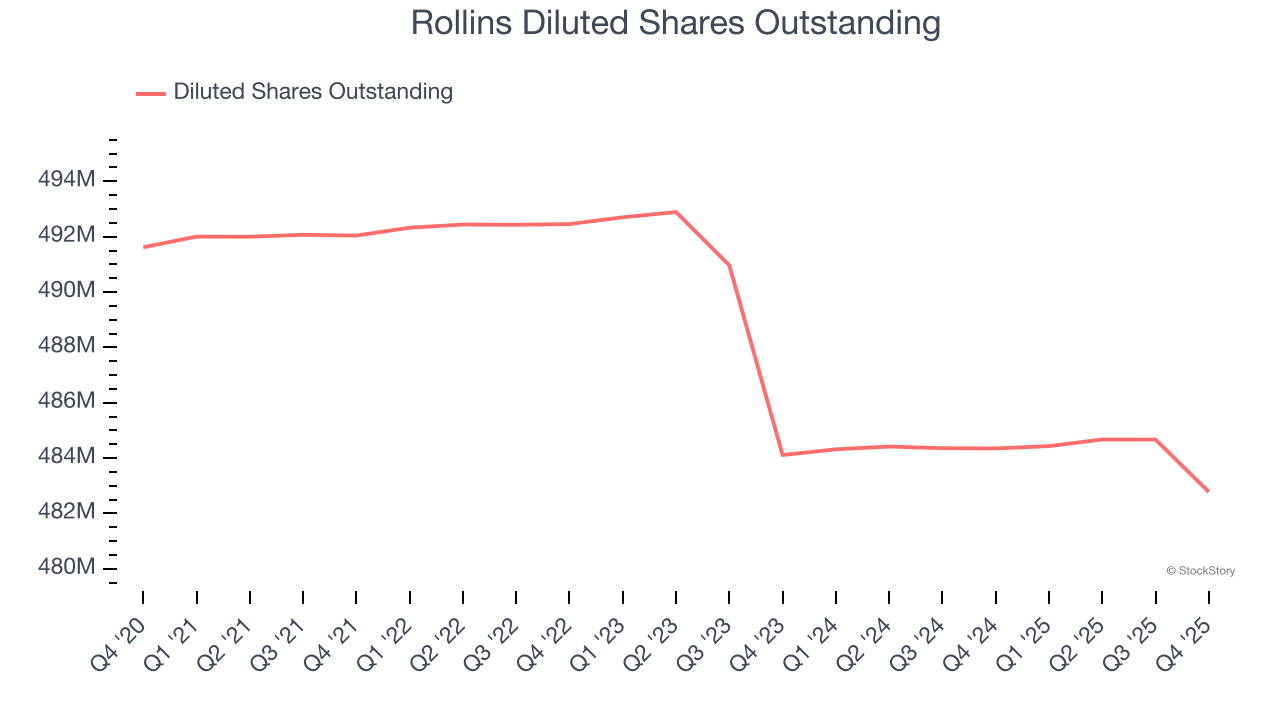

Rollins’s EPS grew at a spectacular 15.6% compounded annual growth rate over the last five years, higher than its 11.7% annualized revenue growth. This tells us the company became more profitable on a per-share basis as it expanded.

Diving into Rollins’s quality of earnings can give us a better understanding of its performance. A five-year view shows that Rollins has repurchased its stock, shrinking its share count by 1.8%. This tells us its EPS outperformed its revenue not because of increased operational efficiency but financial engineering, as buybacks boost per share earnings.

Like with revenue, we analyze EPS over a shorter period to see if we are missing a change in the business.

For Rollins, its two-year annual EPS growth of 11.6% was lower than its five-year trend. We still think its growth was good and hope it can accelerate in the future.

In Q4, Rollins reported adjusted EPS of $0.25, up from $0.23 in the same quarter last year. Despite growing year on year, this print missed analysts’ estimates, but we care more about long-term adjusted EPS growth than short-term movements. Over the next 12 months, Wall Street expects Rollins’s full-year EPS of $1.12 to grow 14.1%.

Key Takeaways from Rollins’s Q4 Results

We struggled to find many positives in these results. Its EBITDA missed and its EPS fell short of Wall Street’s estimates. Overall, this was a weaker quarter. The stock traded down 13.6% to $56.68 immediately following the results.

Rollins’s latest earnings report disappointed. One quarter doesn’t define a company’s quality, so let’s explore whether the stock is a buy at the current price. We think that the latest quarter is only one piece of the longer-term business quality puzzle. Quality, when combined with valuation, can help determine if the stock is a buy. We cover that in our actionable full research report which you can read here (it’s free).