Fast-food chain McDonald’s (NYSE: MCD) reported revenue ahead of Wall Street’s expectations in Q4 CY2025, with sales up 9.7% year on year to $7.01 billion. Its non-GAAP profit of $3.12 per share was 2.2% above analysts’ consensus estimates.

Is now the time to buy McDonald's? Find out by accessing our full research report, it’s free.

McDonald's (MCD) Q4 CY2025 Highlights:

- Revenue: $7.01 billion vs analyst estimates of $6.83 billion (9.7% year-on-year growth, 2.6% beat)

- Adjusted EPS: $3.12 vs analyst estimates of $3.05 (2.2% beat)

- Adjusted EBITDA: $3.28 billion vs analyst estimates of $3.72 billion (46.8% margin, 11.8% miss)

- Operating Margin: 45%, in line with the same quarter last year

- Same-Store Sales rose 5.7% year on year (0.4% in the same quarter last year)

- Market Capitalization: $232.1 billion

"McDonald's value leadership is working," said Chairman and CEO Chris Kempczinski.

Company Overview

With nicknames spanning Mickey D's in the U.S. to Makku in Japan, McDonald’s (NYSE: MCD) is a fast-food behemoth known for its convenience and broken ice cream machines.

Revenue Growth

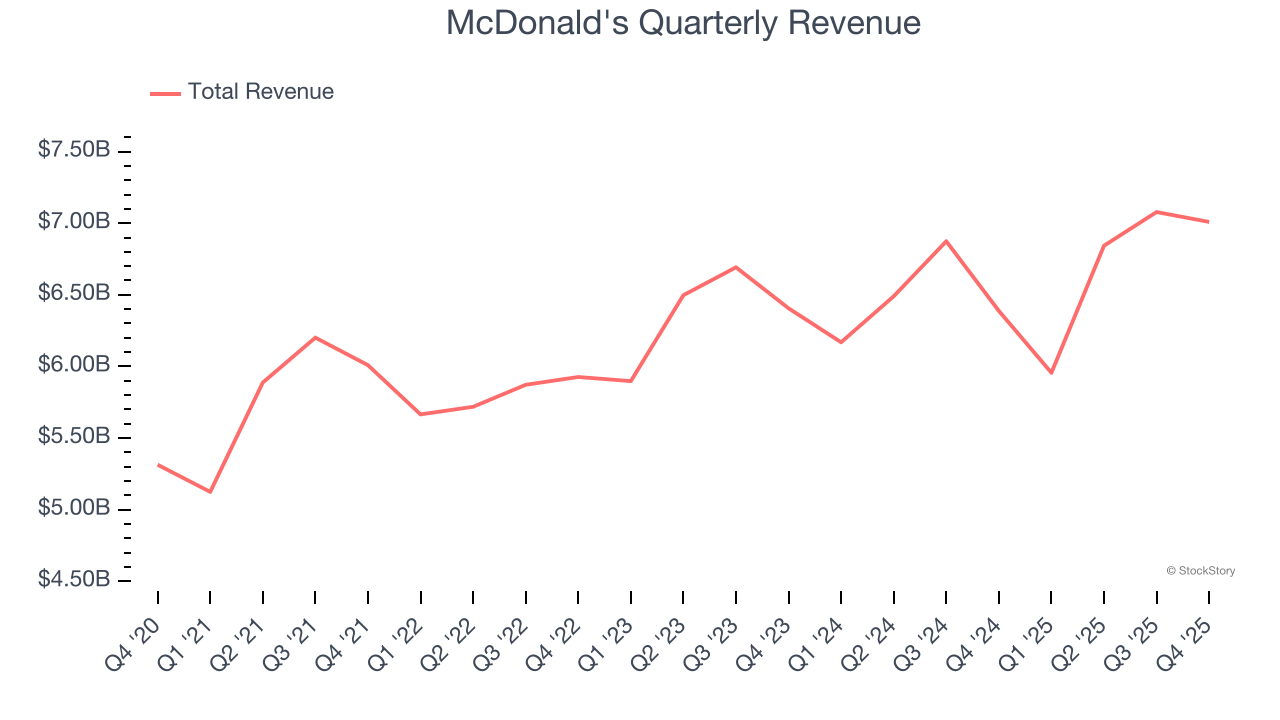

Reviewing a company’s long-term sales performance reveals insights into its quality. Even a bad business can shine for one or two quarters, but a top-tier one grows for years.

With $26.89 billion in revenue over the past 12 months, McDonald's is one of the most widely recognized restaurant chains and benefits from customer loyalty, a luxury many don’t have. Its scale also gives it negotiating leverage with suppliers, enabling it to source its ingredients at a lower cost. However, its scale is a double-edged sword because it’s harder to find incremental growth when your existing restaurant banners have penetrated most of the market. To accelerate system-wide sales, McDonald's likely needs to optimize its pricing or lean into new chains and international expansion.

As you can see below, McDonald’s 4.1% annualized revenue growth over the last six years was sluggish as it barely increased sales at existing, established dining locations.

This quarter, McDonald's reported year-on-year revenue growth of 9.7%, and its $7.01 billion of revenue exceeded Wall Street’s estimates by 2.6%.

Looking ahead, sell-side analysts expect revenue to grow 5.2% over the next 12 months, similar to its six-year rate. While this projection implies its newer menu offerings will fuel better top-line performance, it is still below the sector average. At least the company is tracking well in other measures of financial health.

Microsoft, Alphabet, Coca-Cola, Monster Beverage—all began as under-the-radar growth stories riding a massive trend. We’ve identified the next one: a profitable AI semiconductor play Wall Street is still overlooking. Go here for access to our full report.

Restaurant Performance

Number of Restaurants

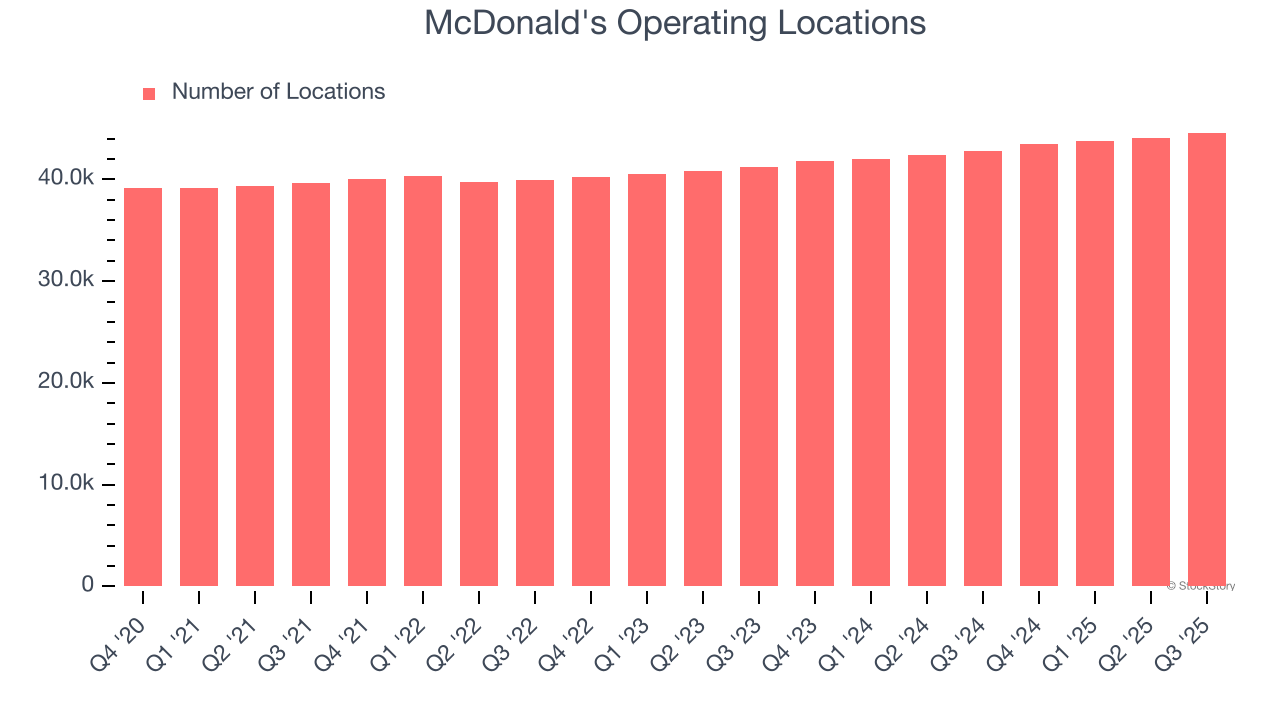

A restaurant chain’s total number of dining locations influences how much it can sell and how quickly revenue can grow.

Over the last two years, McDonald's opened new restaurants at a rapid clip by averaging 4% annual growth, among the fastest in the restaurant sector. Additionally, one dynamic making expansion more seamless is the company’s franchise model, where franchisees are primarily responsible for opening new restaurants while McDonald's provides support.

When a chain opens new restaurants, it usually means it’s investing for growth because there’s healthy demand for its meals and there are markets where its concepts have few or no locations.

Note that McDonald's reports its restaurant count intermittently, so some data points are missing in the chart below.

Same-Store Sales

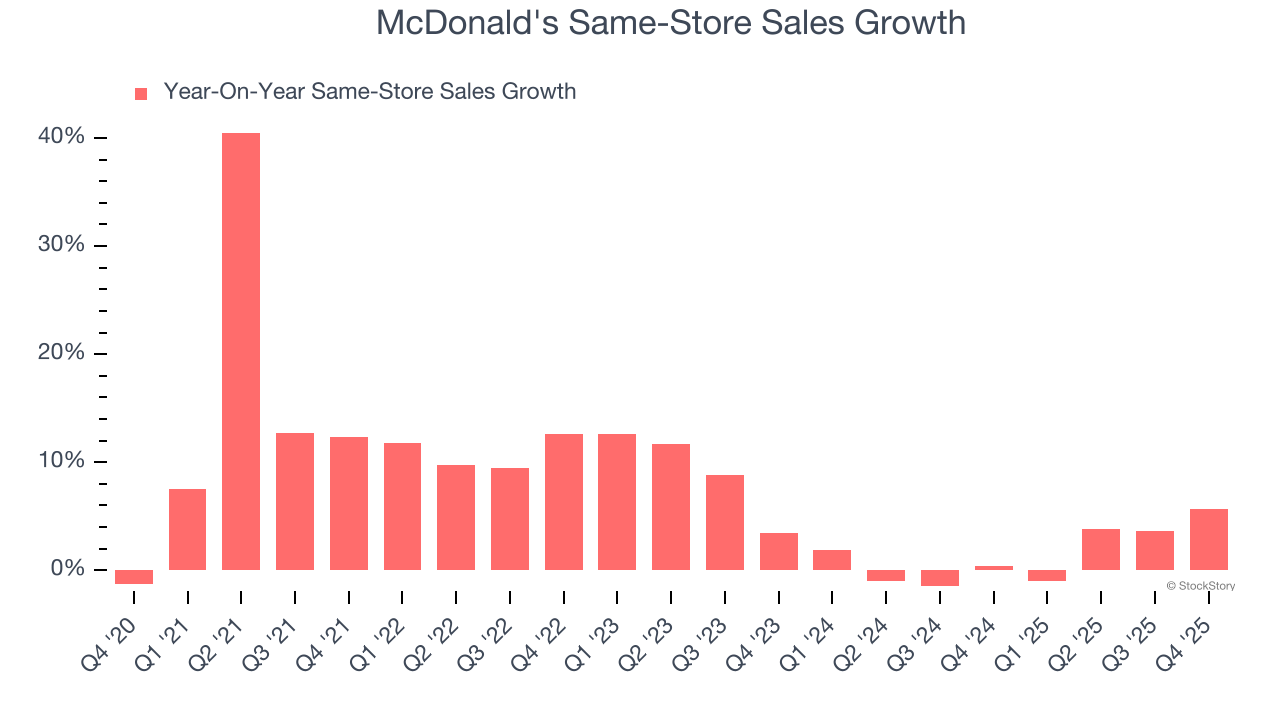

The change in a company's restaurant base only tells one side of the story. The other is the performance of its existing locations, which informs management teams whether they should expand or downsize their physical footprints. Same-store sales provides a deeper understanding of this issue because it measures organic growth at restaurants open for at least a year.

McDonald’s demand within its existing dining locations has been relatively stable over the last two years but was below most restaurant chains. On average, the company’s same-store sales have grown by 1.5% per year. This performance suggests it should consider improving its foot traffic and efficiency before expanding its restaurant base.

In the latest quarter, McDonald’s same-store sales rose 5.7% year on year. This growth was an acceleration from its historical levels, which is always an encouraging sign.

Key Takeaways from McDonald’s Q4 Results

We were impressed by how significantly McDonald's blew past analysts’ same-store sales expectations this quarter. We were also glad its revenue outperformed Wall Street’s estimates. On the other hand, its EBITDA missed. Overall, this print had some key positives. The stock remained flat at $321.24 immediately after reporting.

Is McDonald's an attractive investment opportunity at the current price? When making that decision, it’s important to consider its valuation, business qualities, as well as what has happened in the latest quarter. We cover that in our actionable full research report which you can read here (it’s free).