Manufacturing company Leggett & Platt (NYSE: LEG) met Wall Street’s revenue expectations in Q4 CY2025, but sales fell by 11.2% year on year to $938.6 million. The company’s outlook for the full year was close to analysts’ estimates with revenue guided to $3.9 billion at the midpoint. Its non-GAAP profit of $1.05 per share was significantly above analysts’ consensus estimates.

Is now the time to buy Leggett & Platt? Find out by accessing our full research report, it’s free.

Leggett & Platt (LEG) Q4 CY2025 Highlights:

- Revenue: $938.6 million vs analyst estimates of $938.7 million (11.2% year-on-year decline, in line)

- Adjusted EPS: $1.05 vs analyst estimates of $0.23 (significant beat)

- Adjusted EBITDA: $79.6 million vs analyst estimates of $88.18 million (8.5% margin, 9.7% miss)

- Adjusted EPS guidance for the upcoming financial year 2026 is $1.10 at the midpoint, beating analyst estimates by 1.1%

- Operating Margin: 3.4%, in line with the same quarter last year

- Free Cash Flow Margin: 10.9%, up from 9.5% in the same quarter last year

- Market Capitalization: $1.71 billion

President and CEO Karl Glassman commented, "Throughout 2025, our teams executed our strategic priorities, including strengthening our balance sheet, improving operational efficiency, and positioning the company for long-term growth. We made significant progress on our deleveraging efforts, reducing our debt and lowering our net debt leverage ratio to 2.4x. This was a tremendous step toward achieving our long-term target of 2.0x, making Leggett more agile and enabling us to shift our focus to pursuing opportunities for growth and returning capital to shareholders.

Company Overview

Founded in 1883, Leggett & Platt (NYSE: LEG) is a diversified manufacturer of products and components for various industries.

Revenue Growth

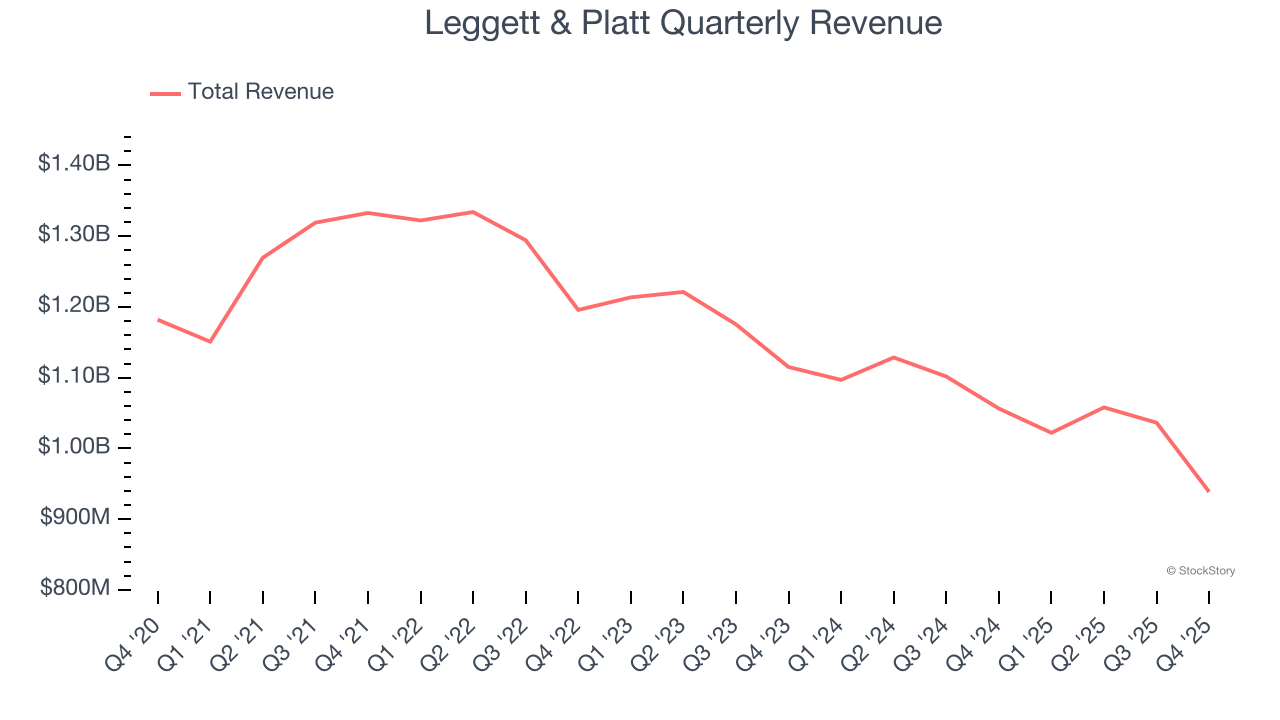

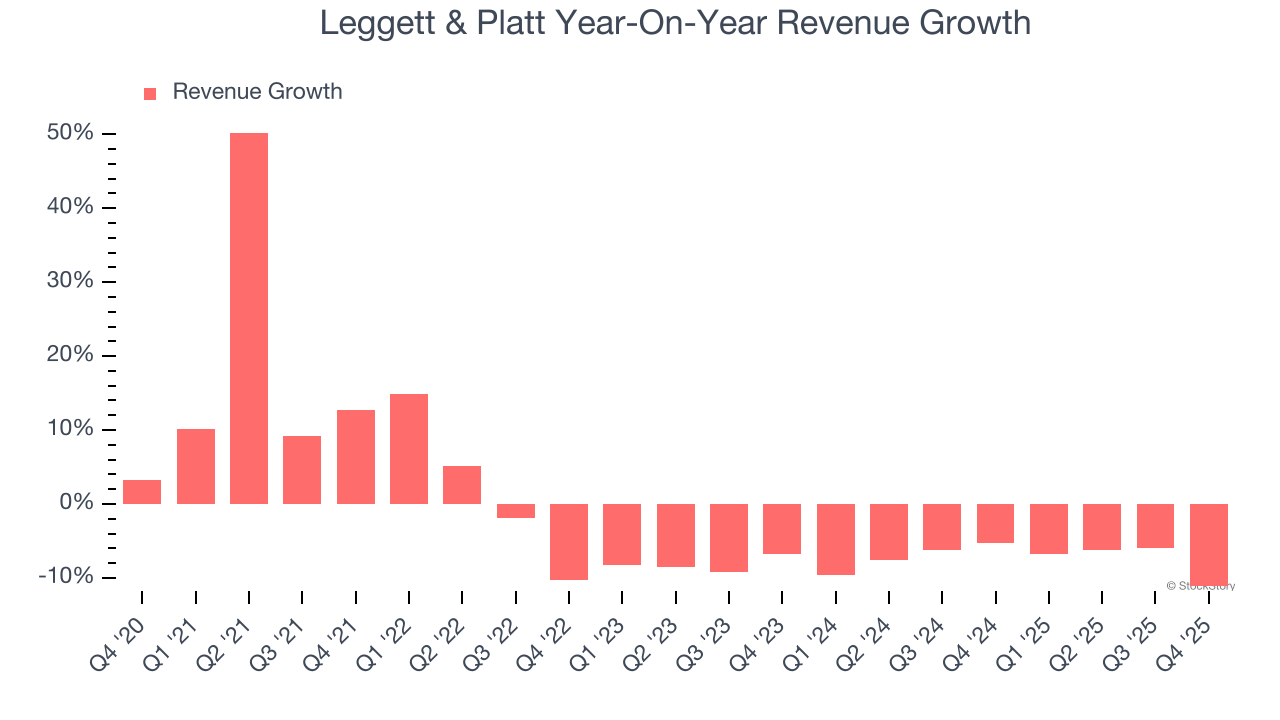

A company’s long-term performance is an indicator of its overall quality. Any business can have short-term success, but a top-tier one grows for years. Leggett & Platt’s demand was weak over the last five years as its sales fell at a 1.1% annual rate. This wasn’t a great result and is a sign of poor business quality.

We at StockStory place the most emphasis on long-term growth, but within consumer discretionary, a stretched historical view may miss a company riding a successful new product or trend. Leggett & Platt’s recent performance shows its demand remained suppressed as its revenue has declined by 7.4% annually over the last two years.

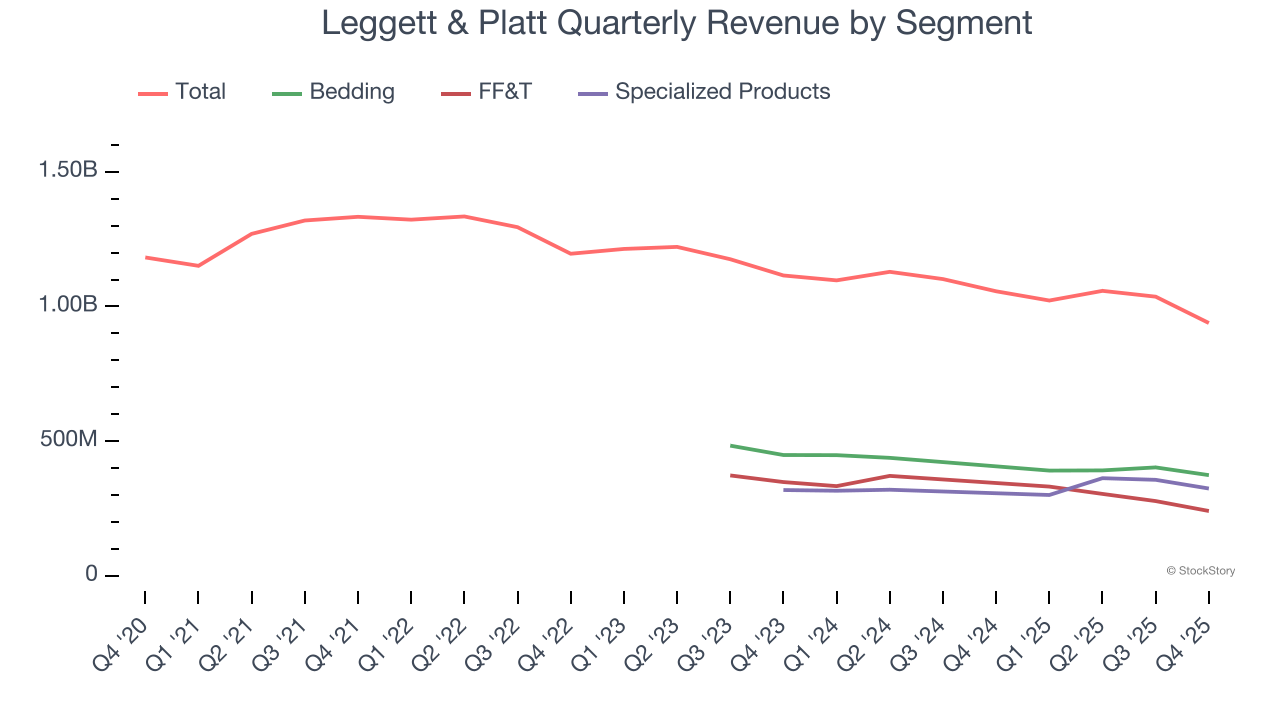

We can dig further into the company’s revenue dynamics by analyzing its three most important segments: Bedding, FF&T, and Specialized Products, which are 39.8%, 25.6%, and 34.5% of revenue. Over the last two years, Leggett & Platt’s Bedding (mattresses and foundations) and FF&T (sofa parts and tiles ) revenues averaged year-on-year declines of 11.7% and 9.3% while its Specialized Products revenue (automobile components) averaged 4.2% growth.

This quarter, Leggett & Platt reported a rather uninspiring 11.2% year-on-year revenue decline to $938.6 million of revenue, in line with Wall Street’s estimates.

Looking ahead, sell-side analysts expect revenue to decline by 3.8% over the next 12 months. While this projection is better than its two-year trend, it’s hard to get excited about a company that is struggling with demand.

Software is eating the world and there is virtually no industry left that has been untouched by it. That drives increasing demand for tools helping software developers do their jobs, whether it be monitoring critical cloud infrastructure, integrating audio and video functionality, or ensuring smooth content streaming. Click here to access a free report on our 3 favorite stocks to play this generational megatrend.

Operating Margin

Operating margin is a key measure of profitability. Think of it as net income - the bottom line - excluding the impact of taxes and interest on debt, which are less connected to business fundamentals.

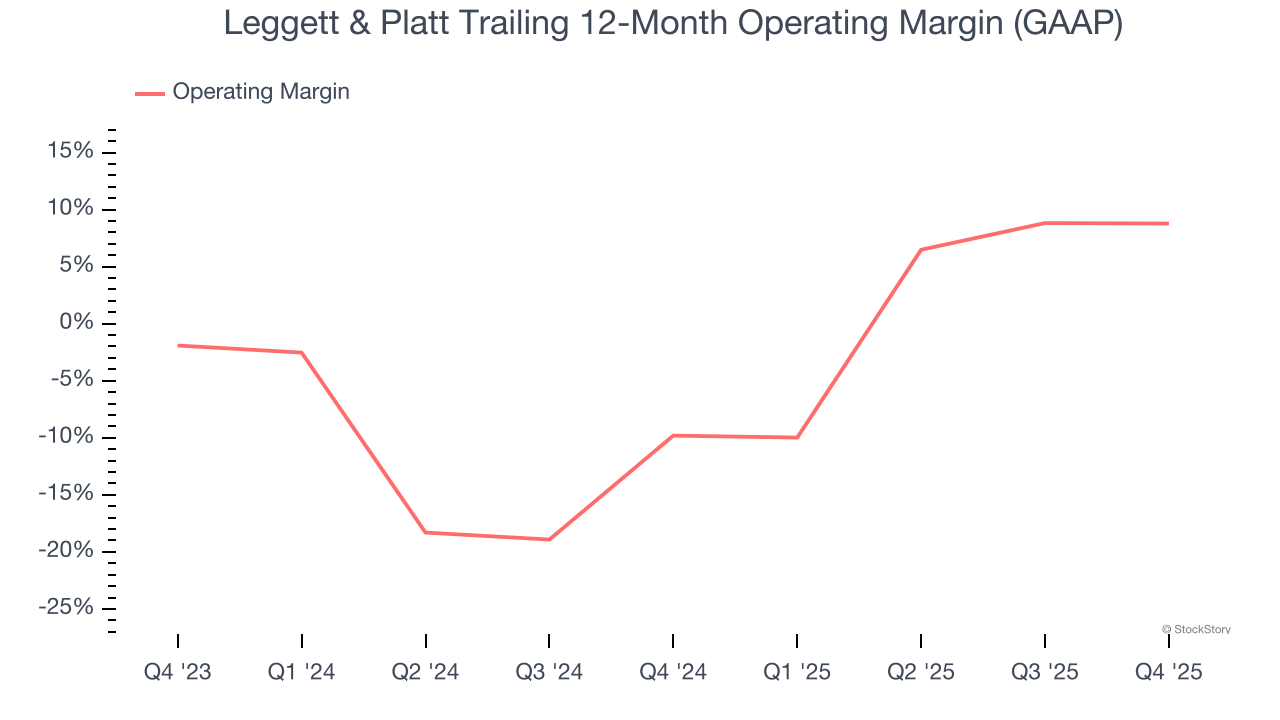

Leggett & Platt’s operating margin has risen over the last 12 months, leading to break even profits over the last two years. However, its large expense base and inefficient cost structure mean it still sports inadequate profitability for a consumer discretionary business.

In Q4, Leggett & Platt generated an operating margin profit margin of 3.4%, in line with the same quarter last year. This indicates the company’s overall cost structure has been relatively stable.

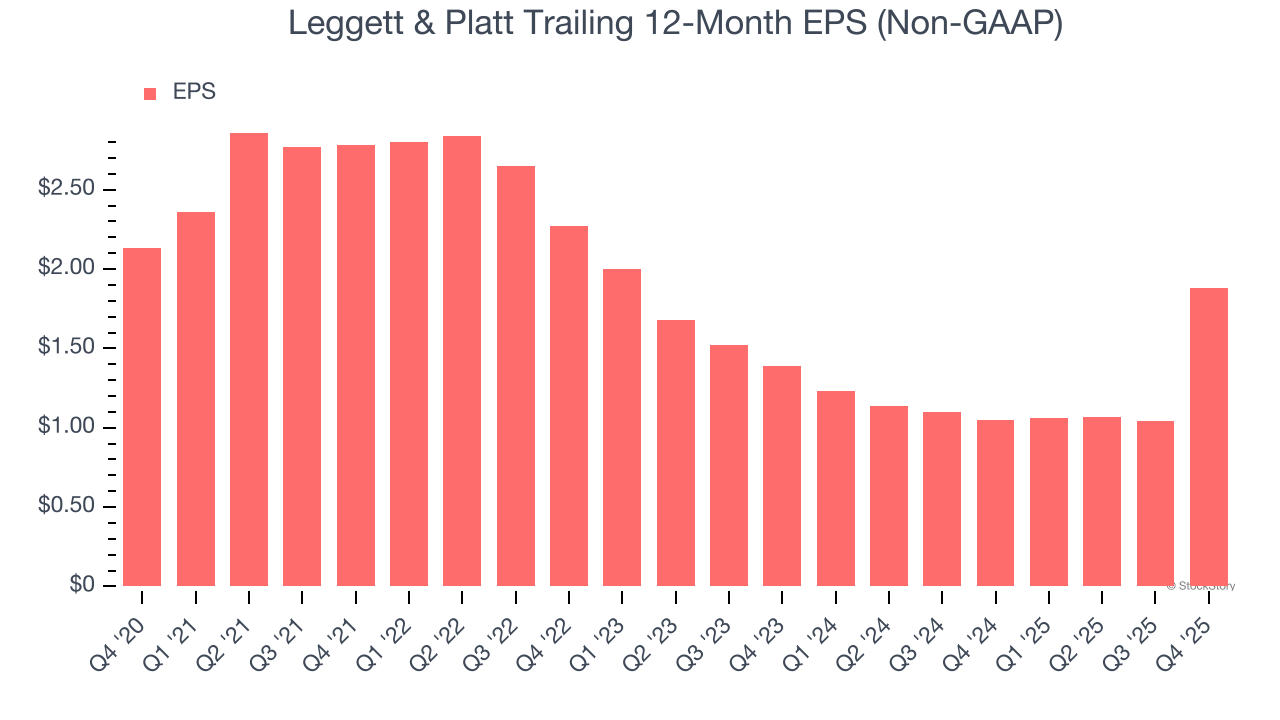

Earnings Per Share

Revenue trends explain a company’s historical growth, but the long-term change in earnings per share (EPS) points to the profitability of that growth – for example, a company could inflate its sales through excessive spending on advertising and promotions.

Sadly for Leggett & Platt, its EPS and revenue declined by 2.5% and 1.1% annually over the last five years. We tend to steer our readers away from companies with falling revenue and EPS, where diminishing earnings could imply changing secular trends and preferences. Consumer Discretionary companies are particularly exposed to this, and if the tide turns unexpectedly, Leggett & Platt’s low margin of safety could leave its stock price susceptible to large downswings.

In Q4, Leggett & Platt reported adjusted EPS of $1.05, up from $0.21 in the same quarter last year. This print easily cleared analysts’ estimates, and shareholders should be content with the results. Over the next 12 months, Wall Street expects Leggett & Platt’s full-year EPS of $1.88 to shrink by 42.7%.

Key Takeaways from Leggett & Platt’s Q4 Results

It was good to see Leggett & Platt beat analysts’ EPS expectations this quarter. We were also glad its full-year EPS guidance slightly exceeded Wall Street’s estimates. On the other hand, its EBITDA missed. Overall, this print had some key positives. The stock remained flat at $12.40 immediately following the results.

So should you invest in Leggett & Platt right now? What happened in the latest quarter matters, but not as much as longer-term business quality and valuation, when deciding whether to invest in this stock. We cover that in our actionable full research report which you can read here (it’s free).