Flavor and fragrance producer IFF (NYSE: IFF) announced better-than-expected revenue in Q4 CY2025, but sales fell by 6.6% year on year to $2.59 billion. The company expects the full year’s revenue to be around $10.65 billion, close to analysts’ estimates. Its non-GAAP profit of $0.80 per share was 3.8% below analysts’ consensus estimates.

Is now the time to buy International Flavors & Fragrances? Find out by accessing our full research report, it’s free.

International Flavors & Fragrances (IFF) Q4 CY2025 Highlights:

- Revenue: $2.59 billion vs analyst estimates of $2.52 billion (6.6% year-on-year decline, 2.9% beat)

- Adjusted EPS: $0.80 vs analyst expectations of $0.83 (3.8% miss)

- EBITDA guidance for the upcoming financial year 2026 is $2.1 billion at the midpoint, in line with analyst expectations

- Operating Margin: 3.7%, in line with the same quarter last year

- Organic Revenue rose 1% year on year (beat)

- Market Capitalization: $19.66 billion

“IFF delivered a solid 2025 performance, meeting the full-year financial commitments we set at the start of the year, despite a challenging operating environment,” said Erik Fyrwald, CEO of IFF.

Company Overview

Responsible for the scents in your favorite perfumes and the flavors in your daily snacks, International Flavors & Fragrances (NYSE: IFF) creates and manufactures ingredients for food, beverages, personal care products, and pharmaceuticals used in countless consumer goods.

Revenue Growth

A company’s long-term performance is an indicator of its overall quality. Any business can experience short-term success, but top-performing ones enjoy sustained growth for years.

With $10.89 billion in revenue over the past 12 months, International Flavors & Fragrances is one of the larger consumer staples companies and benefits from a well-known brand that influences purchasing decisions. However, its scale is a double-edged sword because there are only so many big store chains to sell into, making it harder to find incremental growth. For International Flavors & Fragrances to boost its sales, it likely needs to adjust its prices, launch new offerings, or lean into foreign markets.

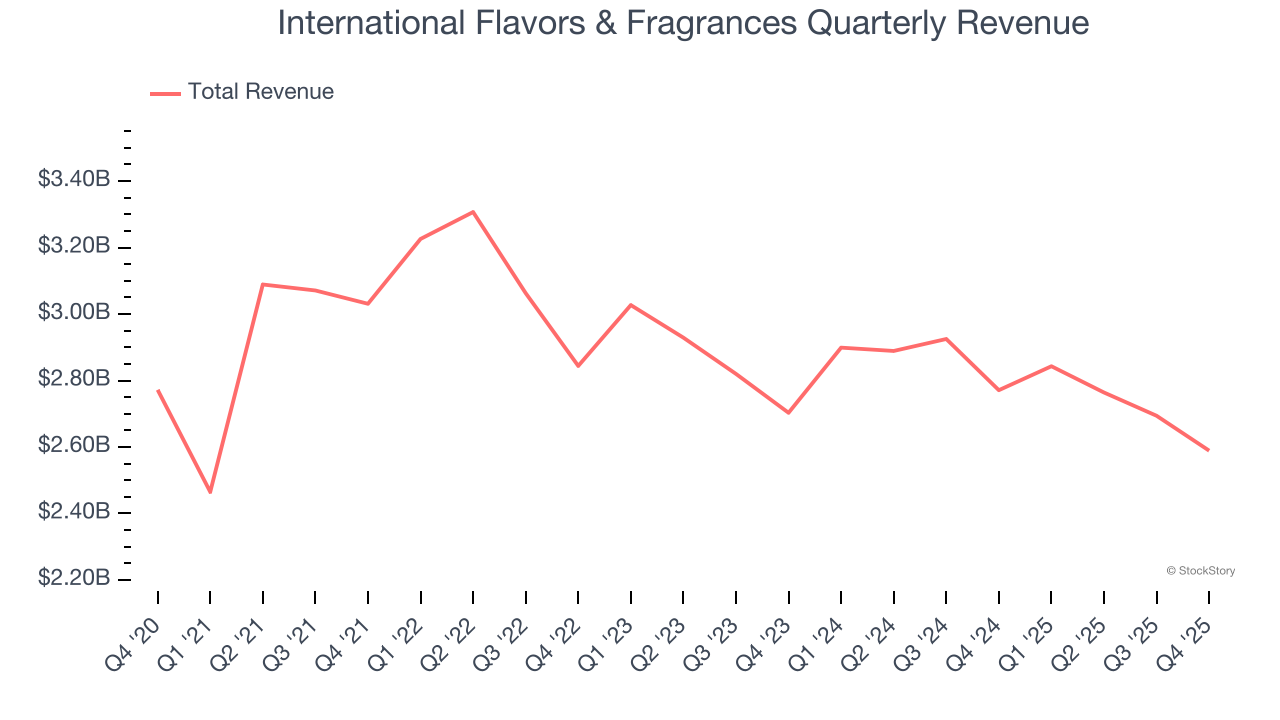

As you can see below, International Flavors & Fragrances’s demand was weak over the last three years. Its sales fell by 4.3% annually, a poor baseline for our analysis.

This quarter, International Flavors & Fragrances’s revenue fell by 6.6% year on year to $2.59 billion but beat Wall Street’s estimates by 2.9%.

Looking ahead, sell-side analysts expect revenue to decline by 2.7% over the next 12 months. it’s tough to feel optimistic about a company facing demand difficulties.

While Wall Street chases Nvidia at all-time highs, an under-the-radar semiconductor supplier is dominating a critical AI component these giants can’t build without. Click here to access our free report one of our favorites growth stories.

Cash Is King

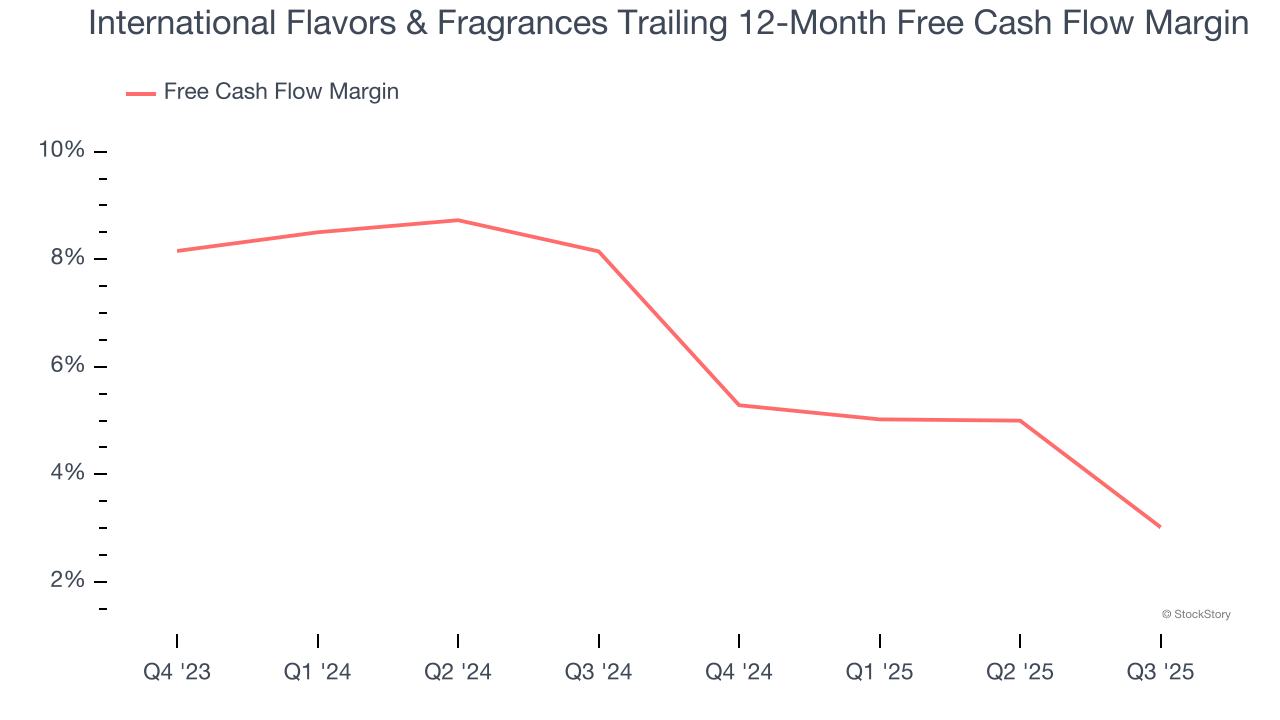

Free cash flow isn't a prominently featured metric in company financials and earnings releases, but we think it's telling because it accounts for all operating and capital expenses, making it tough to manipulate. Cash is king.

International Flavors & Fragrances has shown mediocre cash profitability over the last two years, giving the company limited opportunities to return capital to shareholders. Its free cash flow margin averaged 3.7%, subpar for a consumer staples business.

Key Takeaways from International Flavors & Fragrances’s Q4 Results

We enjoyed seeing International Flavors & Fragrances beat analysts’ organic revenue expectations this quarter. We were also happy its revenue outperformed Wall Street’s estimates. On the other hand, its EPS missed and its gross margin fell short of Wall Street’s estimates. Overall, this print was mixed but still had some key positives. The stock remained flat at $76.22 immediately following the results.

Is International Flavors & Fragrances an attractive investment opportunity at the current price? What happened in the latest quarter matters, but not as much as longer-term business quality and valuation, when deciding whether to invest in this stock. We cover that in our actionable full research report which you can read here (it’s free).