Medical technology company Inspire Medical Systems (NYSE: INSP) reported Q4 CY2025 results beating Wall Street’s revenue expectations, with sales up 12.2% year on year to $269.1 million. On the other hand, the company’s full-year revenue guidance of $975 million at the midpoint came in 2.7% below analysts’ estimates. Its non-GAAP profit of $1.65 per share was significantly above analysts’ consensus estimates.

Is now the time to buy Inspire Medical Systems? Find out by accessing our full research report, it’s free.

Inspire Medical Systems (INSP) Q4 CY2025 Highlights:

- Revenue: $269.1 million vs analyst estimates of $266.3 million (12.2% year-on-year growth, 1.1% beat)

- Adjusted EPS: $1.65 vs analyst estimates of $0.68 (significant beat)

- Adjusted EBITDA: $79.3 million vs analyst estimates of $55.41 million (29.5% margin, 43.1% beat)

- Adjusted EPS guidance for the upcoming financial year 2026 is $2.10 at the midpoint, beating analyst estimates by 25.5%

- “...based on this clarification, we believe the code will transition to CPT code 64582 for the Inspire V procedure, including the use of a -52 modifier...” which indicates a reduced or partially completed service rather than a complete hypoglossal nerve stimulation implantation

- Operating Margin: 17.1%, up from 13.3% in the same quarter last year

- Market Capitalization: $1.98 billion

“We are very excited with the strong finish to 2025. The team made excellent progress with the Inspire V launch, with clinical insights from the early phase of commercial adoption continuing to validate positive patient outcomes and improvements in therapy delivery,” said Tim Herbert, Chairman and CEO of Inspire Medical Systems.

Company Overview

Offering an alternative for the millions who struggle with traditional CPAP machines, Inspire Medical Systems (NYSE: INSP) develops and sells an implantable neurostimulation device that treats obstructive sleep apnea by stimulating nerves to keep airways open during sleep.

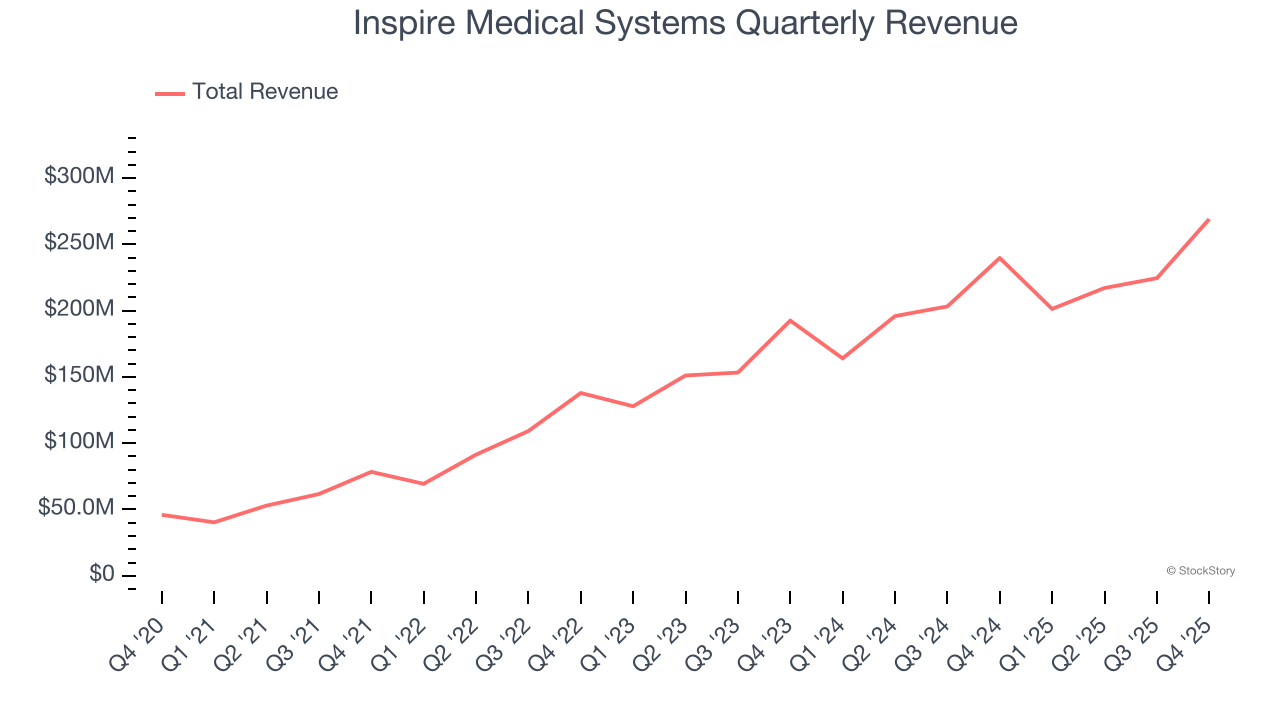

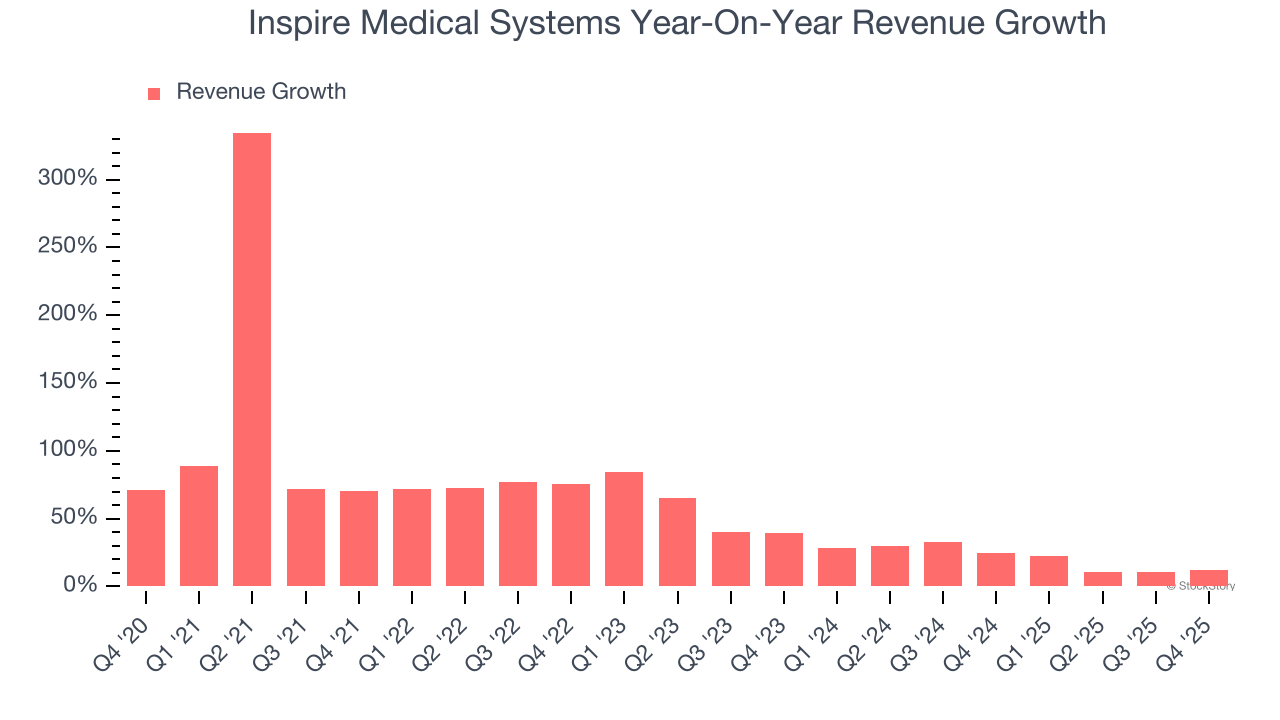

Revenue Growth

A company’s long-term performance is an indicator of its overall quality. Any business can experience short-term success, but top-performing ones enjoy sustained growth for years. Thankfully, Inspire Medical Systems’s 51.2% annualized revenue growth over the last five years was incredible. Its growth beat the average healthcare company and shows its offerings resonate with customers, a helpful starting point for our analysis.

Long-term growth is the most important, but within healthcare, a half-decade historical view may miss new innovations or demand cycles. Inspire Medical Systems’s annualized revenue growth of 20.8% over the last two years is below its five-year trend, but we still think the results suggest healthy demand.

This quarter, Inspire Medical Systems reported year-on-year revenue growth of 12.2%, and its $269.1 million of revenue exceeded Wall Street’s estimates by 1.1%.

Looking ahead, sell-side analysts expect revenue to grow 9.8% over the next 12 months, a deceleration versus the last two years. Despite the slowdown, this projection is healthy and indicates the market sees success for its products and services.

While Wall Street chases Nvidia at all-time highs, an under-the-radar semiconductor supplier is dominating a critical AI component these giants can’t build without. Click here to access our free report one of our favorites growth stories.

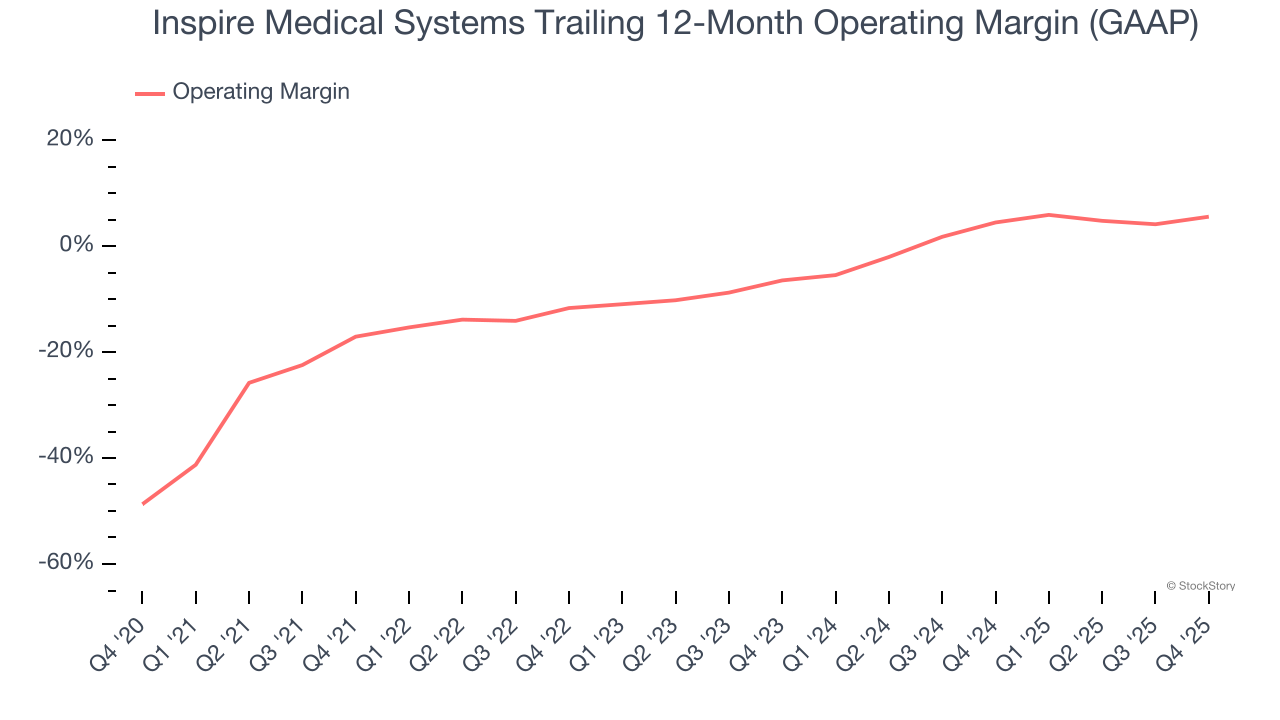

Operating Margin

Although Inspire Medical Systems was profitable this quarter from an operational perspective, it’s generally struggled over a longer time period. Its expensive cost structure has contributed to an average operating margin of negative 1.4% over the last five years. Unprofitable healthcare companies require extra attention because they could get caught swimming naked when the tide goes out.

On the plus side, Inspire Medical Systems’s operating margin rose by 22.7 percentage points over the last five years, as its sales growth gave it operating leverage. Zooming in on its more recent performance, we can see the company’s trajectory is intact as its margin has also increased by 12 percentage points on a two-year basis. These data points are very encouraging and show momentum is on its side.

This quarter, Inspire Medical Systems generated an operating margin profit margin of 17.1%, up 3.8 percentage points year on year. This increase was a welcome development and shows it was more efficient.

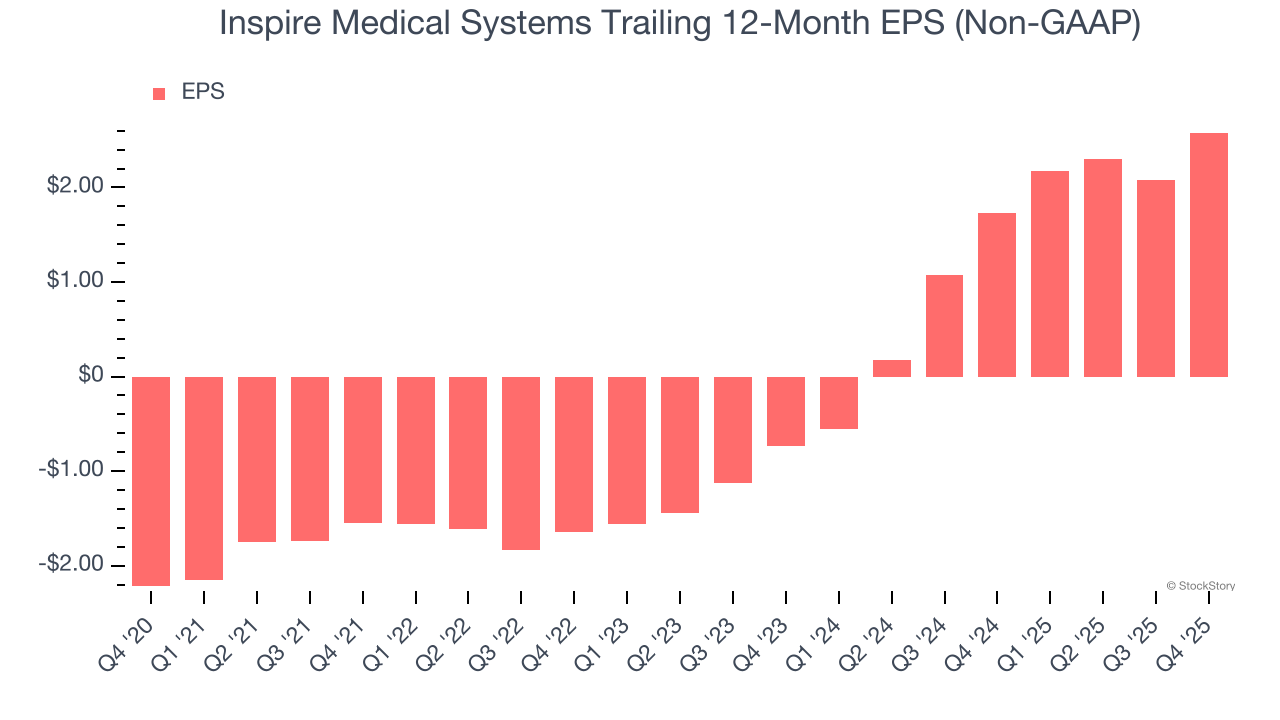

Earnings Per Share

Revenue trends explain a company’s historical growth, but the long-term change in earnings per share (EPS) points to the profitability of that growth – for example, a company could inflate its sales through excessive spending on advertising and promotions.

Inspire Medical Systems’s full-year EPS flipped from negative to positive over the last five years. This is a good sign and shows it’s at an inflection point.

In Q4, Inspire Medical Systems reported adjusted EPS of $1.65, up from $1.15 in the same quarter last year. This print easily cleared analysts’ estimates, and shareholders should be content with the results. Over the next 12 months, Wall Street expects Inspire Medical Systems’s full-year EPS of $2.58 to shrink by 36.4%.

Key Takeaways from Inspire Medical Systems’s Q4 Results

It was good to see Inspire Medical Systems beat analysts’ revenue and EPS expectations this quarter. We were also excited its full-year revenue and EPS guidance were raised from previous ranges. However, full-year revenue guidance missed Wall Street's expectations. Importantly, the company also mentioned getting more clarification regarding the coding that should be used for the Inspire V procedure. In short, it is a disappointing result because the coding clarification likely reduces physician reimbursement for its newer Inspire V procedure, which can create financial and adoption headwinds. It is this dynamic rather than the quarterly performance that is weighing on shares, and the stock traded down 6.3% to $63.93 immediately following the results.

Is Inspire Medical Systems an attractive investment opportunity at the current price? What happened in the latest quarter matters, but not as much as longer-term business quality and valuation, when deciding whether to invest in this stock. We cover that in our actionable full research report which you can read here (it’s free).