Networking technology giant Cisco (NASDAQ: CSCO) beat Wall Street’s revenue expectations in Q4 CY2025, with sales up 9.7% year on year to $15.35 billion. Guidance for next quarter’s revenue was optimistic at $15.5 billion at the midpoint, 2.2% above analysts’ estimates. Its non-GAAP profit of $1.04 per share was 1.7% above analysts’ consensus estimates.

Is now the time to buy Cisco? Find out by accessing our full research report, it’s free.

Cisco (CSCO) Q4 CY2025 Highlights:

- Revenue: $15.35 billion vs analyst estimates of $15.12 billion (9.7% year-on-year growth, 1.5% beat)

- Adjusted EPS: $1.04 vs analyst estimates of $1.02 (1.7% beat)

- Q1 Adjusted gross margin guidance of 66.0% at the midpoint (miss)

- Q1 Adjusted EPS guidance of $1.03 at the midpoint (in line)

- Operating Margin: 24.6%, up from 22.3% in the same quarter last year

- Free Cash Flow Margin: 10%, down from 14.5% in the same quarter last year

- Market Capitalization: $340.9 billion

"Cisco's strong second quarter and first half of fiscal 2026 demonstrate both the power of our portfolio and the fundamental role we continue to play in connecting and protecting customers in a rapidly evolving landscape," said Chuck Robbins, chair and CEO of Cisco.

Company Overview

Founded in 1984 by a husband and wife team who wanted computers at Stanford to talk to computers at UC Berkeley, Cisco (NASDAQ: CSCO) designs and sells networking equipment, security solutions, and collaboration tools that help businesses connect their systems and secure their digital operations.

Revenue Growth

Examining a company’s long-term performance can provide clues about its quality. Any business can have short-term success, but a top-tier one grows for years.

With $59.05 billion in revenue over the past 12 months, Cisco is a behemoth in the business services sector and benefits from economies of scale, giving it an edge in distribution. This also enables it to gain more leverage on its fixed costs than smaller competitors and the flexibility to offer lower prices. However, its scale is a double-edged sword because it’s harder to find incremental growth when you’ve penetrated most of the market. For Cisco to boost its sales, it likely needs to adjust its prices, launch new offerings, or lean into foreign markets.

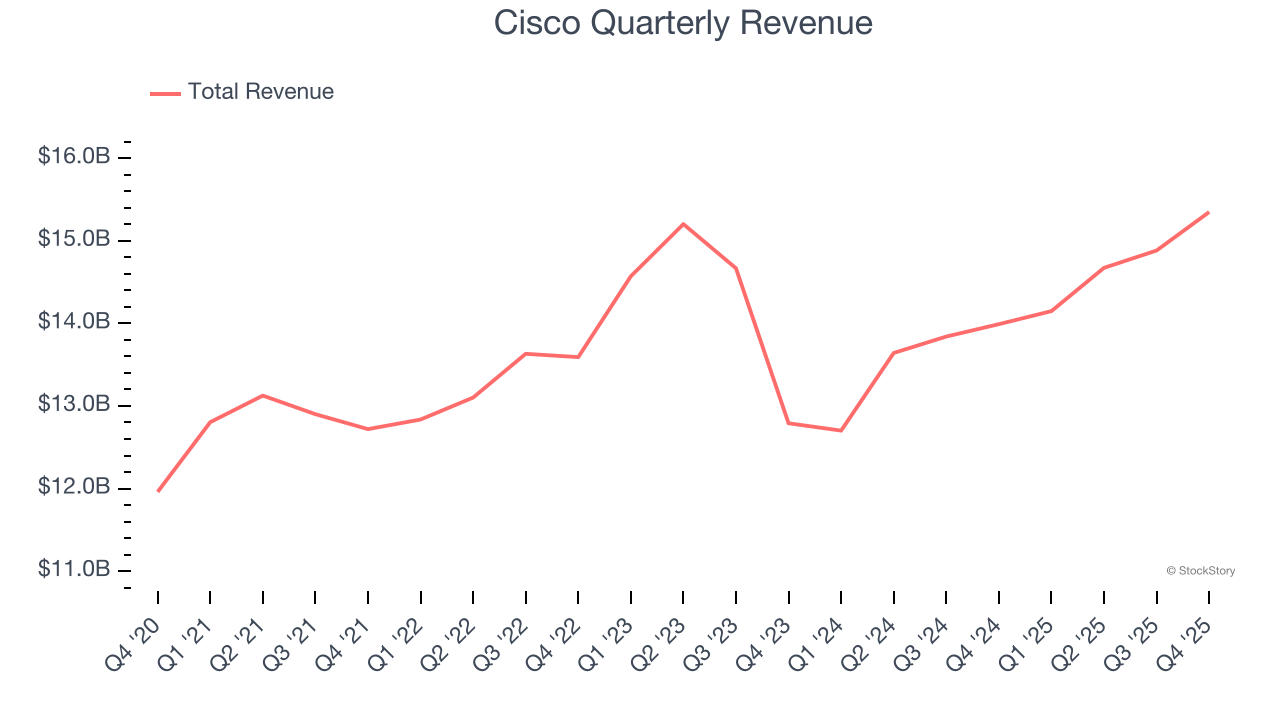

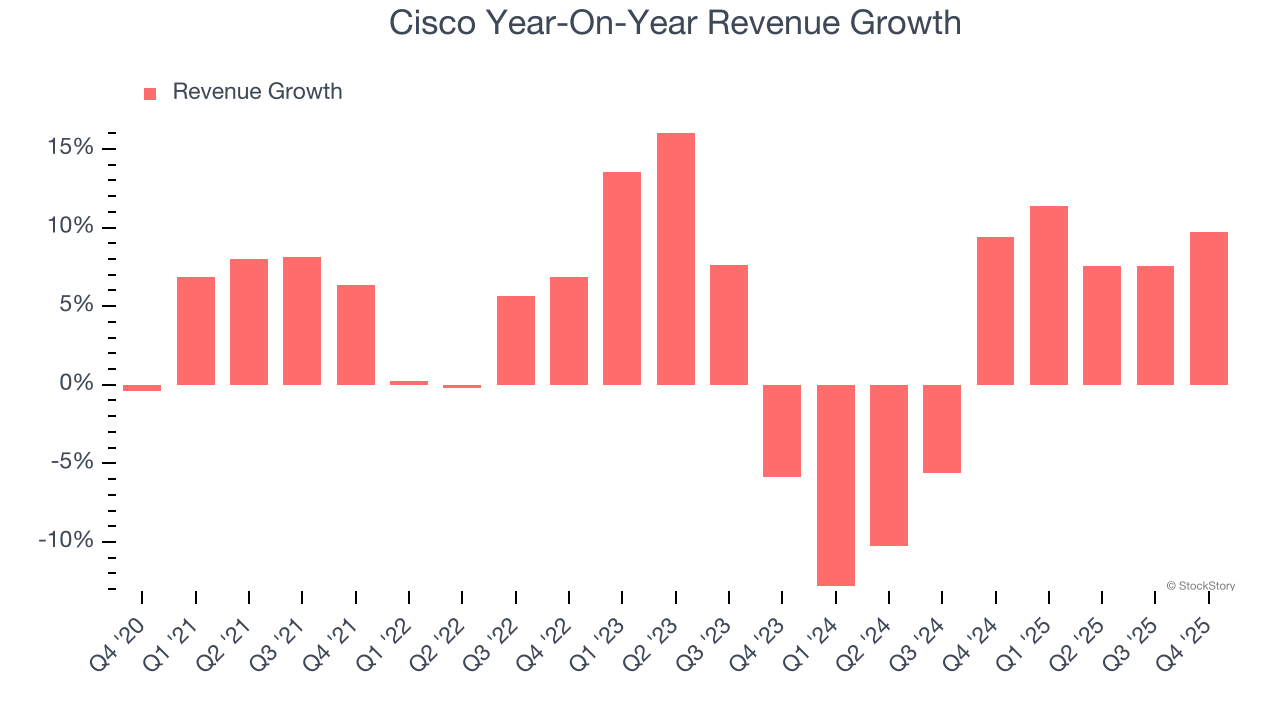

As you can see below, Cisco’s sales grew at a mediocre 4.2% compounded annual growth rate over the last five years. This shows it couldn’t generate demand in any major way and is a tough starting point for our analysis.

We at StockStory place the most emphasis on long-term growth, but within business services, a half-decade historical view may miss recent innovations or disruptive industry trends. Cisco’s recent performance shows its demand has slowed as its annualized revenue growth of 1.6% over the last two years was below its five-year trend. We’re wary when companies in the sector see decelerations in revenue growth, as it could signal changing consumer tastes aided by low switching costs.

This quarter, Cisco reported year-on-year revenue growth of 9.7%, and its $15.35 billion of revenue exceeded Wall Street’s estimates by 1.5%. Company management is currently guiding for a 9.5% year-on-year increase in sales next quarter.

Looking further ahead, sell-side analysts expect revenue to grow 5.3% over the next 12 months, an improvement versus the last two years. This projection is above average for the sector and indicates its newer products and services will spur better top-line performance.

Microsoft, Alphabet, Coca-Cola, Monster Beverage—all began as under-the-radar growth stories riding a massive trend. We’ve identified the next one: a profitable AI semiconductor play Wall Street is still overlooking. Go here for access to our full report.

Operating Margin

Operating margin is an important measure of profitability as it shows the portion of revenue left after accounting for all core expenses – everything from the cost of goods sold to advertising and wages. It’s also useful for comparing profitability across companies with different levels of debt and tax rates because it excludes interest and taxes.

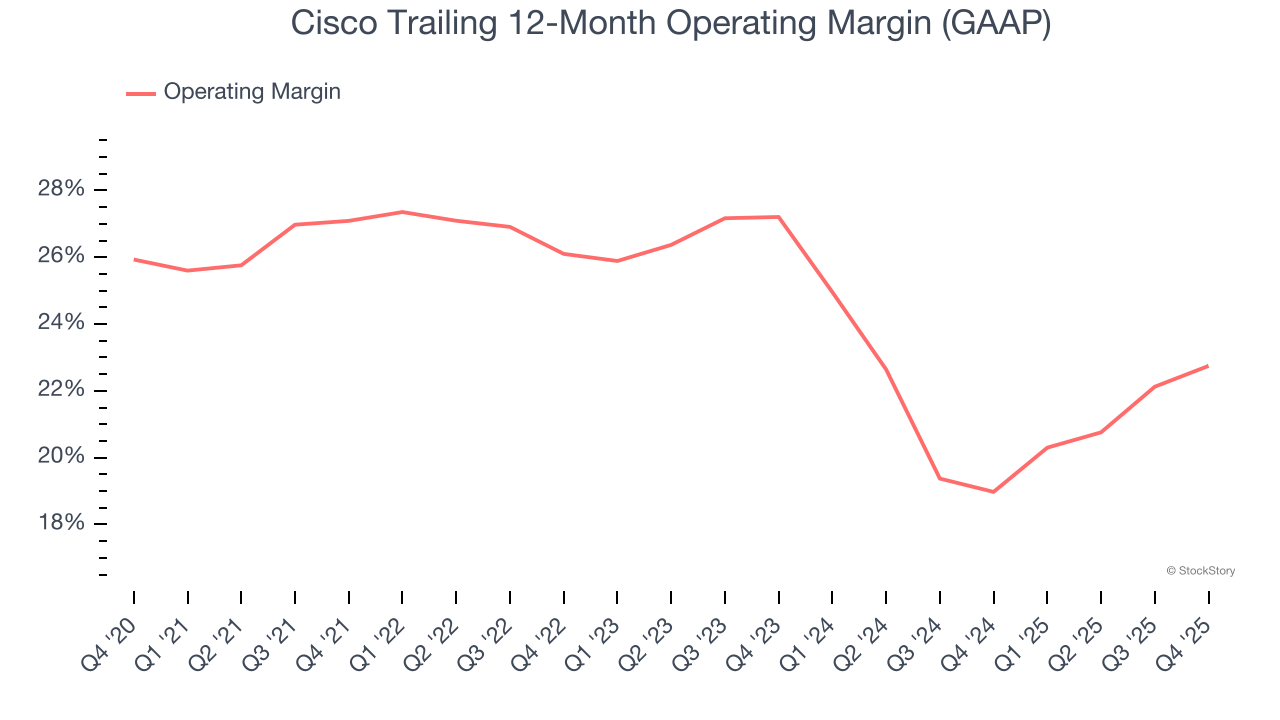

Cisco has been a well-oiled machine over the last five years. It demonstrated elite profitability for a business services business, boasting an average operating margin of 24.4%.

Analyzing the trend in its profitability, Cisco’s operating margin decreased by 4.3 percentage points over the last five years. This raises questions about the company’s expense base because its revenue growth should have given it leverage on its fixed costs, resulting in better economies of scale and profitability.

This quarter, Cisco generated an operating margin profit margin of 24.6%, up 2.4 percentage points year on year. This increase was a welcome development and shows it was more efficient.

Earnings Per Share

Revenue trends explain a company’s historical growth, but the long-term change in earnings per share (EPS) points to the profitability of that growth – for example, a company could inflate its sales through excessive spending on advertising and promotions.

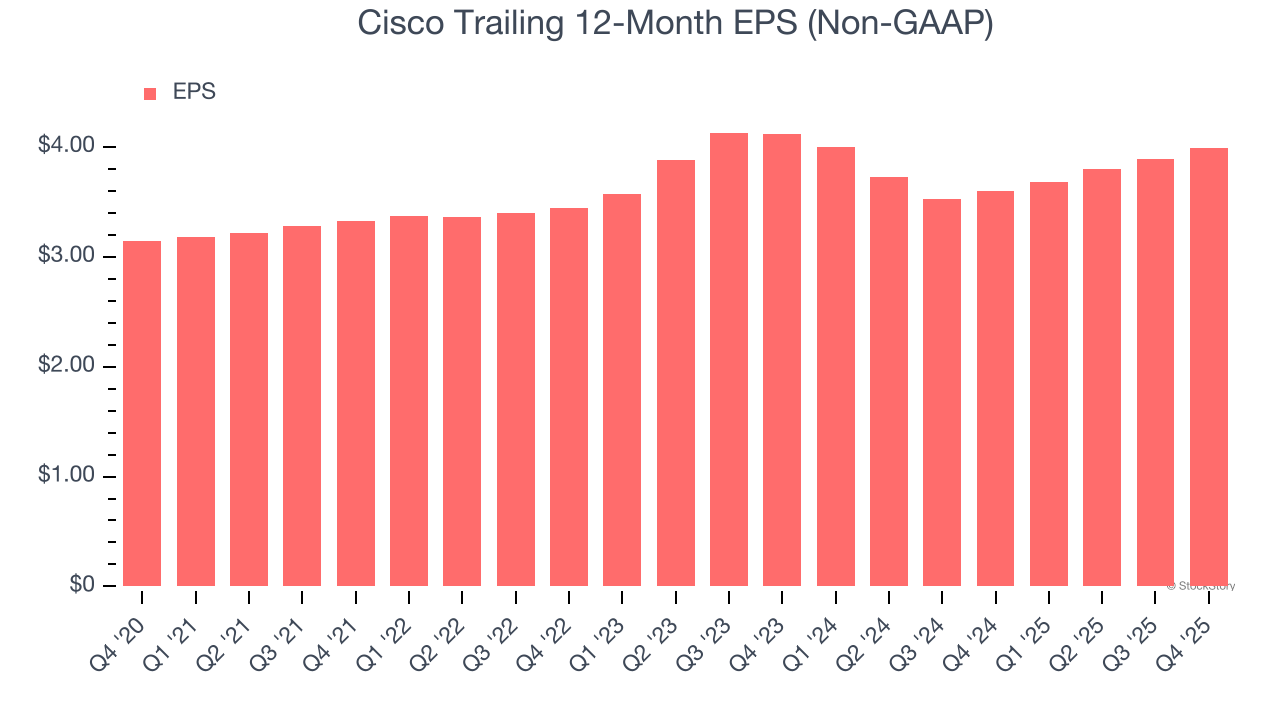

Cisco’s unimpressive 4.9% annual EPS growth over the last five years aligns with its revenue performance. This tells us it maintained its per-share profitability as it expanded.

Like with revenue, we analyze EPS over a more recent period because it can provide insight into an emerging theme or development for the business.

For Cisco, its two-year annual EPS declines of 1.6% show it’s continued to underperform. These results were bad no matter how you slice the data.

In Q4, Cisco reported adjusted EPS of $1.04, up from $0.94 in the same quarter last year. This print beat analysts’ estimates by 1.7%. Over the next 12 months, Wall Street expects Cisco’s full-year EPS of $3.99 to grow 7.1%.

Key Takeaways from Cisco’s Q4 Results

Revenue and EPS in the quarter beat expectations. It was also great to see Cisco’s revenue guidance for next quarter top analysts’ expectations. On the other hand, gross margin guidance for the upcoming quarter missed. Overall, this print was mixed. Investors were likely hoping for more, and shares traded down 5.5% to $80.92 immediately following the results.

So should you invest in Cisco right now? The latest quarter does matter, but not nearly as much as longer-term fundamentals and valuation, when deciding if the stock is a buy. We cover that in our actionable full research report which you can read here (it’s free).