Let’s dig into the relative performance of Toll Brothers (NYSE: TOL) and its peers as we unravel the now-completed Q3 home builders earnings season.

Traditionally, homebuilders have built competitive advantages with economies of scale that lead to advantaged purchasing and brand recognition among consumers. Aesthetic trends have always been important in the space, but more recently, energy efficiency and conservation are driving innovation. However, these companies are still at the whim of the macro, specifically interest rates that heavily impact new and existing home sales. In fact, homebuilders are one of the most cyclical subsectors within industrials.

The 13 home builders stocks we track reported a mixed Q3. As a group, revenues beat analysts’ consensus estimates by 3.3% while next quarter’s revenue guidance was in line.

In light of this news, share prices of the companies have held steady as they are up 3.8% on average since the latest earnings results.

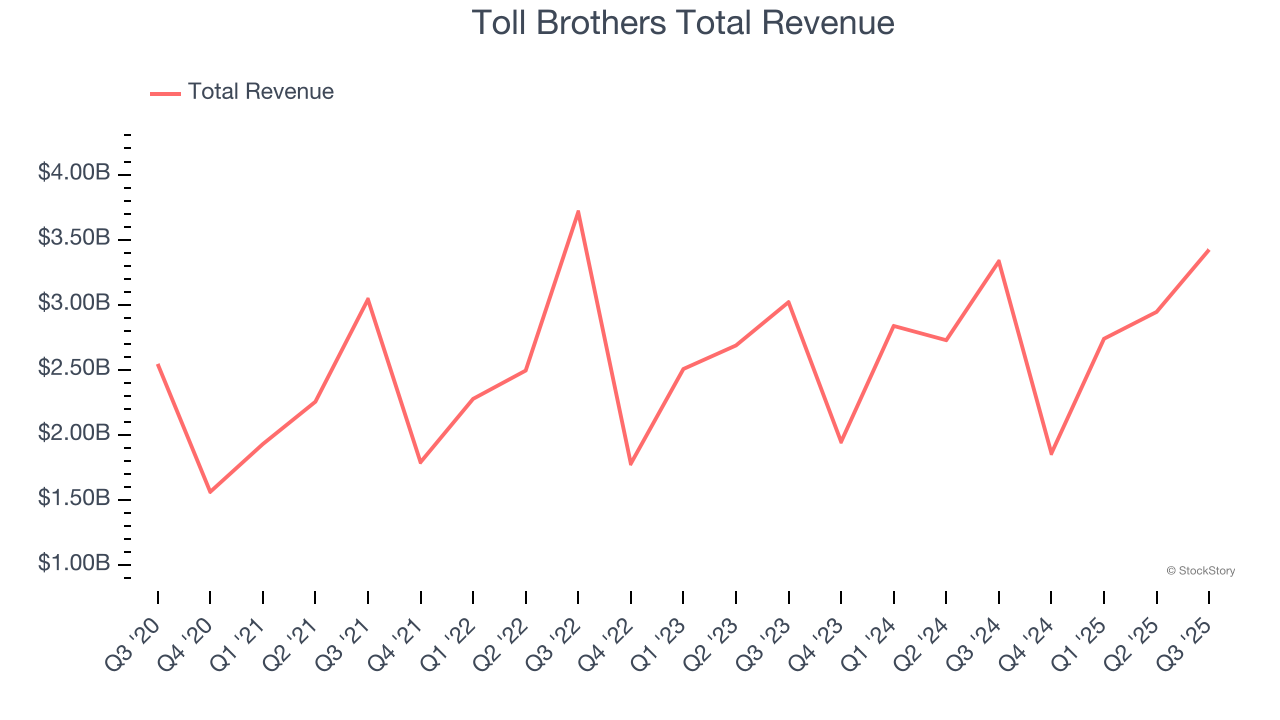

Toll Brothers (NYSE: TOL)

Started by two brothers who started by building and selling just one home in Pennsylvania, today Toll Brothers (NYSE: TOL) is a luxury homebuilder across the United States.

Toll Brothers reported revenues of $3.42 billion, up 2.7% year on year. This print exceeded analysts’ expectations by 3.2%. Despite the top-line beat, it was still a slower quarter for the company with a significant miss of analysts’ EBITDA estimates and a significant miss of analysts’ EPS estimates.

Douglas C. Yearley, Jr., chairman and chief executive officer, stated: “Fiscal 2025 proved to be another strong year for Toll Brothers, as we executed well in a choppy environment. We delivered 11,292 homes at an average price of $960,000, generating a record $10.8 billion of home sales revenues, and posted an adjusted gross margin of 27.3%, an SG&A margin of 9.5%, and earnings of $13.49 per diluted share. We grew our community count by 9%, continued to produce strong operating cash flows of $1.1 billion, returned approximately $750 million to stockholders through share repurchases and dividends, and generated a return on beginning equity of 17.6%. In our fourth quarter, we met or exceeded guidance across all of our core home building metrics, generating $3.4 billion in home sales revenue with an adjusted gross margin of 27.1% and an SG&A margin of 8.3%. We earned $4.58 per diluted share, which was modestly below guidance due to the delayed closing of the sale of our Apartment Living business that we announced in September.

Interestingly, the stock is up 1.5% since reporting and currently trades at $138.14.

Read our full report on Toll Brothers here, it’s free.

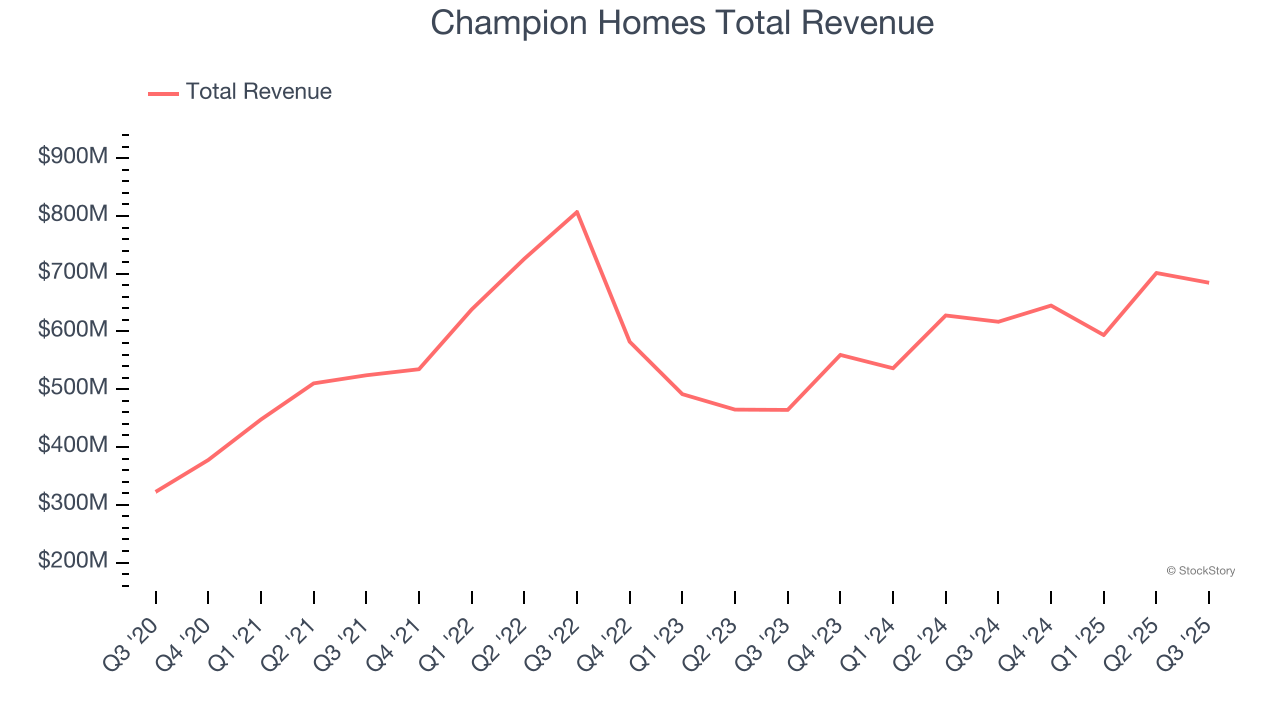

Best Q3: Champion Homes (NYSE: SKY)

Founded in 1951, Champion Homes (NYSE: SKY) is a manufacturer of modular homes and buildings in North America.

Champion Homes reported revenues of $684.4 million, up 11% year on year, outperforming analysts’ expectations by 6.9%. The business had an incredible quarter with an impressive beat of analysts’ EBITDA estimates and a solid beat of analysts’ adjusted operating income estimates.

Champion Homes delivered the fastest revenue growth among its peers. The market seems happy with the results as the stock is up 36.7% since reporting. It currently trades at $90.92.

Is now the time to buy Champion Homes? Access our full analysis of the earnings results here, it’s free.

Weakest Q3: Meritage Homes (NYSE: MTH)

Originally founded in 1985 in Arizona as Monterey Homes, Meritage Homes (NYSE: MTH) is a homebuilder specializing in designing and constructing energy-efficient and single-family homes in the US.

Meritage Homes reported revenues of $1.42 billion, down 10.8% year on year, falling short of analysts’ expectations by 3.4%. It was a disappointing quarter as it posted a significant miss of analysts’ revenue estimates and a significant miss of analysts’ adjusted operating income estimates.

Meritage Homes delivered the weakest performance against analyst estimates in the group. As expected, the stock is down 2.2% since the results and currently trades at $69.51.

Read our full analysis of Meritage Homes’s results here.

Taylor Morrison Home (NYSE: TMHC)

Named “America’s Most Trusted Home Builder” in 2019, Taylor Morrison Home (NYSE: TMHC) builds single family homes and communities across the United States.

Taylor Morrison Home reported revenues of $2.10 billion, down 1.2% year on year. This number beat analysts’ expectations by 3.4%. Overall, it was a strong quarter as it also produced an impressive beat of analysts’ EBITDA estimates and a solid beat of analysts’ adjusted operating income estimates.

The stock is down 2.4% since reporting and currently trades at $61.10.

Read our full, actionable report on Taylor Morrison Home here, it’s free.

Lennar (NYSE: LEN)

One of the largest homebuilders in America, Lennar (NYSE: LEN) is known for constructing affordable, move-up, and retirement homes across a range of markets and communities.

Lennar reported revenues of $9.37 billion, down 5.8% year on year. This result topped analysts’ expectations by 2.6%. Zooming out, it was a softer quarter as it recorded a significant miss of analysts’ adjusted operating income estimates and a significant miss of analysts’ EBITDA estimates.

The stock is down 3.9% since reporting and currently trades at $112.83.

Read our full, actionable report on Lennar here, it’s free.

Market Update

In response to the Fed’s rate hikes in 2022 and 2023, inflation has been gradually trending down from its post-pandemic peak, trending closer to the Fed’s 2% target. Despite higher borrowing costs, the economy has avoided flashing recessionary signals. This is the much-desired soft landing that many investors hoped for. The recent rate cuts (0.5% in September and 0.25% in November 2024) have bolstered the stock market, making 2024 a strong year for equities. Donald Trump’s presidential win in November sparked additional market gains, sending indices to record highs in the days following his victory. However, debates continue over possible tariffs and corporate tax adjustments, raising questions about economic stability in 2025.

Want to invest in winners with rock-solid fundamentals? Check out our 9 Best Market-Beating Stocks and add them to your watchlist. These companies are poised for growth regardless of the political or macroeconomic climate.

StockStory’s analyst team — all seasoned professional investors — uses quantitative analysis and automation to deliver market-beating insights faster and with higher quality.