Digital infrastructure provider Applied Digital (NASDAQ: APLD) beat Wall Street’s revenue expectations in Q4 CY2025, with sales up 98% year on year to $126.6 million. Its non-GAAP loss of $0 per share was significantly above analysts’ consensus estimates.

Is now the time to buy Applied Digital? Find out by accessing our full research report, it’s free for active Edge members.

Applied Digital (APLD) Q4 CY2025 Highlights:

- Revenue: $126.6 million vs analyst estimates of $110.3 million (98% year-on-year growth, 14.8% beat)

- Adjusted EPS: $0 vs analyst estimates of -$0.21 (significant beat)

- Adjusted EBITDA: $20.2 million vs analyst estimates of $4.16 million (16% margin, significant beat)

- Operating Margin: -24.5%, up from -28.6% in the same quarter last year

- Free Cash Flow was -$567.9 million compared to -$223.3 million in the same quarter last year

- Market Capitalization: $8.64 billion

“The Dakotas represent a compelling region for hyperscalers due to their cool climate and abundant energy. We believe our first-mover advantage, combined with our proven ability to execute technically complex data center construction, positions Applied Digital with a strong competitive advantage. Having already secured two hyperscalers in the region, inbound demand has increased meaningfully. We are also in advanced discussions with another investment-grade hyperscaler across multiple regions, including additional locations in the Dakotas and select southern U.S. markets. While there can be no assurance of future contracts, we believe we are well positioned to begin construction in the near term on these new sites,” said Wes Cummins, Chairman and Chief Executive Officer.

Company Overview

Pivoting from its origins in cryptocurrency mining to become a key player in the AI infrastructure boom, Applied Digital (NASDAQ: APLD) designs and operates specialized data centers that provide high-performance computing infrastructure for artificial intelligence and blockchain applications.

Revenue Growth

Reviewing a company’s long-term sales performance reveals insights into its quality. Any business can put up a good quarter or two, but many enduring ones grow for years.

With $281.7 million in revenue over the past 12 months, Applied Digital is a small player in the business services space, which sometimes brings disadvantages compared to larger competitors benefiting from economies of scale and numerous distribution channels. On the bright side, it can grow faster because it has more room to expand.

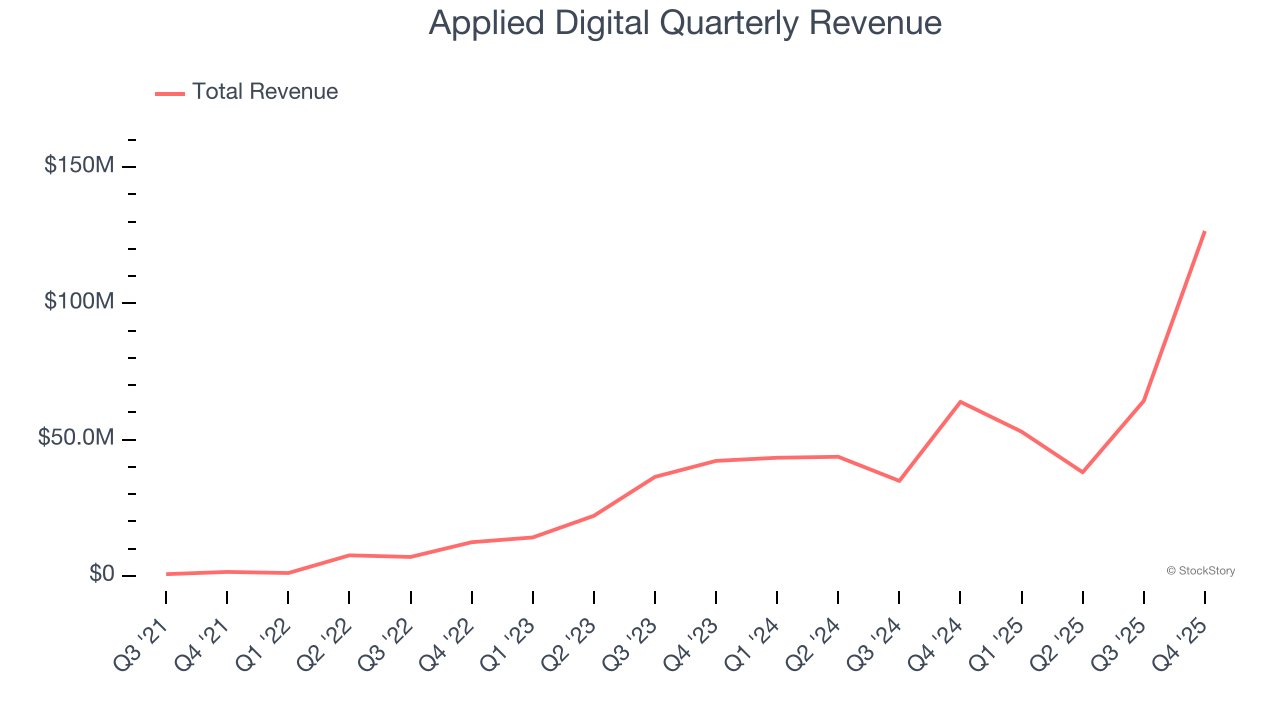

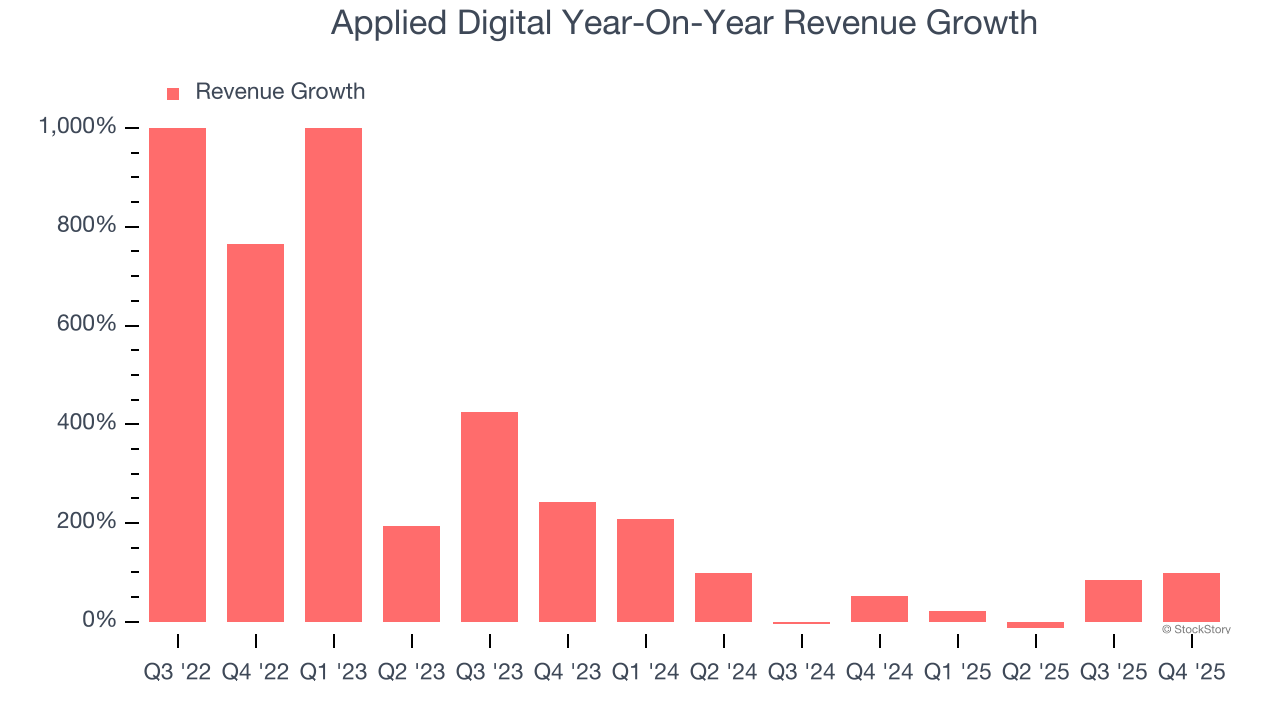

As you can see below, Applied Digital grew its sales at an incredible 211% compounded annual growth rate over the last four years. This shows it had high demand, a useful starting point for our analysis.

We at StockStory place the most emphasis on long-term growth, but within business services, a stretched historical view may miss recent innovations or disruptive industry trends. Applied Digital’s annualized revenue growth of 56.8% over the last two years is below its four-year trend, but we still think the results suggest healthy demand.

This quarter, Applied Digital reported magnificent year-on-year revenue growth of 98.2%, and its $126.6 million of revenue beat Wall Street’s estimates by 14.8%.

Looking ahead, sell-side analysts expect revenue to grow 41.6% over the next 12 months, a deceleration versus the last two years. Despite the slowdown, this projection is admirable and indicates the market sees success for its products and services.

The 1999 book Gorilla Game predicted Microsoft and Apple would dominate tech before it happened. Its thesis? Identify the platform winners early. Today, enterprise software companies embedding generative AI are becoming the new gorillas. a profitable, fast-growing enterprise software stock that is already riding the automation wave and looking to catch the generative AI next.

Operating Margin

Operating margin is a key measure of profitability. Think of it as net income - the bottom line - excluding the impact of taxes and interest on debt, which are less connected to business fundamentals.

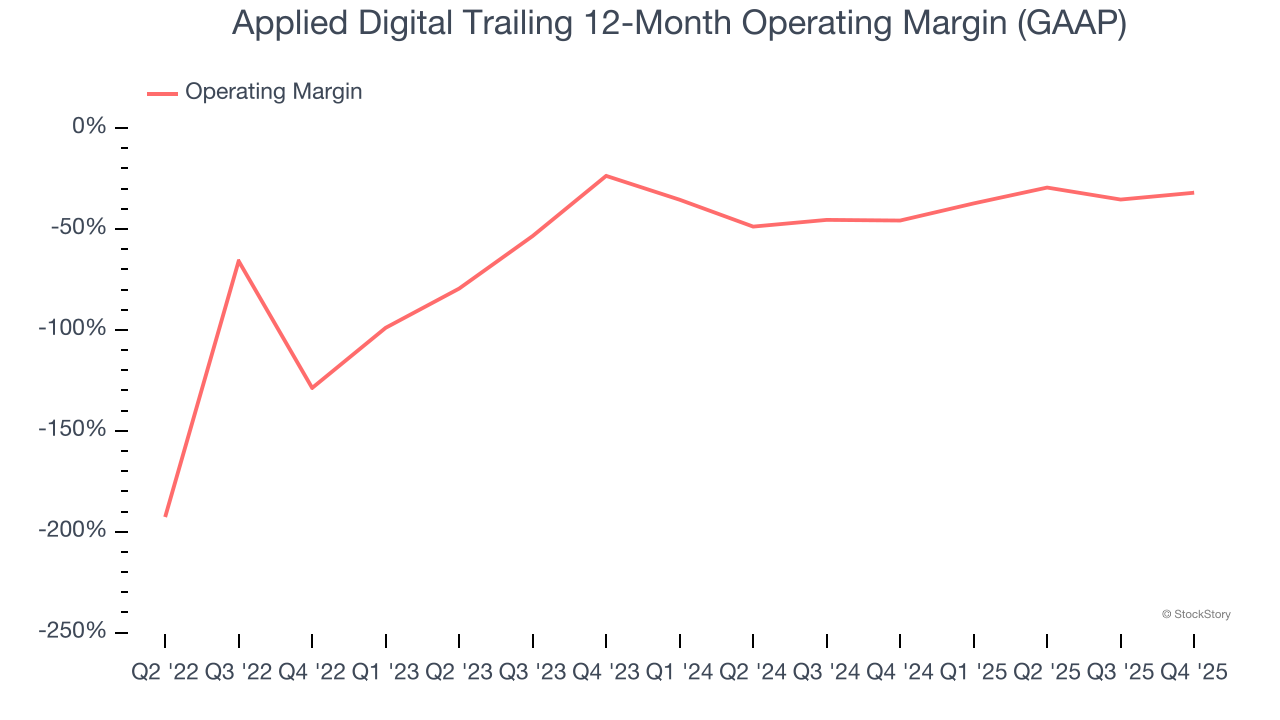

Applied Digital’s high expenses have contributed to an average operating margin of negative 41.3% over the last five years. Unprofitable business services companies require extra attention because they could get caught swimming naked when the tide goes out. It’s hard to trust that the business can endure a full cycle.

On the plus side, Applied Digital’s operating margin rose over the last five years, as its sales growth gave it operating leverage. Still, it will take much more for the company to reach long-term profitability.

Applied Digital’s operating margin was negative 24.5% this quarter.

Earnings Per Share

Revenue trends explain a company’s historical growth, but the long-term change in earnings per share (EPS) points to the profitability of that growth – for example, a company could inflate its sales through excessive spending on advertising and promotions.

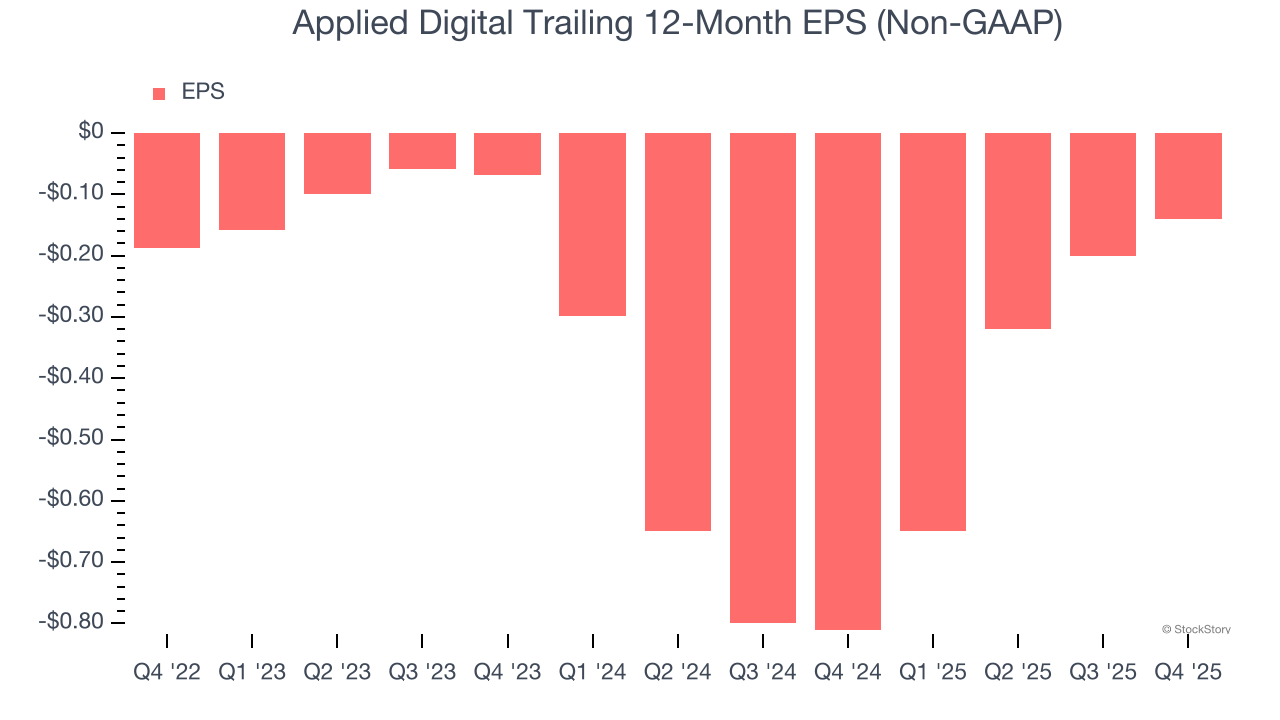

Applied Digital’s full-year EPS was flat over the last three years. This performance was underwhelming across the board.

Like with revenue, we analyze EPS over a shorter period to see if we are missing a change in the business.

For Applied Digital, its two-year annual EPS declines of 42.3% show its recent history was to blame for its underperformance over the last three years. These results were bad no matter how you slice the data.

In Q4, Applied Digital reported adjusted EPS of $0, up from negative $0.06 in the same quarter last year. This print easily cleared analysts’ estimates, and shareholders should be content with the results. Over the next 12 months, Wall Street expects Applied Digital to perform poorly. Analysts forecast its full-year EPS of negative $0.14 will tumble to negative $0.97.

Key Takeaways from Applied Digital’s Q4 Results

It was good to see Applied Digital beat analysts’ EPS expectations this quarter. We were also excited its revenue outperformed Wall Street’s estimates by a wide margin. Zooming out, we think this quarter featured some important positives. The stock traded up 5.3% to $31.14 immediately following the results.

Indeed, Applied Digital had a rock-solid quarterly earnings result, but is this stock a good investment here? The latest quarter does matter, but not nearly as much as longer-term fundamentals and valuation, when deciding if the stock is a buy. We cover that in our actionable full research report which you can read here, it’s free for active Edge members.