As the Q3 earnings season comes to a close, it’s time to take stock of this quarter’s best and worst performers in the vertical software industry, including Guidewire Software (NYSE: GWRE) and its peers.

Software is eating the world, and while a large number of solutions such as project management or video conferencing software can be useful to a wide array of industries, some have very specific needs. As a result, vertical software, which addresses industry-specific workflows, is growing and fueled by the pressures to improve productivity, whether it be for a life sciences, education, or banking company.

The 4 vertical software stocks we track reported a very strong Q3. As a group, revenues beat analysts’ consensus estimates by 2.5% while next quarter’s revenue guidance was in line.

Amidst this news, share prices of the companies have had a rough stretch. On average, they are down 15.8% since the latest earnings results.

Weakest Q3: Guidewire Software (NYSE: GWRE)

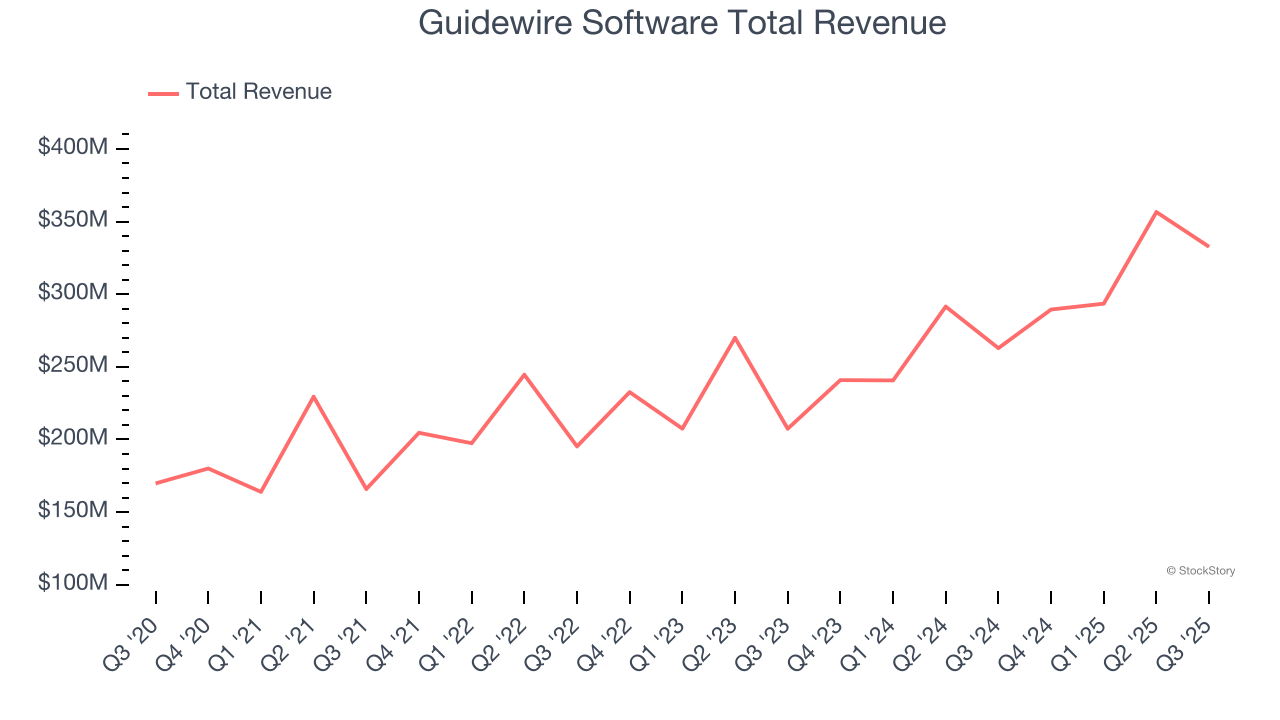

With its systems powering the operations of hundreds of insurance brands across 42 countries, Guidewire Software (NYSE: GWRE) provides a technology platform that helps property and casualty insurance companies manage their core operations, digital engagement, and analytics.

Guidewire Software reported revenues of $332.6 million, up 26.5% year on year. This print exceeded analysts’ expectations by 4.6%. Overall, it was a satisfactory quarter for the company with an impressive beat of analysts’ EBITDA estimates but a significant miss of analysts’ billings estimates.

Guidewire Software scored the biggest analyst estimates beat and fastest revenue growth, but had the weakest full-year guidance update of the whole group. Even though it had a relatively good quarter, the market seems discontent with the results. The stock is down 4.6% since reporting and currently trades at $158.97.

Is now the time to buy Guidewire Software? Access our full analysis of the earnings results here, it’s free.

Best Q3: Alarm.com (NASDAQ: ALRM)

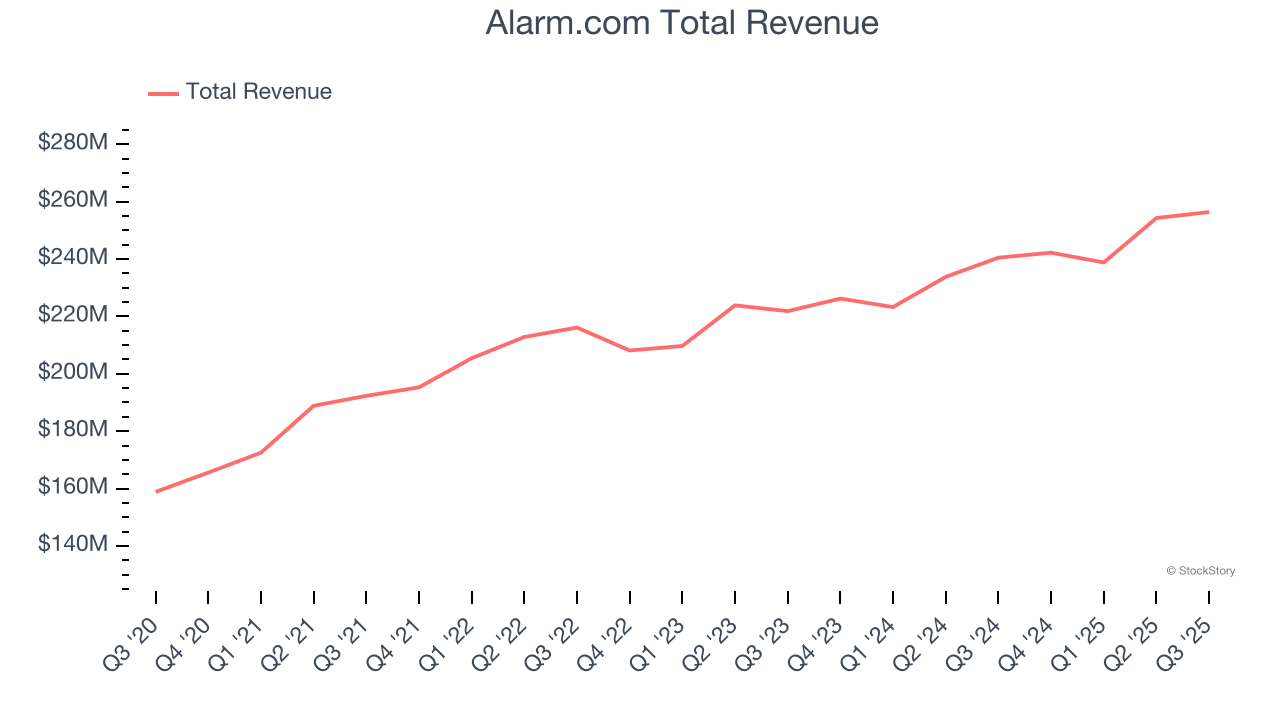

Processing over 325 billion data points annually from more than 150 million connected devices, Alarm.com (NASDAQ: ALRM) provides cloud-based platforms that enable residential and commercial property owners to remotely monitor and control their security, video, energy, and other connected devices.

Alarm.com reported revenues of $256.4 million, up 6.6% year on year, outperforming analysts’ expectations by 2.2%. The business had an exceptional quarter with an impressive beat of analysts’ EBITDA estimates and full-year EPS guidance exceeding analysts’ expectations.

The market seems content with the results as the stock is up 4.6% since reporting. It currently trades at $49.28.

Is now the time to buy Alarm.com? Access our full analysis of the earnings results here, it’s free.

Bentley Systems (NASDAQ: BSY)

Pioneering the concept of "digital twins" for infrastructure projects long before it became an industry buzzword, Bentley Systems (NASDAQ: BSY) provides software solutions that help engineers design, build, and operate infrastructure projects across sectors including roads, bridges, utilities, mining, and industrial facilities.

Bentley Systems reported revenues of $375.5 million, up 12% year on year, exceeding analysts’ expectations by 1.6%. It may have had the worst quarter among its peers, but its results were still good as it also locked in an impressive beat of analysts’ EBITDA estimates and a decent beat of analysts’ billings estimates.

Bentley Systems delivered the weakest performance against analyst estimates in the group. As expected, the stock is down 22.2% since the results and currently trades at $38.11.

Read our full analysis of Bentley Systems’s results here.

Manhattan Associates (NASDAQ: MANH)

Built on a "versionless" cloud architecture that delivers quarterly updates to all customers, Manhattan Associates (NASDAQ: MANH) develops cloud-based software that helps retailers, wholesalers, and manufacturers manage their supply chains, inventory, and omnichannel operations.

Manhattan Associates reported revenues of $275.8 million, up 3.4% year on year. This number beat analysts’ expectations by 1.6%. Overall, it was a very strong quarter as it also recorded a solid beat of analysts’ EBITDA estimates and full-year EPS guidance exceeding analysts’ expectations.

Manhattan Associates scored the highest full-year guidance raise but had the slowest revenue growth among its peers. The stock is down 19% since reporting and currently trades at $165.78.

Read our full, actionable report on Manhattan Associates here, it’s free.

Want to invest in winners with rock-solid fundamentals? Check out our 9 Best Market-Beating Stocks and add them to your watchlist. These companies are poised for growth regardless of the political or macroeconomic climate.

StockStory’s analyst team — all seasoned professional investors — uses quantitative analysis and automation to deliver market-beating insights faster and with higher quality.