Ophthalmology biopharmaceutical company Ocular Therapeutix (NASDAQ: OCUL) reported Q3 CY2025 results topping the market’s revenue expectations, but sales fell by 5.7% year on year to $14.54 million. Its non-GAAP loss of $0.38 per share was 9.6% below analysts’ consensus estimates.

Is now the time to buy Ocular Therapeutix? Find out by accessing our full research report, it’s free for active Edge members.

Ocular Therapeutix (OCUL) Q3 CY2025 Highlights:

- Revenue: $14.54 million vs analyst estimates of $14.01 million (5.7% year-on-year decline, 3.8% beat)

- Adjusted EPS: -$0.38 vs analyst expectations of -$0.35 (9.6% miss)

- Adjusted EBITDA: -$68.52 million (-471% margin, 49.5% year-on-year decline)

- Operating Margin: -472%, down from -298% in the same quarter last year

- Free Cash Flow was -$56.72 million compared to -$36.65 million in the same quarter last year

- Market Capitalization: $2.59 billion

Company Overview

Pioneering a drug delivery platform that can eliminate the need for monthly eye injections, Ocular Therapeutix (NASDAQ: OCUL) develops sustained-release treatments for eye diseases using its proprietary ELUTYX bioresorbable hydrogel technology that gradually releases medication.

Revenue Growth

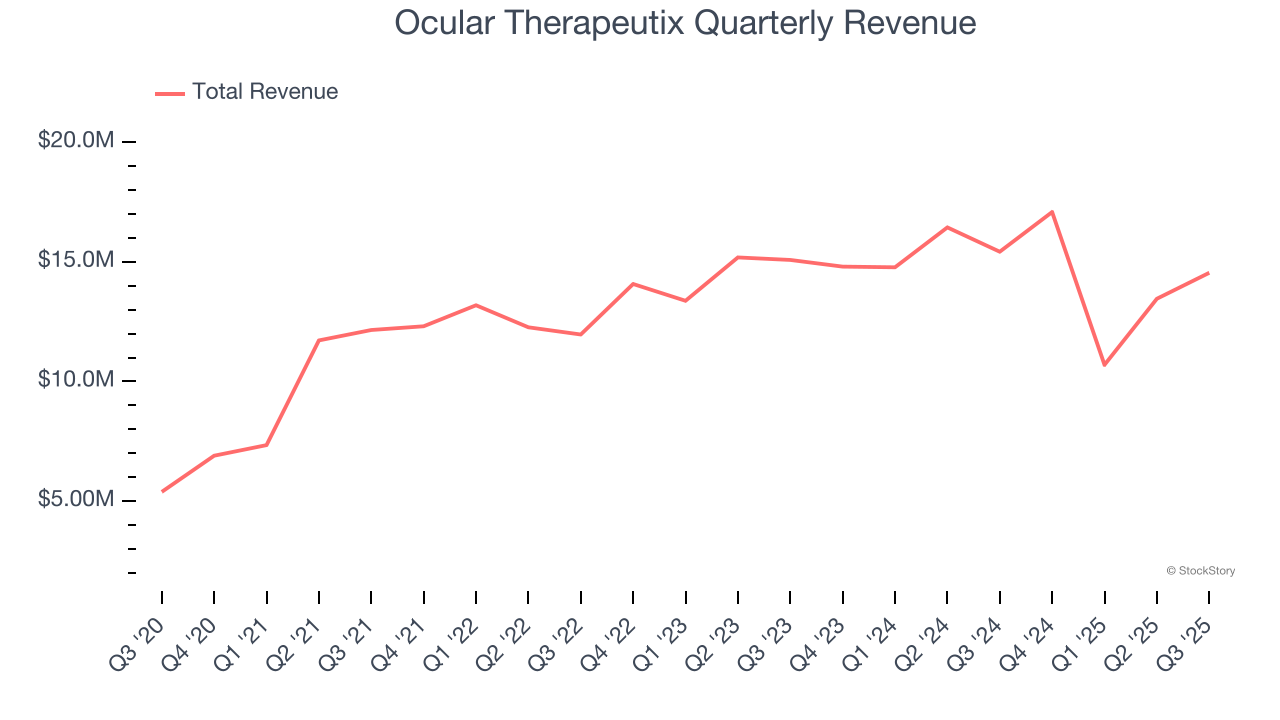

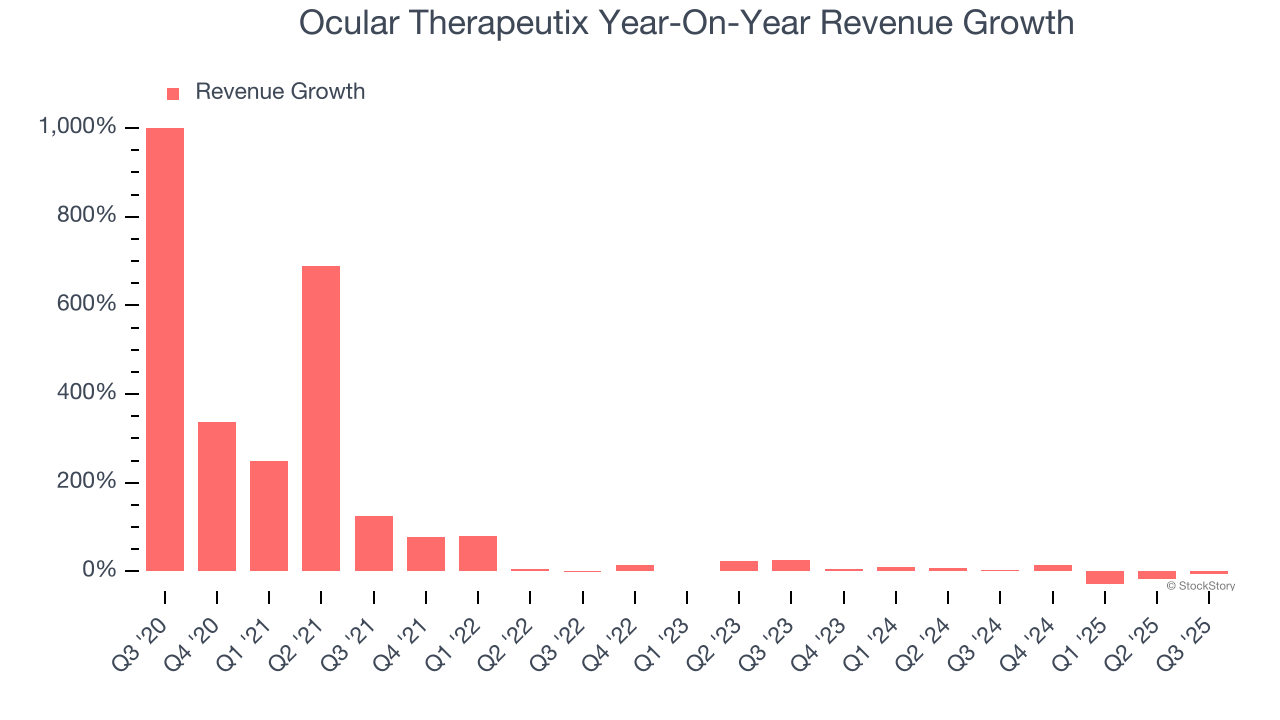

Reviewing a company’s long-term sales performance reveals insights into its quality. Any business can put up a good quarter or two, but the best consistently grow over the long haul. Over the last five years, Ocular Therapeutix grew its sales at an incredible 39.5% compounded annual growth rate. Its growth beat the average healthcare company and shows its offerings resonate with customers.

We at StockStory place the most emphasis on long-term growth, but within healthcare, a half-decade historical view may miss recent innovations or disruptive industry trends. Ocular Therapeutix’s recent performance marks a sharp pivot from its five-year trend as its revenue has shown annualized declines of 1.7% over the last two years.

This quarter, Ocular Therapeutix’s revenue fell by 5.7% year on year to $14.54 million but beat Wall Street’s estimates by 3.8%.

Looking ahead, sell-side analysts expect revenue to grow 6.3% over the next 12 months, an improvement versus the last two years. This projection is above the sector average and indicates its newer products and services will spur better top-line performance.

Microsoft, Alphabet, Coca-Cola, Monster Beverage—all began as under-the-radar growth stories riding a massive trend. We’ve identified the next one: a profitable AI semiconductor play Wall Street is still overlooking. Go here for access to our full report.

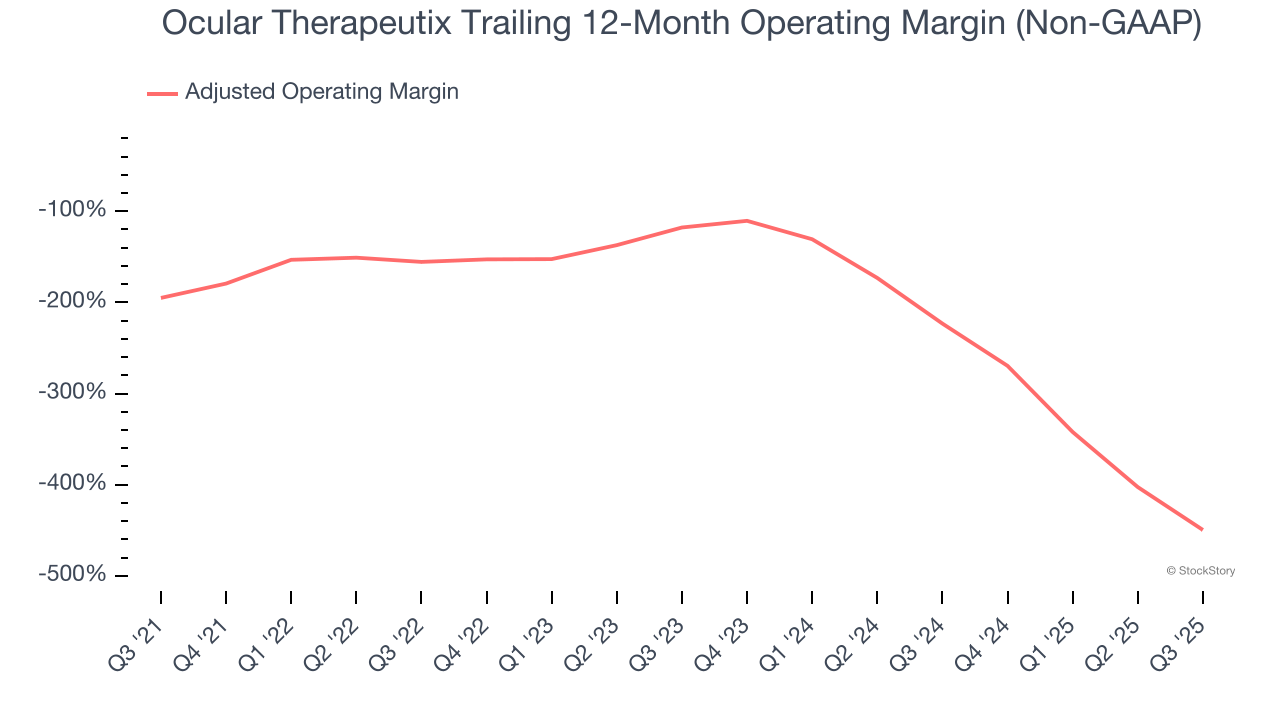

Adjusted Operating Margin

Adjusted operating margin is a key measure of profitability. Think of it as net income (the bottom line) excluding the impact of non-recurring expenses, taxes, and interest on debt - metrics less connected to business fundamentals.

Ocular Therapeutix’s high expenses have contributed to an average adjusted operating margin of negative 231% over the last five years. Unprofitable healthcare companies require extra attention because they could get caught swimming naked when the tide goes out. It’s hard to trust that the business can endure a full cycle.

Analyzing the trend in its profitability, Ocular Therapeutix’s adjusted operating margin decreased significantly over the last five years. This performance was caused by more recent speed bumps as the company’s margin fell by 331.9 percentage points on a two-year basis. We’re disappointed in these results because it shows its expenses were rising and it couldn’t pass those costs onto its customers.

In Q3, Ocular Therapeutix generated a negative 472% adjusted operating margin.

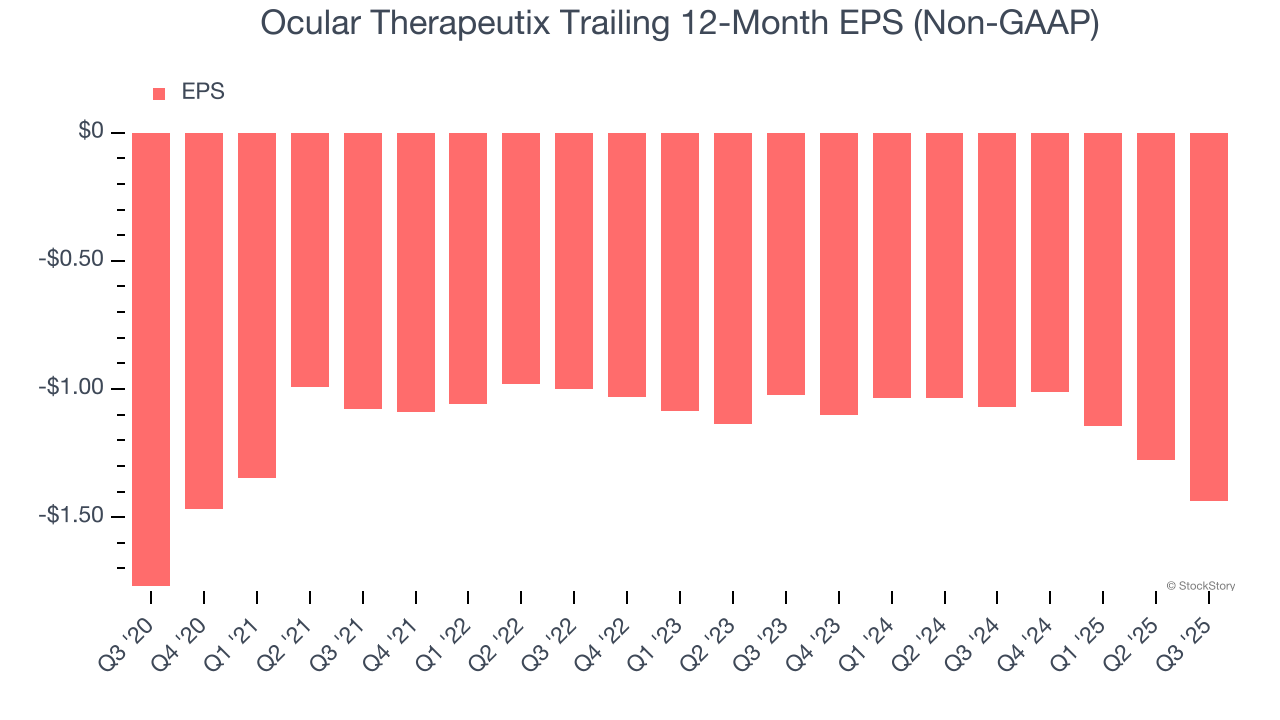

Earnings Per Share

We track the long-term change in earnings per share (EPS) for the same reason as long-term revenue growth. Compared to revenue, however, EPS highlights whether a company’s growth is profitable.

Although Ocular Therapeutix’s full-year earnings are still negative, it reduced its losses and improved its EPS by 4.1% annually over the last five years. The next few quarters will be critical for assessing its long-term profitability.

In Q3, Ocular Therapeutix reported adjusted EPS of negative $0.38, down from negative $0.22 in the same quarter last year. This print missed analysts’ estimates. Over the next 12 months, Wall Street expects Ocular Therapeutix to improve its earnings losses. Analysts forecast its full-year EPS of negative $1.44 will advance to negative $1.39.

Key Takeaways from Ocular Therapeutix’s Q3 Results

We enjoyed seeing Ocular Therapeutix beat analysts’ revenue expectations this quarter. On the other hand, its EPS missed. Overall, this was a softer quarter. The stock remained flat at $11.83 immediately following the results.

Is Ocular Therapeutix an attractive investment opportunity right now? We think that the latest quarter is only one piece of the longer-term business quality puzzle. Quality, when combined with valuation, can help determine if the stock is a buy. We cover that in our actionable full research report which you can read here, it’s free for active Edge members.