Medical technology company Inspire Medical Systems (NYSE: INSP) beat Wall Street’s revenue expectations in Q2 CY2025, with sales up 10.8% year on year to $217.1 million. On the other hand, the company’s full-year revenue guidance of $905 million at the midpoint came in 4.6% below analysts’ estimates. Its GAAP loss of $0.12 per share was significantly below analysts’ consensus estimates.

Is now the time to buy Inspire Medical Systems? Find out by accessing our full research report, it’s free.

Inspire Medical Systems (INSP) Q2 CY2025 Highlights:

- Revenue: $217.1 million vs analyst estimates of $214.4 million (10.8% year-on-year growth, 1.2% beat)

- EPS (GAAP): -$0.12 vs analyst estimates of $0.20 (significant miss)

- Adjusted EBITDA: $44.11 million vs analyst estimates of $36.38 million (20.3% margin, 21.2% beat)

- The company dropped its revenue guidance for the full year to $905 million at the midpoint from $947.5 million, a 4.5% decrease because the "U.S. commercial launch [of Inspire V] is progressing slower than expected, and the timeline to complete the full transition to Inspire V has been pushed forward, which will impact financial results for the year"

- EPS (GAAP) guidance for the full year is $0.45 at the midpoint, missing analyst estimates by 80.1%

- Operating Margin: -1.5%, down from 2.6% in the same quarter last year

- Market Capitalization: $3.72 billion

“The full launch of our FDA-cleared Inspire V system in the U.S. is an important milestone for Inspire. We have been receiving strong positive feedback from both surgeons and patients who value the simplified procedure and excellent patient outcomes enabled by this next generation technology,” said Tim Herbert, Chairman and CEO of Inspire.

Company Overview

Offering an alternative for the millions who struggle with traditional CPAP machines, Inspire Medical Systems (NYSE: INSP) develops and sells an implantable neurostimulation device that treats obstructive sleep apnea by stimulating nerves to keep airways open during sleep.

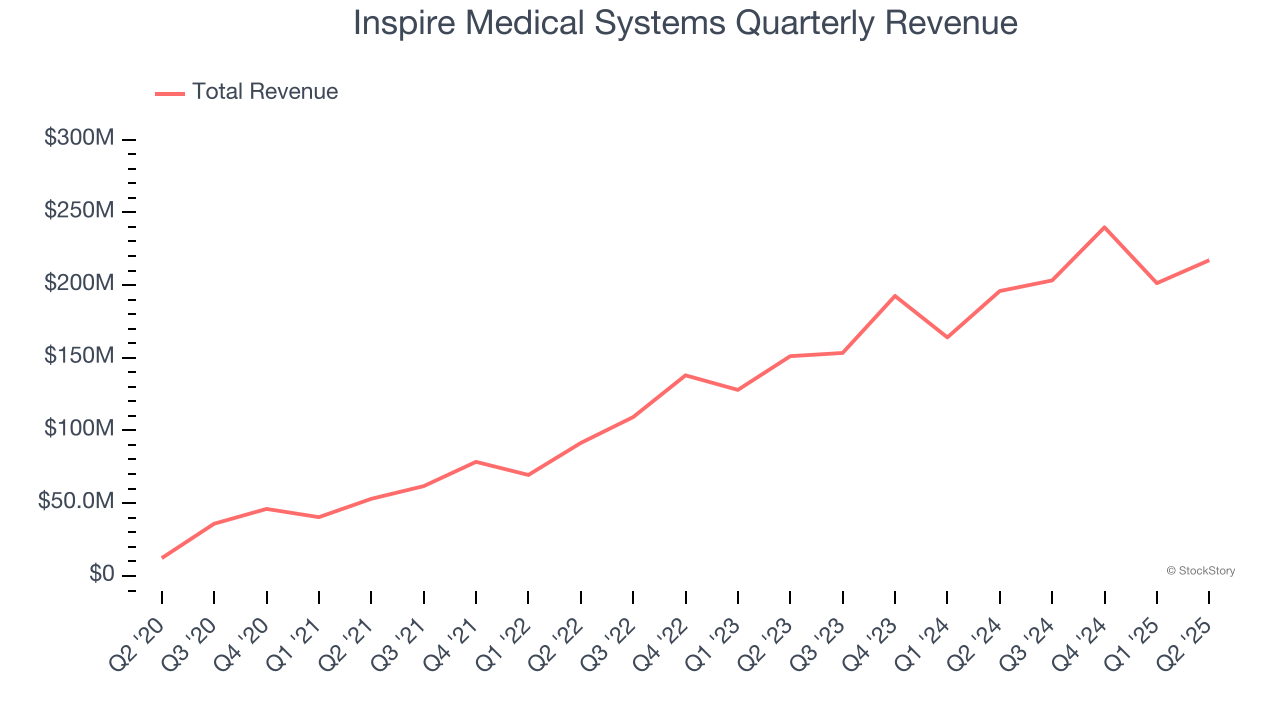

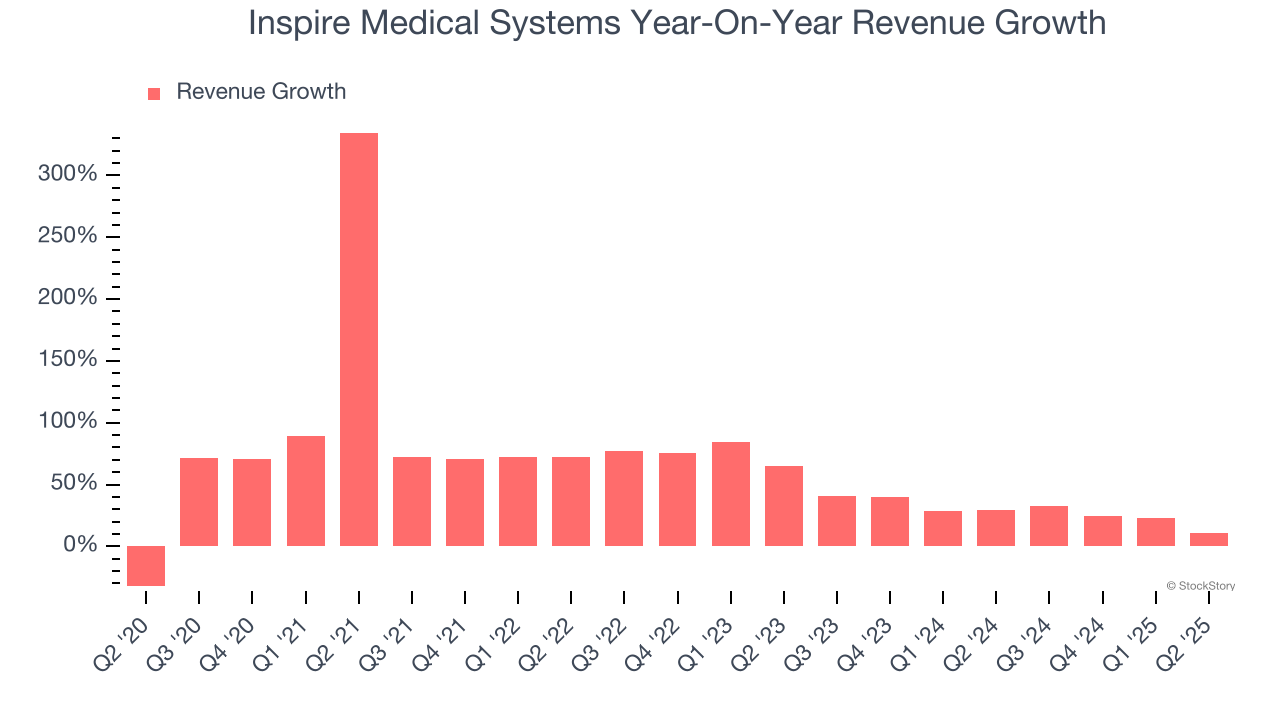

Revenue Growth

Examining a company’s long-term performance can provide clues about its quality. Any business can have short-term success, but a top-tier one grows for years. Over the last five years, Inspire Medical Systems grew its sales at an incredible 60.3% compounded annual growth rate. Its growth surpassed the average healthcare company and shows its offerings resonate with customers, a great starting point for our analysis.

Long-term growth is the most important, but within healthcare, a half-decade historical view may miss new innovations or demand cycles. Inspire Medical Systems’s annualized revenue growth of 28% over the last two years is below its five-year trend, but we still think the results suggest healthy demand.

This quarter, Inspire Medical Systems reported year-on-year revenue growth of 10.8%, and its $217.1 million of revenue exceeded Wall Street’s estimates by 1.2%.

Looking ahead, sell-side analysts expect revenue to grow 20.3% over the next 12 months, a deceleration versus the last two years. Despite the slowdown, this projection is healthy and indicates the market sees success for its products and services.

Here at StockStory, we certainly understand the potential of thematic investing. Diverse winners from Microsoft (MSFT) to Alphabet (GOOG), Coca-Cola (KO) to Monster Beverage (MNST) could all have been identified as promising growth stories with a megatrend driving the growth. So, in that spirit, we’ve identified a relatively under-the-radar profitable growth stock benefiting from the rise of AI, available to you FREE via this link.

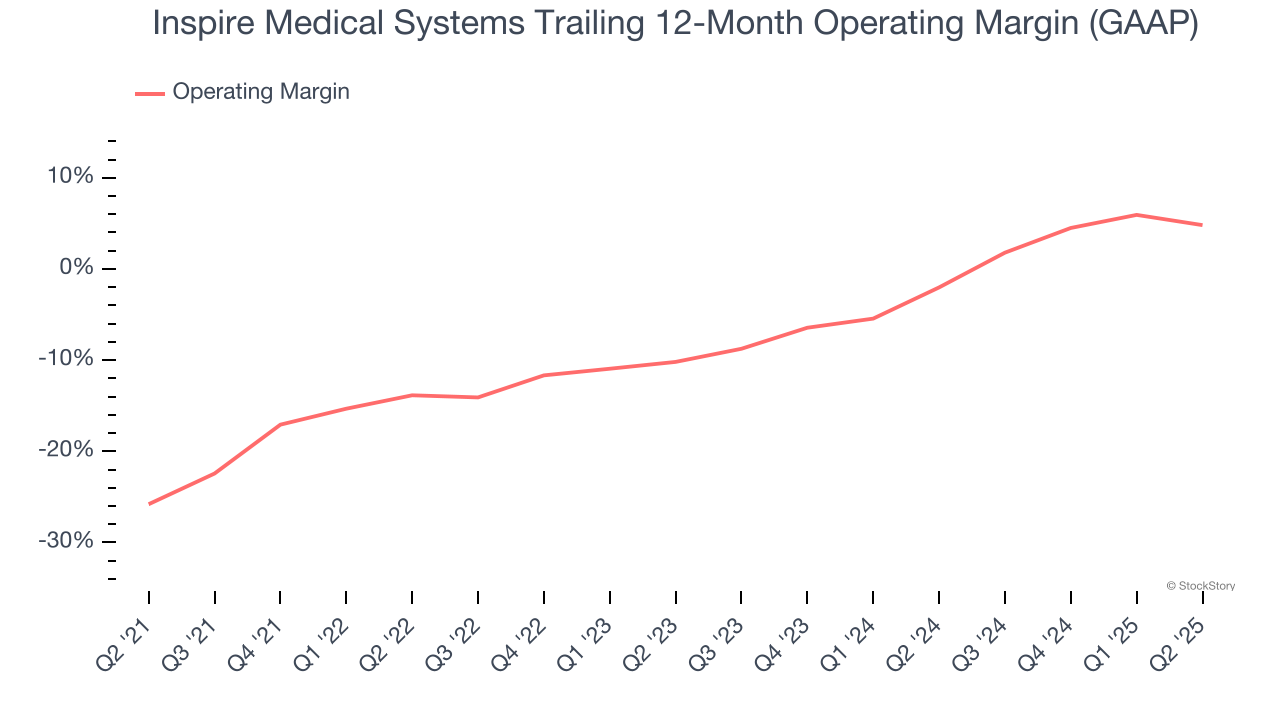

Operating Margin

Operating margin is one of the best measures of profitability because it tells us how much money a company takes home after subtracting all core expenses, like marketing and R&D.

Inspire Medical Systems’s high expenses have contributed to an average operating margin of negative 4.4% over the last five years. Unprofitable healthcare companies require extra attention because they could get caught swimming naked when the tide goes out.

On the plus side, Inspire Medical Systems’s operating margin rose by 30.6 percentage points over the last five years, as its sales growth gave it operating leverage. Zooming in on its more recent performance, we can see the company’s trajectory is intact as its margin has also increased by 15 percentage points on a two-year basis. These data points are very encouraging and show momentum is on its side.

Inspire Medical Systems’s operating margin was negative 1.5% this quarter.

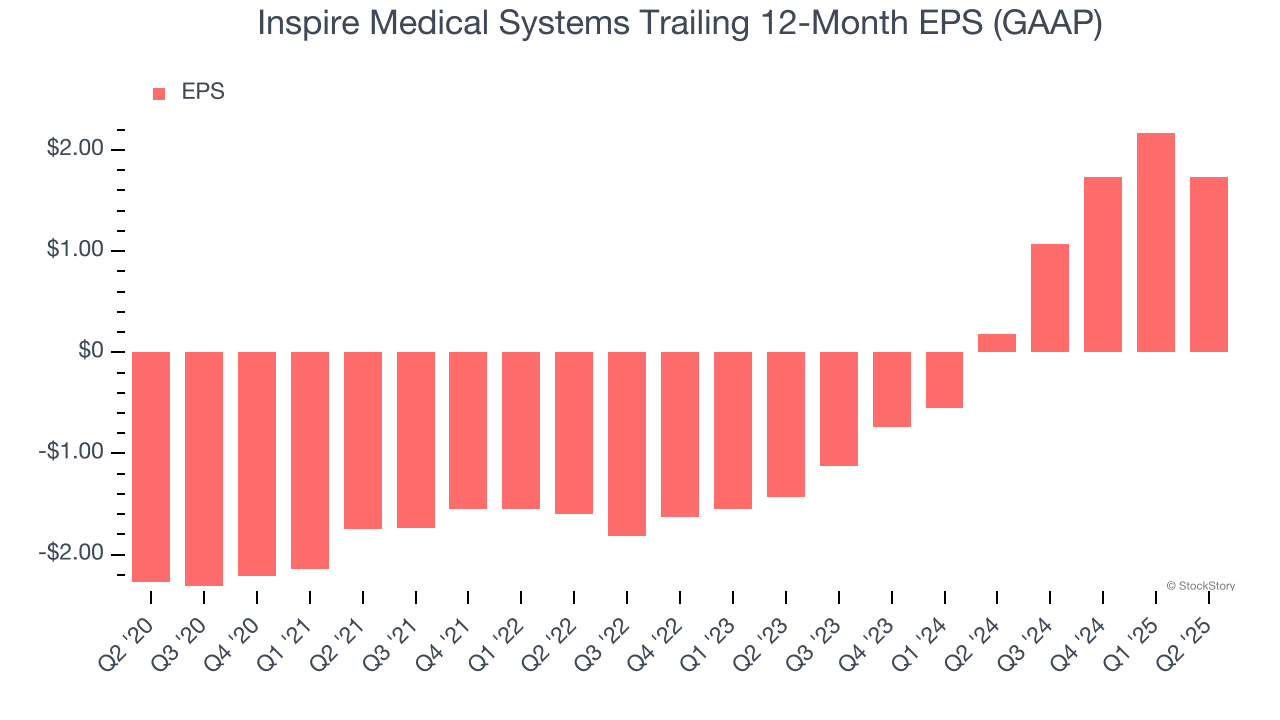

Earnings Per Share

We track the long-term change in earnings per share (EPS) for the same reason as long-term revenue growth. Compared to revenue, however, EPS highlights whether a company’s growth is profitable.

Inspire Medical Systems’s full-year EPS flipped from negative to positive over the last five years. This is a good sign and shows it’s at an inflection point.

In Q2, Inspire Medical Systems reported EPS at negative $0.12, down from $0.32 in the same quarter last year. This print missed analysts’ estimates, but we care more about long-term EPS growth than short-term movements. Over the next 12 months, Wall Street expects Inspire Medical Systems’s full-year EPS of $1.73 to grow 71.2%.

Key Takeaways from Inspire Medical Systems’s Q2 Results

It was good to see Inspire Medical Systems narrowly top analysts’ revenue expectations this quarter. The company also beat EBITDA expectations. On the other hand, its full-year revenue guidance was lowered and missed Wall Street's estimates. Additionally, full-year EPS guidance fell short of Wall Street’s estimates. This was due to a slower-than-expected launch and scaling of the new Inspire V product family. Overall, this quarter could have been better. The stock traded down 12.5% immediately after reporting.

Inspire Medical Systems’s earnings report left more to be desired. Let’s look forward to see if this quarter has created an opportunity to buy the stock. What happened in the latest quarter matters, but not as much as longer-term business quality and valuation, when deciding whether to invest in this stock. We cover that in our actionable full research report which you can read here, it’s free.