Over the last six months, Cohen & Steers’s shares have sunk to $76.54, producing a disappointing 11.7% loss - a stark contrast to the S&P 500’s 8.1% gain. This was partly driven by its softer quarterly results and may have investors wondering how to approach the situation.

Is there a buying opportunity in Cohen & Steers, or does it present a risk to your portfolio? Dive into our full research report to see our analyst team’s opinion, it’s free.

Why Is Cohen & Steers Not Exciting?

Despite the more favorable entry price, we're cautious about Cohen & Steers. Here are two reasons we avoid CNS and a stock we'd rather own.

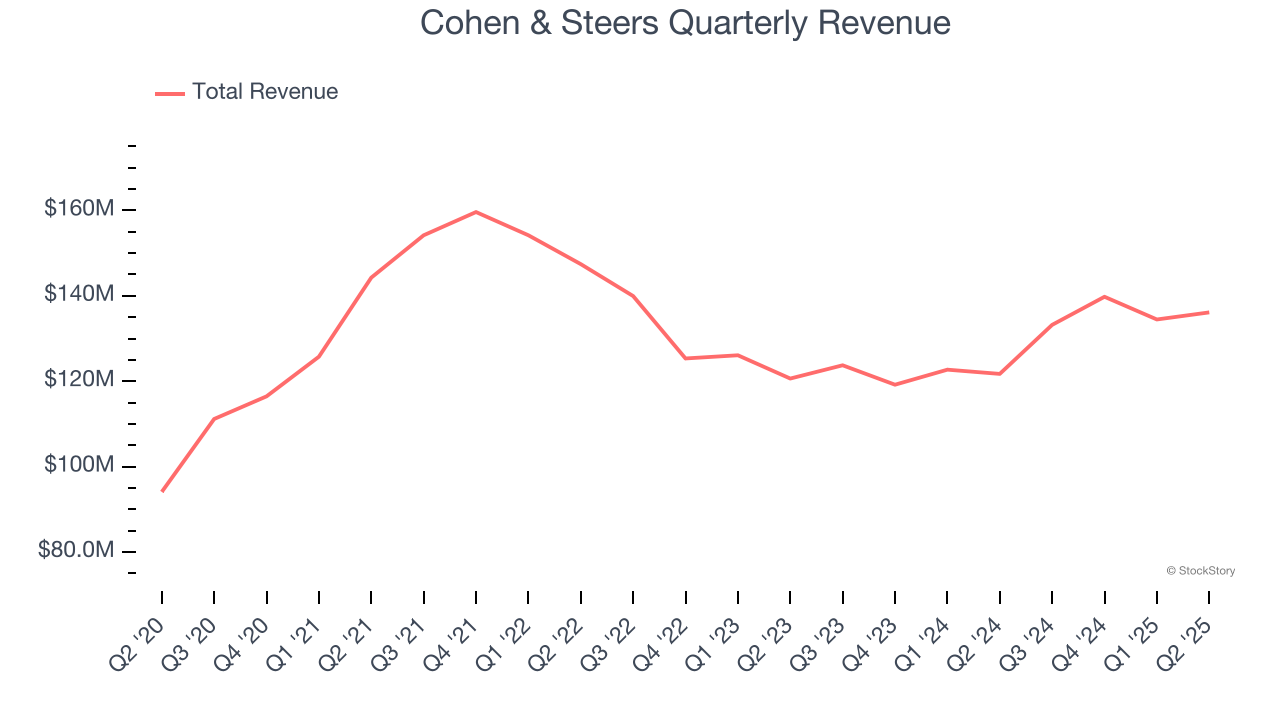

1. Long-Term Revenue Growth Disappoints

Reviewing a company’s long-term sales performance reveals insights into its quality. Any business can put up a good quarter or two, but many enduring ones grow for years.

Over the last four years, Cohen & Steers grew its revenue at a sluggish 2.2% compounded annual growth rate. This was below our standards.

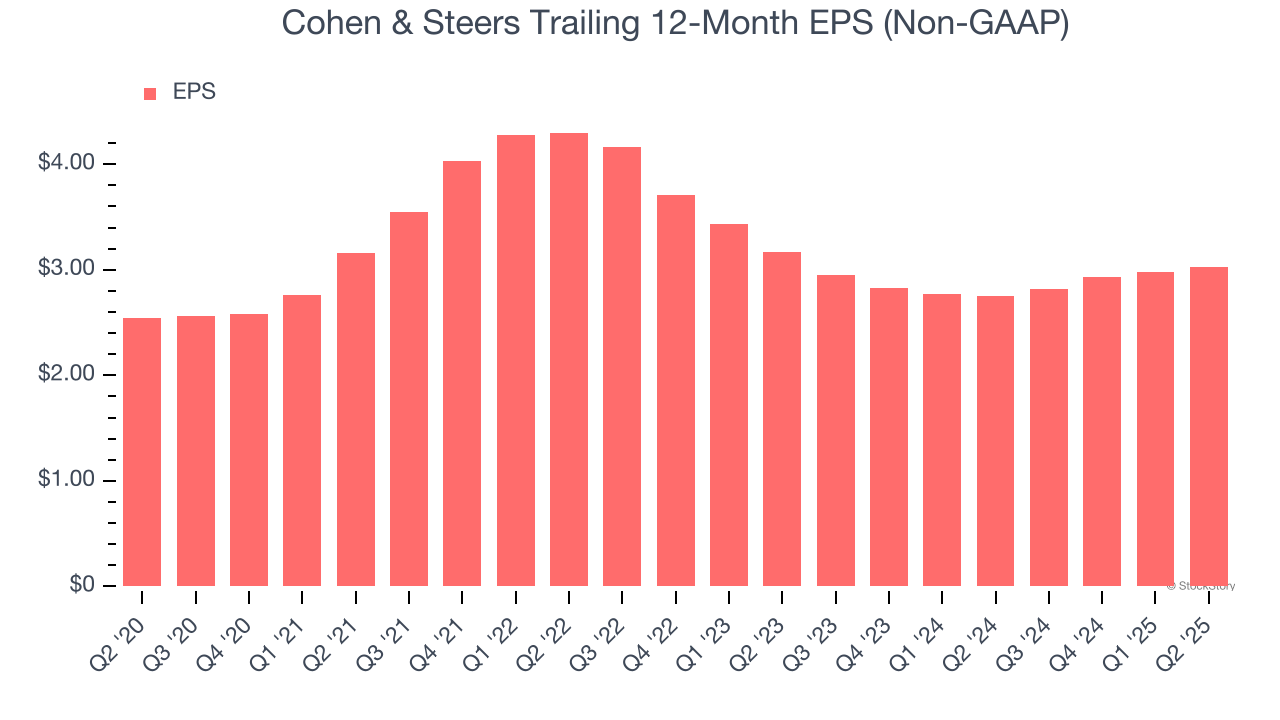

2. EPS Barely Growing

Analyzing the long-term change in earnings per share (EPS) shows whether a company's incremental sales were profitable – for example, revenue could be inflated through excessive spending on advertising and promotions.

Cohen & Steers’s full-year EPS grew at a weak 3.6% compounded annual growth rate over the last five years, worse than the broader financials sector.

Final Judgment

Cohen & Steers isn’t a terrible business, but it doesn’t pass our bar. After the recent drawdown, the stock trades at 23.8× forward P/E (or $76.54 per share). Beauty is in the eye of the beholder, but we don’t really see a big opportunity at the moment. We're pretty confident there are superior stocks to buy right now. We’d suggest looking at a dominant Aerospace business that has perfected its M&A strategy.

High-Quality Stocks for All Market Conditions

Donald Trump’s April 2025 "Liberation Day" tariffs sent markets into a tailspin, but stocks have since rebounded strongly, proving that knee-jerk reactions often create the best buying opportunities.

The smart money is already positioning for the next leg up. Don’t miss out on the recovery - check out our Top 6 Stocks for this week. This is a curated list of our High Quality stocks that have generated a market-beating return of 183% over the last five years (as of March 31st 2025).

Stocks that made our list in 2020 include now familiar names such as Nvidia (+1,545% between March 2020 and March 2025) as well as under-the-radar businesses like the once-small-cap company Exlservice (+354% five-year return). Find your next big winner with StockStory today.

StockStory is growing and hiring equity analyst and marketing roles. Are you a 0 to 1 builder passionate about the markets and AI? See the open roles here.