Wintrust Financial currently trades at $128.83 per share and has shown little upside over the past six months, posting a middling return of 4.1%.

Is now the time to buy WTFC? Find out in our full research report, it’s free.

Why Does Wintrust Financial Spark Debate?

Founded in 1991 as a community-focused alternative to big banks in the Chicago area, Wintrust Financial (NASDAQGS:WTFC) operates community banks in the Chicago area and provides specialty finance services including insurance premium financing and wealth management.

Two Things to Like:

1. Net Interest Income Skyrockets, Fueling Growth Opportunities

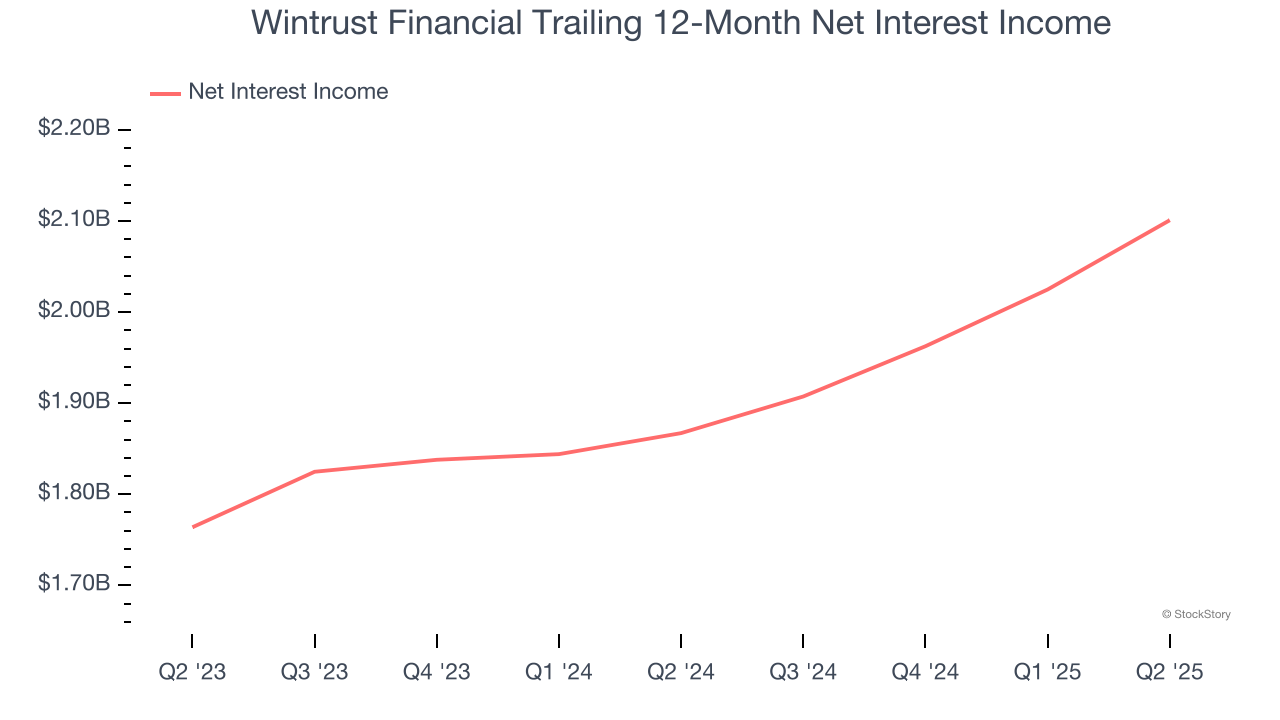

While bank generate revenue from multiple sources, investors view net interest income as a cornerstone - its predictable, recurring characteristics stand in sharp contrast to the volatility of one-time fees.

Wintrust Financial’s net interest income has grown at a 15.4% annualized rate over the last five years, better than the broader banking industry and faster than its total revenue. Its growth was driven by both an increase in its outstanding loans and net interest margin, which represents how much a bank earns in relation to its outstanding loan book.

2. Outstanding Long-Term EPS Growth

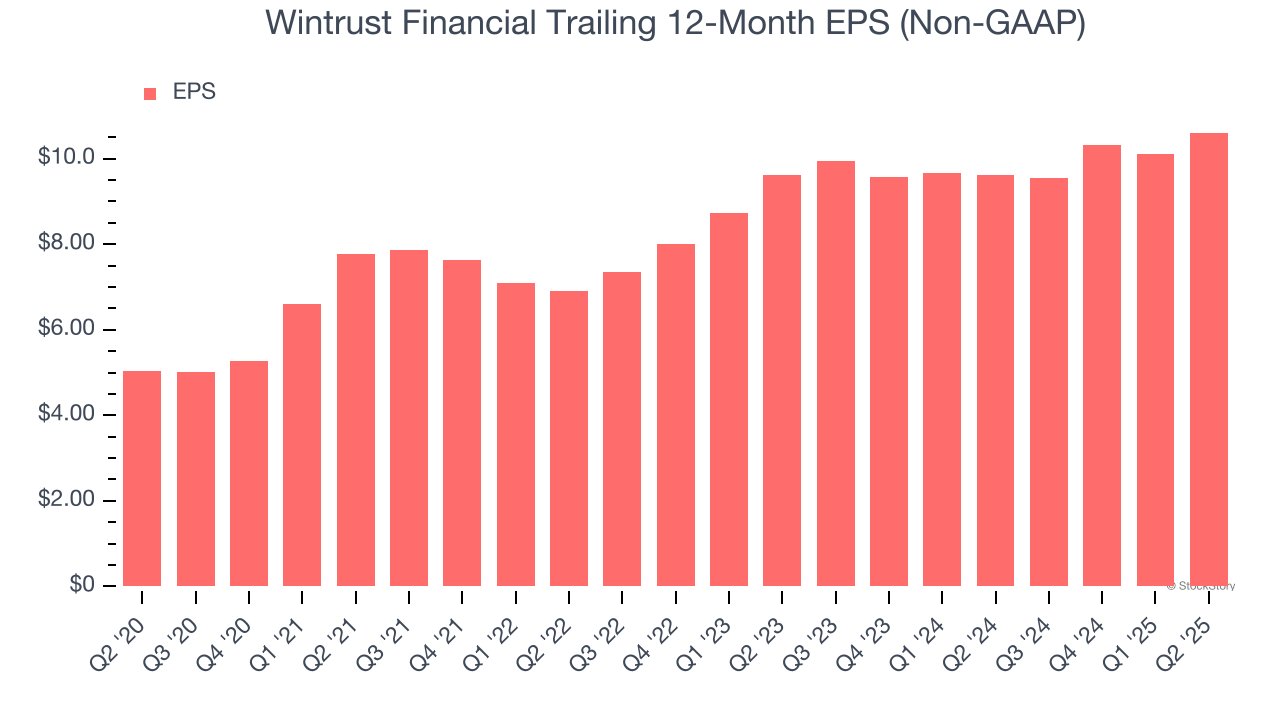

Analyzing the long-term change in earnings per share (EPS) shows whether a company's incremental sales were profitable – for example, revenue could be inflated through excessive spending on advertising and promotions.

Wintrust Financial’s EPS grew at an astounding 16.1% compounded annual growth rate over the last five years, higher than its 10.6% annualized revenue growth. This tells us the company became more profitable on a per-share basis as it expanded.

One Reason to be Careful:

Projected Net Interest Income Growth Is Slim

Forecasted net interest income by Wall Street analysts signals a company’s potential. Predictions may not always be accurate, but accelerating growth typically boosts valuation multiples and stock prices while slowing growth does the opposite.

Over the next 12 months, sell-side analysts expect Wintrust Financial’s net interest income to rise by 7%, a slight deceleration versus its 9.1% annualized growth for the past two years. This projection is slightly below its 9.1% annualized growth rate for the past two years.

Final Judgment

Wintrust Financial has huge potential even though it has some open questions, but at $128.83 per share (or 1.3× forward P/B), is now the time to initiate a position? See for yourself in our in-depth research report, it’s free.

Stocks We Like Even More Than Wintrust Financial

Trump’s April 2025 tariff bombshell triggered a massive market selloff, but stocks have since staged an impressive recovery, leaving those who panic sold on the sidelines.

Take advantage of the rebound by checking out our Top 5 Strong Momentum Stocks for this week. This is a curated list of our High Quality stocks that have generated a market-beating return of 183% over the last five years (as of March 31st 2025).

Stocks that made our list in 2020 include now familiar names such as Nvidia (+1,545% between March 2020 and March 2025) as well as under-the-radar businesses like the once-small-cap company Comfort Systems (+782% five-year return). Find your next big winner with StockStory today.

StockStory is growing and hiring equity analyst and marketing roles. Are you a 0 to 1 builder passionate about the markets and AI? See the open roles here.