Earnings results often indicate what direction a company will take in the months ahead. With Q1 behind us, let’s have a look at Box (NYSE: BOX) and its peers.

Rising employee costs and the shift to more remote work has increased the ever-present pressure to improve corporate productivity, which in turn has driven rising demand for productivity software that enables remote work, streamline project management and automate business tasks.

The 17 productivity software stocks we track reported a strong Q1. As a group, revenues beat analysts’ consensus estimates by 3% while next quarter’s revenue guidance was in line.

Thankfully, share prices of the companies have been resilient as they are up 6.2% on average since the latest earnings results.

Box (NYSE: BOX)

Founded in 2005 by Aaron Levie and Dylan Smith, Box (NYSE: BOX) provides organizations with software to securely store, share and collaborate around work documents in the cloud.

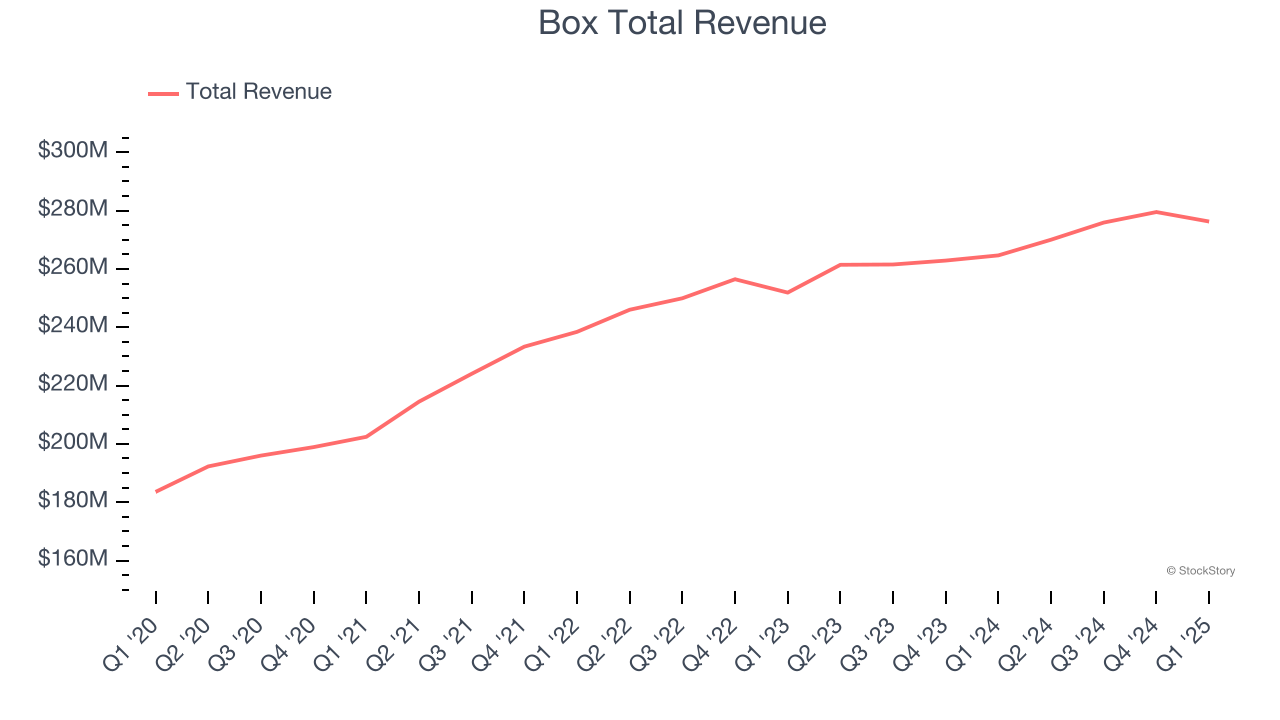

Box reported revenues of $276.3 million, up 4.4% year on year. This print exceeded analysts’ expectations by 0.6%. Overall, it was a very strong quarter for the company with an impressive beat of analysts’ billings estimates and EPS guidance for next quarter exceeding analysts’ expectations.

Interestingly, the stock is up 5.7% since reporting and currently trades at $33.26.

Is now the time to buy Box? Access our full analysis of the earnings results here, it’s free.

Best Q1: Pegasystems (NASDAQ: PEGA)

Founded by Alan Trefler in 1983, Pegasystems (NASDAQ: PEGA) offers a software-as-a-service platform to automate and optimize workflows in customer service and engagement.

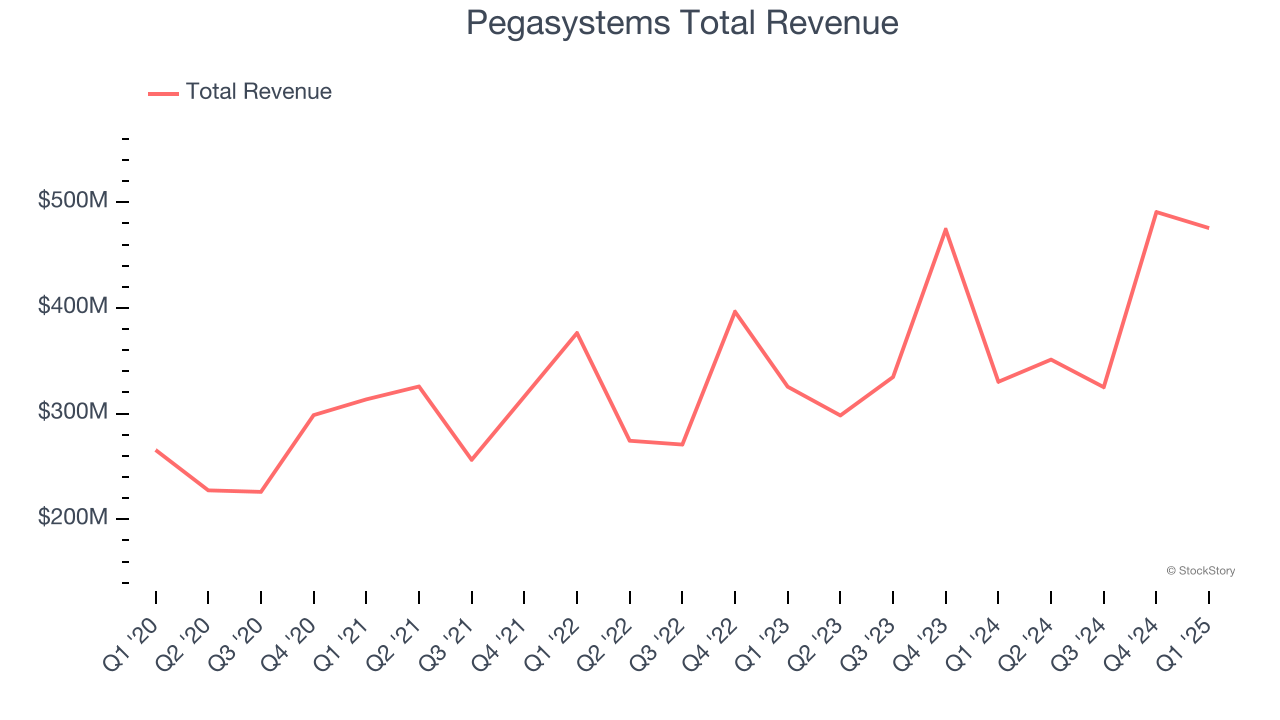

Pegasystems reported revenues of $475.6 million, up 44.1% year on year, outperforming analysts’ expectations by 33.1%. The business had an incredible quarter with an impressive beat of analysts’ billings estimates and a solid beat of analysts’ EBITDA estimates.

Pegasystems pulled off the biggest analyst estimates beat among its peers. The market seems happy with the results as the stock is up 57% since reporting. It currently trades at $54.

Is now the time to buy Pegasystems? Access our full analysis of the earnings results here, it’s free.

Weakest Q1: SoundHound AI (NASDAQ: SOUN)

Founded in 2005, SoundHound AI (NASDAQ: SOUN) develops independent voice artificial intelligence solutions that enable businesses across various industries to offer customized conversational experiences to consumers.

SoundHound AI reported revenues of $29.13 million, up 151% year on year, falling short of analysts’ expectations by 4.4%. It was a softer quarter as it posted a significant miss of analysts’ EBITDA estimates.

SoundHound AI delivered the fastest revenue growth but had the weakest performance against analyst estimates in the group. Interestingly, the stock is up 13.8% since the results and currently trades at $11.07.

Read our full analysis of SoundHound AI’s results here.

Atlassian (NASDAQ: TEAM)

Founded by Australian co-CEOs Mike Cannon-Brookes and Scott Farquhar in 2002, Atlassian (NASDAQ: TEAM) provides software as a service that makes it easier for large teams of software developers to manage projects, especially in software development.

Atlassian reported revenues of $1.36 billion, up 14.1% year on year. This print was in line with analysts’ expectations. More broadly, it was a mixed quarter as it also produced a solid beat of analysts’ EBITDA estimates but a significant miss of analysts’ billings estimates.

The stock is down 6.7% since reporting and currently trades at $213.70.

Read our full, actionable report on Atlassian here, it’s free.

Monday.com (NASDAQ: MNDY)

Founded in 2014 and named after the dreaded first day of the work week, Monday.com (NASDAQ: MNDY) is a software-as-a-service platform that helps organizations plan and track work efficiently.

Monday.com reported revenues of $282.3 million, up 30.1% year on year. This number beat analysts’ expectations by 2.3%. Overall, it was a strong quarter as it also logged a solid beat of analysts’ EBITDA estimates and an impressive beat of analysts’ billings estimates.

The company added 243 enterprise customers paying more than $50,000 annually to reach a total of 3,444. The stock is up 10.6% since reporting and currently trades at $307.40.

Read our full, actionable report on Monday.com here, it’s free.

Market Update

In response to the Fed’s rate hikes in 2022 and 2023, inflation has been gradually trending down from its post-pandemic peak, trending closer to the Fed’s 2% target. Despite higher borrowing costs, the economy has avoided flashing recessionary signals. This is the much-desired soft landing that many investors hoped for. The recent rate cuts (0.5% in September and 0.25% in November 2024) have bolstered the stock market, making 2024 a strong year for equities. Donald Trump’s presidential win in November sparked additional market gains, sending indices to record highs in the days following his victory. However, debates continue over possible tariffs and corporate tax adjustments, raising questions about economic stability in 2025.

Want to invest in winners with rock-solid fundamentals? Check out our Top 5 Growth Stocks and add them to your watchlist. These companies are poised for growth regardless of the political or macroeconomic climate.