Wrapping up Q1 earnings, we look at the numbers and key takeaways for the branded pharmaceuticals stocks, including Supernus Pharmaceuticals (NASDAQ: SUPN) and its peers.

Looking ahead, the branded pharmaceutical industry is positioned for tailwinds from advancements in precision medicine, increasing adoption of AI to enhance drug development efficiency, and growing global demand for treatments addressing chronic and rare diseases. However, headwinds include heightened regulatory scrutiny, pricing pressures from governments and insurers, and the looming patent cliffs for key blockbuster drugs. Patent cliffs bring about competition from generics, forcing branded pharmaceutical companies back to the drawing board to find the next big thing.

The 10 branded pharmaceuticals stocks we track reported a satisfactory Q1. As a group, revenues were in line with analysts’ consensus estimates.

In light of this news, share prices of the companies have held steady. On average, they are relatively unchanged since the latest earnings results.

Supernus Pharmaceuticals (NASDAQ: SUPN)

With a diverse portfolio of eight FDA-approved medications targeting neurological conditions, Supernus Pharmaceuticals (NASDAQ: SUPN) develops and markets treatments for central nervous system disorders including epilepsy, ADHD, Parkinson's disease, and migraine.

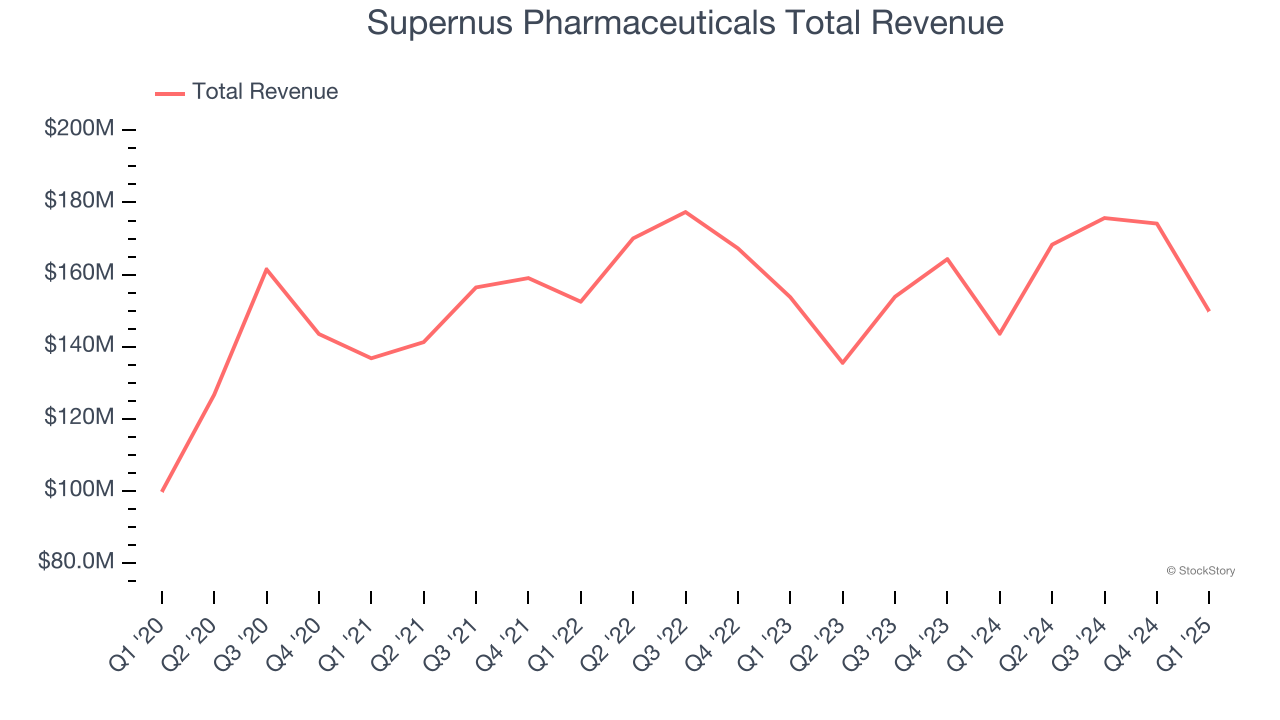

Supernus Pharmaceuticals reported revenues of $149.8 million, up 4.3% year on year. This print exceeded analysts’ expectations by 1.3%. Despite the top-line beat, it was still a slower quarter for the company with full-year operating income guidance missing analysts’ expectations.

“Our first quarter results reflect, once again, double-digit revenue growth from our core products, as well as strong growth in adjusted operating earnings,” said Jack Khattar, President and CEO of Supernus.

Supernus Pharmaceuticals delivered the weakest full-year guidance update of the whole group. The market was likely pricing in the results, and the stock is flat since reporting. It currently trades at $32.20.

Read our full report on Supernus Pharmaceuticals here, it’s free.

Best Q1: Bristol-Myers Squibb (NYSE: BMY)

With roots dating back to 1887 and a transformative merger in 1989 that gave the company its current name, Bristol-Myers Squibb (NYSE: BMY) discovers, develops, and markets prescription medications for serious diseases including cancer, blood disorders, immunological conditions, and cardiovascular diseases.

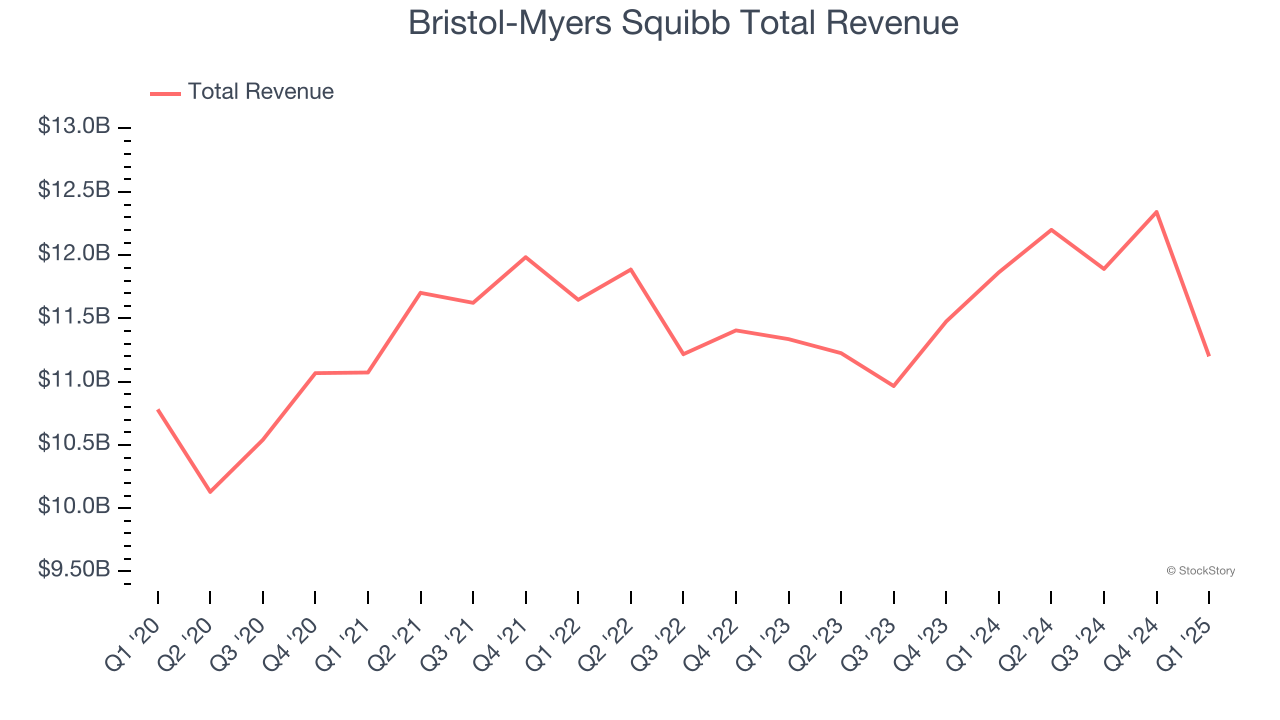

Bristol-Myers Squibb reported revenues of $11.2 billion, down 5.6% year on year, outperforming analysts’ expectations by 3.9%. The business had a very strong quarter with an impressive beat of analysts’ EPS estimates and full-year revenue guidance slightly topping analysts’ expectations.

Bristol-Myers Squibb achieved the biggest analyst estimates beat among its peers. The market seems content with the results as the stock is up 1.3% since reporting. It currently trades at $49.13.

Is now the time to buy Bristol-Myers Squibb? Access our full analysis of the earnings results here, it’s free.

Weakest Q1: Eli Lilly (NYSE: LLY)

Founded in 1876 by a Civil War veteran and pharmacist frustrated with the poor quality of medicines, Eli Lilly (NYSE: LLY) discovers, develops, and manufactures pharmaceutical products for conditions including diabetes, obesity, cancer, immunological disorders, and neurological diseases.

Eli Lilly reported revenues of $12.73 billion, up 45.2% year on year, exceeding analysts’ expectations by 0.9%. Still, it was a slower quarter as it posted a significant miss of analysts’ full-year EPS guidance estimates and a miss of analysts’ EPS estimates.

As expected, the stock is down 10.2% since the results and currently trades at $805.

Read our full analysis of Eli Lilly’s results here.

Organon (NYSE: OGN)

Spun off from Merck in 2021 to create a company dedicated to addressing unmet needs in women's health, Organon (NYSE: OGN) is a global healthcare company focused on improving women's health through prescription therapies, medical devices, biosimilars, and established medicines.

Organon reported revenues of $1.51 billion, down 6.7% year on year. This result beat analysts’ expectations by 0.6%. Overall, it was a strong quarter as it also put up an impressive beat of analysts’ EPS estimates.

The stock is down 22.8% since reporting and currently trades at $9.96.

Read our full, actionable report on Organon here, it’s free.

Pfizer (NYSE: PFE)

With roots dating back to 1849 when two German immigrants opened a fine chemicals business in Brooklyn, Pfizer (NYSE: PFE) is a global biopharmaceutical company that discovers, develops, manufactures, and sells medicines and vaccines for a wide range of diseases and conditions.

Pfizer reported revenues of $13.72 billion, down 7.8% year on year. This number came in 1.6% below analysts' expectations. Zooming out, it was a mixed quarter as it also produced a solid beat of analysts’ organic revenue estimates but a miss of analysts’ full-year EPS guidance estimates.

Pfizer had the slowest revenue growth among its peers. The stock is up 10.4% since reporting and currently trades at $25.43.

Read our full, actionable report on Pfizer here, it’s free.

Market Update

Thanks to the Fed’s rate hikes in 2022 and 2023, inflation has been on a steady path downward, easing back toward that 2% sweet spot. Fortunately (miraculously to some), all this tightening didn’t send the economy tumbling into a recession, so here we are, cautiously celebrating a soft landing. The cherry on top? Recent rate cuts (half a point in September 2024, a quarter in November) have propped up markets, especially after Trump’s November win lit a fire under major indices and sent them to all-time highs. However, there’s still plenty to ponder — tariffs, corporate tax cuts, and what 2025 might hold for the economy.

Want to invest in winners with rock-solid fundamentals? Check out our Hidden Gem Stocks and add them to your watchlist. These companies are poised for growth regardless of the political or macroeconomic climate.

StockStory is growing and hiring equity analyst and marketing roles. Are you a 0 to 1 builder passionate about the markets and AI? See the open roles here.