Domain name registry operator Verisign (NASDAQ: VRSN) met Wall Street’s revenue expectations in Q1 CY2025, with sales up 4.7% year on year to $402.3 million. Its GAAP profit of $2.10 per share was in line with analysts’ consensus estimates.

Is now the time to buy VeriSign? Find out by accessing our full research report, it’s free.

VeriSign (VRSN) Q1 CY2025 Highlights:

- Revenue: $402.3 million vs analyst estimates of $401.8 million (4.7% year-on-year growth, in line)

- EPS (GAAP): $2.10 vs analyst expectations of $2.09 (in line)

- Operating Margin: 67.4%, in line with the same quarter last year

- Free Cash Flow Margin: 71%, up from 56.1% in the previous quarter

- Market Capitalization: $23.66 billion

“Verisign delivered solid results in the first quarter. As part of our ongoing commitment to return value to shareholders, I’m particularly pleased to announce the initiation of a quarterly cash dividend,” said Jim Bidzos, Executive Chairman, President and Chief Executive Officer.

Company Overview

While the company is not a domain registrar and does not directly sell domain names to end users, Verisign (NASDAQ: VRSN) operates and maintains the infrastructure to support domain names such as .com and .net.

E-commerce Software

While e-commerce has been around for over two decades and enjoyed meaningful growth, its overall penetration of retail still remains low. Only around $1 in every $5 spent on retail purchases comes from digital orders, leaving over 80% of the retail market still ripe for online disruption. It is these large swathes of the retail where e-commerce has not yet taken hold that drives the demand for various e-commerce software solutions.

Sales Growth

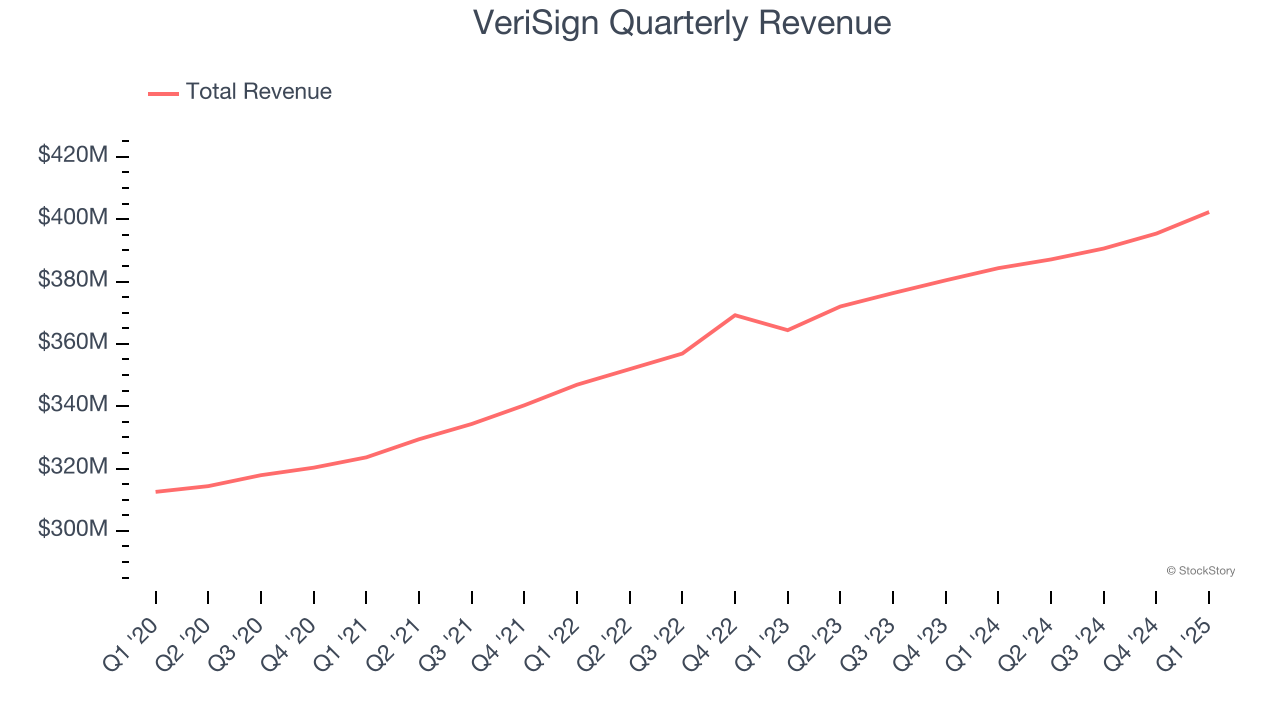

Reviewing a company’s long-term sales performance reveals insights into its quality. Any business can have short-term success, but a top-tier one grows for years. Over the last three years, VeriSign grew its sales at a weak 5.3% compounded annual growth rate. This fell short of our benchmark for the software sector and is a rough starting point for our analysis.

This quarter, VeriSign grew its revenue by 4.7% year on year, and its $402.3 million of revenue was in line with Wall Street’s estimates.

Looking ahead, sell-side analysts expect revenue to grow 3.8% over the next 12 months, similar to its three-year rate. This projection doesn't excite us and implies its products and services will see some demand headwinds.

Unless you’ve been living under a rock, it should be obvious by now that generative AI is going to have a huge impact on how large corporations do business. While Nvidia and AMD are trading close to all-time highs, we prefer a lesser-known (but still profitable) stock benefiting from the rise of AI. Click here to access our free report one of our favorites growth stories.

Cash Is King

Although earnings are undoubtedly valuable for assessing company performance, we believe cash is king because you can’t use accounting profits to pay the bills.

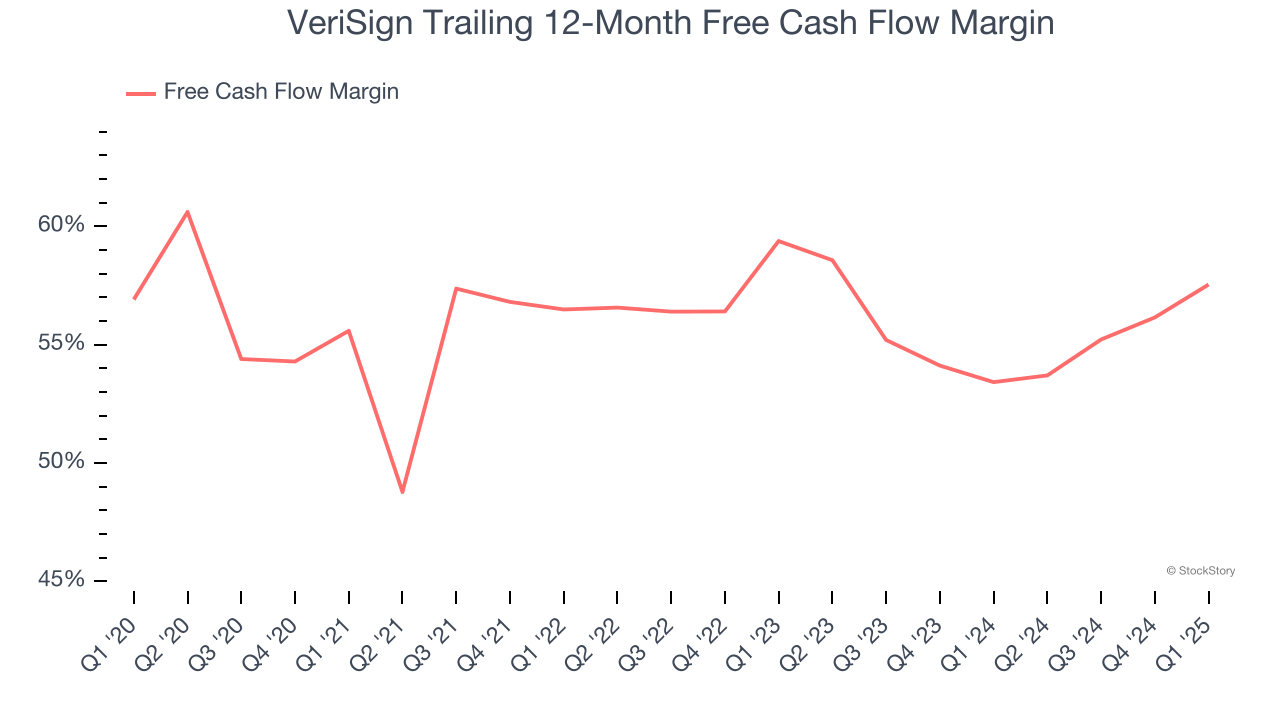

VeriSign has shown terrific cash profitability, driven by its lucrative business model that enables it to reinvest, return capital to investors, and stay ahead of the competition while maintaining an ample cushion. The company’s free cash flow margin was among the best in the software sector, averaging an eye-popping 57.5% over the last year.

VeriSign’s free cash flow clocked in at $285.5 million in Q1, equivalent to a 71% margin. This result was good as its margin was 5 percentage points higher than in the same quarter last year. Its cash profitability was also above its one-year level, and we hope the company can build on this trend.

Key Takeaways from VeriSign’s Q1 Results

Revenue and EPS both met expectations, making for an unexciting but solid quarter. The stock remained flat at $252 immediately after reporting.

Is VeriSign an attractive investment opportunity at the current price? The latest quarter does matter, but not nearly as much as longer-term fundamentals and valuation, when deciding if the stock is a buy. We cover that in our actionable full research report which you can read here, it’s free.