Medical technology company Integer Holdings (NYSE: ITGR) beat Wall Street’s revenue expectations in Q1 CY2025, with sales up 7.3% year on year to $437.4 million. The company expects the full year’s revenue to be around $1.86 billion, close to analysts’ estimates. Its non-GAAP profit of $1.31 per share was 5.5% above analysts’ consensus estimates.

Is now the time to buy Integer Holdings? Find out by accessing our full research report, it’s free.

Integer Holdings (ITGR) Q1 CY2025 Highlights:

- Revenue: $437.4 million vs analyst estimates of $428.7 million (7.3% year-on-year growth, 2% beat)

- Adjusted EPS: $1.31 vs analyst estimates of $1.24 (5.5% beat)

- Adjusted EBITDA: $91.51 million vs analyst estimates of $88.82 million (20.9% margin, 3% beat)

- The company reconfirmed its revenue guidance for the full year of $1.86 billion at the midpoint

- Management raised its full-year Adjusted EPS guidance to $6.33 at the midpoint, a 5.1% increase

- EBITDA guidance for the full year is $411.5 million at the midpoint, above analyst estimates of $408.2 million

- Operating Margin: 11.3%, up from 9.5% in the same quarter last year

- Free Cash Flow was $6.06 million, up from -$5.83 million in the same quarter last year

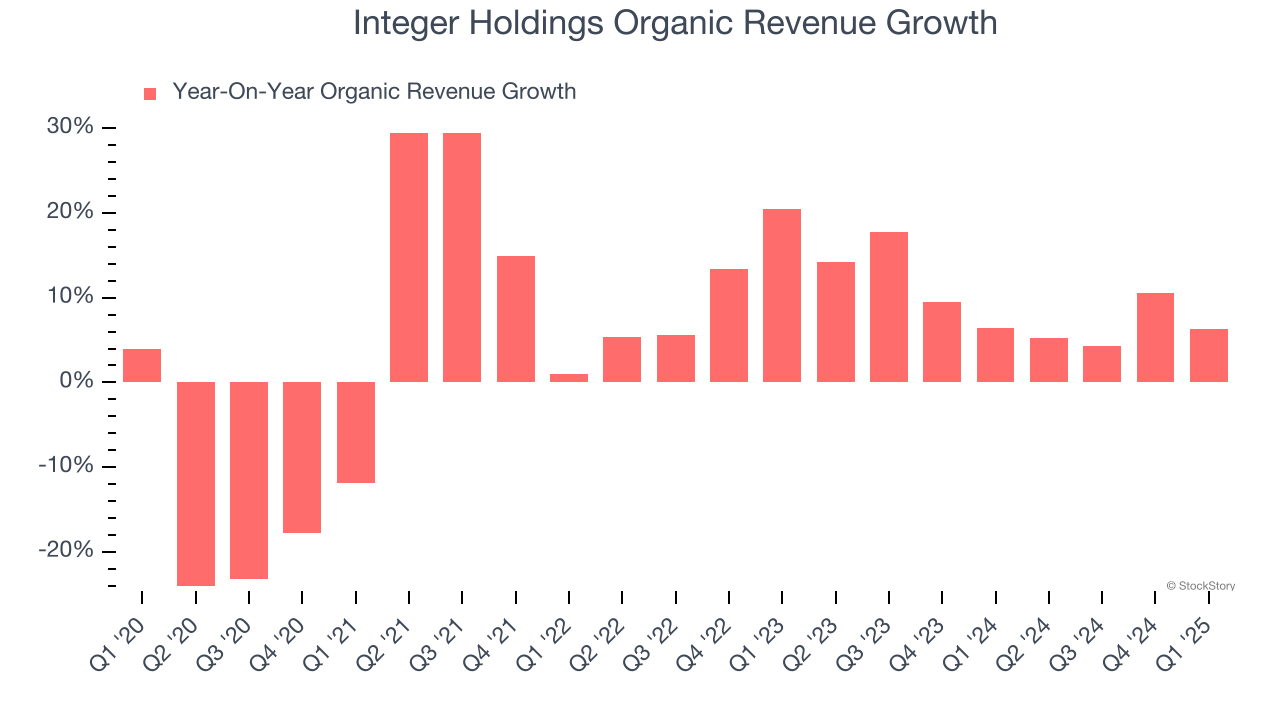

- Organic Revenue rose 6.3% year on year, in line with the same quarter last year

- Market Capitalization: $4.20 billion

“Integer started the year off strong with first quarter 2025 sales growing at 7% year-over-year as we continue to execute our strategy by launching new products and adding capabilities in targeted growth markets. Integer also delivered 14% adjusted operating income growth,” said Joseph Dziedzic, Integer’s president and CEO.

Company Overview

With its name reflecting the mathematical term for "whole" or "complete," Integer Holdings (NYSE: ITGR) is a medical device outsource manufacturer that produces components and systems for cardiac, vascular, neurological, and other medical applications.

Medical Devices & Supplies - Specialty

The medical devices industry operates a business model that balances steady demand with significant investments in innovation and regulatory compliance. The industry benefits from recurring revenue streams tied to consumables, maintenance services, and incremental upgrades to the latest technologies, although specialty devices are more niche. The capital-intensive nature of product development, coupled with lengthy regulatory pathways and the need for clinical validation, can weigh on profitability and timelines. In addition, there are constant pricing pressures from healthcare systems and insurers maximizing cost efficiency. Over the next several years, one tailwind is demographic–aging populations means rising chronic disease rates that drive greater demand for medical interventions and monitoring solutions. Advances in digital health, such as remote patient monitoring and smart devices, are also expected to unlock new demand by shortening upgrade cycles. On the other hand, the industry faces headwinds from pricing and reimbursement pressures as healthcare providers increasingly adopt value-based care models. Additionally, the integration of cybersecurity for connected devices adds further risk and complexity for device manufacturers.

Sales Growth

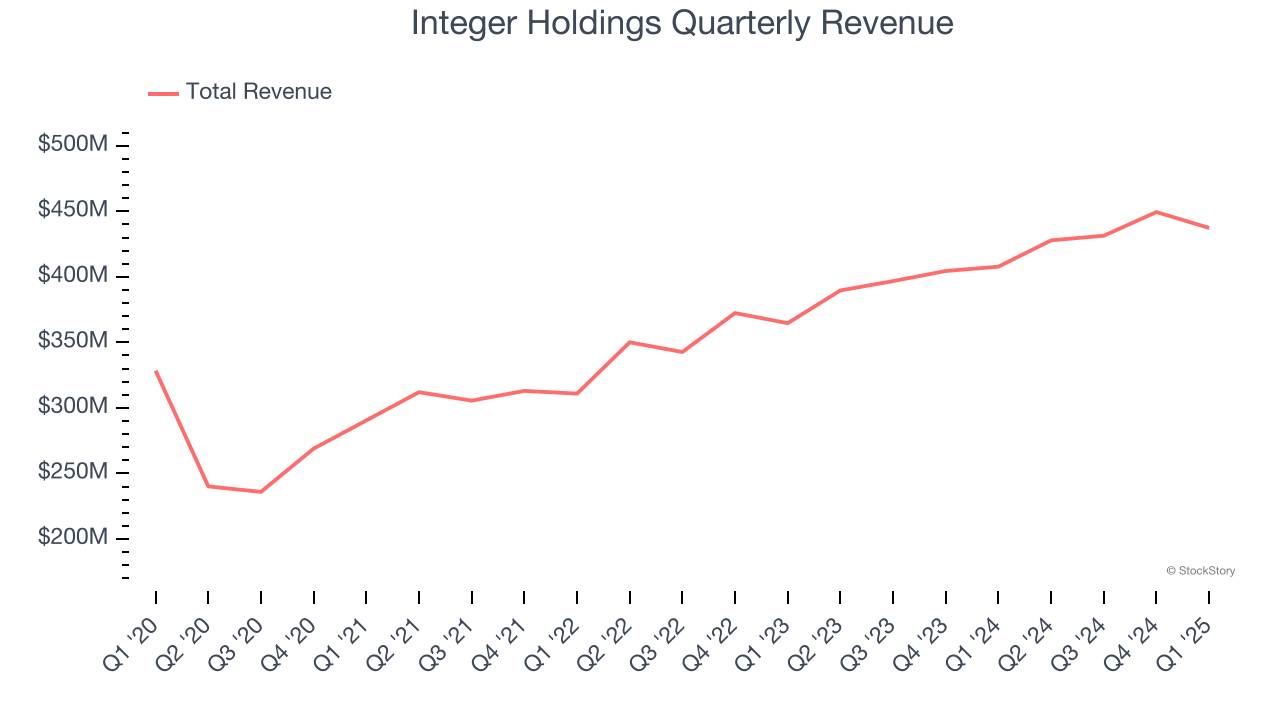

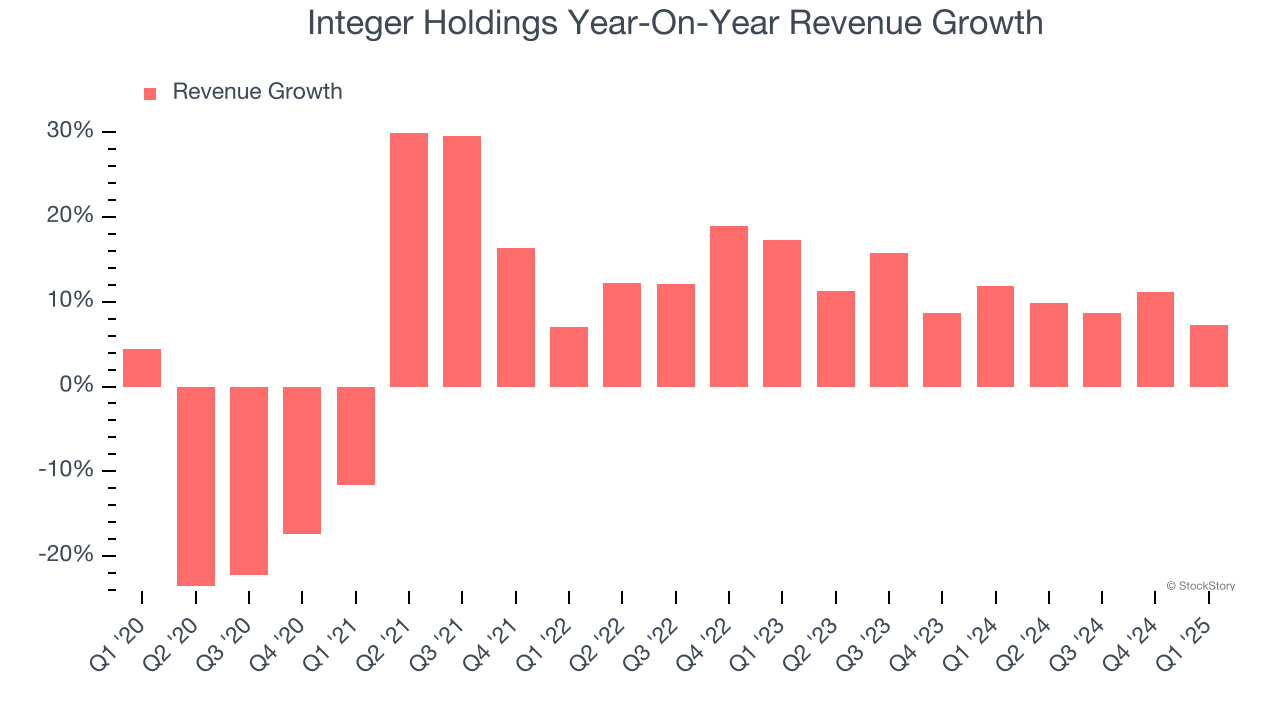

A company’s long-term performance is an indicator of its overall quality. Any business can have short-term success, but a top-tier one grows for years. Over the last five years, Integer Holdings grew its sales at a mediocre 6.5% compounded annual growth rate. This was below our standard for the healthcare sector and is a rough starting point for our analysis.

Long-term growth is the most important, but within healthcare, a half-decade historical view may miss new innovations or demand cycles. Integer Holdings’s annualized revenue growth of 10.5% over the last two years is above its five-year trend, suggesting some bright spots.

Integer Holdings also reports organic revenue, which strips out one-time events like acquisitions and currency fluctuations that don’t accurately reflect its fundamentals. Over the last two years, Integer Holdings’s organic revenue averaged 9.3% year-on-year growth. Because this number aligns with its normal revenue growth, we can see the company’s core operations (not acquisitions and divestitures) drove most of its results.

This quarter, Integer Holdings reported year-on-year revenue growth of 7.3%, and its $437.4 million of revenue exceeded Wall Street’s estimates by 2%.

Looking ahead, sell-side analysts expect revenue to grow 8.8% over the next 12 months, a slight deceleration versus the last two years. Still, this projection is admirable and suggests the market is forecasting success for its products and services.

Software is eating the world and there is virtually no industry left that has been untouched by it. That drives increasing demand for tools helping software developers do their jobs, whether it be monitoring critical cloud infrastructure, integrating audio and video functionality, or ensuring smooth content streaming. Click here to access a free report on our 3 favorite stocks to play this generational megatrend.

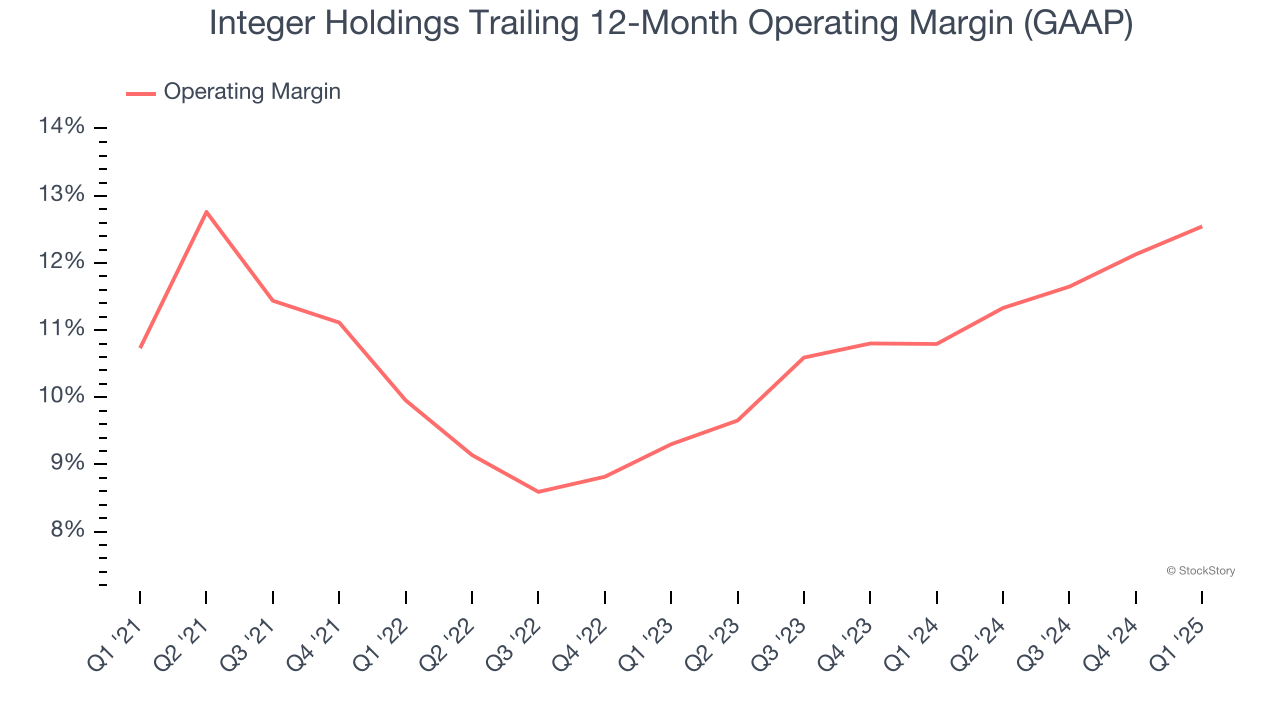

Operating Margin

Integer Holdings has done a decent job managing its cost base over the last five years. The company has produced an average operating margin of 10.8%, higher than the broader healthcare sector.

Analyzing the trend in its profitability, Integer Holdings’s operating margin rose by 1.8 percentage points over the last five years, as its sales growth gave it operating leverage. This performance was mostly driven by its recent improvements as the company’s margin has increased by 3.2 percentage points on a two-year basis.

This quarter, Integer Holdings generated an operating profit margin of 11.3%, up 1.8 percentage points year on year. This increase was a welcome development and shows it was more efficient.

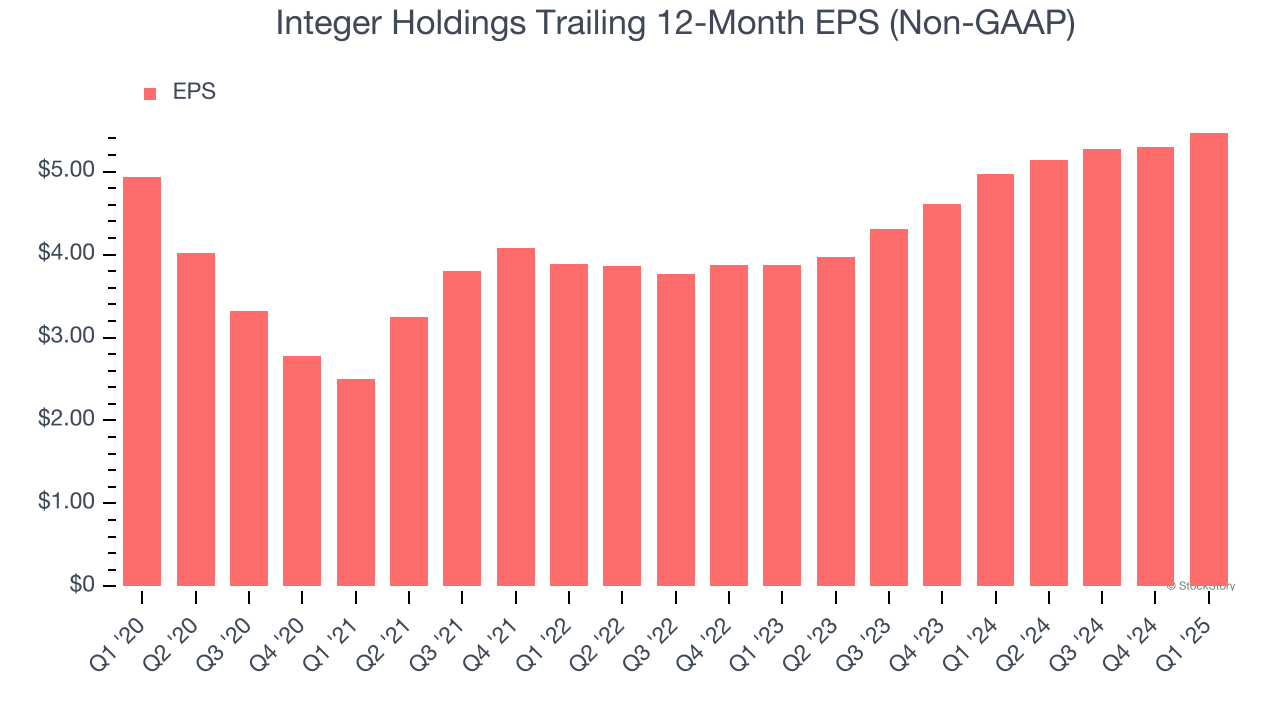

Earnings Per Share

Revenue trends explain a company’s historical growth, but the long-term change in earnings per share (EPS) points to the profitability of that growth – for example, a company could inflate its sales through excessive spending on advertising and promotions.

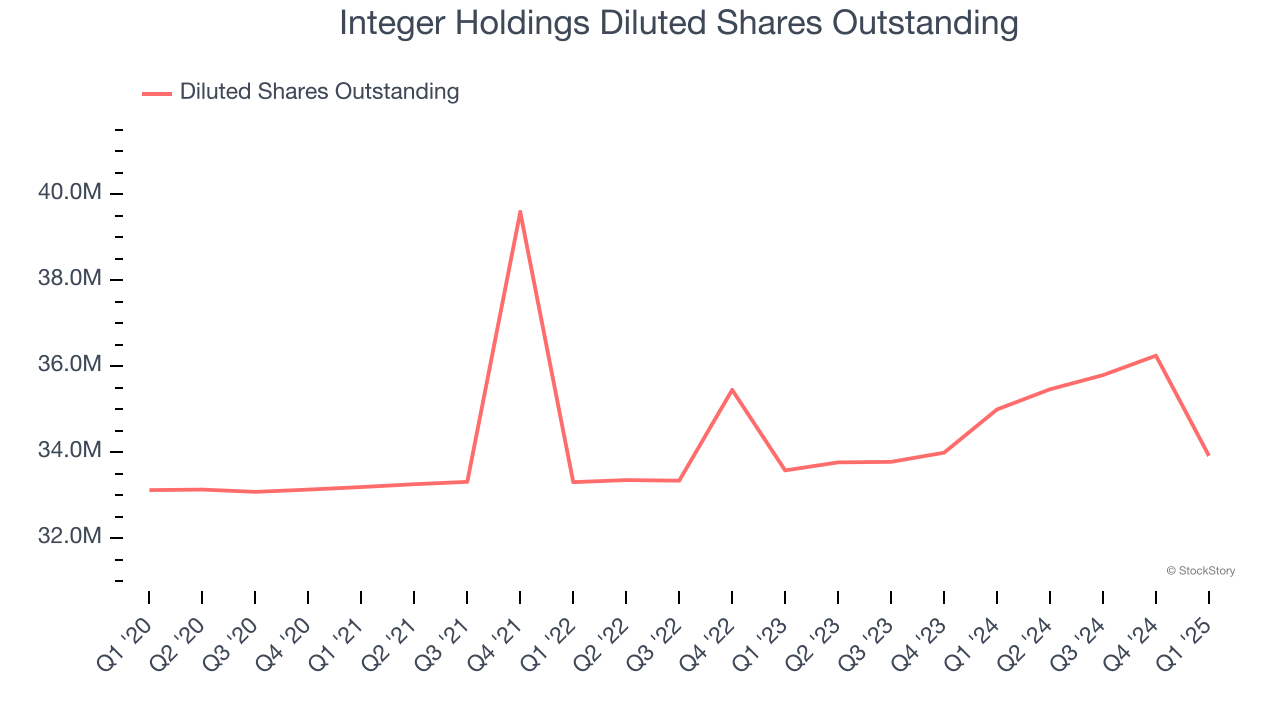

Integer Holdings’s EPS grew at an unimpressive 2.1% compounded annual growth rate over the last five years, lower than its 6.5% annualized revenue growth. However, its operating margin actually expanded during this time, telling us that non-fundamental factors such as interest expenses and taxes affected its ultimate earnings.

We can take a deeper look into Integer Holdings’s earnings to better understand the drivers of its performance. A five-year view shows Integer Holdings has diluted its shareholders, growing its share count by 2.4%. This dilution overshadowed its increased operating efficiency and has led to lower per share earnings. Taxes and interest expenses can also affect EPS but don’t tell us as much about a company’s fundamentals.

In Q1, Integer Holdings reported EPS at $1.31, up from $1.14 in the same quarter last year. This print beat analysts’ estimates by 5.5%. Over the next 12 months, Wall Street expects Integer Holdings’s full-year EPS of $5.47 to grow 14.6%.

Key Takeaways from Integer Holdings’s Q1 Results

We enjoyed seeing Integer Holdings lift its full-year EPS guidance. We were also happy its organic revenue, EPS, and EBITDA beat Wall Street’s estimates. Overall, we think this was still a solid quarter with some key areas of upside. The stock traded up 1.9% to $122.51 immediately following the results.

Sure, Integer Holdings had a solid quarter, but if we look at the bigger picture, is this stock a buy? If you’re making that decision, you should consider the bigger picture of valuation, business qualities, as well as the latest earnings. We cover that in our actionable full research report which you can read here, it’s free.