Geospatial technology provider Trimble (NASDAQ: TRMB) reported revenue ahead of Wall Street’s expectations in Q4 CY2024, with sales up 5.5% year on year to $983.4 million. The company expects next quarter’s revenue to be around $809 million, close to analysts’ estimates. Its non-GAAP profit of $0.89 per share was in line with analysts’ consensus estimates.

Is now the time to buy Trimble? Find out by accessing our full research report, it’s free.

Trimble (TRMB) Q4 CY2024 Highlights:

- Revenue: $983.4 million vs analyst estimates of $943.4 million (5.5% year-on-year growth, 4.2% beat)

- Adjusted EPS: $0.89 vs analyst estimates of $0.89 (in line)

- Adjusted EBITDA: $298.1 million vs analyst estimates of $292.1 million (30.3% margin, 2.1% beat)

- Management’s revenue guidance for the upcoming financial year 2025 is $3.42 billion at the midpoint, missing analyst estimates by 0.5% and implying -7.1% growth (vs -2.8% in FY2024)

- Adjusted EPS guidance for the upcoming financial year 2025 is $2.87 at the midpoint, missing analyst estimates by 0.8%

- Operating Margin: 17.6%, up from 10.4% in the same quarter last year

- Free Cash Flow Margin: 11.1%, up from 9.6% in the same quarter last year

- Organic Revenue rose 17% year on year (3% in the same quarter last year)

- Market Capitalization: $18.01 billion

"Fiscal 2024 was a transformative year for Trimble. We simplified and focused the Company through portfolio moves and re-segmentation. We also delivered for our customers while strengthening the Company — as evidenced by record levels of software as a percent of total revenue, and record levels of ARR, gross margin and profitability," said Rob Painter, president and CEO of Trimble.

Company Overview

Playing a role in the construction of the Paris Grand, Trimble (NASDAQ: TRMB) offers geospatial devices and technology to the agriculture, construction, transportation, and logistics industries.

Internet of Things

Industrial Internet of Things (IoT) companies are buoyed by the secular trend of a more connected world. They often specialize in nascent areas such as hardware and services for factory automation, fleet tracking, or smart home technologies. Those who play their cards right can generate recurring subscription revenues by providing cloud-based software services, boosting their margins. On the other hand, if the technologies these companies have invested in don’t pan out, they may have to make costly pivots.

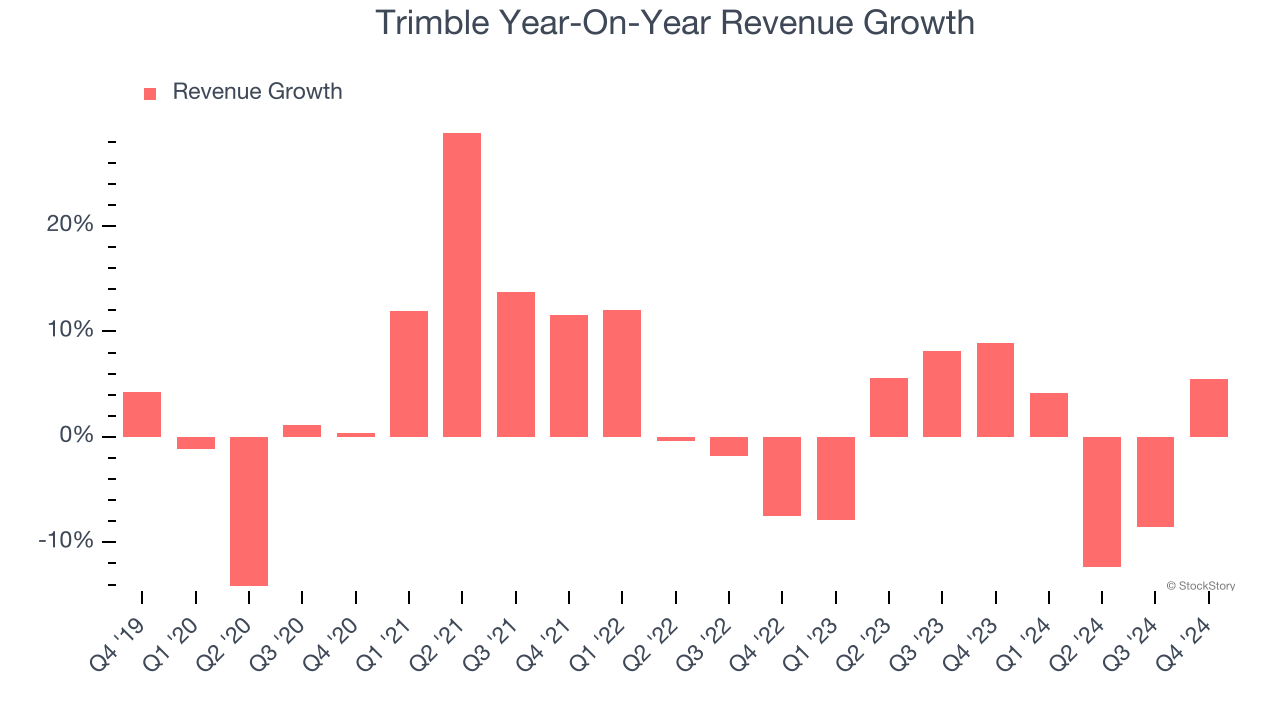

Sales Growth

A company’s long-term sales performance signals its overall quality. Even a bad business can shine for one or two quarters, but a top-tier one grows for years. Regrettably, Trimble’s sales grew at a sluggish 2.4% compounded annual growth rate over the last five years. This fell short of our benchmarks and is a rough starting point for our analysis.

Long-term growth is the most important, but within industrials, a half-decade historical view may miss new industry trends or demand cycles. Trimble’s recent history shows its demand slowed as its revenue was flat over the last two years.

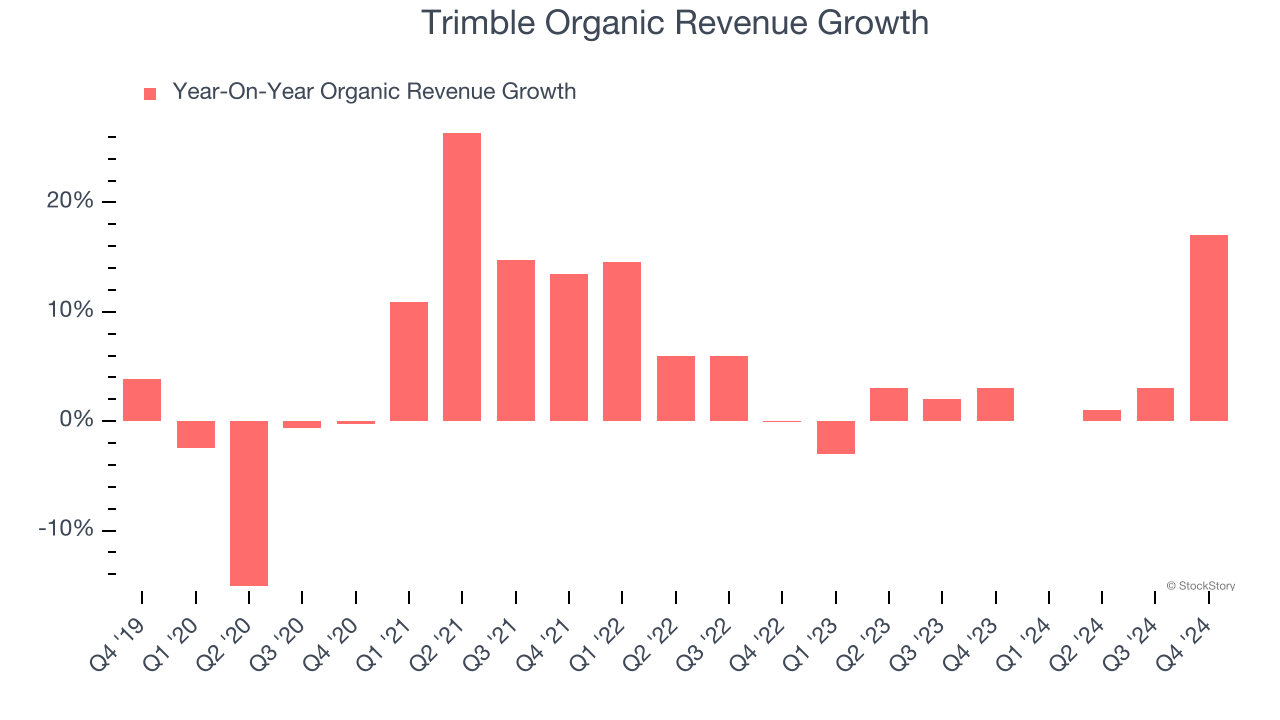

We can better understand the company’s sales dynamics by analyzing its organic revenue, which strips out one-time events like acquisitions and currency fluctuations that don’t accurately reflect its fundamentals. Over the last two years, Trimble’s organic revenue averaged 3.3% year-on-year growth. Because this number is better than its normal revenue growth, we can see that some mixture of divestitures and foreign exchange rates dampened its headline results.

This quarter, Trimble reported year-on-year revenue growth of 5.5%, and its $983.4 million of revenue exceeded Wall Street’s estimates by 4.2%. Company management is currently guiding for a 15.1% year-on-year decline in sales next quarter.

Looking further ahead, sell-side analysts expect revenue to decline by 6.7% over the next 12 months, a deceleration versus the last two years. This projection is underwhelming and implies its products and services will see some demand headwinds.

Unless you’ve been living under a rock, it should be obvious by now that generative AI is going to have a huge impact on how large corporations do business. While Nvidia and AMD are trading close to all-time highs, we prefer a lesser-known (but still profitable) stock benefiting from the rise of AI. Click here to access our free report one of our favorites growth stories.

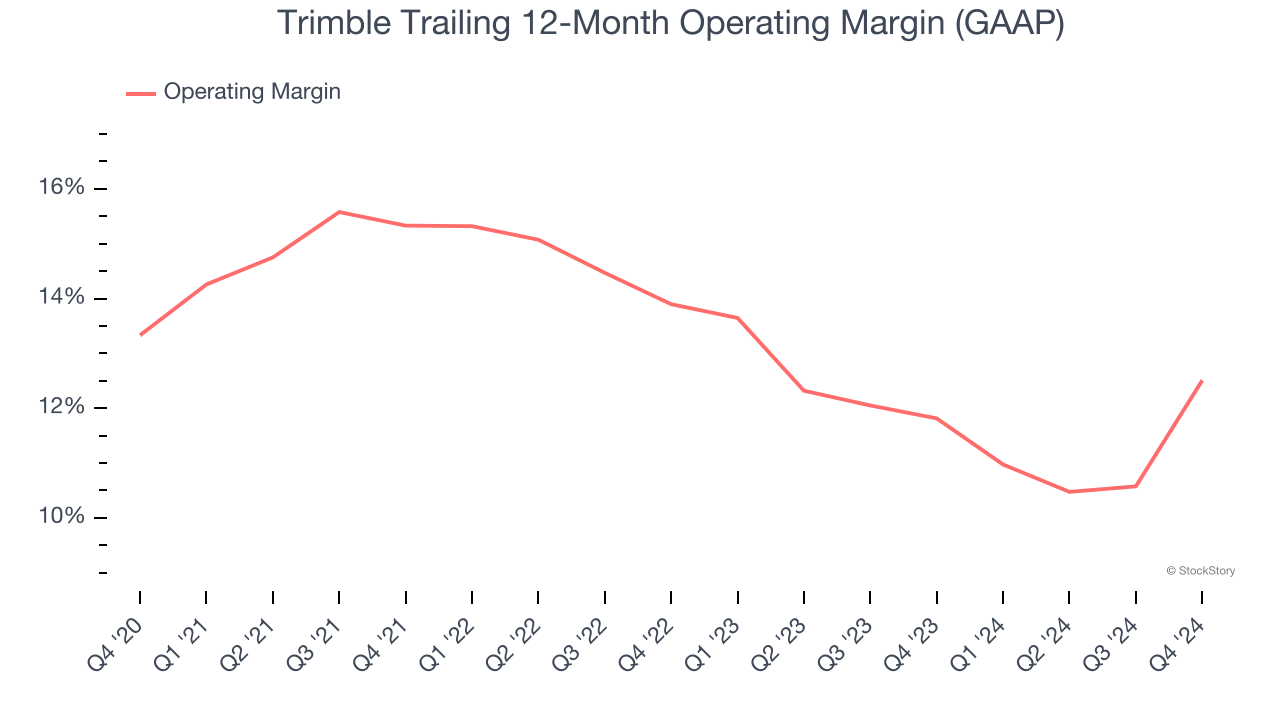

Operating Margin

Trimble has been an efficient company over the last five years. It was one of the more profitable businesses in the industrials sector, boasting an average operating margin of 13.4%. This result isn’t surprising as its high gross margin gives it a favorable starting point.

Looking at the trend in its profitability, Trimble’s operating margin might have seen some fluctuations but has generally stayed the same over the last five years , highlighting the long-term consistency of its business.

This quarter, Trimble generated an operating profit margin of 17.6%, up 7.3 percentage points year on year. The increase was solid, and since its operating margin rose more than its gross margin, we can infer it was recently more efficient with expenses such as marketing, R&D, and administrative overhead.

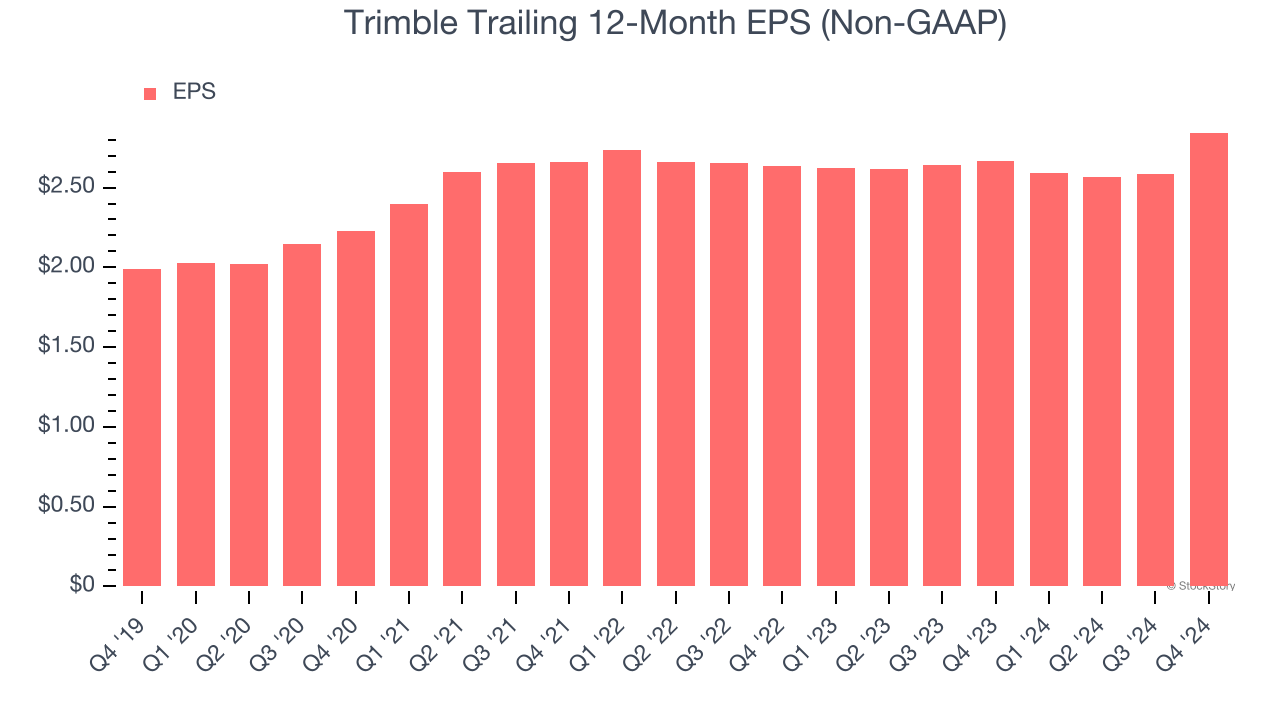

Earnings Per Share

We track the long-term change in earnings per share (EPS) for the same reason as long-term revenue growth. Compared to revenue, however, EPS highlights whether a company’s growth is profitable.

Trimble’s EPS grew at an unimpressive 7.4% compounded annual growth rate over the last five years. This performance was better than its flat revenue but doesn’t tell us much about its business quality because its operating margin didn’t expand.

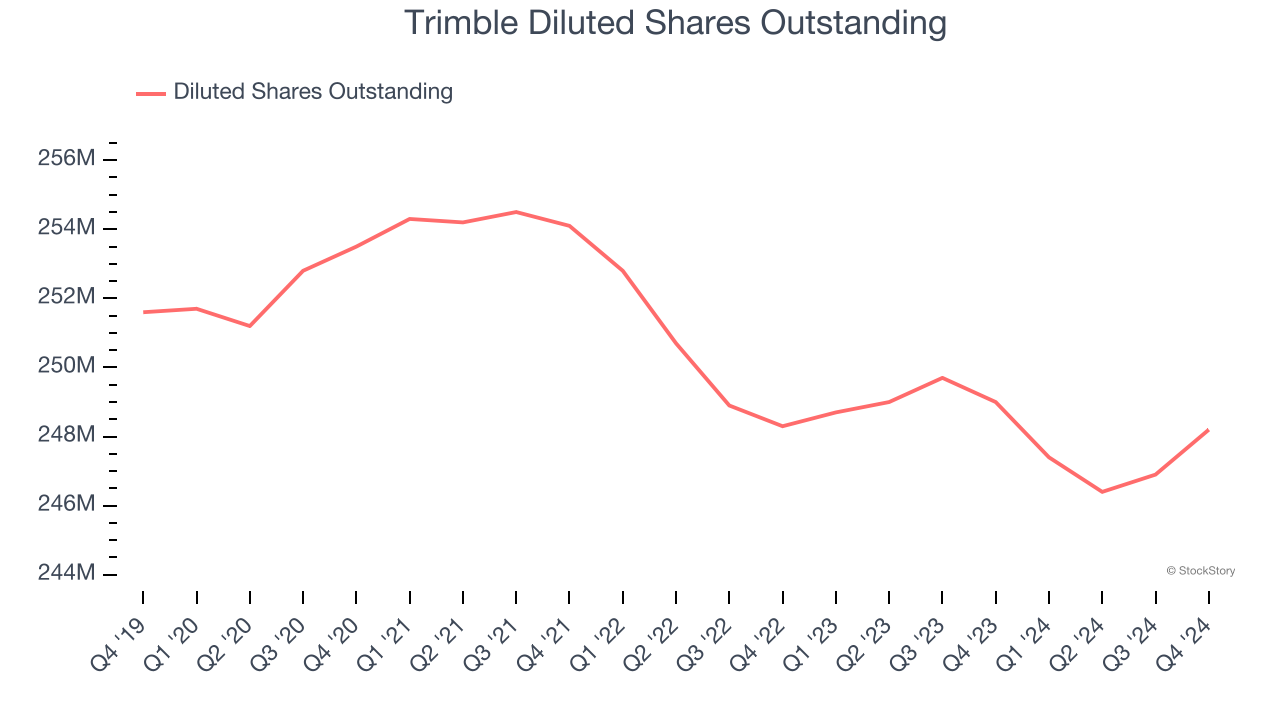

Diving into the nuances of Trimble’s earnings can give us a better understanding of its performance. A five-year view shows that Trimble has repurchased its stock, shrinking its share count by 1.4%. This tells us its EPS outperformed its revenue not because of increased operational efficiency but financial engineering, as buybacks boost per share earnings.

Like with revenue, we analyze EPS over a shorter period to see if we are missing a change in the business.

For Trimble, its two-year annual EPS growth of 3.8% was lower than its five-year trend. We hope its growth can accelerate in the future.

In Q4, Trimble reported EPS at $0.89, up from $0.63 in the same quarter last year. This print was close to analysts’ estimates. Over the next 12 months, Wall Street expects Trimble’s full-year EPS of $2.84 to grow 1%.

Key Takeaways from Trimble’s Q4 Results

We were impressed by how significantly Trimble blew past analysts’ organic revenue expectations this quarter. We were also happy its EBITDA outperformed. On the other hand, its full-year revenue and EPS guidance fell short of Wall Street’s estimates. Overall, this quarter was mixed. The areas below expectations seem to be driving the move, and shares traded down 3% to $72.85 immediately following the results.

So should you invest in Trimble right now? The latest quarter does matter, but not nearly as much as longer-term fundamentals and valuation, when deciding if the stock is a buy. We cover that in our actionable full research report which you can read here, it’s free.