Filtration equipment manufacturer Donaldson (NYSE: DCI) reported Q3 CY2025 results exceeding the market’s revenue expectations, with sales up 3.9% year on year to $935.4 million. Its non-GAAP profit of $0.94 per share was 1.8% above analysts’ consensus estimates.

Is now the time to buy Donaldson? Find out by accessing our full research report, it’s free for active Edge members.

Donaldson (DCI) Q3 CY2025 Highlights:

- Revenue: $935.4 million vs analyst estimates of $923.1 million (3.9% year-on-year growth, 1.3% beat)

- Adjusted EPS: $0.94 vs analyst estimates of $0.92 (1.8% beat)

- Adjusted EBITDA: $174.6 million vs analyst estimates of $172.3 million (18.7% margin, 1.3% beat)

- Management slightly raised its full-year Adjusted EPS guidance to $4.03 at the midpoint

- Operating Margin: 16%, up from 14.5% in the same quarter last year

- Free Cash Flow Margin: 11.9%, up from 5.3% in the same quarter last year

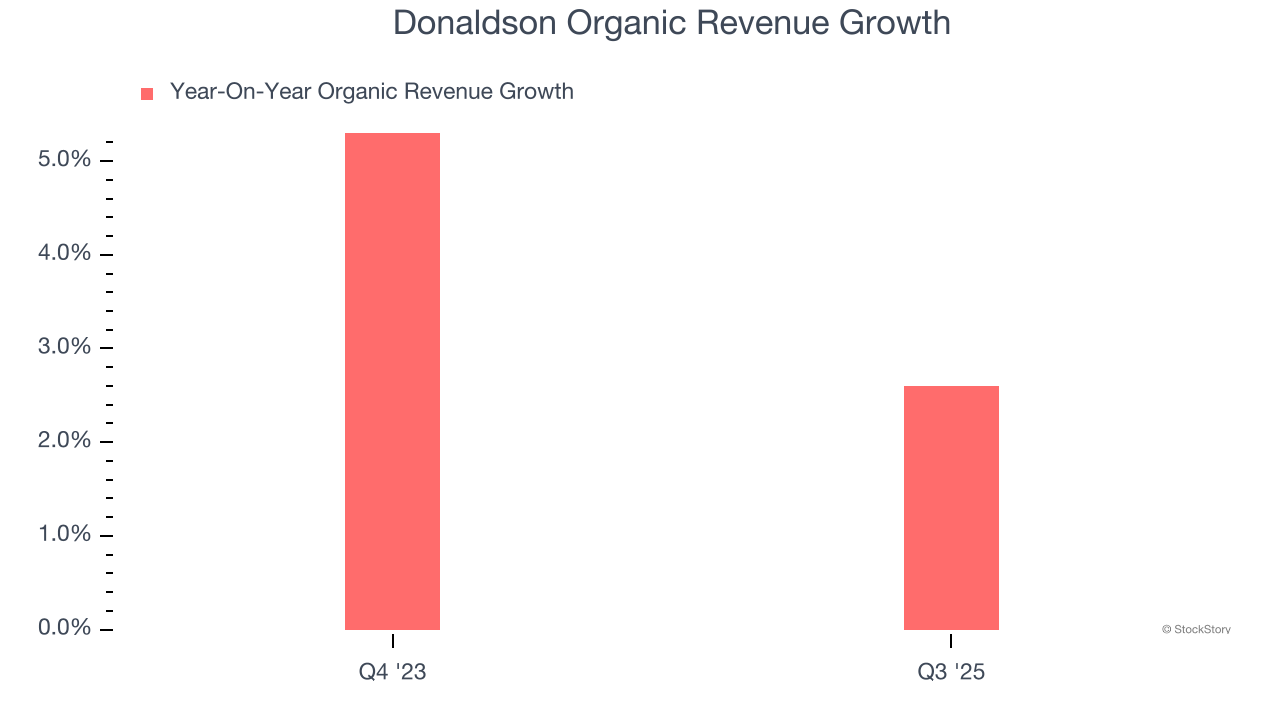

- Organic Revenue rose 2.6% year on year

- Market Capitalization: $10.15 billion

Company Overview

Playing a vital role in the historic Apollo 11 mission, Donaldson (NYSE: DCI) manufacturers and sells filtration equipment for various industries.

Revenue Growth

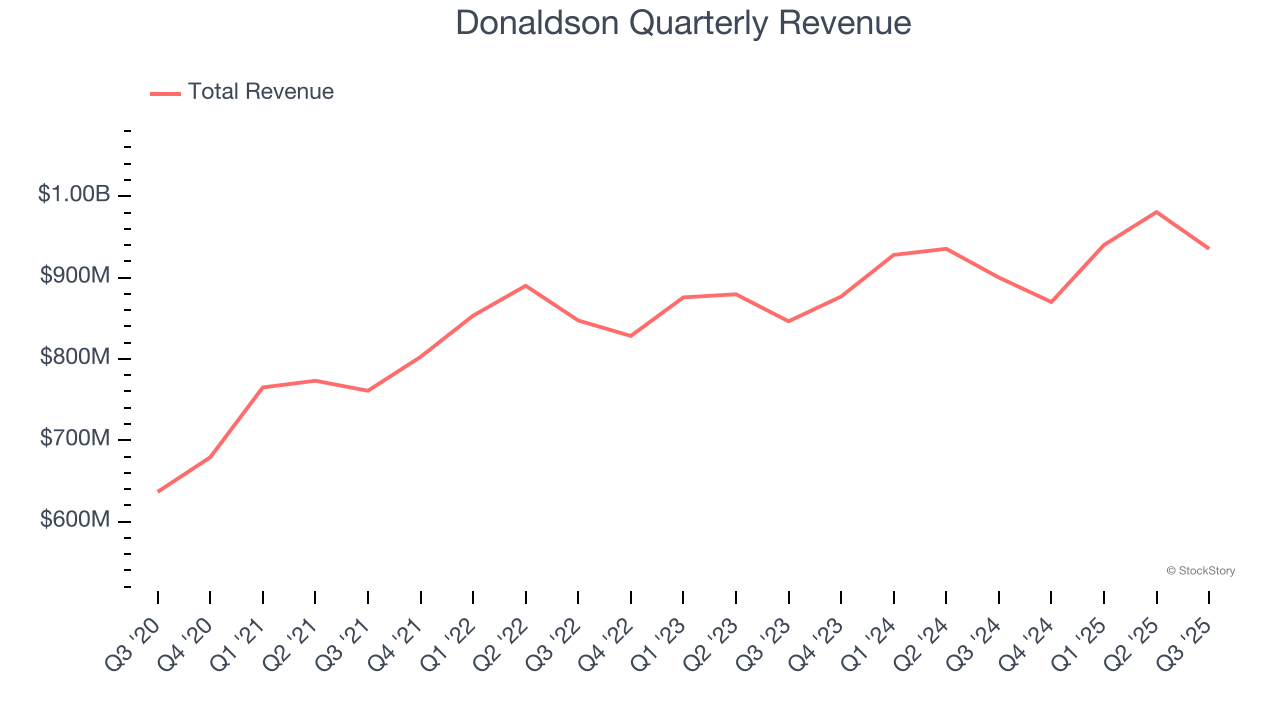

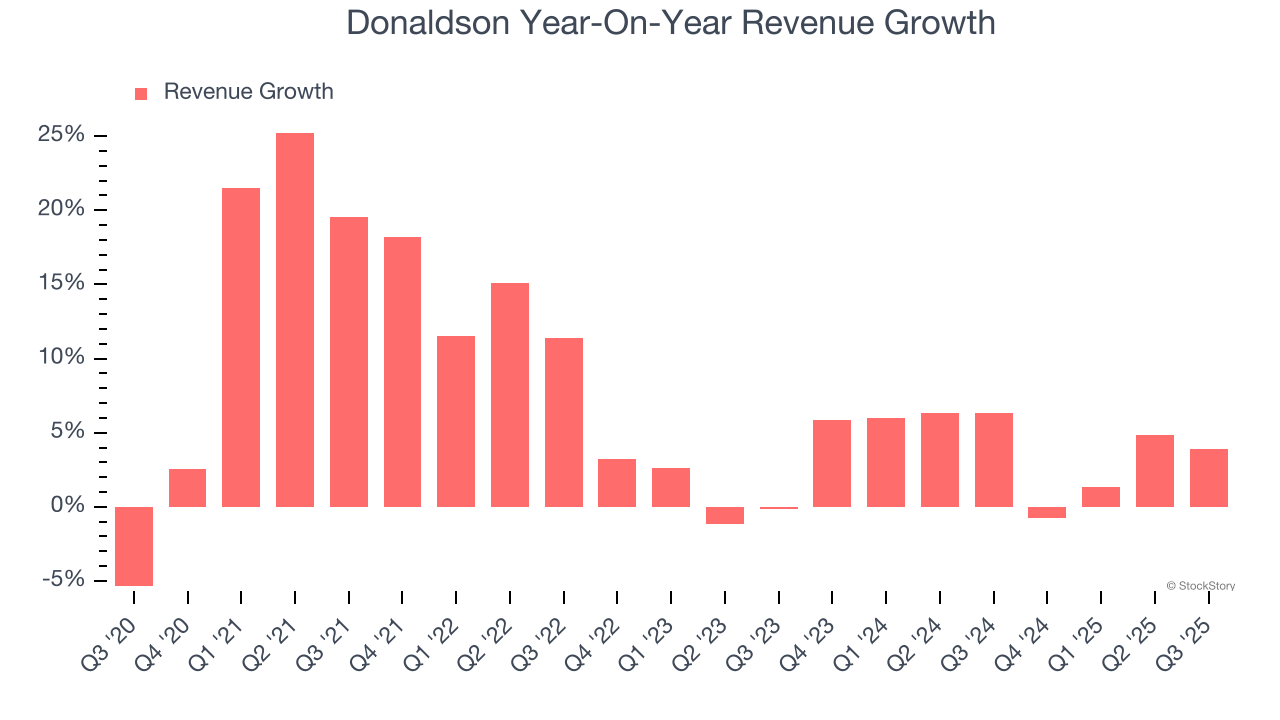

A company’s long-term sales performance is one signal of its overall quality. Any business can put up a good quarter or two, but the best consistently grow over the long haul. Over the last five years, Donaldson grew its sales at a decent 7.9% compounded annual growth rate. Its growth was slightly above the average industrials company and shows its offerings resonate with customers.

We at StockStory place the most emphasis on long-term growth, but within industrials, a half-decade historical view may miss cycles, industry trends, or a company capitalizing on catalysts such as a new contract win or a successful product line. Donaldson’s recent performance shows its demand has slowed as its annualized revenue growth of 4.2% over the last two years was below its five-year trend.

We can dig further into the company’s sales dynamics by analyzing its organic revenue, which strips out one-time events like acquisitions and currency fluctuations that don’t accurately reflect its fundamentals. Over the last two years, Donaldson’s organic revenue averaged 4% year-on-year growth. Because this number aligns with its two-year revenue growth, we can see the company’s core operations (not acquisitions and divestitures) drove most of its results.

This quarter, Donaldson reported modest year-on-year revenue growth of 3.9% but beat Wall Street’s estimates by 1.3%.

Looking ahead, sell-side analysts expect revenue to grow 3.4% over the next 12 months, similar to its two-year rate. This projection is underwhelming and implies its newer products and services will not lead to better top-line performance yet.

Microsoft, Alphabet, Coca-Cola, Monster Beverage—all began as under-the-radar growth stories riding a massive trend. We’ve identified the next one: a profitable AI semiconductor play Wall Street is still overlooking. Go here for access to our full report.

Operating Margin

Operating margin is one of the best measures of profitability because it tells us how much money a company takes home after procuring and manufacturing its products, marketing and selling those products, and most importantly, keeping them relevant through research and development.

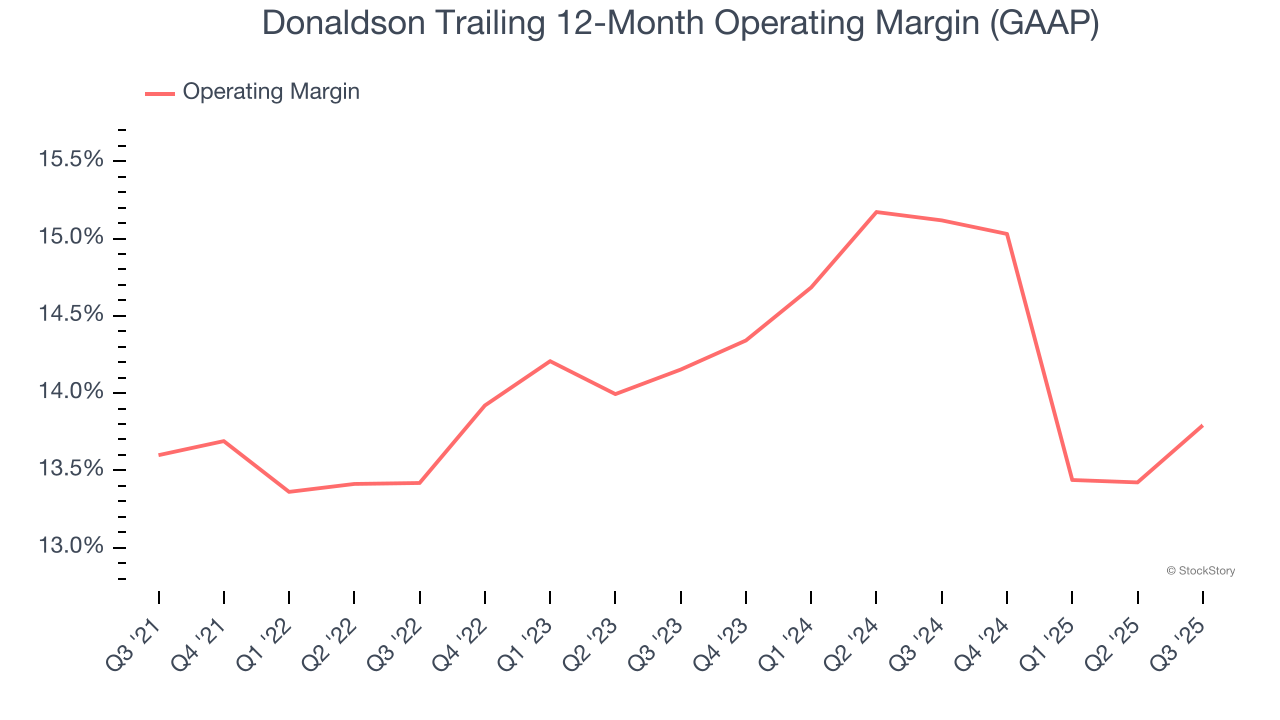

Donaldson’s operating margin might fluctuated slightly over the last 12 months but has remained more or less the same, averaging 14% over the last five years. This profitability was top-notch for an industrials business, showing it’s an well-run company with an efficient cost structure. This result isn’t too surprising as its gross margin gives it a favorable starting point.

Looking at the trend in its profitability, Donaldson’s operating margin might fluctuated slightly but has generally stayed the same over the last five years. This raises questions about the company’s expense base because its revenue growth should have given it leverage on its fixed costs, resulting in better economies of scale and profitability.

This quarter, Donaldson generated an operating margin profit margin of 16%, up 1.4 percentage points year on year. The increase was encouraging, and because its operating margin rose more than its gross margin, we can infer it was more efficient with expenses such as marketing, R&D, and administrative overhead.

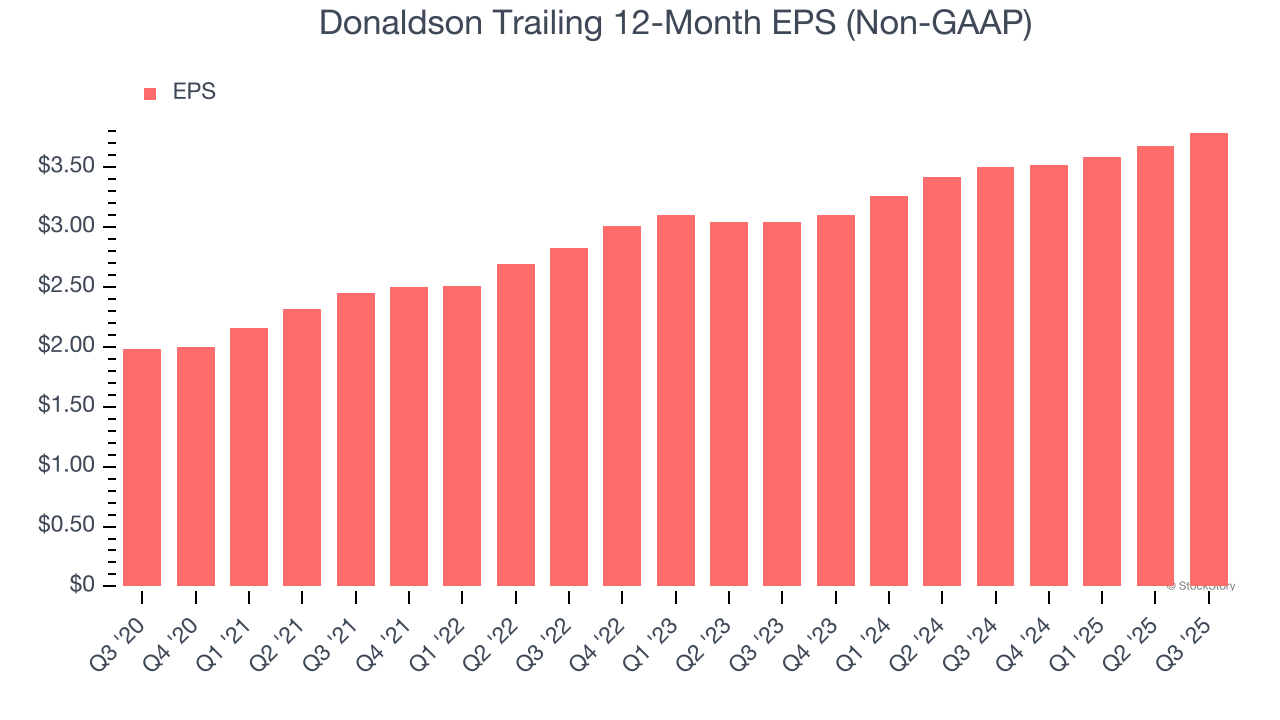

Earnings Per Share

Revenue trends explain a company’s historical growth, but the long-term change in earnings per share (EPS) points to the profitability of that growth – for example, a company could inflate its sales through excessive spending on advertising and promotions.

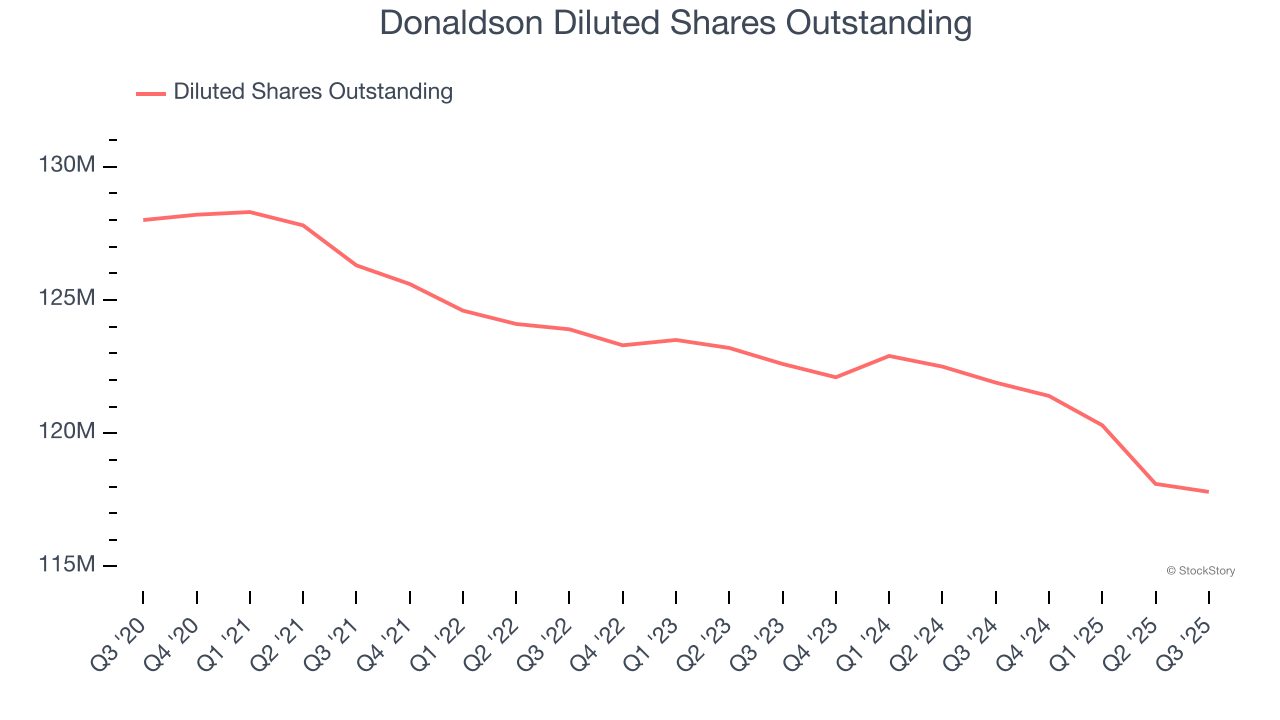

Donaldson’s EPS grew at a remarkable 13.9% compounded annual growth rate over the last five years, higher than its 7.9% annualized revenue growth. This tells us the company became more profitable on a per-share basis as it expanded.

We can take a deeper look into Donaldson’s earnings quality to better understand the drivers of its performance. A five-year view shows that Donaldson has repurchased its stock, shrinking its share count by 8%. This tells us its EPS outperformed its revenue not because of increased operational efficiency but financial engineering, as buybacks boost per share earnings.

Like with revenue, we analyze EPS over a more recent period because it can provide insight into an emerging theme or development for the business.

For Donaldson, its two-year annual EPS growth of 11.7% was lower than its five-year trend. We still think its growth was good and hope it can accelerate in the future.

In Q3, Donaldson reported adjusted EPS of $0.94, up from $0.83 in the same quarter last year. This print beat analysts’ estimates by 1.8%. We also like to analyze expected EPS growth based on Wall Street analysts’ consensus projections, but there is insufficient data.

Key Takeaways from Donaldson’s Q3 Results

It was good to see Donaldson narrowly top analysts’ revenue expectations this quarter. We were also happy its EBITDA narrowly outperformed Wall Street’s estimates. Overall, this print had some key positives. The stock traded up 2.7% to $90 immediately after reporting.

So do we think Donaldson is an attractive buy at the current price? We think that the latest quarter is only one piece of the longer-term business quality puzzle. Quality, when combined with valuation, can help determine if the stock is a buy. We cover that in our actionable full research report which you can read here, it’s free for active Edge members.