The end of an earnings season can be a great time to discover new stocks and assess how companies are handling the current business environment. Let’s take a look at how Appian (NASDAQ: APPN) and the rest of the automation software stocks fared in Q3.

The whole purpose of software is to automate tasks to increase productivity. Today, innovative new software techniques, often involving AI and machine learning, are finally allowing automation that has graduated from simple one- or two-step workflows to more complex processes integral to enterprises. The result is surging demand for modern automation software.

The 7 automation software stocks we track reported a strong Q3. As a group, revenues beat analysts’ consensus estimates by 4.4% while next quarter’s revenue guidance was in line.

While some automation software stocks have fared somewhat better than others, they have collectively declined. On average, share prices are down 2.6% since the latest earnings results.

Appian (NASDAQ: APPN)

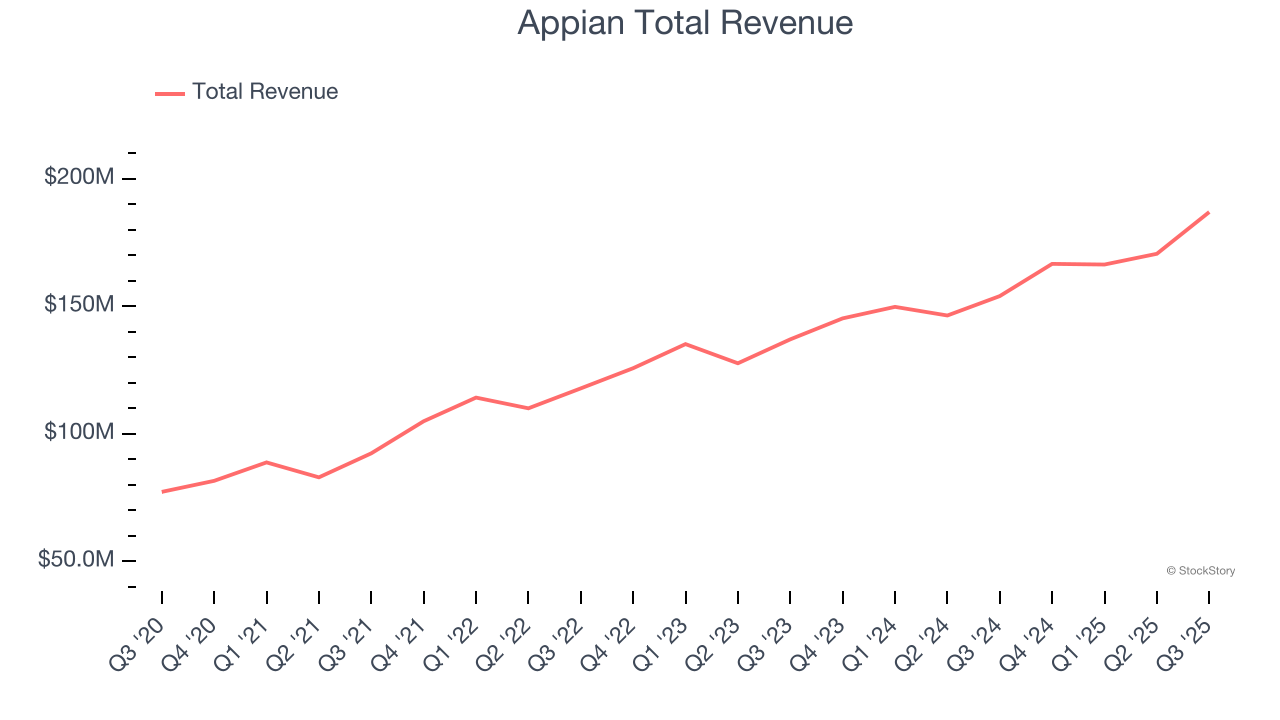

Powering billions of transactions daily since its founding in 1999, Appian (NASDAQ: APPN) provides a low-code platform that helps businesses automate complex processes and operationalize artificial intelligence without extensive programming knowledge.

Appian reported revenues of $187 million, up 21.4% year on year. This print exceeded analysts’ expectations by 7.4%. Overall, it was a very strong quarter for the company with an impressive beat of analysts’ billings estimates and a solid beat of analysts’ EBITDA estimates.

Interestingly, the stock is up 23.6% since reporting and currently trades at $36.27.

Is now the time to buy Appian? Access our full analysis of the earnings results here, it’s free for active Edge members.

Best Q3: Pegasystems (NASDAQ: PEGA)

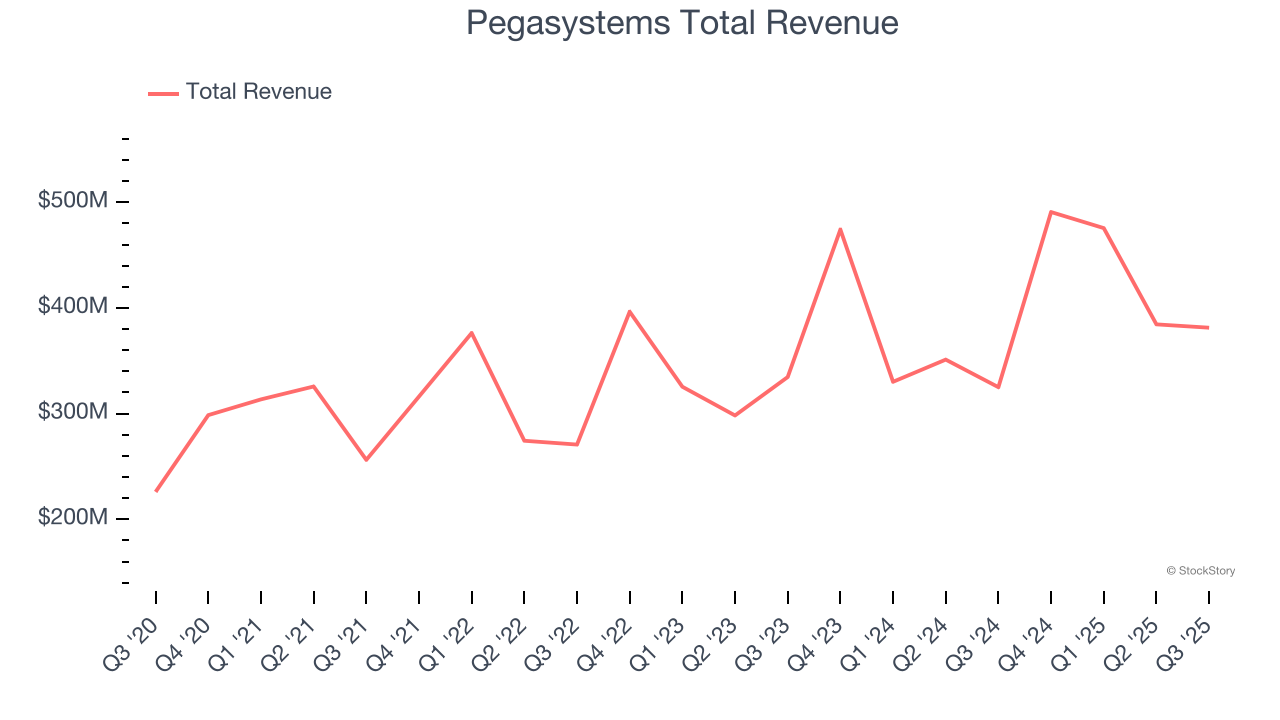

With a "Center-out Business Architecture" approach that transcends organizational silos, Pegasystems (NASDAQ: PEGA) develops software that helps organizations automate workflows and use artificial intelligence to improve customer experiences and business processes.

Pegasystems reported revenues of $381.4 million, up 17.3% year on year, outperforming analysts’ expectations by 8.5%. The business had a stunning quarter with a solid beat of analysts’ billings estimates and an impressive beat of analysts’ EBITDA estimates.

Pegasystems pulled off the biggest analyst estimates beat among its peers. However, the results were likely priced into the stock as it’s traded sideways since reporting. Shares currently sit at $57.43.

Is now the time to buy Pegasystems? Access our full analysis of the earnings results here, it’s free for active Edge members.

Weakest Q3: SoundHound AI (NASDAQ: SOUN)

Born from the idea that machines should understand human speech as naturally as people do, SoundHound AI (NASDAQ: SOUN) develops voice recognition and conversational intelligence technology that enables businesses to integrate voice assistants into their products and services.

SoundHound AI reported revenues of $42.05 million, up 67.6% year on year, exceeding analysts’ expectations by 2.7%. Still, it was a softer quarter as it posted a significant miss of analysts’ EBITDA estimates and a miss of analysts’ billings estimates.

As expected, the stock is down 23.6% since the results and currently trades at $10.98.

Read our full analysis of SoundHound AI’s results here.

Jamf (NASDAQ: JAMF)

With its name playfully derived from "Just Another Management Framework," Jamf (NASDAQ: JAMF) provides software that helps organizations deploy, manage, and secure Apple devices across their workforce while maintaining a seamless user experience.

Jamf reported revenues of $183.5 million, up 15.2% year on year. This number surpassed analysts’ expectations by 3.4%. Overall, it was an exceptional quarter as it also recorded an impressive beat of analysts’ billings estimates and a solid beat of analysts’ EBITDA estimates.

Jamf had the slowest revenue growth among its peers. The stock is up 1.2% since reporting and currently trades at $13.02.

Read our full, actionable report on Jamf here, it’s free for active Edge members.

Microsoft (NASDAQ: MSFT)

Originally named "Micro-soft" for microcomputer software when founded in 1975, Microsoft (NASDAQ: MSFT) is a global technology company that develops software, cloud services, devices, and AI solutions for consumers, businesses, and organizations worldwide.

Microsoft reported revenues of $77.67 billion, up 18.4% year on year. This result beat analysts’ expectations by 2.9%. It was a very strong quarter as it also logged a narrow beat of analysts’ revenue estimates, as the beat in Intelligent Cloud and Business Services trumped the miss in Personal Computing and an impressive beat of analysts’ revenue estimates.

The stock is down 12.1% since reporting and currently trades at $477.87.

Read our full, actionable report on Microsoft here, it’s free for active Edge members.

Market Update

As a result of the Fed’s rate hikes in 2022 and 2023, inflation has come down from frothy levels post-pandemic. The general rise in the price of goods and services is trending towards the Fed’s 2% goal as of late, which is good news. The higher rates that fought inflation also didn't slow economic activity enough to catalyze a recession. So far, soft landing. This, combined with recent rate cuts (half a percent in September 2024 and a quarter percent in November 2024) have led to strong stock market performance in 2024. The icing on the cake for 2024 returns was Donald Trump’s victory in the U.S. Presidential Election in early November, sending major indices to all-time highs in the week following the election. Still, debates around the health of the economy and the impact of potential tariffs and corporate tax cuts remain, leaving much uncertainty around 2025.

Want to invest in winners with rock-solid fundamentals? Check out our Strong Momentum Stocks and add them to your watchlist. These companies are poised for growth regardless of the political or macroeconomic climate.

StockStory’s analyst team — all seasoned professional investors — uses quantitative analysis and automation to deliver market-beating insights faster and with higher quality.