Civil infrastructure company Construction Partners (NASDAQ: ROAD) met Wall Streets revenue expectations in Q3 CY2025, with sales up 67.2% year on year to $899.8 million. The company’s full-year revenue guidance of $3.45 billion at the midpoint came in 0.8% above analysts’ estimates. Its GAAP profit of $1.02 per share was 7.7% below analysts’ consensus estimates.

Is now the time to buy Construction Partners? Find out by accessing our full research report, it’s free for active Edge members.

Construction Partners (ROAD) Q3 CY2025 Highlights:

- Revenue: $899.8 million vs analyst estimates of $895.9 million (67.2% year-on-year growth, in line)

- EPS (GAAP): $1.02 vs analyst expectations of $1.11 (7.7% miss)

- EBITDA guidance for the upcoming financial year 2026 is $530 million at the midpoint, above analyst estimates of $521.8 million

- Operating Margin: 11.2%, up from 8.5% in the same quarter last year

- Free Cash Flow Margin: 8.8%, down from 15.6% in the same quarter last year

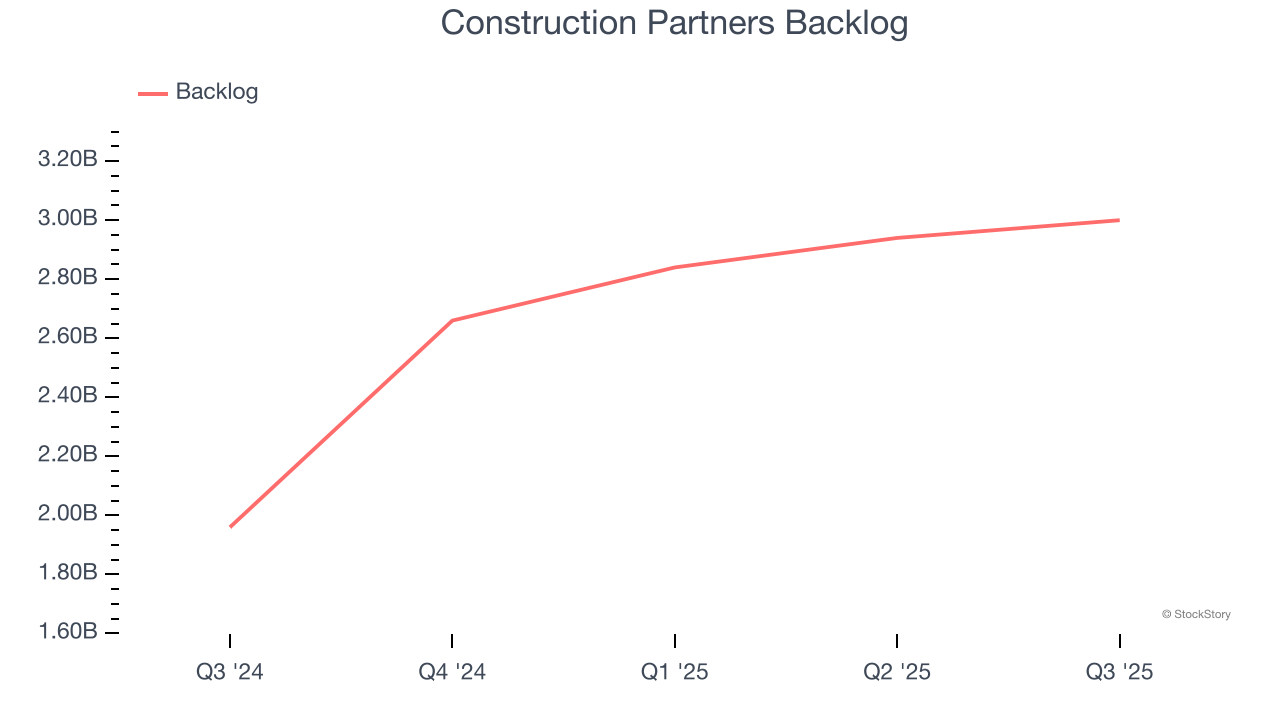

- Backlog: $3 billion at quarter end, up 53.1% year on year

- Market Capitalization: $5.84 billion

Fred J. (Jule) Smith, III, the Company's President and Chief Executive Officer, said, "We delivered a strong fourth quarter that capped a year of significant growth and margin expansion, in line with the preliminary financial ranges we announced in October. Our disciplined execution across our Sunbelt operations, powered by more than 6,800 employees, continues to drive record results through safe, efficient project construction and strong market demand. Fiscal 2025 was a transformative year for CPI, marked by strategic geographic expansion and accelerated financial performance. Through five strategic acquisitions, we entered Texas and Oklahoma and strengthened our footprint in Tennessee and Alabama, extending our reach into several high-growth local markets. In addition, we completed two acquisitions in October, subsequent to the end of our fiscal year, to enter the Daytona Beach market in Florida and significantly expand our operations in Houston, Texas.

Company Overview

Founded in 2001, Construction Partners (NASDAQ: ROAD) is a civil infrastructure company that builds and maintains roads, highways, and other infrastructure projects.

Revenue Growth

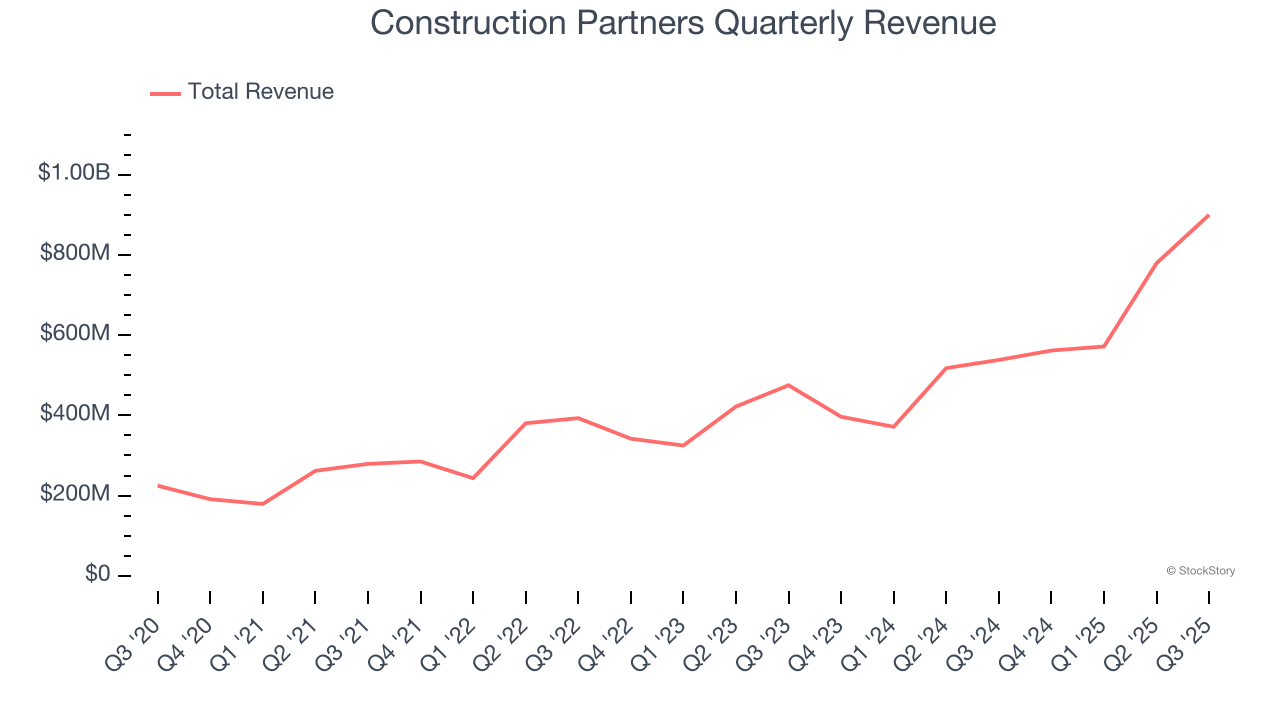

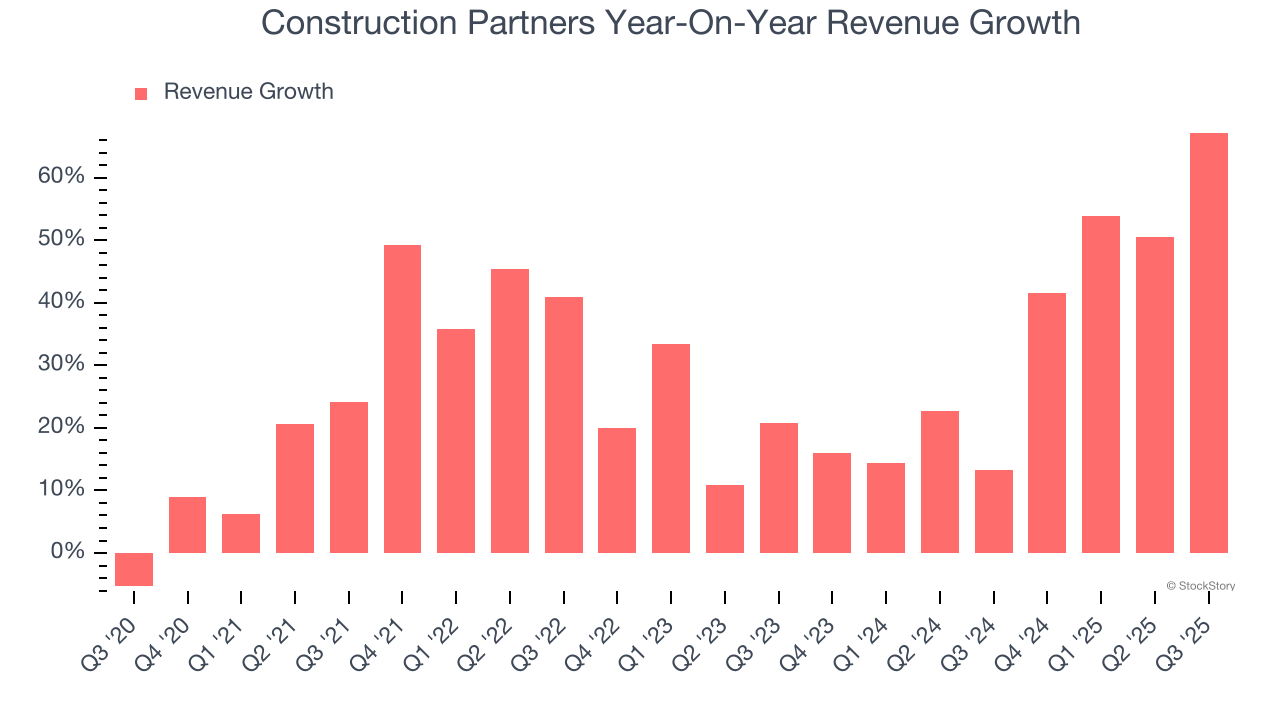

Reviewing a company’s long-term sales performance reveals insights into its quality. Any business can put up a good quarter or two, but the best consistently grow over the long haul. Thankfully, Construction Partners’s 29.1% annualized revenue growth over the last five years was incredible. Its growth surpassed the average industrials company and shows its offerings resonate with customers, a great starting point for our analysis.

Long-term growth is the most important, but within industrials, a half-decade historical view may miss new industry trends or demand cycles. Construction Partners’s annualized revenue growth of 34.1% over the last two years is above its five-year trend, suggesting its demand was strong and recently accelerated.

Construction Partners also reports its backlog, or the value of its outstanding orders that have not yet been executed or delivered. Construction Partners’s backlog reached $3 billion in the latest quarter and averaged 53.1% year-on-year growth over the last two years. Because this number is better than its revenue growth, we can see the company accumulated more orders than it could fulfill and deferred revenue to the future. This could imply elevated demand for Construction Partners’s products and services but raises concerns about capacity constraints.

This quarter, Construction Partners’s year-on-year revenue growth of 67.2% was magnificent, and its $899.8 million of revenue was in line with Wall Street’s estimates.

Looking ahead, sell-side analysts expect revenue to grow 20.9% over the next 12 months, a deceleration versus the last two years. Still, this projection is admirable and indicates the market sees success for its products and services.

The 1999 book Gorilla Game predicted Microsoft and Apple would dominate tech before it happened. Its thesis? Identify the platform winners early. Today, enterprise software companies embedding generative AI are becoming the new gorillas. a profitable, fast-growing enterprise software stock that is already riding the automation wave and looking to catch the generative AI next.

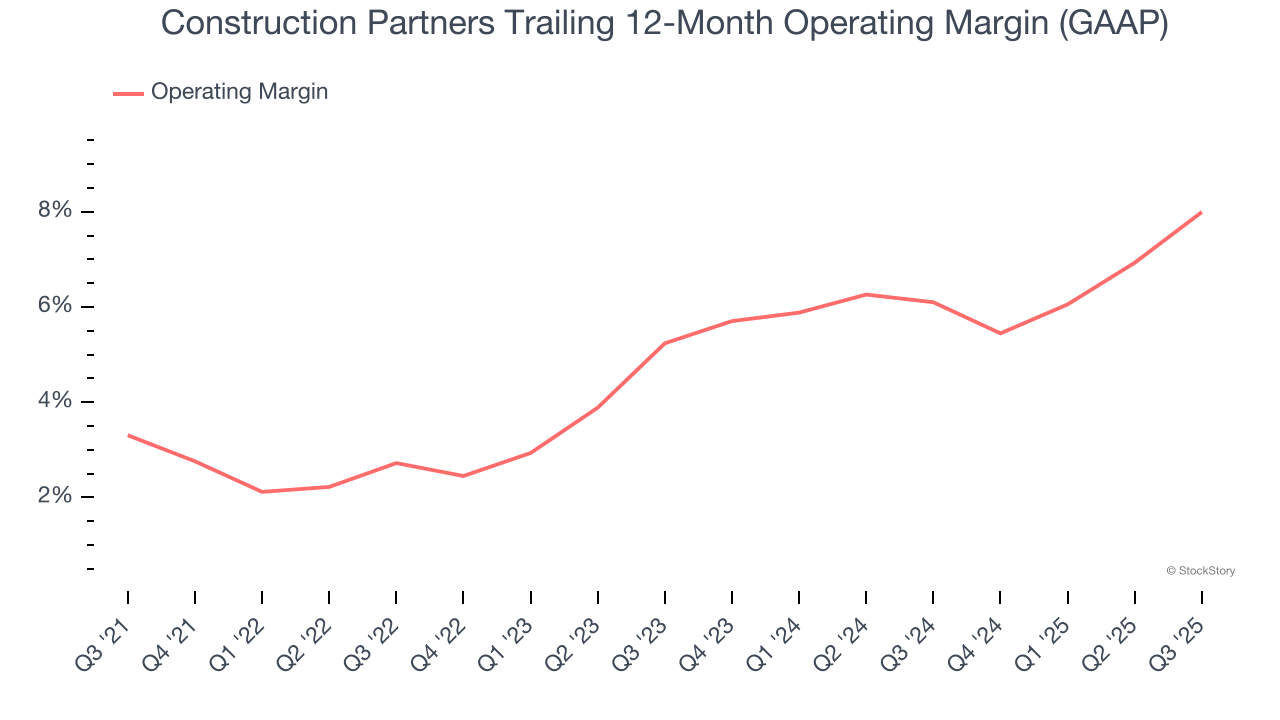

Operating Margin

Operating margin is an important measure of profitability as it shows the portion of revenue left after accounting for all core expenses – everything from the cost of goods sold to advertising and wages. It’s also useful for comparing profitability across companies with different levels of debt and tax rates because it excludes interest and taxes.

Construction Partners was profitable over the last five years but held back by its large cost base. Its average operating margin of 5.7% was weak for an industrials business. This result isn’t too surprising given its low gross margin as a starting point.

On the plus side, Construction Partners’s operating margin rose by 4.7 percentage points over the last five years, as its sales growth gave it operating leverage.

This quarter, Construction Partners generated an operating margin profit margin of 11.2%, up 2.7 percentage points year on year. The increase was encouraging, and because its operating margin rose more than its gross margin, we can infer it was more efficient with expenses such as marketing, R&D, and administrative overhead.

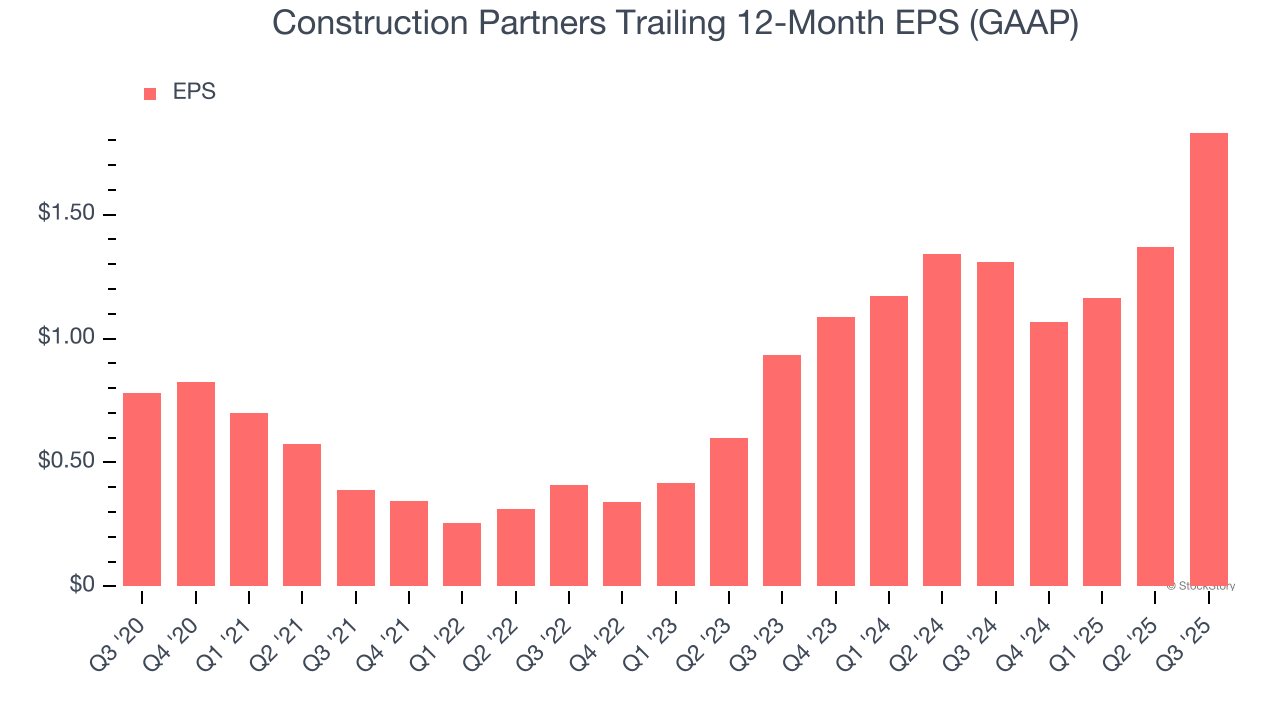

Earnings Per Share

We track the long-term change in earnings per share (EPS) for the same reason as long-term revenue growth. Compared to revenue, however, EPS highlights whether a company’s growth is profitable.

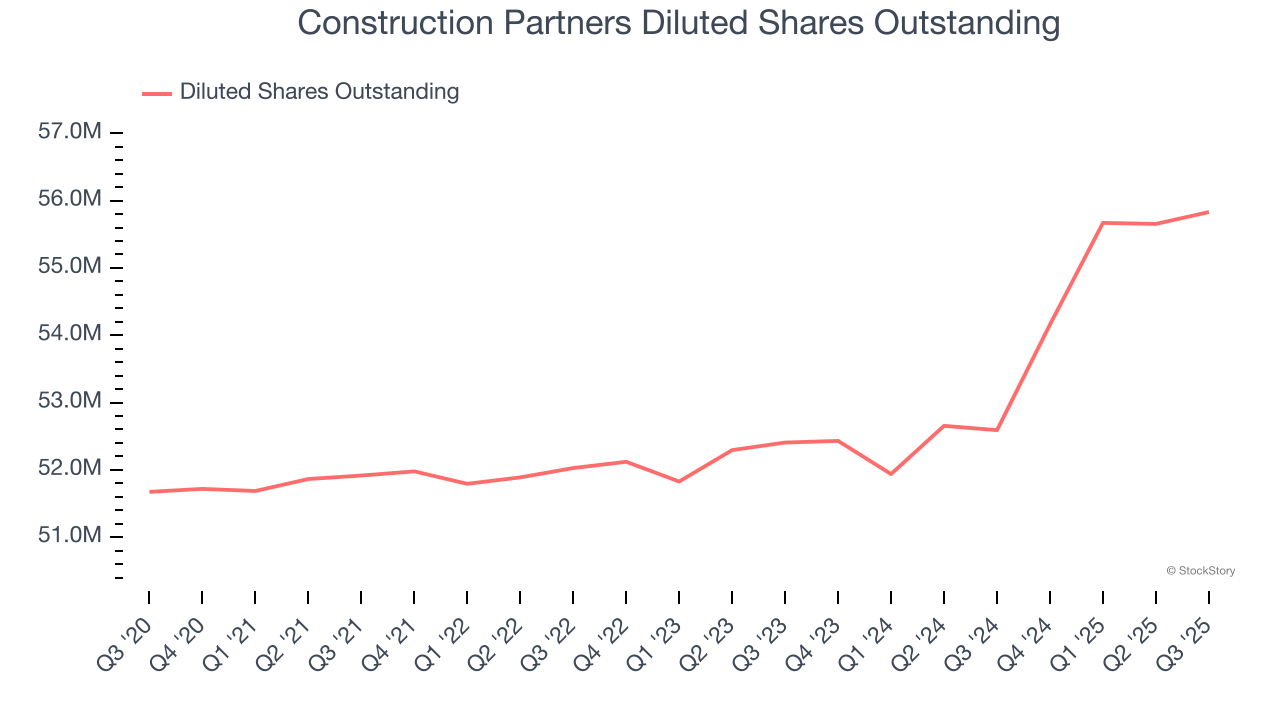

Construction Partners’s EPS grew at an astounding 18.6% compounded annual growth rate over the last five years. Despite its operating margin improvement during that time, this performance was lower than its 29.1% annualized revenue growth, telling us that non-fundamental factors such as interest and taxes affected its ultimate earnings.

Diving into Construction Partners’s quality of earnings can give us a better understanding of its performance. A five-year view shows Construction Partners has diluted its shareholders, growing its share count by 8%. This dilution overshadowed its increased operational efficiency and has led to lower per share earnings. Taxes and interest expenses can also affect EPS but don’t tell us as much about a company’s fundamentals.

Like with revenue, we analyze EPS over a shorter period to see if we are missing a change in the business.

For Construction Partners, its two-year annual EPS growth of 39.9% was higher than its five-year trend. We love it when earnings growth accelerates, especially when it accelerates off an already high base.

In Q3, Construction Partners reported EPS of $1.02, up from $0.56 in the same quarter last year. Despite growing year on year, this print missed analysts’ estimates, but we care more about long-term EPS growth than short-term movements. Over the next 12 months, Wall Street expects Construction Partners’s full-year EPS of $1.83 to grow 61.3%.

Key Takeaways from Construction Partners’s Q3 Results

It was great to see Construction Partners’s full-year EBITDA guidance top analysts’ expectations. We were also glad its full-year revenue guidance slightly exceeded Wall Street’s estimates. On the other hand, its EPS missed. Zooming out, we think this was a mixed quarter. The market seemed to be hoping for more, and the stock traded down 6.9% to $97 immediately following the results.

So should you invest in Construction Partners right now? What happened in the latest quarter matters, but not as much as longer-term business quality and valuation, when deciding whether to invest in this stock. We cover that in our actionable full research report which you can read here, it’s free for active Edge members.