Snack food company J&J Snack Foods (NASDAQ: JJSF) met Wall Streets revenue expectations in Q3 CY2025, but sales fell by 3.9% year on year to $410.2 million. Its GAAP profit of $0.58 per share was 55% below analysts’ consensus estimates.

Is now the time to buy J&J Snack Foods? Find out by accessing our full research report, it’s free for active Edge members.

J&J Snack Foods (JJSF) Q3 CY2025 Highlights:

- Revenue: $410.2 million vs analyst estimates of $409.8 million (3.9% year-on-year decline, in line)

- EPS (GAAP): $0.58 vs analyst expectations of $1.29 (55% miss due to $24 million in non-recurring plant closure expenses)

- Adjusted EBITDA: $57.37 million vs analyst estimates of $50.87 million (14% margin, 12.8% beat)

- Operating Margin: 2.8%, down from 9.3% in the same quarter last year

- Free Cash Flow Margin: 10.9%, up from 6.8% in the same quarter last year

- Market Capitalization: $1.62 billion

"We are pleased with our fourth quarter performance, delivering Adjusted EBITDA of $57.4 million on sales of $410.2 million despite some challenges during the summer. Both sales and adjusted EBITDA were down about 4% as compared to the prior year quarter," stated Dan Fachner, Chairman, President, and CEO.

Company Overview

Best known for its SuperPretzel soft pretzels and ICEE frozen drinks, J&J Snack Foods (NASDAQ: JJSF) produces a range of snacks and beverages and distributes them primarily to supermarket and food service customers.

Revenue Growth

A company’s long-term performance is an indicator of its overall quality. Any business can experience short-term success, but top-performing ones enjoy sustained growth for years.

With $1.58 billion in revenue over the past 12 months, J&J Snack Foods is a small consumer staples company, which sometimes brings disadvantages compared to larger competitors benefiting from economies of scale and negotiating leverage with retailers.

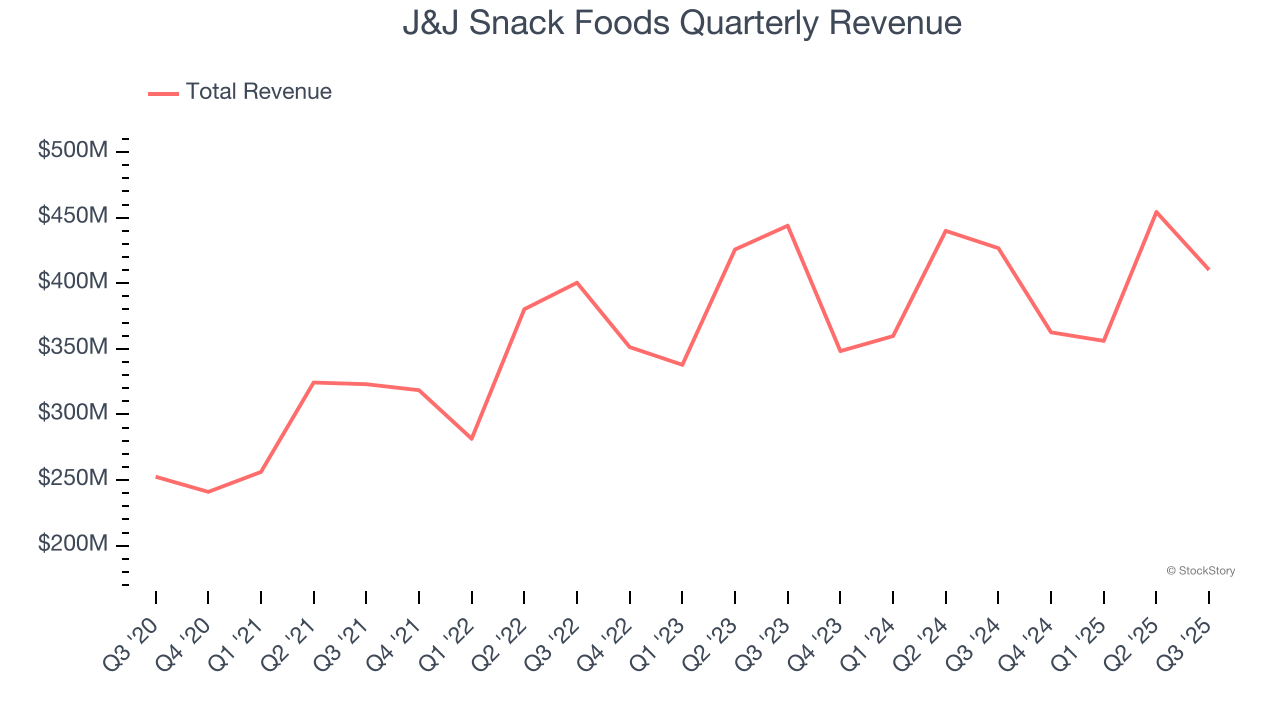

As you can see below, J&J Snack Foods’s sales grew at a tepid 4.7% compounded annual growth rate over the last three years. This shows it failed to generate demand in any major way and is a rough starting point for our analysis.

This quarter, J&J Snack Foods reported a rather uninspiring 3.9% year-on-year revenue decline to $410.2 million of revenue, in line with Wall Street’s estimates.

Looking ahead, sell-side analysts expect revenue to grow 2.5% over the next 12 months, a slight deceleration versus the last three years. This projection is underwhelming and indicates its products will face some demand challenges.

While Wall Street chases Nvidia at all-time highs, an under-the-radar semiconductor supplier is dominating a critical AI component these giants can’t build without. Click here to access our free report one of our favorites growth stories.

Cash Is King

Free cash flow isn't a prominently featured metric in company financials and earnings releases, but we think it's telling because it accounts for all operating and capital expenses, making it tough to manipulate. Cash is king.

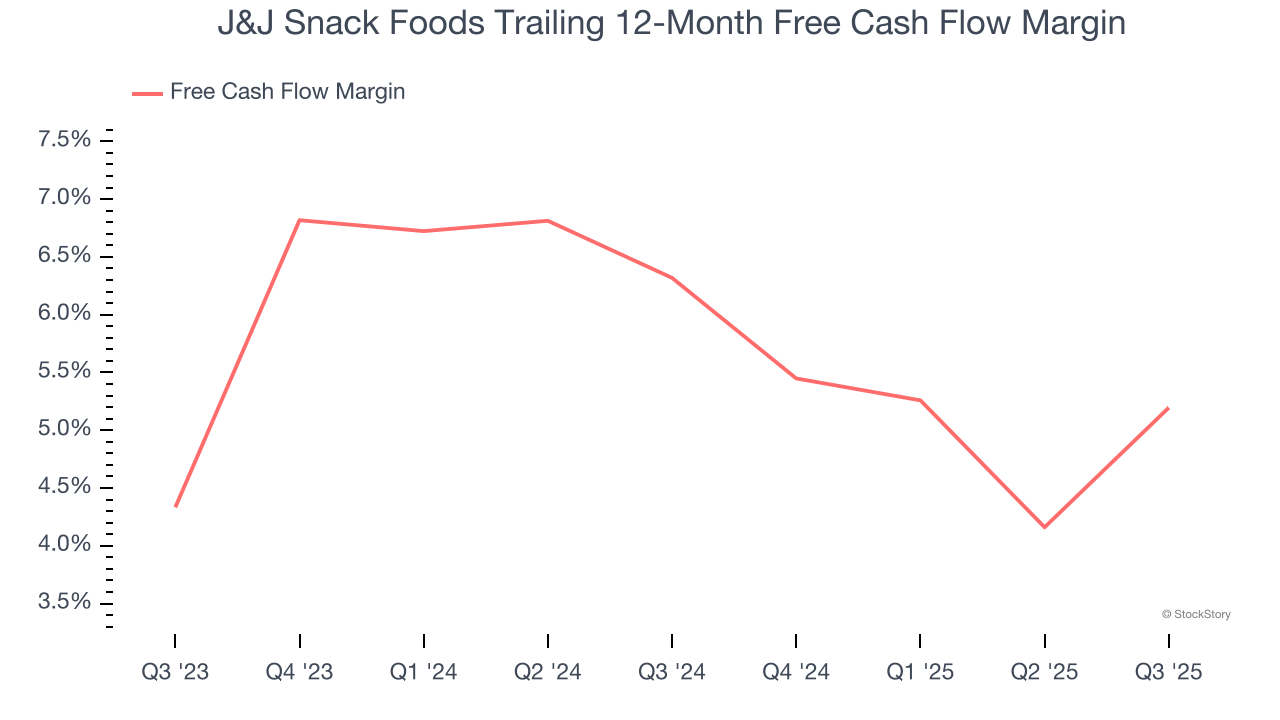

J&J Snack Foods has shown decent cash profitability, giving it some flexibility to reinvest or return capital to investors. The company’s free cash flow margin averaged 5.8% over the last two years, slightly better than the broader consumer staples sector.

Taking a step back, we can see that J&J Snack Foods’s margin dropped by 1.1 percentage points over the last year. Continued declines could signal it is in the middle of an investment cycle.

J&J Snack Foods’s free cash flow clocked in at $44.82 million in Q3, equivalent to a 10.9% margin. This result was good as its margin was 4.1 percentage points higher than in the same quarter last year, but we wouldn’t read too much into the short term because investment needs can be seasonal, leading to temporary swings. Long-term trends trump fluctuations.

Key Takeaways from J&J Snack Foods’s Q3 Results

We were impressed by how significantly J&J Snack Foods blew past analysts’ EBITDA expectations this quarter despite in line revenue. We were also glad its gross margin outperformed Wall Street’s estimates. Zooming out, we think this was a solid quarter. The stock remained flat at $82.70 immediately after reporting.

Should you buy the stock or not? What happened in the latest quarter matters, but not as much as longer-term business quality and valuation, when deciding whether to invest in this stock. We cover that in our actionable full research report which you can read here, it’s free for active Edge members.