Rural goods retailer Tractor Supply (NASDAQ: TSCO) met Wall Street’s revenue expectations in Q3 CY2025, with sales up 7.2% year on year to $3.72 billion. Its GAAP profit of $0.49 per share was in line with analysts’ consensus estimates.

Is now the time to buy Tractor Supply? Find out by accessing our full research report, it’s free for active Edge members.

Tractor Supply (TSCO) Q3 CY2025 Highlights:

- Revenue: $3.72 billion vs analyst estimates of $3.71 billion (7.2% year-on-year growth, in line)

- EPS (GAAP): $0.49 vs analyst estimates of $0.48 (in line)

- Adjusted EBITDA: $466.8 million vs analyst estimates of $471.6 million (12.6% margin, 1% miss)

- EPS (GAAP) guidance for the full year is $2.09 at the midpoint, roughly in line with what analysts were expecting

- Operating Margin: 9.2%, in line with the same quarter last year

- Free Cash Flow was $30.28 million, up from -$101.9 million in the same quarter last year

- Locations: 2,364 at quarter end, down from 2,475 in the same quarter last year

- Same-Store Sales rose 3.9% year on year (-0.2% in the same quarter last year)

- Market Capitalization: $29.06 billion

“The Tractor Supply team delivered a strong third quarter. This performance was driven by ongoing share gains, agile execution through an extended summer season and healthy transaction growth,” said Hal Lawton, President and Chief Executive Officer of Tractor Supply.

Company Overview

Started as a mail-order tractor parts business, Tractor Supply (NASDAQ: TSCO) is a retailer of general goods such as agricultural supplies, hardware, and pet food for the rural consumer.

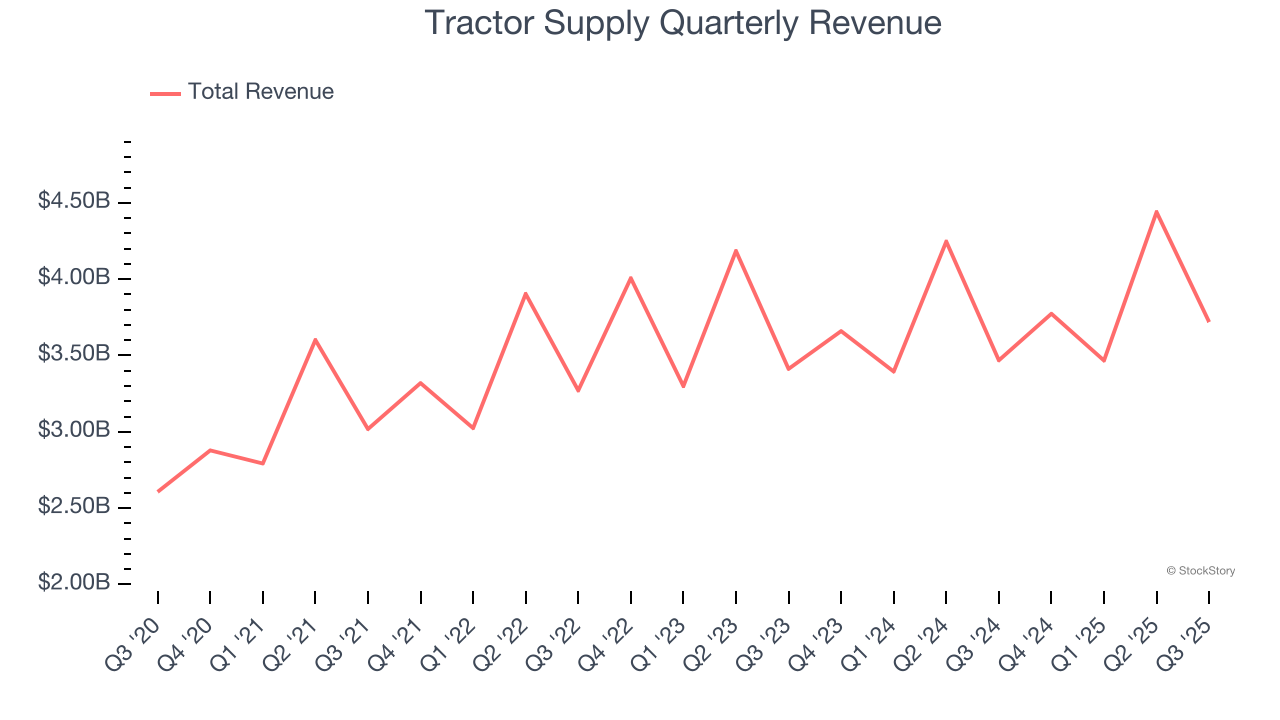

Revenue Growth

A company’s long-term sales performance can indicate its overall quality. Any business can put up a good quarter or two, but the best consistently grow over the long haul.

With $15.4 billion in revenue over the past 12 months, Tractor Supply is one of the larger companies in the consumer retail industry and benefits from a well-known brand that influences purchasing decisions.

As you can see below, Tractor Supply’s sales grew at a decent 10.9% compounded annual growth rate over the last six years (we compare to 2019 to normalize for COVID-19 impacts) as it opened new stores and expanded its reach.

This quarter, Tractor Supply grew its revenue by 7.2% year on year, and its $3.72 billion of revenue was in line with Wall Street’s estimates.

Looking ahead, sell-side analysts expect revenue to grow 6.6% over the next 12 months, a deceleration versus the last six years. We still think its growth trajectory is attractive given its scale and implies the market is forecasting success for its products.

Here at StockStory, we certainly understand the potential of thematic investing. Diverse winners from Microsoft (MSFT) to Alphabet (GOOG), Coca-Cola (KO) to Monster Beverage (MNST) could all have been identified as promising growth stories with a megatrend driving the growth. So, in that spirit, we’ve identified a relatively under-the-radar profitable growth stock benefiting from the rise of AI, available to you FREE via this link.

Store Performance

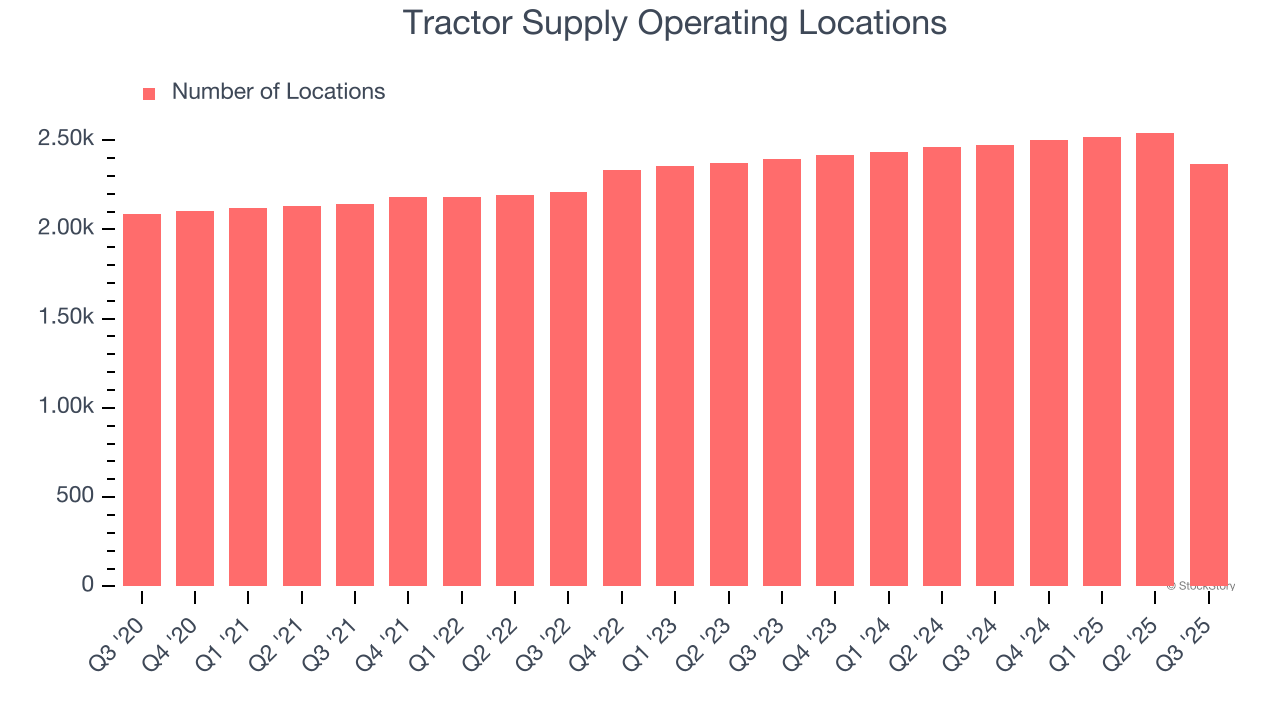

Number of Stores

A retailer’s store count often determines how much revenue it can generate.

Tractor Supply operated 2,364 locations in the latest quarter. It has opened new stores quickly over the last two years, averaging 2.5% annual growth, faster than the broader consumer retail sector.

When a retailer opens new stores, it usually means it’s investing for growth because demand is greater than supply, especially in areas where consumers may not have a store within reasonable driving distance.

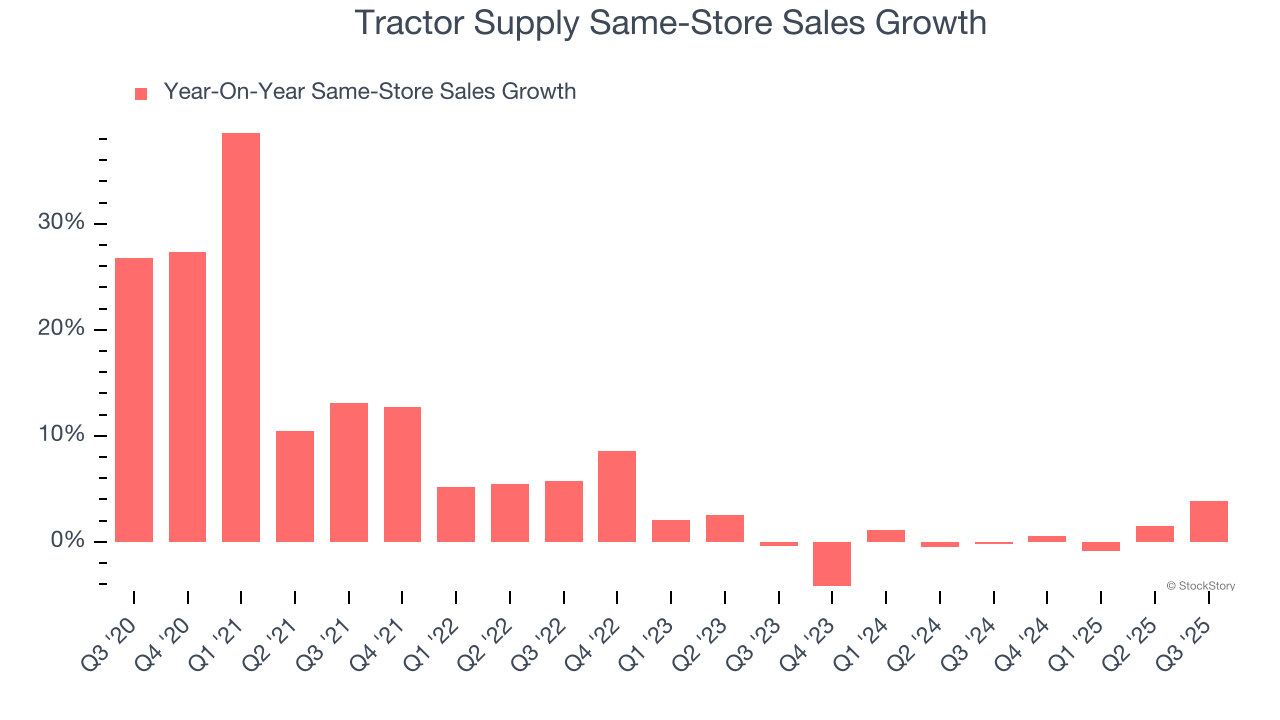

Same-Store Sales

A company's store base only paints one part of the picture. When demand is high, it makes sense to open more. But when demand is low, it’s prudent to close some locations and use the money in other ways. Same-store sales is an industry measure of whether revenue is growing at those existing stores and is driven by customer visits (often called traffic) and the average spending per customer (ticket).

Tractor Supply’s demand within its existing locations has barely increased over the last two years as its same-store sales were flat. Tractor Supply should consider improving its foot traffic and efficiency before expanding its store base.

In the latest quarter, Tractor Supply’s same-store sales rose 3.9% year on year. This growth was an acceleration from its historical levels, which is always an encouraging sign.

Key Takeaways from Tractor Supply’s Q3 Results

Revenue, EPS, and full-year EPS were roughly in line with expectations. Overall, this was a quarter without any positive surprises. The stock traded down 3.6% to $52.90 immediately after reporting.

Is Tractor Supply an attractive investment opportunity at the current price? If you’re making that decision, you should consider the bigger picture of valuation, business qualities, as well as the latest earnings. We cover that in our actionable full research report which you can read here, it’s free for active Edge members.