Electronic manufacturing services company Plexus (NASDAQ: PLXS) announced better-than-expected revenue in Q3 CY2025, but sales were flat year on year at $1.06 billion. Guidance for next quarter’s revenue was better than expected at $1.07 billion at the midpoint, 1.8% above analysts’ estimates. Its non-GAAP profit of $2.14 per share was 14.8% above analysts’ consensus estimates.

Is now the time to buy Plexus? Find out by accessing our full research report, it’s free for active Edge members.

Plexus (PLXS) Q3 CY2025 Highlights:

- Revenue: $1.06 billion vs analyst estimates of $1.05 billion (flat year on year, 1.1% beat)

- Adjusted EPS: $2.14 vs analyst estimates of $1.86 (14.8% beat)

- Revenue Guidance for Q4 CY2025 is $1.07 billion at the midpoint, above analyst estimates of $1.05 billion

- Adjusted EPS guidance for Q4 CY2025 is $1.73 at the midpoint, below analyst estimates of $1.81

- Operating Margin: 5%, in line with the same quarter last year

- Market Capitalization: $4.06 billion

Todd Kelsey, President and Chief Executive Officer, commented, “The Plexus team continues to deliver a differentiated value proposition for our customers, and generated strong fiscal fourth quarter results. I am particularly pleased with our non-GAAP EPS of $2.14, which exceeded guidance, and our free cash flow, which again exceeded projections.”

Company Overview

With over 20,000 team members across 26 global facilities, Plexus (NASDAQ: PLXS) designs, manufactures, and services complex electronic products for companies in aerospace/defense, healthcare, and industrial sectors.

Revenue Growth

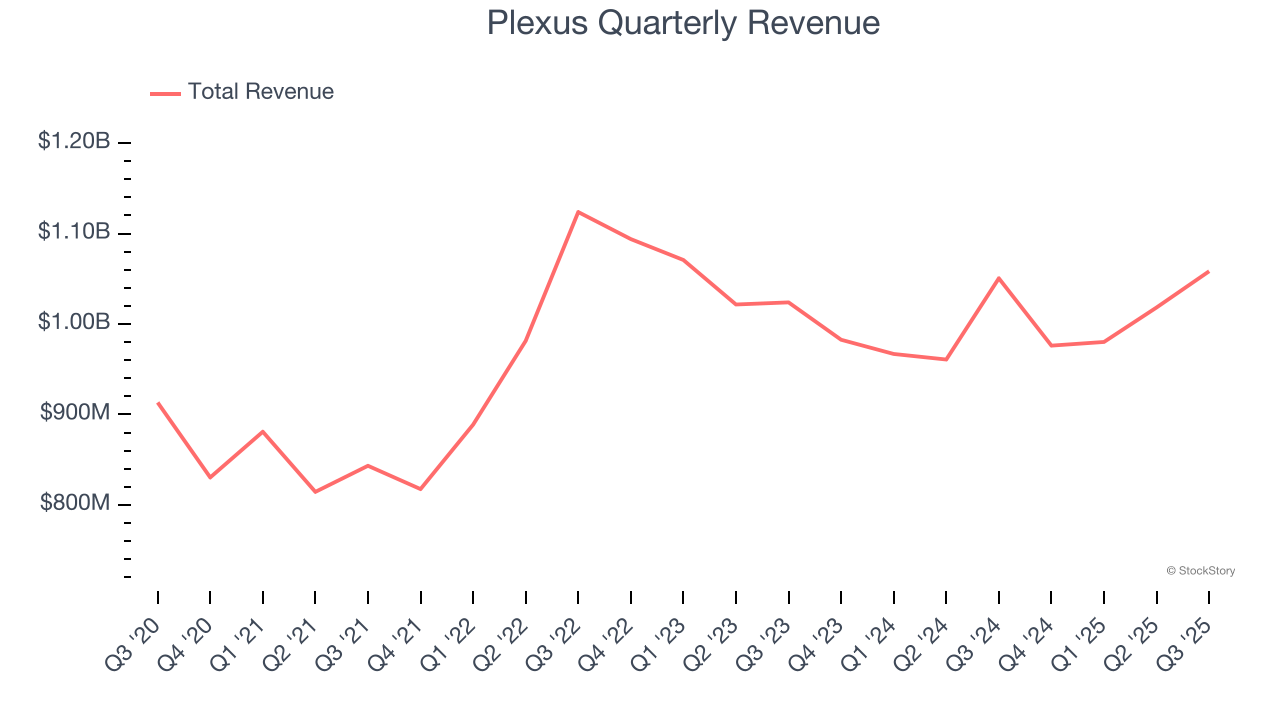

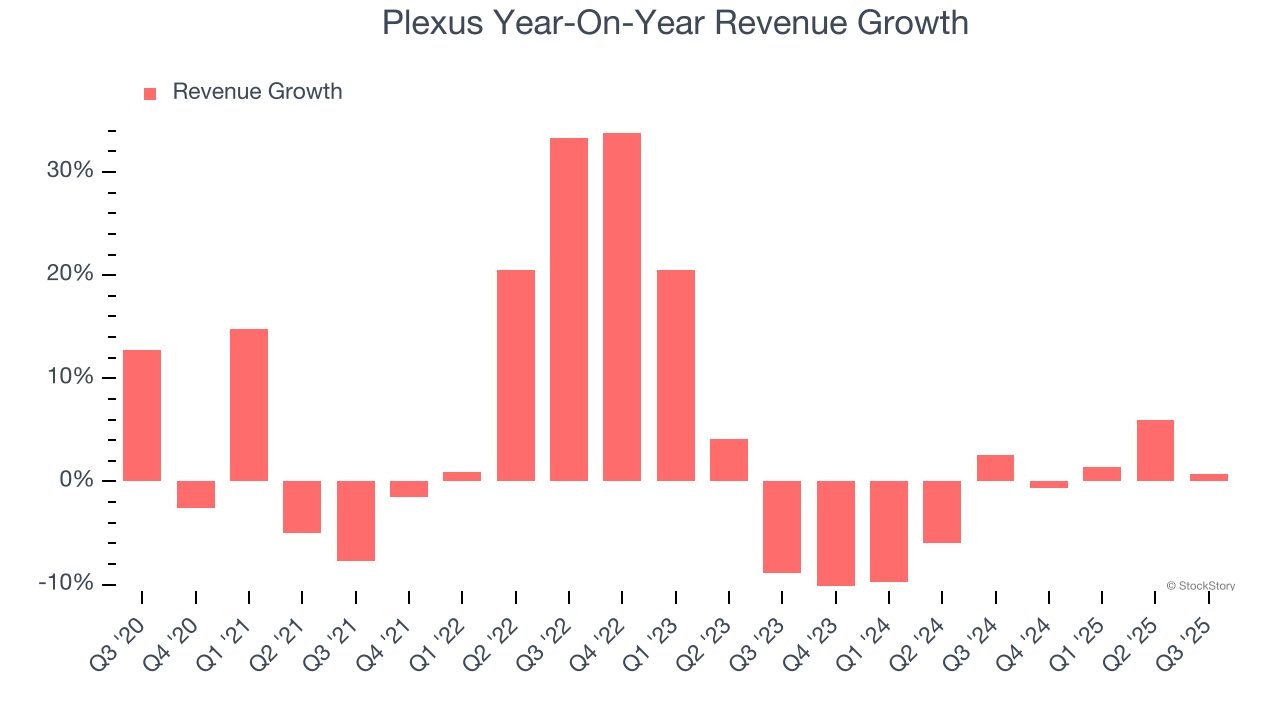

Examining a company’s long-term performance can provide clues about its quality. Any business can have short-term success, but a top-tier one grows for years.

With $4.03 billion in revenue over the past 12 months, Plexus is a mid-sized business services company, which sometimes brings disadvantages compared to larger competitors benefiting from better economies of scale.

As you can see below, Plexus’s sales grew at a tepid 3.5% compounded annual growth rate over the last five years. This shows it failed to generate demand in any major way and is a rough starting point for our analysis.

Long-term growth is the most important, but within business services, a half-decade historical view may miss new innovations or demand cycles. Plexus’s performance shows it grew in the past but relinquished its gains over the last two years, as its revenue fell by 2.1% annually.

This quarter, Plexus’s $1.06 billion of revenue was flat year on year but beat Wall Street’s estimates by 1.1%. Company management is currently guiding for a 9.6% year-on-year increase in sales next quarter.

Looking further ahead, sell-side analysts expect revenue to grow 7.6% over the next 12 months, an improvement versus the last two years. This projection is admirable and implies its newer products and services will spur better top-line performance.

Unless you’ve been living under a rock, it should be obvious by now that generative AI is going to have a huge impact on how large corporations do business. While Nvidia and AMD are trading close to all-time highs, we prefer a lesser-known (but still profitable) stock benefiting from the rise of AI. Click here to access our free report one of our favorites growth stories.

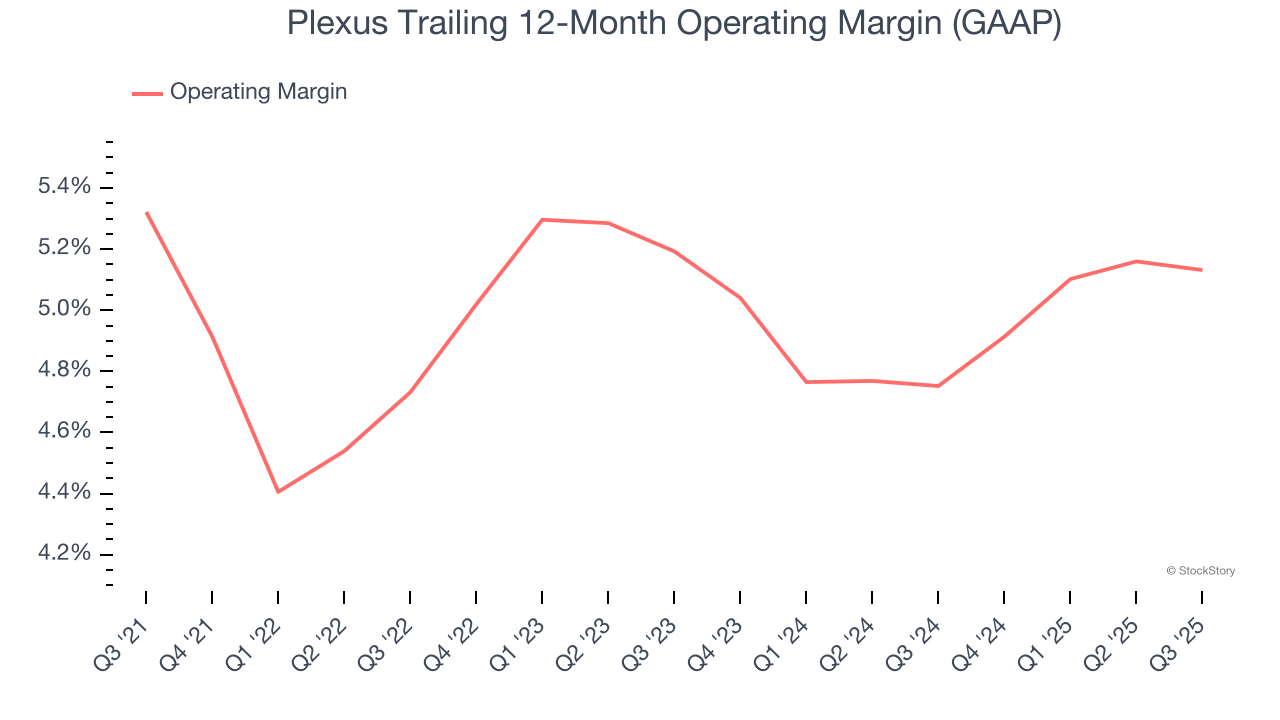

Operating Margin

Operating margin is one of the best measures of profitability because it tells us how much money a company takes home after subtracting all core expenses, like marketing and R&D.

Plexus’s operating margin might fluctuated slightly over the last 12 months but has generally stayed the same, averaging 5% over the last five years. This profitability was lousy for a business services business and caused by its suboptimal cost structure.

Looking at the trend in its profitability, Plexus’s operating margin might fluctuated slightly but has generally stayed the same over the last five years. This raises questions about the company’s expense base because its revenue growth should have given it leverage on its fixed costs, resulting in better economies of scale and profitability.

This quarter, Plexus generated an operating margin profit margin of 5%, in line with the same quarter last year. This indicates the company’s overall cost structure has been relatively stable.

Earnings Per Share

We track the long-term change in earnings per share (EPS) for the same reason as long-term revenue growth. Compared to revenue, however, EPS highlights whether a company’s growth is profitable.

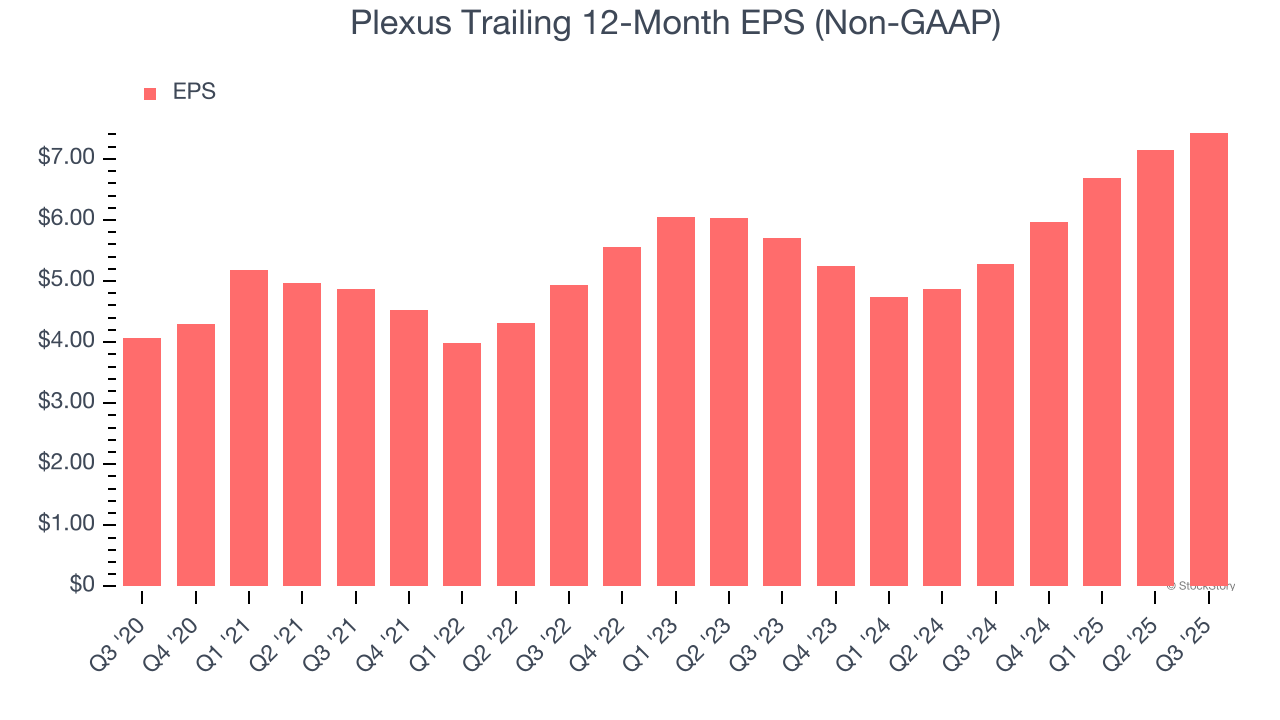

Plexus’s EPS grew at a spectacular 12.8% compounded annual growth rate over the last five years, higher than its 3.5% annualized revenue growth. However, this alone doesn’t tell us much about its business quality because its operating margin didn’t improve.

Like with revenue, we analyze EPS over a more recent period because it can provide insight into an emerging theme or development for the business.

For Plexus, its two-year annual EPS growth of 14.2% was higher than its five-year trend. We love it when earnings growth accelerates, especially when it accelerates off an already high base.

In Q3, Plexus reported adjusted EPS of $2.14, up from $1.85 in the same quarter last year. This print easily cleared analysts’ estimates, and shareholders should be content with the results. Over the next 12 months, Wall Street expects Plexus’s full-year EPS of $7.43 to grow 2.1%.

Key Takeaways from Plexus’s Q3 Results

It was good to see Plexus beat analysts’ EPS expectations this quarter. We were also glad its revenue guidance for next quarter exceeded Wall Street’s estimates. On the other hand, its EPS guidance for next quarter missed. Overall, we think this was a mixed quarter with some key areas of upside but also some areas of disappointment. The stock remained flat at $145 immediately following the results.

Big picture, is Plexus a buy here and now? If you’re making that decision, you should consider the bigger picture of valuation, business qualities, as well as the latest earnings. We cover that in our actionable full research report which you can read here, it’s free for active Edge members.