While the S&P 500 is up 30.6% since April 2025, Walker & Dunlop (currently trading at $82.70 per share) has lagged behind, posting a return of 14.8%. This may have investors wondering how to approach the situation.

Is now the time to buy Walker & Dunlop, or should you be careful about including it in your portfolio? Get the full stock story straight from our expert analysts, it’s free for active Edge members.

Why Is Walker & Dunlop Not Exciting?

We don't have much confidence in Walker & Dunlop. Here are three reasons you should be careful with WD and a stock we'd rather own.

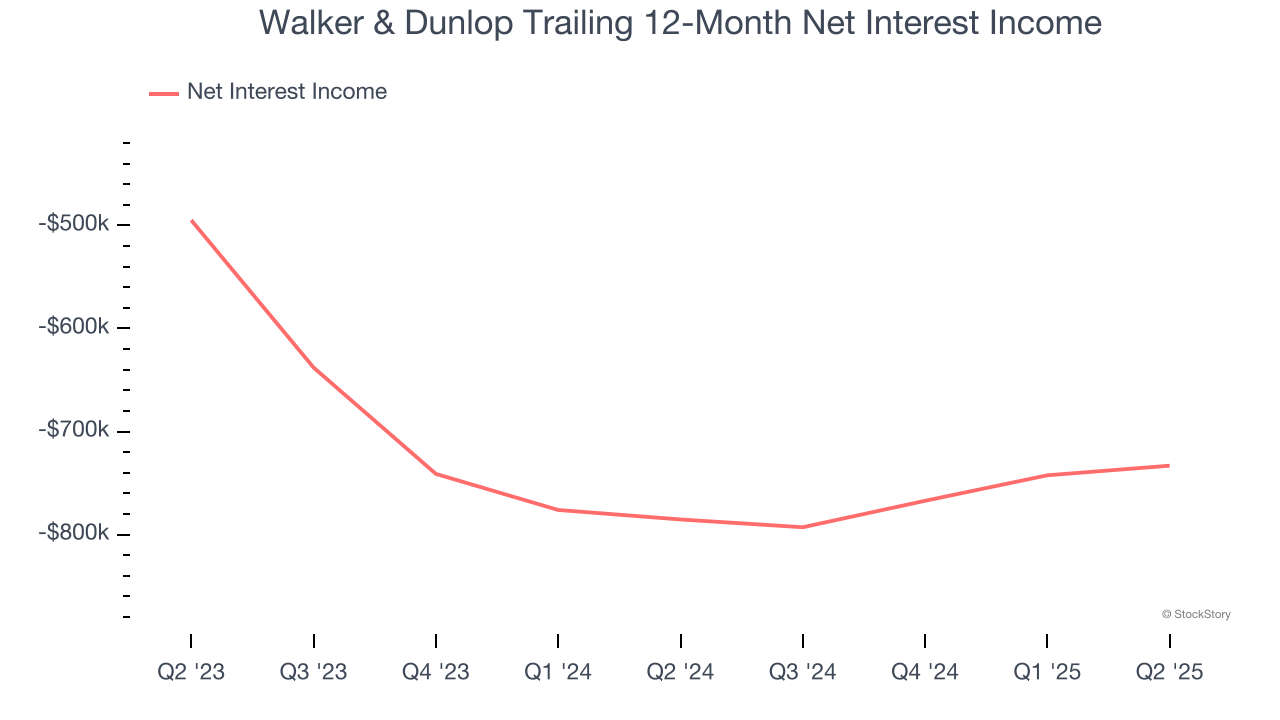

1. Declining Net Interest Income Reflects Weakness

Our experience and research show the market cares primarily about a bank’s net interest income growth as one-time fees are considered a lower-quality and non-recurring revenue source.

Walker & Dunlop’s net interest income has declined by 56.7% annually over the last five years, much worse than the broader banking industry. This shows that lending underperformed its other business lines.

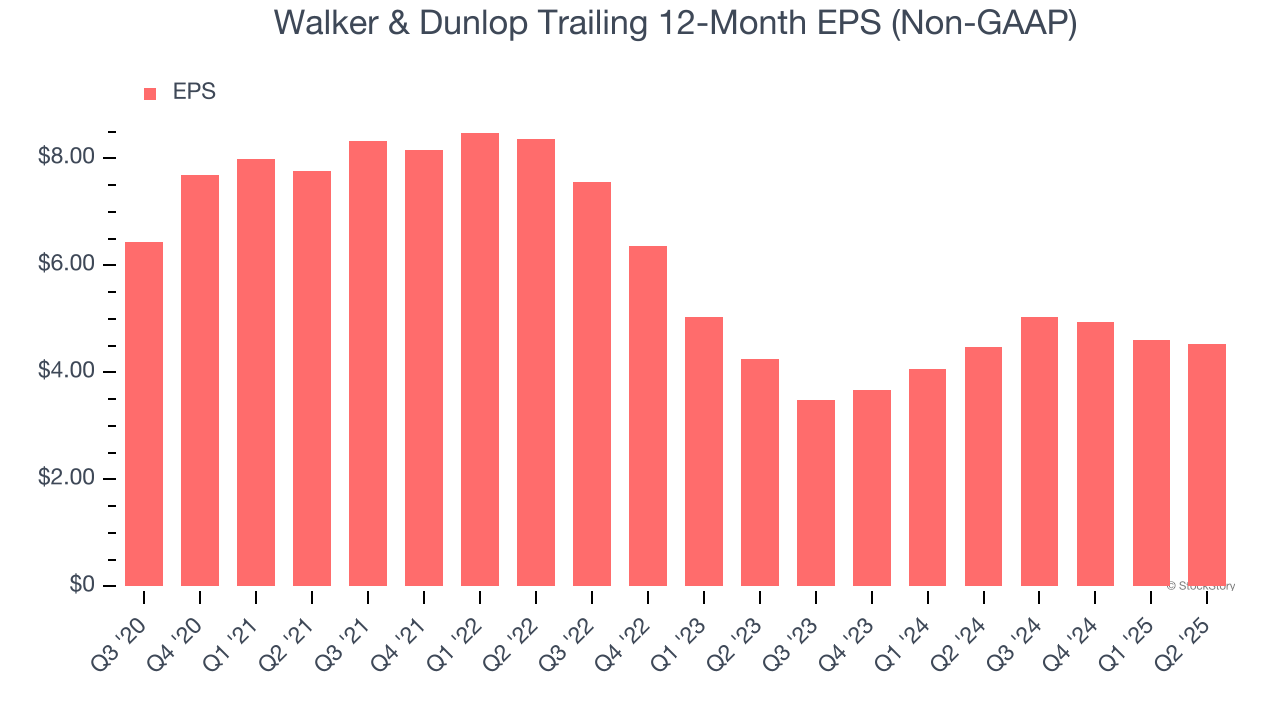

2. EPS Trending Down

We track the long-term change in earnings per share (EPS) because it highlights whether a company’s growth is profitable.

Sadly for Walker & Dunlop, its EPS declined by 6.9% annually over the last five years while its revenue grew by 5.4%. This tells us the company became less profitable on a per-share basis as it expanded.

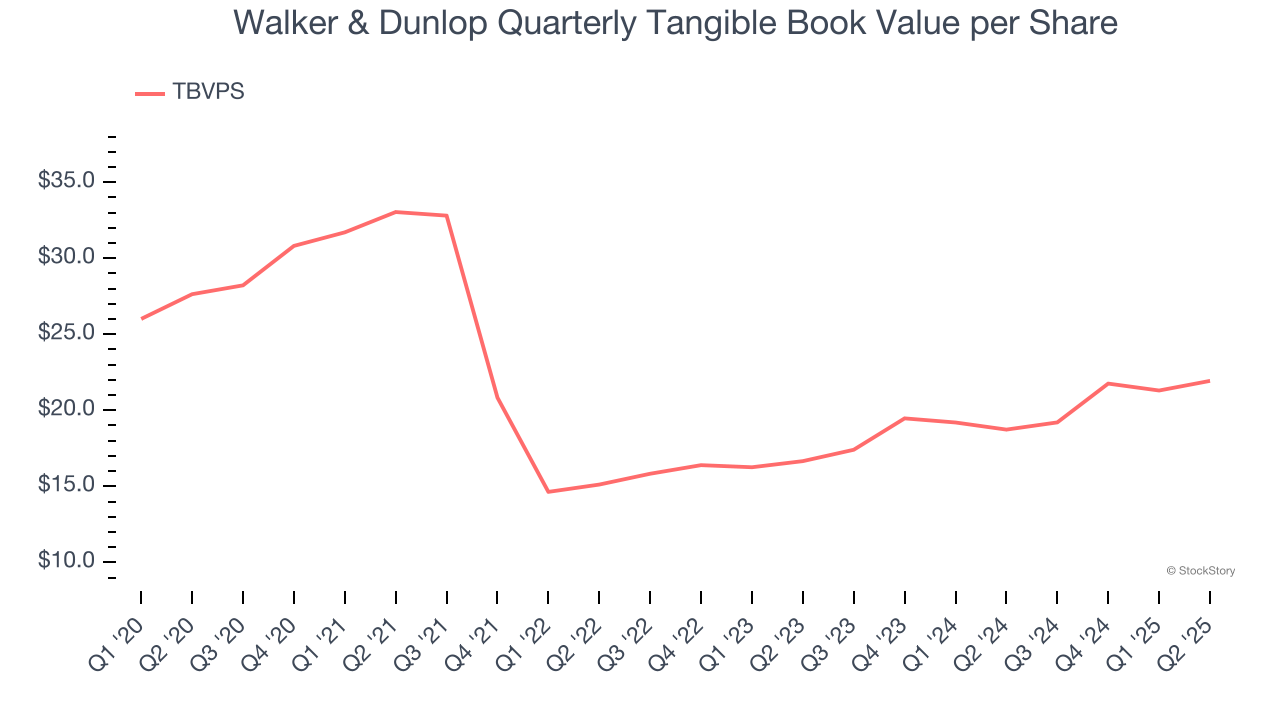

3. Growing TBVPS Reflects Strong Asset Base

For banks, tangible book value per share (TBVPS) is a crucial metric that measures the actual value of shareholders’ equity, stripping out goodwill and other intangible assets that may not be recoverable in a worst-case scenario.

Although Walker & Dunlop’s TBVPS declined at a 4.5% annual clip over the last five years. the good news is that its growth inflected positive over the past two years as TBVPS grew at an impressive 14.8% annual clip (from $16.66 to $21.94 per share).

Final Judgment

Walker & Dunlop isn’t a terrible business, but it doesn’t pass our quality test. With its shares lagging the market recently, the stock trades at 1.5× forward P/B (or $82.70 per share). This valuation tells us it’s a bit of a market darling with a lot of good news priced in - we think there are better opportunities elsewhere. Let us point you toward one of our top digital advertising picks.

High-Quality Stocks for All Market Conditions

When Trump unveiled his aggressive tariff plan in April 2025, markets tanked as investors feared a full-blown trade war. But those who panicked and sold missed the subsequent rebound that’s already erased most losses.

Don’t let fear keep you from great opportunities and take a look at Top 6 Stocks for this week. This is a curated list of our High Quality stocks that have generated a market-beating return of 183% over the last five years (as of March 31st 2025).

Stocks that made our list in 2020 include now familiar names such as Nvidia (+1,545% between March 2020 and March 2025) as well as under-the-radar businesses like the once-micro-cap company Kadant (+351% five-year return). Find your next big winner with StockStory today.

StockStory is growing and hiring equity analyst and marketing roles. Are you a 0 to 1 builder passionate about the markets and AI? See the open roles here.