Over the past six months, United Parcel Service’s shares (currently trading at $126.26) have posted a disappointing 6% loss, well below the S&P 500’s 10.4% gain. This may have investors wondering how to approach the situation.

Is now the time to buy United Parcel Service, or should you be careful about including it in your portfolio? See what our analysts have to say in our full research report, it’s free.Despite the more favorable entry price, we don't have much confidence in United Parcel Service. Here are three reasons why we avoid UPS and a stock we'd rather own.

Why Do We Think United Parcel Service Will Underperform?

Trademarking its recognizable UPS Brown color, UPS (NYSE: UPS) offers package delivery, supply chain management, and freight forwarding services.

1. Demand Slipping as Sales Volumes Decline

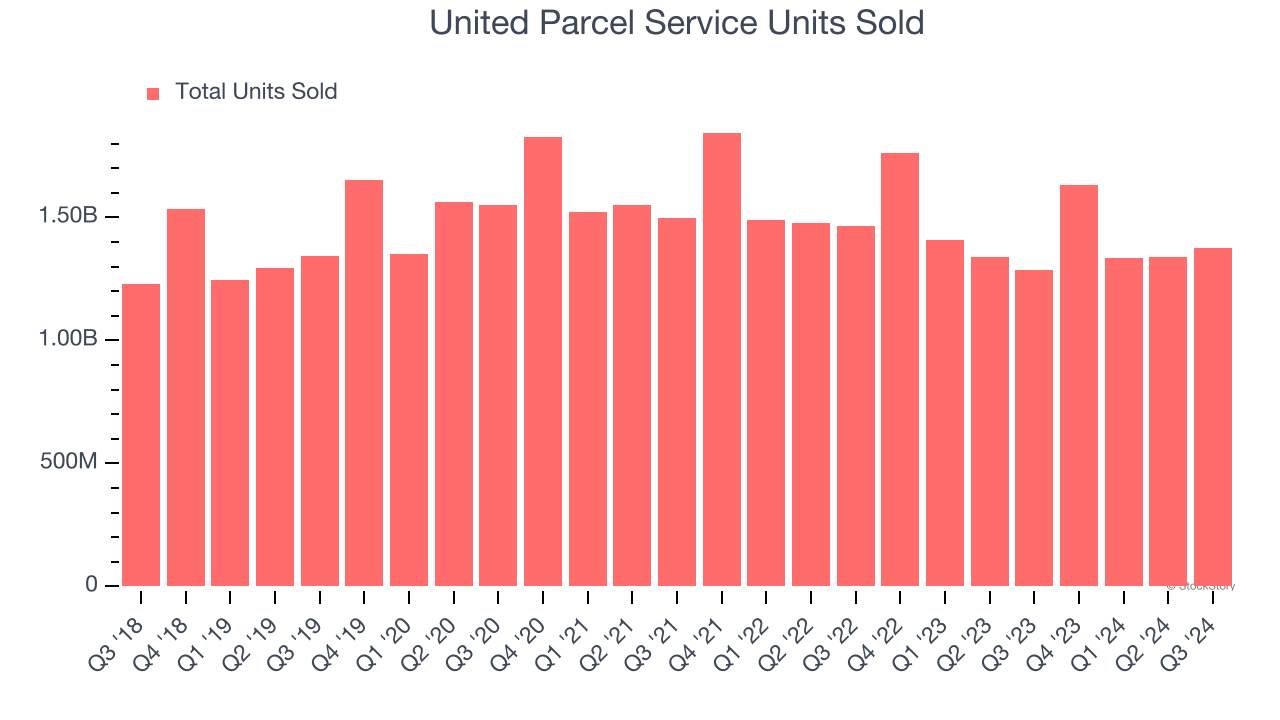

Revenue growth can be broken down into changes in price and volume (the number of units sold). While both are important, volume is the lifeblood of a successful Air Freight and Logistics company because there’s a ceiling to what customers will pay.

United Parcel Service’s units sold came in at 1.38 billion in the latest quarter, and they averaged 4.6% year-on-year declines over the last two years. This performance was underwhelming and implies there may be increasing competition or market saturation. It also suggests United Parcel Service might have to lower prices or invest in product improvements to grow, factors that can hinder near-term profitability.

2. EPS Growth Has Stalled

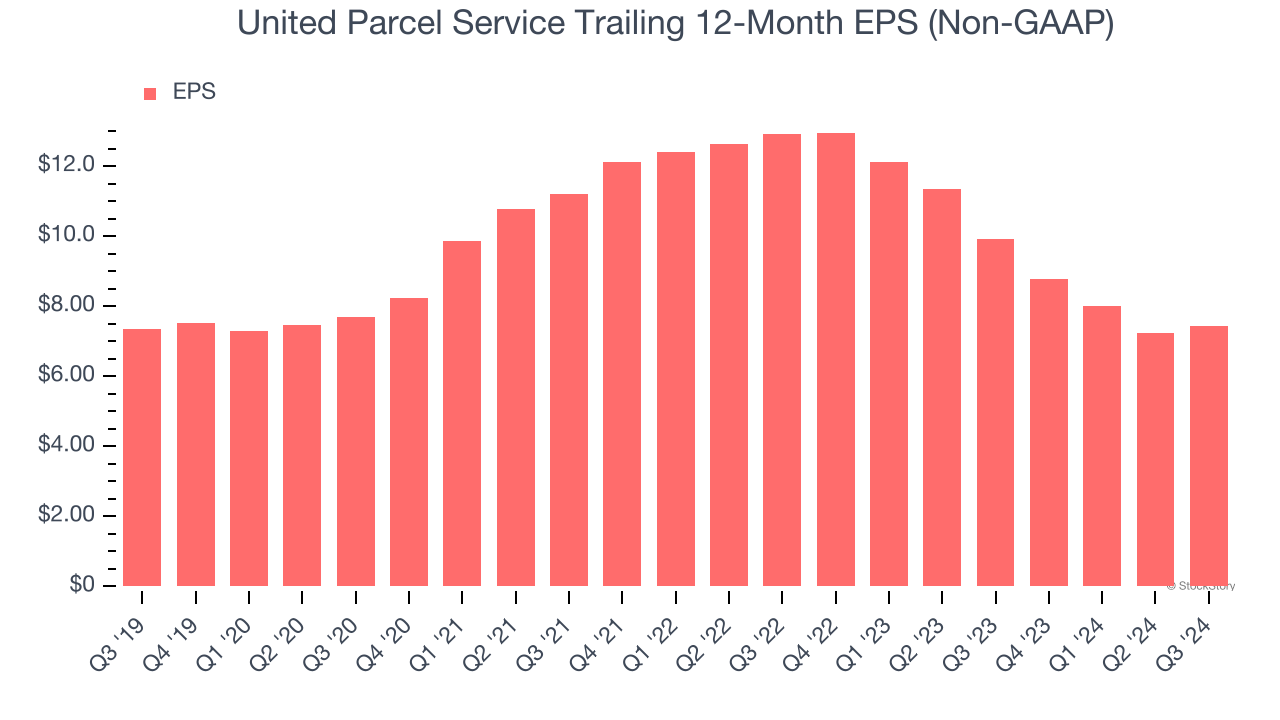

We track the long-term change in earnings per share (EPS) because it highlights whether a company’s growth is profitable.

United Parcel Service’s flat EPS over the last five years was below its 4.3% annualized revenue growth. This tells us the company became less profitable on a per-share basis as it expanded.

3. New Investments Fail to Bear Fruit as ROIC Declines

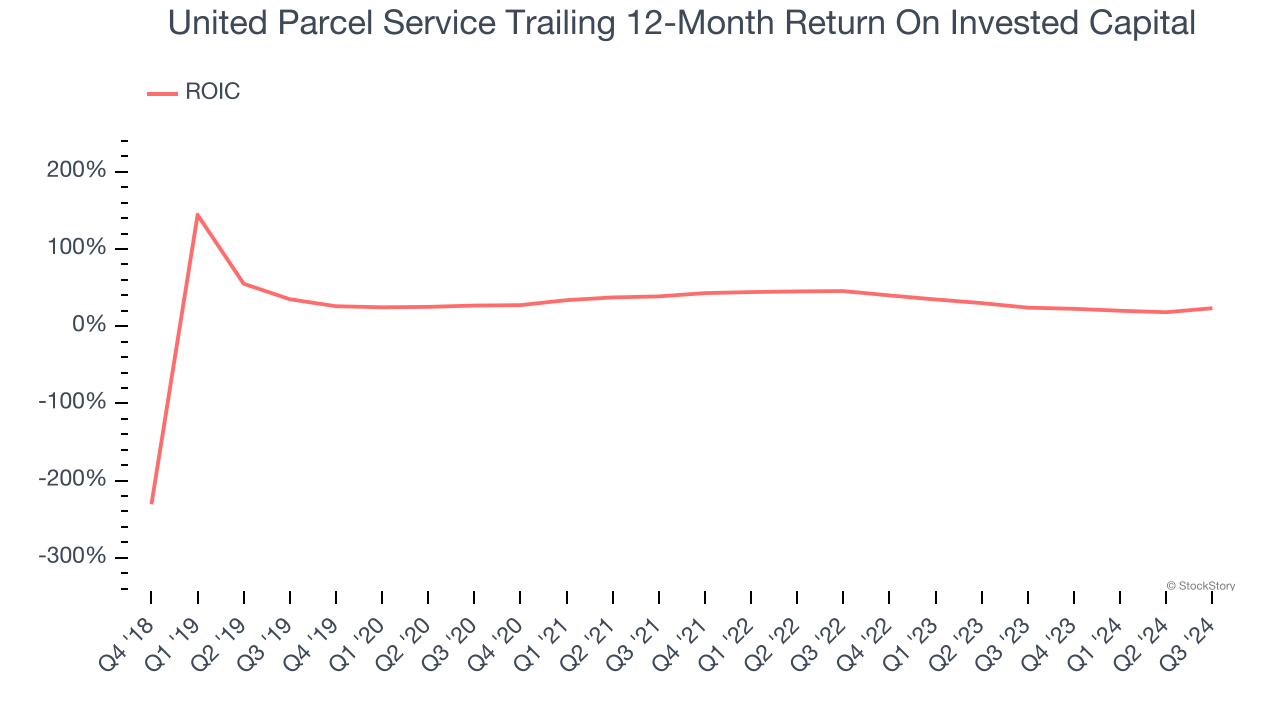

ROIC, or return on invested capital, is a metric showing how much operating profit a company generates relative to the money it has raised (debt and equity).

We typically prefer to invest in companies with high returns because it means they have viable business models, but the trend in a company’s ROIC is often what surprises the market and moves the stock price. United Parcel Service’s ROIC has decreased over the last few years. We like what management has done in the past, but its declining returns are perhaps a symptom of fewer profitable growth opportunities.

Final Judgment

United Parcel Service falls short of our quality standards. After the recent drawdown, the stock trades at 14.5× forward price-to-earnings (or $126.26 per share). While this valuation is reasonable, we don’t see a big opportunity at the moment. There are superior stocks to buy right now. We’d suggest looking at KLA Corporation, a picks and shovels play for semiconductor manufacturing.

Stocks We Like More Than United Parcel Service

The Trump trade may have passed, but rates are still dropping and inflation is still cooling. Opportunities are ripe for those ready to act - and we’re here to help you pick them.

Get started by checking out our Top 9 Market-Beating Stocks. This is a curated list of our High Quality stocks that have generated a market-beating return of 175% over the last five years.

Stocks that made our list in 2019 include now familiar names such as Nvidia (+2,691% between September 2019 and September 2024) as well as under-the-radar businesses like United Rentals (+550% five-year return). Find your next big winner with StockStory today for free.