Homebuilder Lennar (NYSE: LEN) missed Wall Street’s revenue expectations in Q4 CY2024, with sales falling 9.3% year on year to $9.95 billion. Its GAAP profit of $4.06 per share was 2.5% below analysts’ consensus estimates.

Is now the time to buy Lennar? Find out by accessing our full research report, it’s free.

Lennar (LEN) Q4 CY2024 Highlights:

- Revenue: $9.95 billion vs analyst estimates of $10.11 billion (9.3% year-on-year decline, 1.7% miss)

- Adjusted EPS: $4.06 vs analyst expectations of $4.16 (2.5% miss)

- Operating Margin: 15.1%, down from 17.2% in the same quarter last year

- Backlog: $5.4 billion at quarter end, down 18.6% year on year

- Market Capitalization: $40.89 billion

Stuart Miller, Executive Chairman and Co-Chief Executive Officer of Lennar, said, "In the course of our fourth quarter, the housing market that appeared to be improving as the Fed cut short-term interest rates, proved to be far more challenging as mortgage rates rose almost 100 basis points through the quarter. Even while demand remained strong, and the chronic supply shortage continued to drive the market, our results were driven by affordability limitations from higher interest rates."

Company Overview

One of the largest homebuilders in America, Lennar (NYSE: LEN) is known for constructing affordable, move-up, and retirement homes across a range of markets and communities.

Home Builders

Traditionally, homebuilders have built competitive advantages with economies of scale that lead to advantaged purchasing and brand recognition among consumers. Aesthetic trends have always been important in the space, but more recently, energy efficiency and conservation are driving innovation. However, these companies are still at the whim of the macro, specifically interest rates that heavily impact new and existing home sales. In fact, homebuilders are one of the most cyclical subsectors within industrials.

Sales Growth

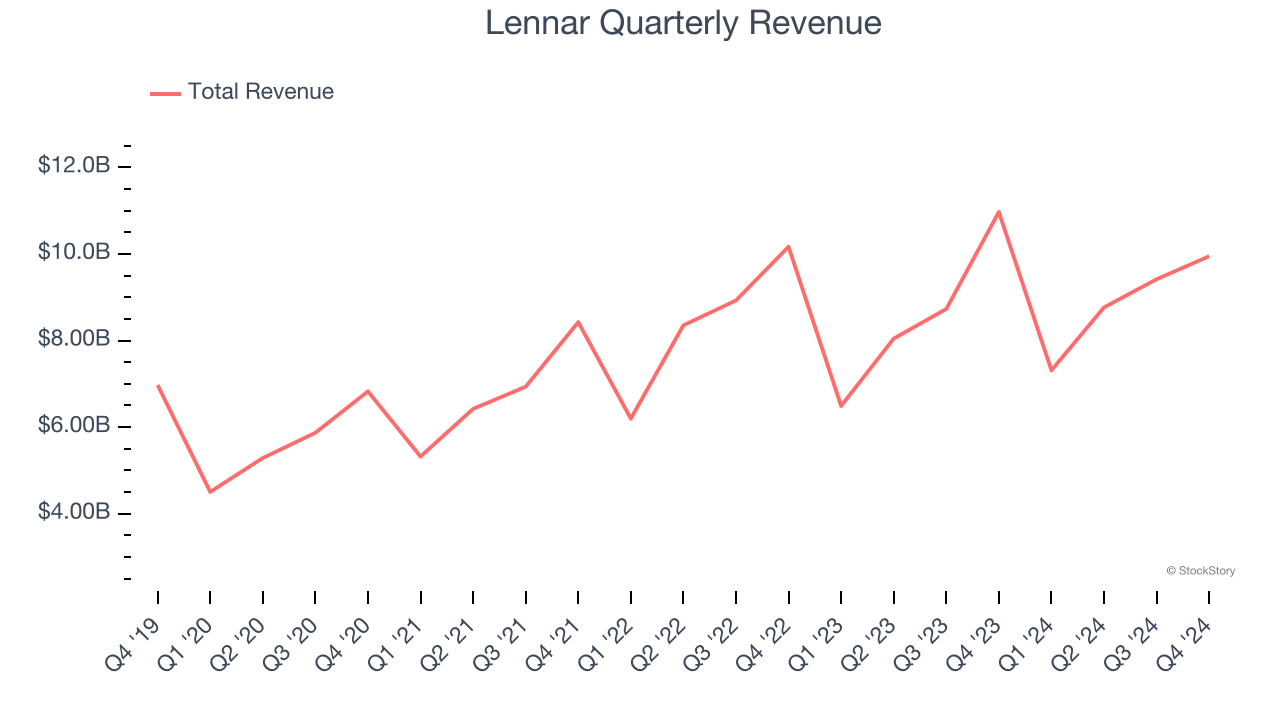

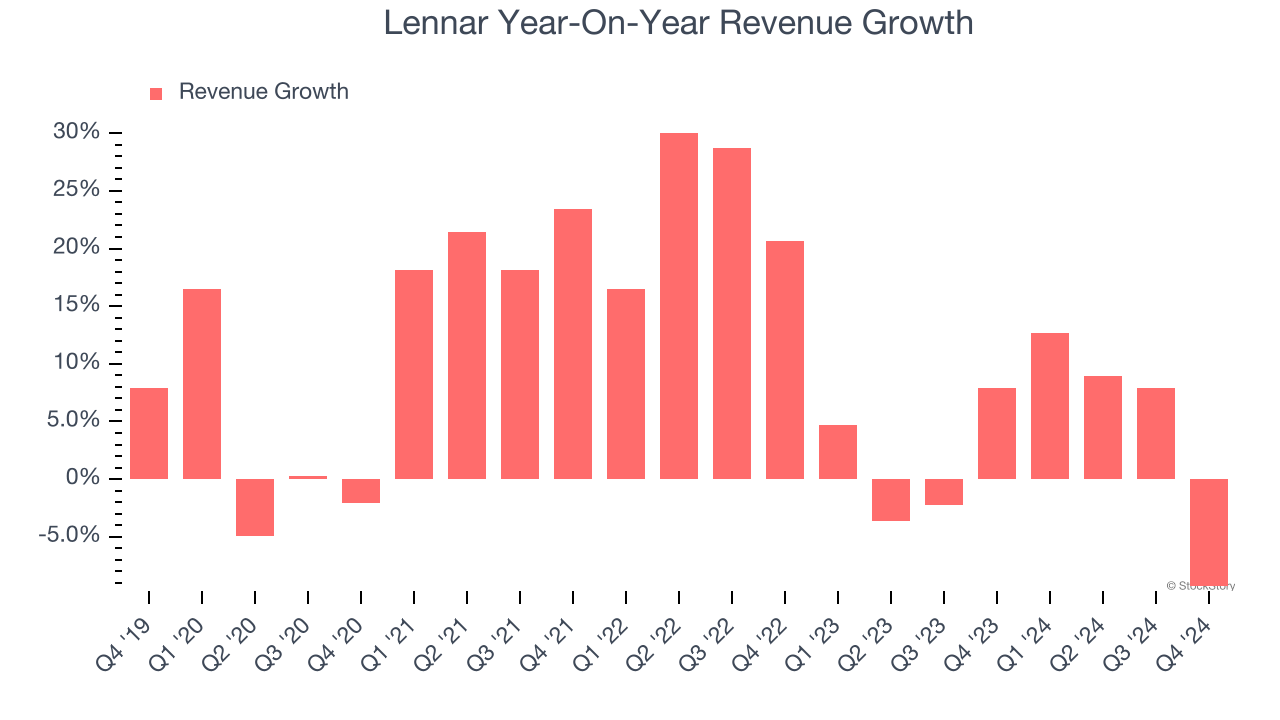

A company’s long-term performance is an indicator of its overall quality. While any business can experience short-term success, top-performing ones enjoy sustained growth for years. Thankfully, Lennar’s 9.7% annualized revenue growth over the last five years was solid. Its growth beat the average industrials company and shows its offerings resonate with customers.

Long-term growth is the most important, but within industrials, a half-decade historical view may miss new industry trends or demand cycles. Lennar’s recent history shows its demand slowed as its annualized revenue growth of 2.6% over the last two years is below its five-year trend.

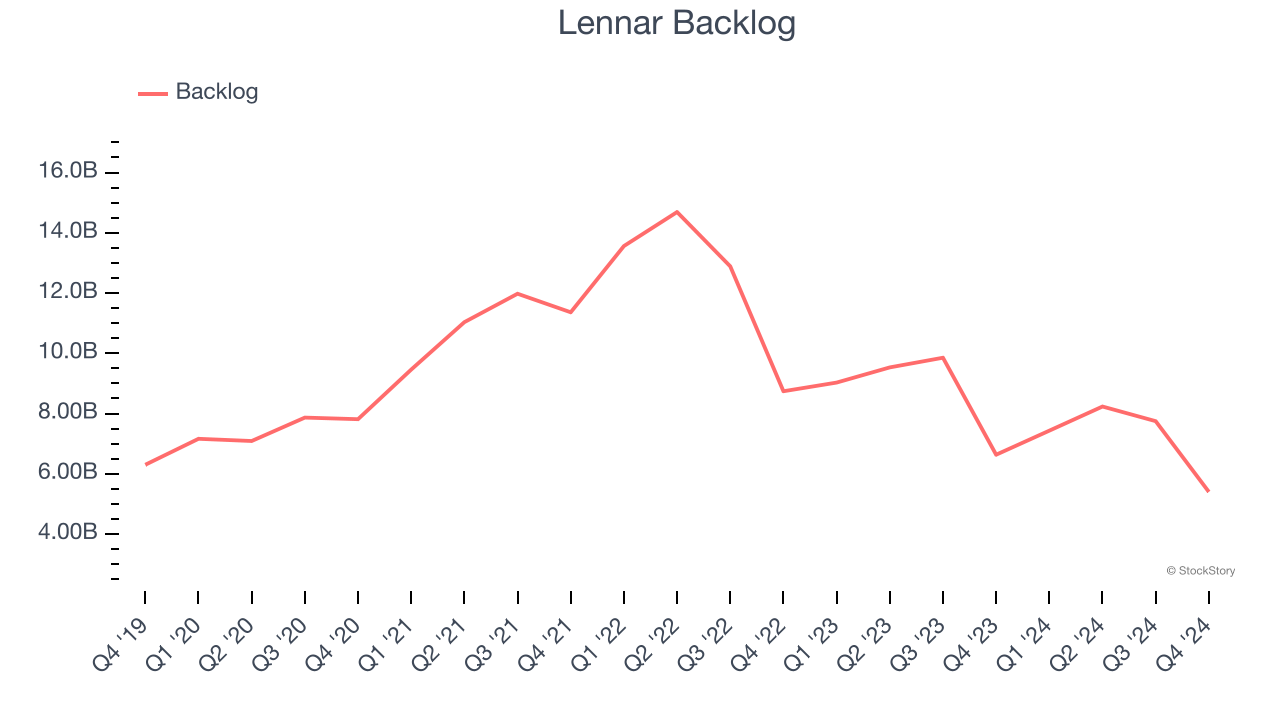

We can dig further into the company’s revenue dynamics by analyzing its backlog, or the value of its outstanding orders that have not yet been executed or delivered. Lennar’s backlog reached $5.4 billion in the latest quarter and averaged 23.4% year-on-year declines over the last two years. Because this number is lower than its revenue growth, we can see the company hasn’t secured enough new orders to maintain its growth rate in the future.

This quarter, Lennar missed Wall Street’s estimates and reported a rather uninspiring 9.3% year-on-year revenue decline, generating $9.95 billion of revenue.

Looking ahead, sell-side analysts expect revenue to grow 7.9% over the next 12 months, an improvement versus the last two years. This projection is above the sector average and implies its newer products and services will spur better top-line performance.

Today’s young investors won’t have read the timeless lessons in Gorilla Game: Picking Winners In High Technology because it was written more than 20 years ago when Microsoft and Apple were first establishing their supremacy. But if we apply the same principles, then enterprise software stocks leveraging their own generative AI capabilities may well be the Gorillas of the future. So, in that spirit, we are excited to present our Special Free Report on a profitable, fast-growing enterprise software stock that is already riding the automation wave and looking to catch the generative AI next.

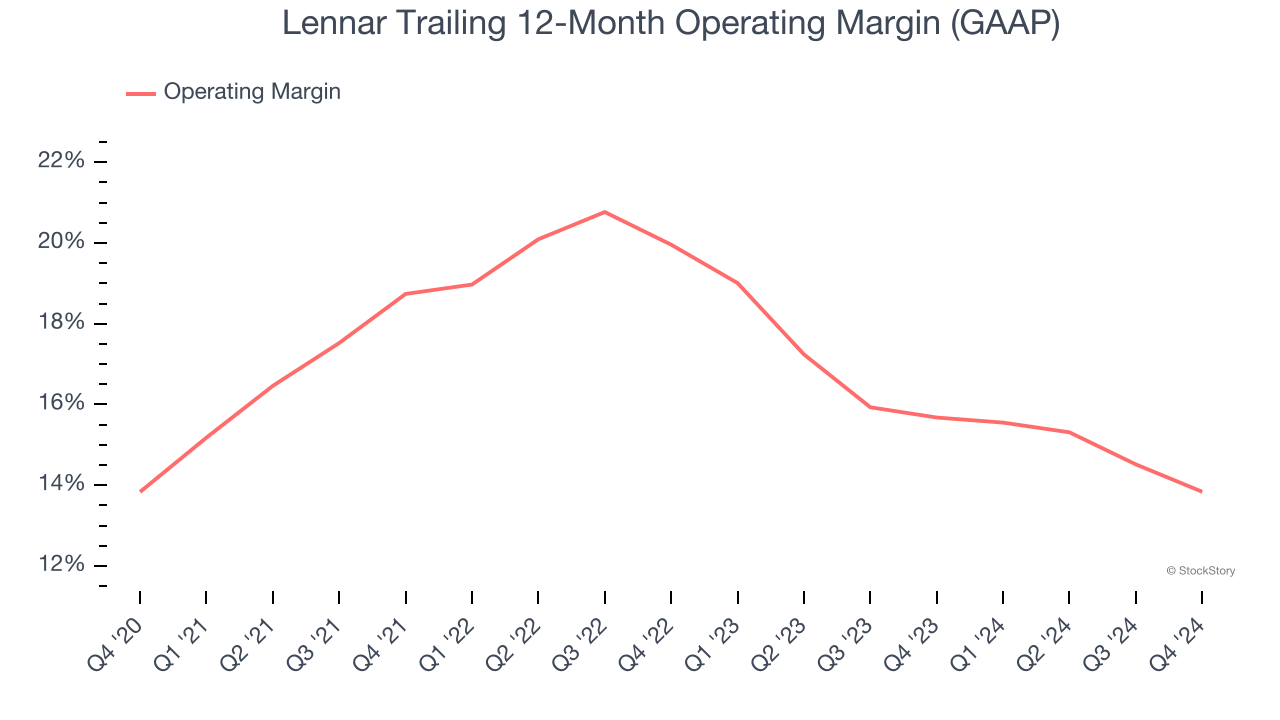

Operating Margin

Lennar has been a well-oiled machine over the last five years. It demonstrated elite profitability for an industrials business, boasting an average operating margin of 16.5%. This result was particularly impressive because of its low gross margin, which is mostly a factor of what it sells and takes huge shifts to move meaningfully. Companies have more control over their operating margins, and it’s a show of well-managed operations if they’re high when gross margins are low.

Looking at the trend in its profitability, Lennar’s operating margin might have seen some fluctuations but has generally stayed the same over the last five years, highlighting the long-term consistency of its business.

In Q4, Lennar generated an operating profit margin of 15.1%, down 2.1 percentage points year on year. Since Lennar’s operating margin decreased more than its gross margin, we can assume it was recently less efficient because expenses such as marketing, R&D, and administrative overhead increased.

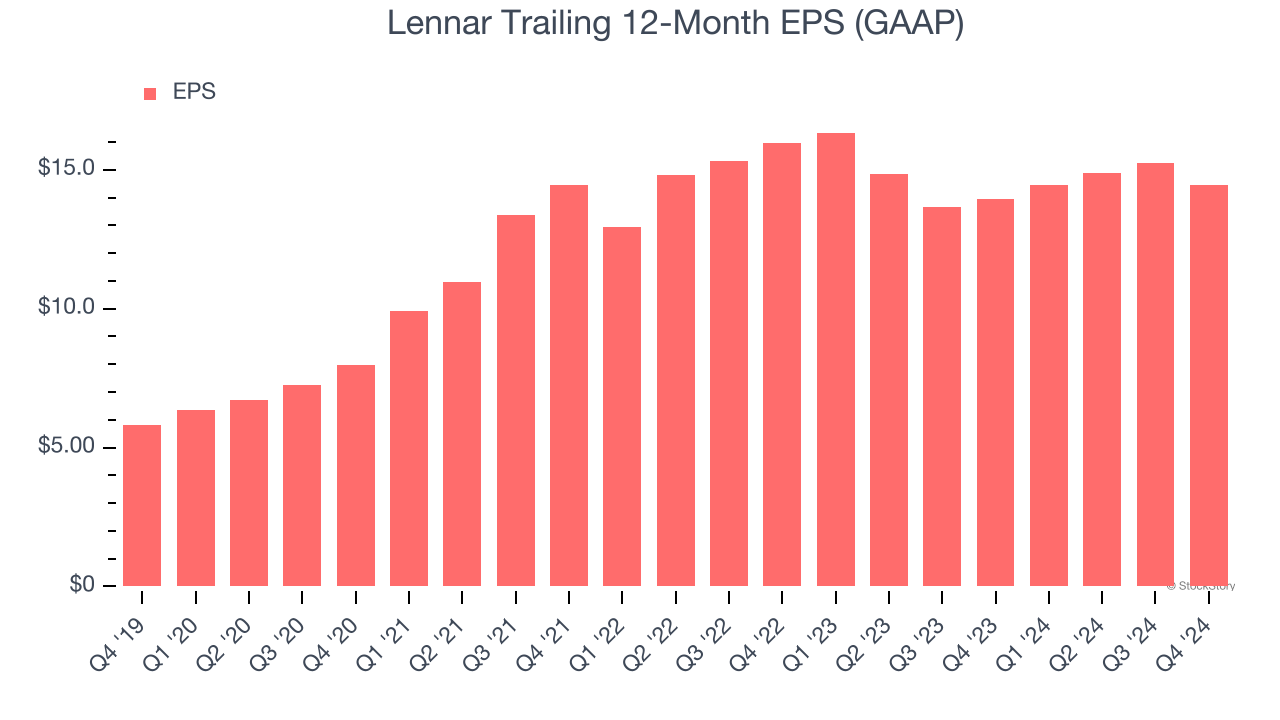

Earnings Per Share

We track the long-term change in earnings per share (EPS) for the same reason as long-term revenue growth. Compared to revenue, however, EPS highlights whether a company’s growth is profitable.

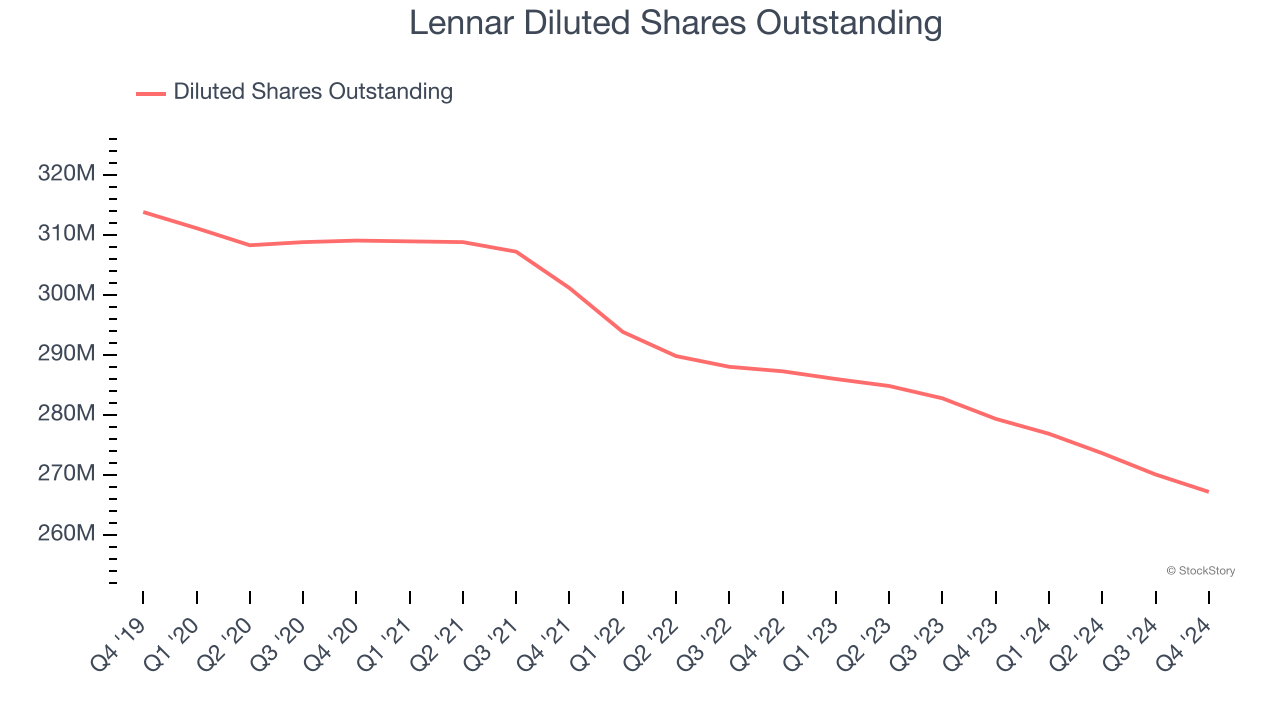

Lennar’s EPS grew at an astounding 19.9% compounded annual growth rate over the last five years, higher than its 9.7% annualized revenue growth. However, this alone doesn’t tell us much about its business quality because its operating margin didn’t expand.

Diving into Lennar’s quality of earnings can give us a better understanding of its performance. A five-year view shows that Lennar has repurchased its stock, shrinking its share count by 14.9%. This tells us its EPS outperformed its revenue not because of increased operational efficiency but financial engineering, as buybacks boost per share earnings.

Like with revenue, we analyze EPS over a more recent period because it can provide insight into an emerging theme or development for the business.

For Lennar, its two-year annual EPS declines of 4.9% mark a reversal from its (seemingly) healthy five-year trend. We hope Lennar can return to earnings growth in the future.In Q4, Lennar reported EPS at $4.06, down from $4.87 in the same quarter last year. This print missed analysts’ estimates, but we care more about long-term EPS growth than short-term movements. Over the next 12 months, Wall Street expects Lennar’s full-year EPS of $14.45 to grow 7.5%.

Key Takeaways from Lennar’s Q4 Results

We struggled to find many resounding positives in these results as the company's backlog, a leading indicator for sales, missed significantly. Furthermore, its revenue and EPS fell short of Wall Street’s estimates. Overall, this was a weaker quarter. The stock traded down 7.1% to $135.55 immediately after reporting.

The latest quarter from Lennar’s wasn’t that good. One earnings report doesn’t define a company’s quality, though, so let’s explore whether the stock is a buy at the current price. What happened in the latest quarter matters, but not as much as longer-term business quality and valuation, when deciding whether to invest in this stock. We cover that in our actionable full research report which you can read here, it’s free.