Water technology company Xylem (NYSE: XYL) missed Wall Street’s revenue expectations in Q3 CY2024 as sales only rose 1.3% year on year to $2.10 billion. The company’s full-year revenue guidance of $8.5 billion at the midpoint also came in slightly below analysts’ estimates. Its non-GAAP profit of $1.11 per share wasin line with analysts’ consensus estimates.

Is now the time to buy Xylem? Find out by accessing our full research report, it’s free.

Xylem (XYL) Q3 CY2024 Highlights:

- Revenue: $2.10 billion vs analyst estimates of $2.17 billion (3.2% miss)

- Adjusted EPS: $1.11 vs analyst expectations of $1.11 (in line)

- EBITDA: $447 million vs analyst estimates of $455.5 million (1.9% miss)

- The company dropped its revenue guidance for the full year to $8.5 billion at the midpoint from $8.55 billion, a 0.6% decrease

- Management reiterated its full-year Adjusted EPS guidance of $4.23 at the midpoint

- Gross Margin (GAAP): 37.3%, in line with the same quarter last year

- Operating Margin: 13.3%, up from 9.2% in the same quarter last year

- EBITDA Margin: 21.2%, down from 22.3% in the same quarter last year

- Free Cash Flow Margin: 14.8%, similar to the same quarter last year

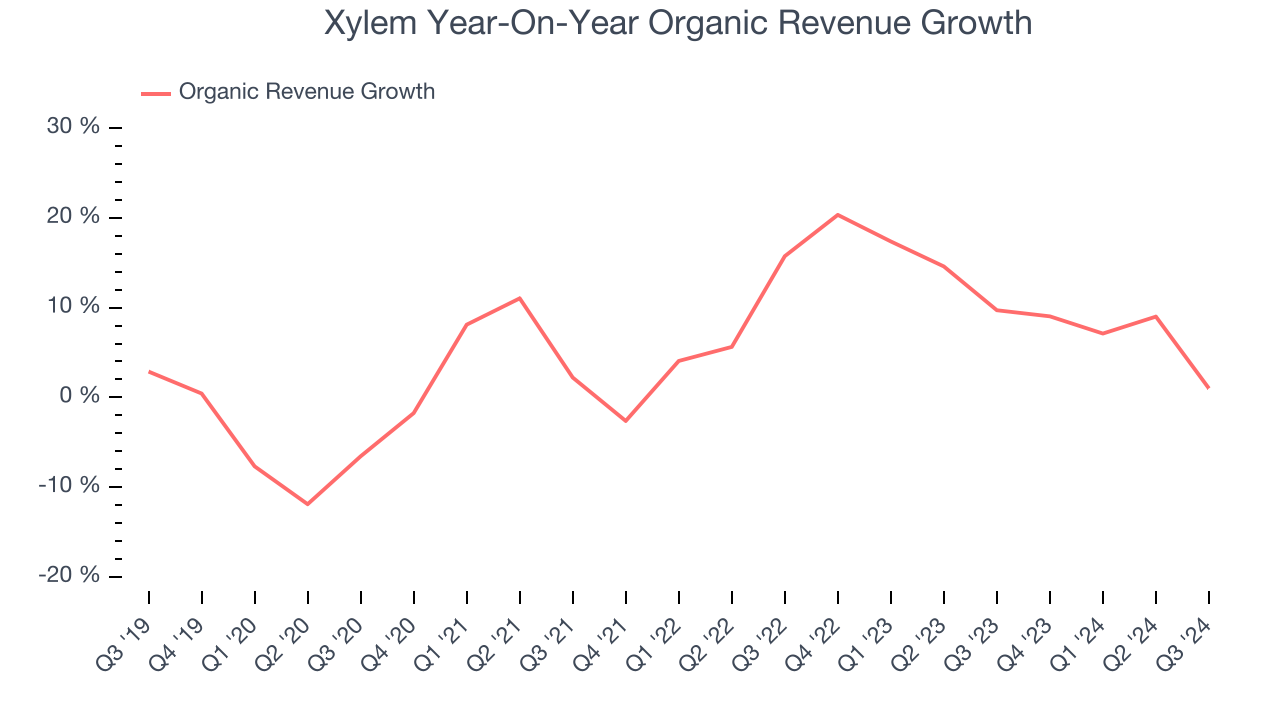

- Organic Revenue rose 1% year on year (9.7% in the same quarter last year)

- Market Capitalization: $31.63 billion

“The team delivered strong results in the quarter, with earnings at the high end of guidance, and margin expansion beating our expectations,” said Matthew Pine, Xylem’s President and CEO.

Company Overview

Formed through a spinoff, Xylem (NYSE: XYL) manufactures and services engineered products across a wide variety of applications primarily in the water sector.

Water Infrastructure

Trends towards conservation and reducing groundwater depletion are putting water infrastructure and treatment products front and center. Companies that can innovate and create solutions–especially automated or connected solutions–to address these thematic trends will create incremental demand and speed up replacement cycles. On the other hand, water infrastructure and treatment companies are at the whim of economic cycles. Consumer spending and interest rates, for example, can greatly impact the industrial production that drives demand for these companies’ offerings.

Sales Growth

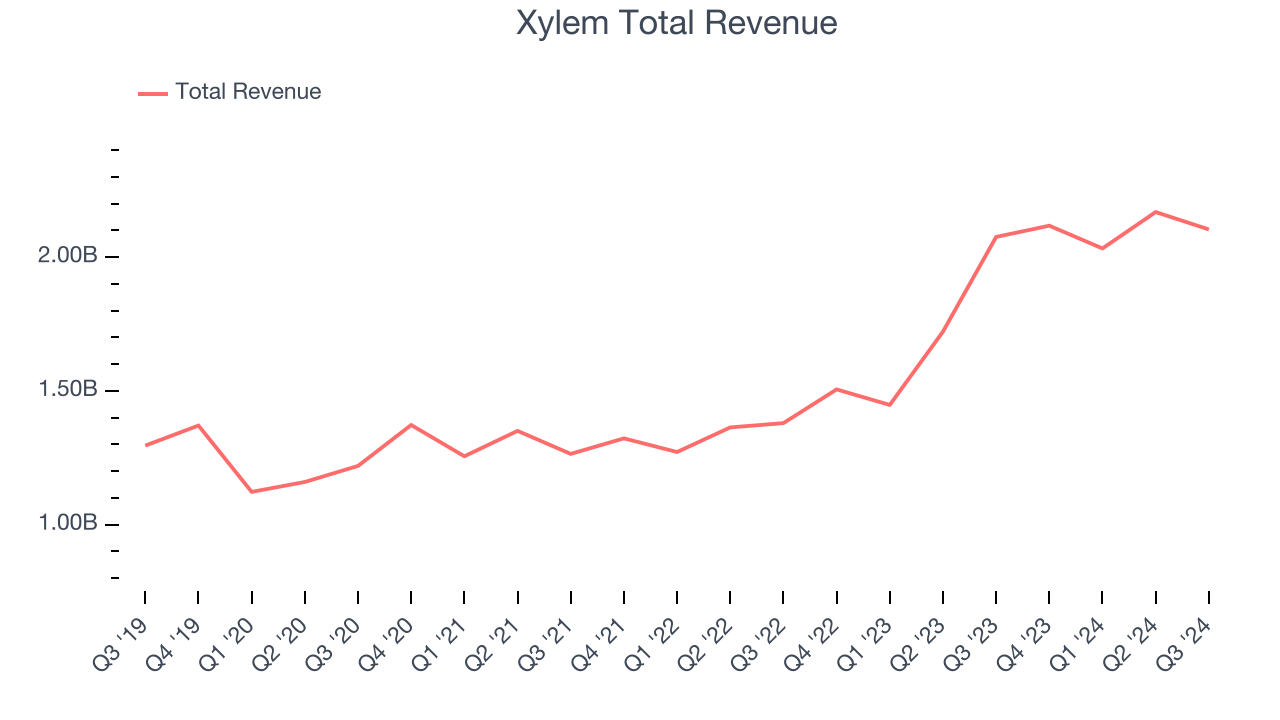

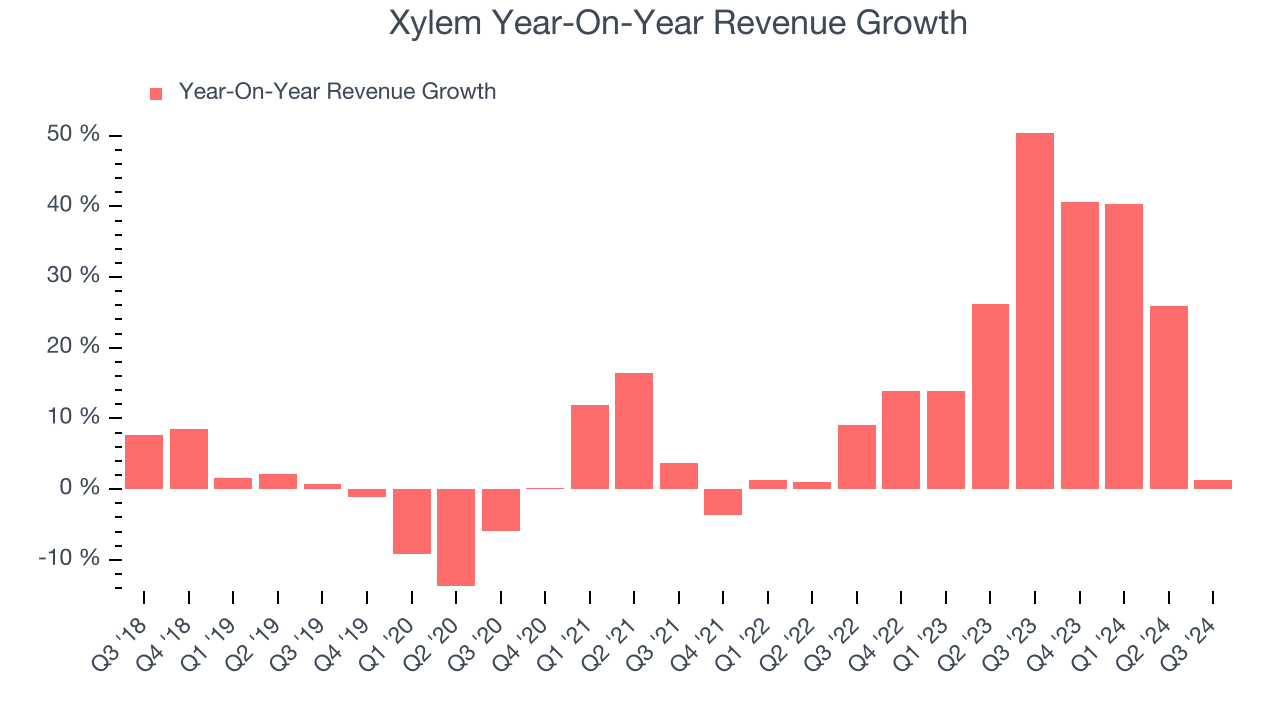

A company’s long-term performance can indicate its business quality. Any business can put up a good quarter or two, but many enduring ones grow for years. Thankfully, Xylem’s 9.9% annualized revenue growth over the last five years was solid. This is a good starting point for our analysis.

Long-term growth is the most important, but within industrials, a half-decade historical view may miss new industry trends or demand cycles. Xylem’s annualized revenue growth of 25.6% over the last two years is above its five-year trend, suggesting its demand was strong and recently accelerated.

Xylem also reports organic revenue, which strips out one-time events like acquisitions and currency fluctuations because they don’t accurately reflect its fundamentals. Over the last two years, Xylem’s organic revenue averaged 11% year-on-year growth. Because this number is lower than its normal revenue growth, we can see that some mixture of acquisitions and foreign exchange rates boosted its headline performance.

This quarter, Xylem’s revenue grew 1.3% year on year to $2.10 billion, falling short of Wall Street’s estimates.

Looking ahead, sell-side analysts expect revenue to grow 5.8% over the next 12 months, a deceleration versus the last two years. This projection doesn't excite us and illustrates the market thinks its products and services will see some demand headwinds. At least the company is tracking well in other measures of financial health.

Unless you’ve been living under a rock, it should be obvious by now that generative AI is going to have a huge impact on how large corporations do business. While Nvidia and AMD are trading close to all-time highs, we prefer a lesser-known (but still profitable) semiconductor stock benefitting from the rise of AI. Click here to access our free report on our favorite semiconductor growth story.

Operating Margin

Operating margin is one of the best measures of profitability because it tells us how much money a company takes home after procuring and manufacturing its products, marketing and selling them, and, most importantly, keeping them relevant through research and development.

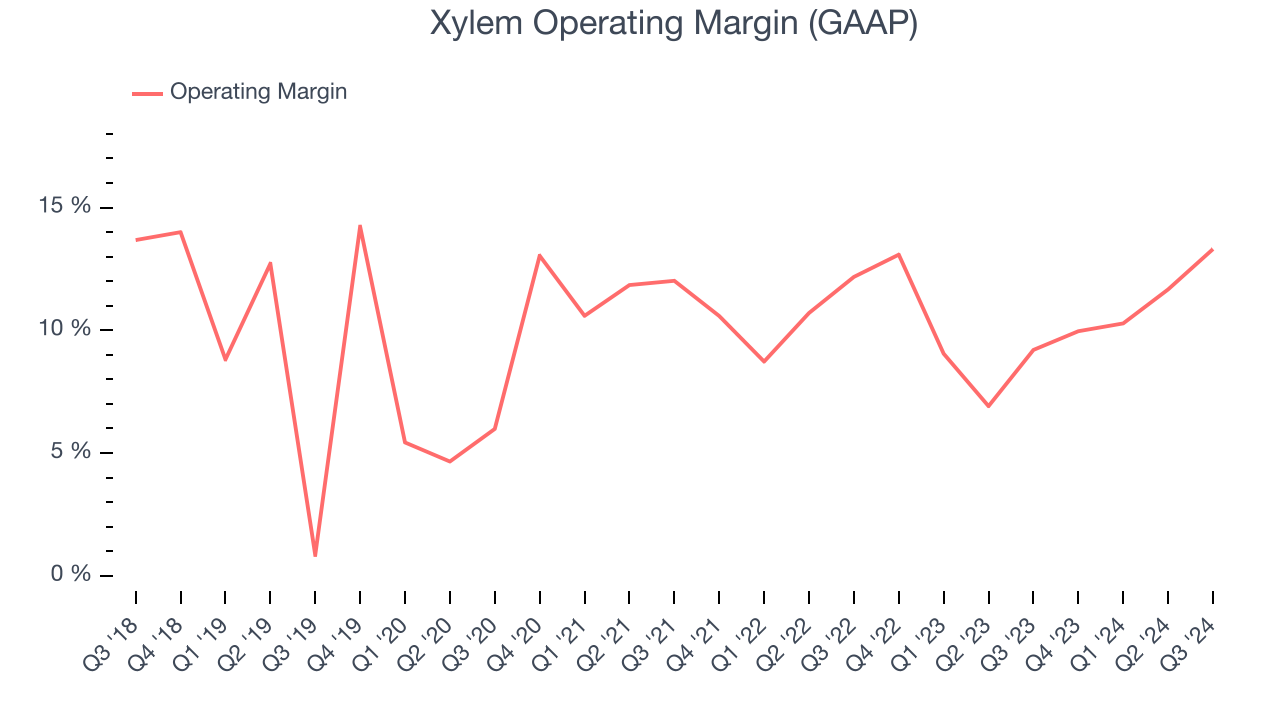

Xylem has managed its cost base well over the last five years. It demonstrated solid profitability for an industrials business, producing an average operating margin of 10.3%. This result isn’t surprising as its high gross margin gives it a favorable starting point.

Looking at the trend in its profitability, Xylem’s annual operating margin rose by 3.5 percentage points over the last five years, as its sales growth gave it operating leverage.

This quarter, Xylem generated an operating profit margin of 13.3%, up 4.1 percentage points year on year. The increase was encouraging, and since its operating margin rose more than its gross margin, we can infer it was recently more efficient with expenses such as marketing, R&D, and administrative overhead.

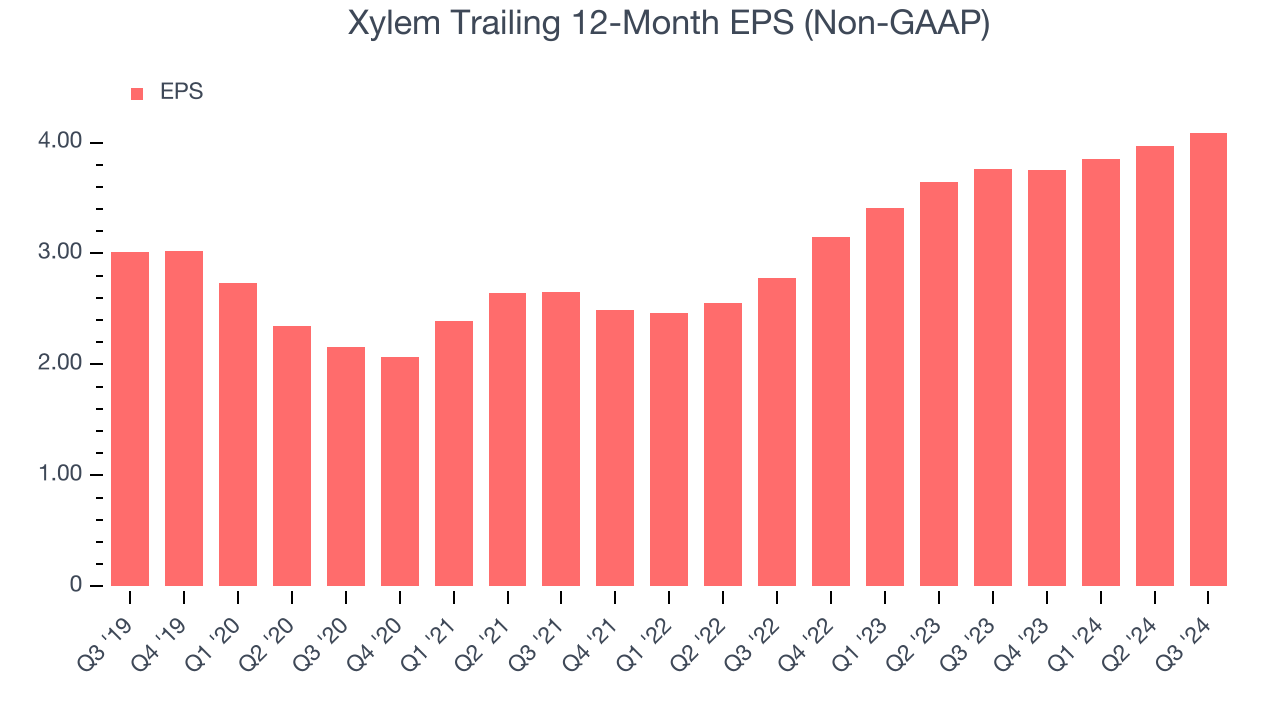

Earnings Per Share

We track the long-term change in earnings per share (EPS) for the same reason as long-term revenue growth. Compared to revenue, however, EPS highlights whether a company’s growth was profitable.

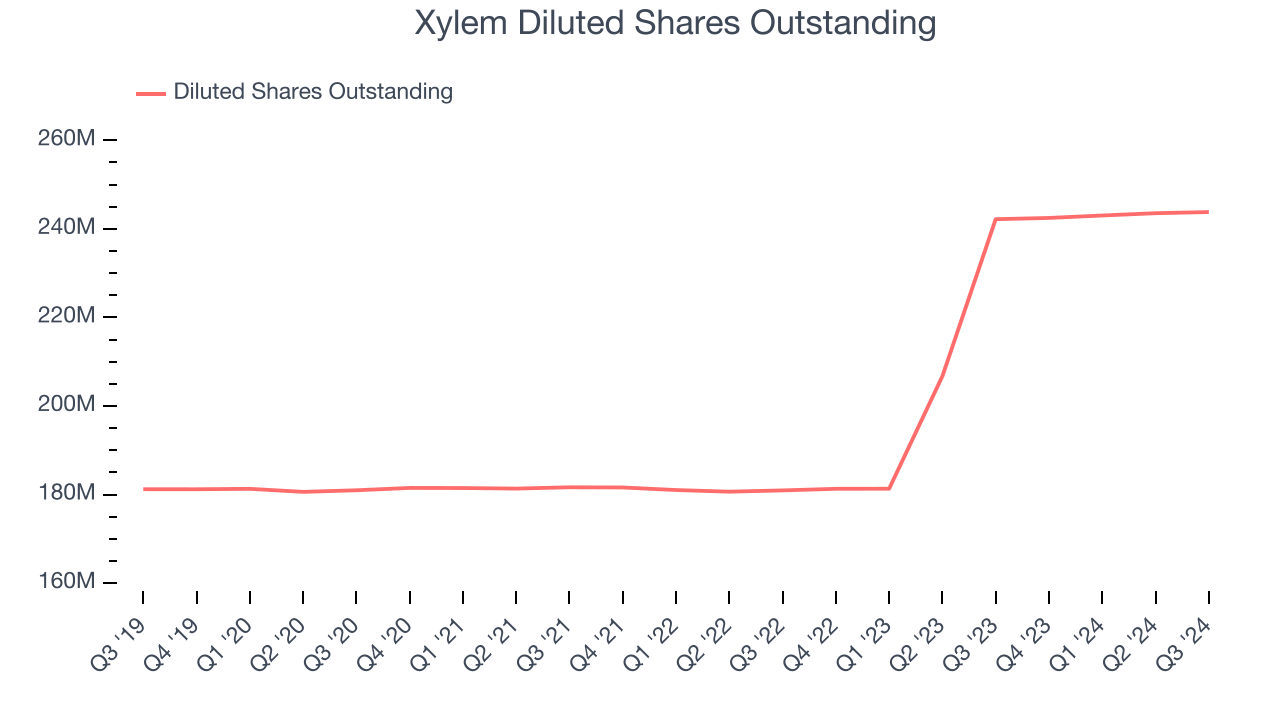

Xylem’s EPS grew at an unimpressive 6.3% compounded annual growth rate over the last five years, lower than its 9.9% annualized revenue growth. However, its operating margin actually expanded during this timeframe, telling us that non-fundamental factors affected its ultimate earnings.

We can take a deeper look into Xylem’s earnings to better understand the drivers of its performance. A five-year view shows Xylem has diluted its shareholders, growing its share count by 34.5%. This dilution overshadowed its increased operating efficiency and has led to lower per share earnings. Taxes and interest expenses can also affect EPS but don’t tell us as much about a company’s fundamentals.

Like with revenue, we analyze EPS over a more recent period because it can give insight into an emerging theme or development for the business.

For Xylem, its two-year annual EPS growth of 21.3% was higher than its five-year trend. This acceleration made it one of the faster-growing industrials companies in recent history.In Q3, Xylem reported EPS at $1.11, up from $0.99 in the same quarter last year. This print was close to analysts’ estimates. Over the next 12 months, Wall Street expects Xylem’s full-year EPS of $4.09 to grow by 13.6%.

Key Takeaways from Xylem’s Q3 Results

We struggled to find many strong positives in these results. Its revenue missed and its organic revenue fell short Wall Street’s estimates. Overall, this was a softer quarter. The stock traded down 1.8% to $128 immediately after reporting.

Xylem didn’t show it’s best hand this quarter, but does that create an opportunity to buy the stock right now? What happened in the latest quarter matters, but not as much as longer-term business quality and valuation, when deciding whether to invest in this stock. We cover that in our actionable full research report which you can read here, it’s free.