Industrial machinery company Parker-Hannifin (NYSE: PH) met Wall Street’s revenue expectations in Q3 CY2024, with sales up 1.2% year on year to $4.90 billion. Its non-GAAP profit of $6.20 per share wasalso in line with analysts’ consensus estimates.

Is now the time to buy Parker-Hannifin? Find out by accessing our full research report, it’s free.

Parker-Hannifin (PH) Q3 CY2024 Highlights:

- Revenue: $4.90 billion vs analyst estimates of $4.9 billion (in line)

- Adjusted EPS: $6.20 vs analyst expectations of $6.14 (in line)

- EBITDA: $1.19 billion vs analyst estimates of $1.22 billion (3% miss)

- Management slightly raised its full-year Adjusted EPS guidance to $26.70 at the midpoint

- Gross Margin (GAAP): 36.8%, in line with the same quarter last year

- Operating Margin: 19.5%, up from 18.1% in the same quarter last year

- EBITDA Margin: 24.2%, in line with the same quarter last year

- Free Cash Flow Margin: 13.2%, up from 11.4% in the same quarter last year

- Organic Revenue rose 1.4% year on year, in line with the same quarter last year

- Market Capitalization: $80.33 billion

“Through continued execution of The Win Strategy, our global team produced outstanding results in the first quarter,” said Chairman and Chief Executive Officer, Jenny Parmentier.

Company Overview

Founded in 1917, Parker Hannifin (NYSE: PH) is a manufacturer of motion and control systems for a wide variety of mobile, industrial and aerospace markets.

Gas and Liquid Handling

Gas and liquid handling companies possess the technical know-how and specialized equipment to handle valuable (and sometimes dangerous) substances. Lately, water conservation and carbon capture–which requires hydrogen and other gasses as well as specialized infrastructure–have been trending up, creating new demand for products such as filters, pumps, and valves. On the other hand, gas and liquid handling companies are at the whim of economic cycles. Consumer spending and interest rates, for example, can greatly impact the industrial production that drives demand for these companies’ offerings.

Sales Growth

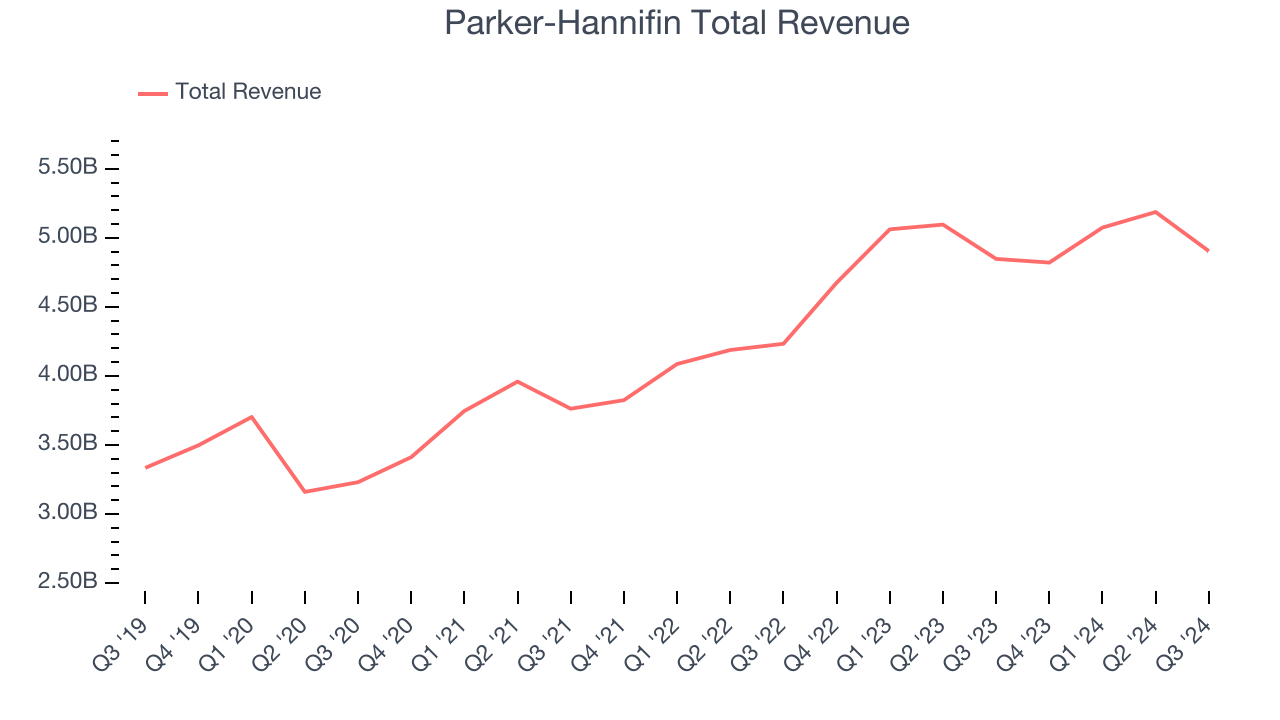

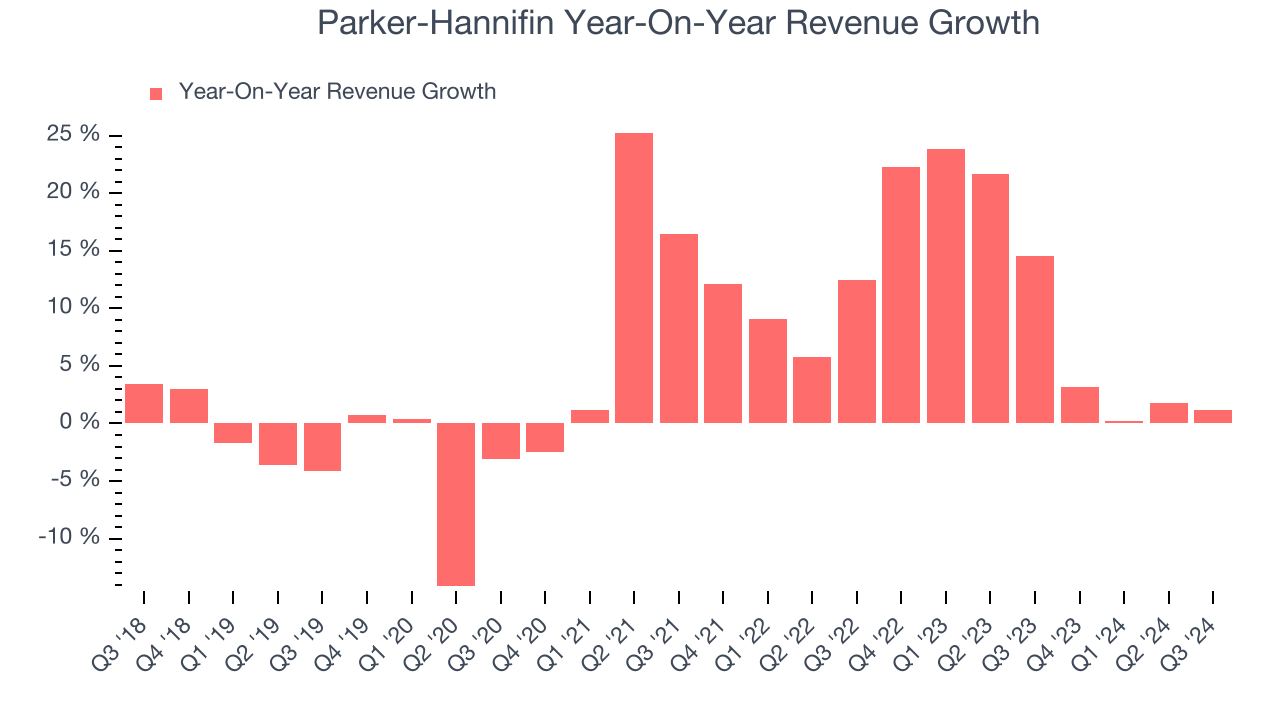

Reviewing a company’s long-term performance can reveal insights into its business quality. Any business can have short-term success, but a top-tier one sustains growth for years. Unfortunately, Parker-Hannifin’s 7.1% annualized revenue growth over the last five years was mediocre. This shows it couldn’t expand in any major way, a tough starting point for our analysis.

We at StockStory place the most emphasis on long-term growth, but within industrials, a half-decade historical view may miss cycles, industry trends, or a company capitalizing on catalysts such as a new contract win or a successful product line. Parker-Hannifin’s annualized revenue growth of 10.6% over the last two years is above its five-year trend, suggesting its demand recently accelerated.

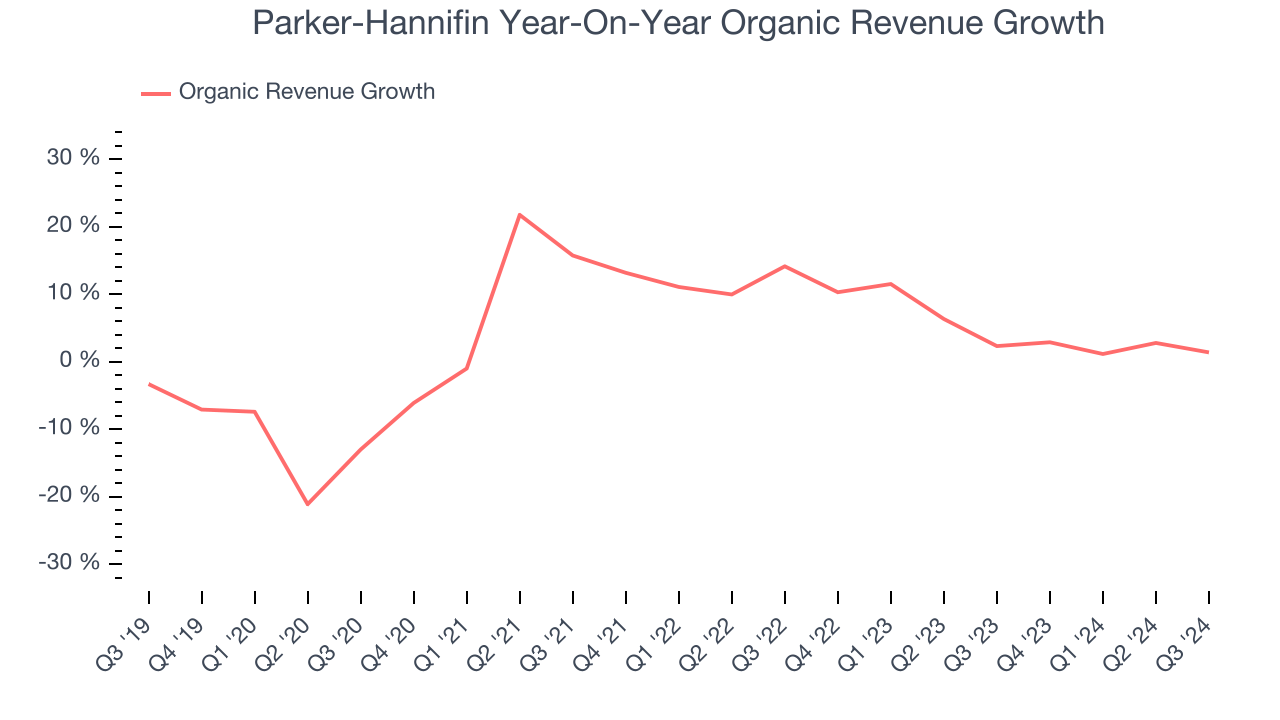

Parker-Hannifin also reports organic revenue, which strips out one-time events like acquisitions and currency fluctuations because they don’t accurately reflect its fundamentals. Over the last two years, Parker-Hannifin’s organic revenue averaged 4.9% year-on-year growth. Because this number is lower than its normal revenue growth, we can see that some mixture of acquisitions and foreign exchange rates boosted its headline performance.

This quarter, Parker-Hannifin grew its revenue by 1.2% year on year, and its $4.90 billion of revenue was in line with Wall Street’s estimates.

Looking ahead, sell-side analysts expect revenue to grow 4.4% over the next 12 months, a deceleration versus the last two years. This projection is underwhelming and shows the market thinks its products and services will face some demand challenges. At least the company is tracking well in other measures of financial health.

When a company has more cash than it knows what to do with, buying back its own shares can make a lot of sense–as long as the price is right. Luckily, we’ve found one, a low-priced stock that is gushing free cash flow AND buying back shares. Click here to claim your Special Free Report on a fallen angel growth story that is already recovering from a setback.

Operating Margin

Operating margin is one of the best measures of profitability because it tells us how much money a company takes home after procuring and manufacturing its products, marketing and selling them, and, most importantly, keeping them relevant through research and development.

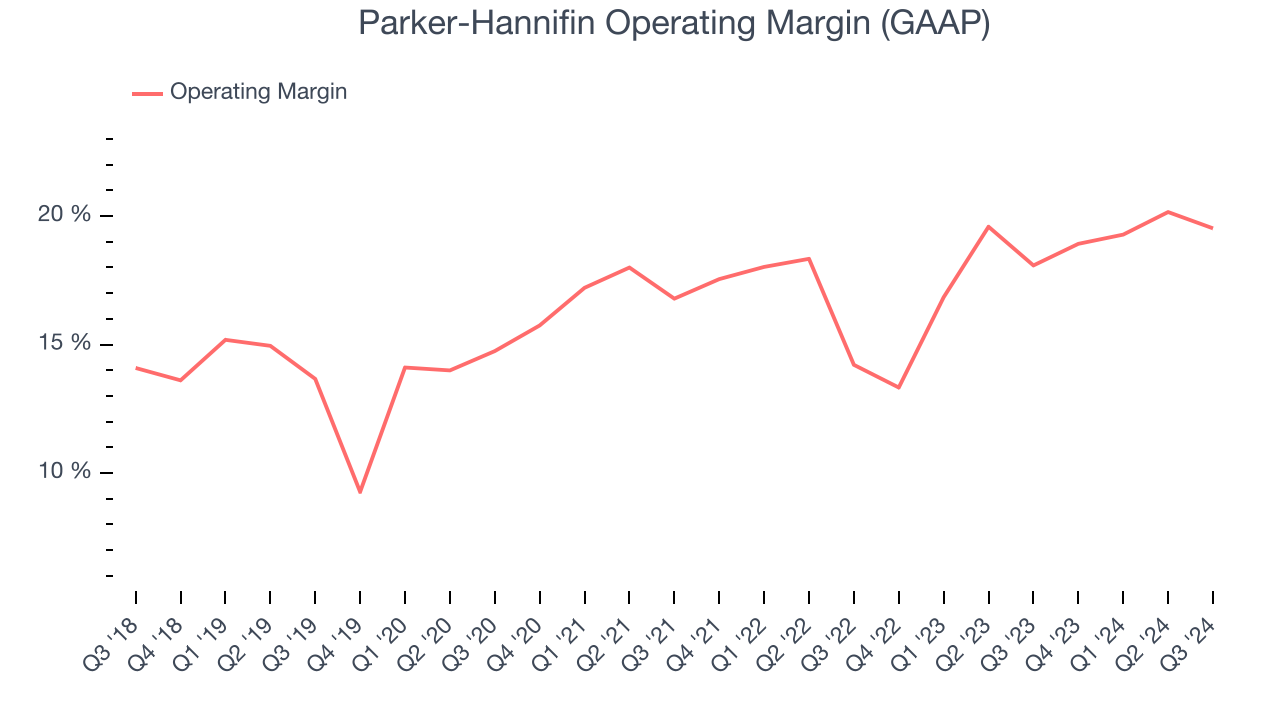

Parker-Hannifin has been a well-oiled machine over the last five years. It demonstrated elite profitability for an industrials business, boasting an average operating margin of 16.9%.

Looking at the trend in its profitability, Parker-Hannifin’s annual operating margin rose by 6.5 percentage points over the last five years, showing its efficiency has meaningfully improved.

In Q3, Parker-Hannifin generated an operating profit margin of 19.5%, up 1.4 percentage points year on year. The increase was encouraging, and since its operating margin rose more than its gross margin, we can infer it was recently more efficient with expenses such as marketing, R&D, and administrative overhead.

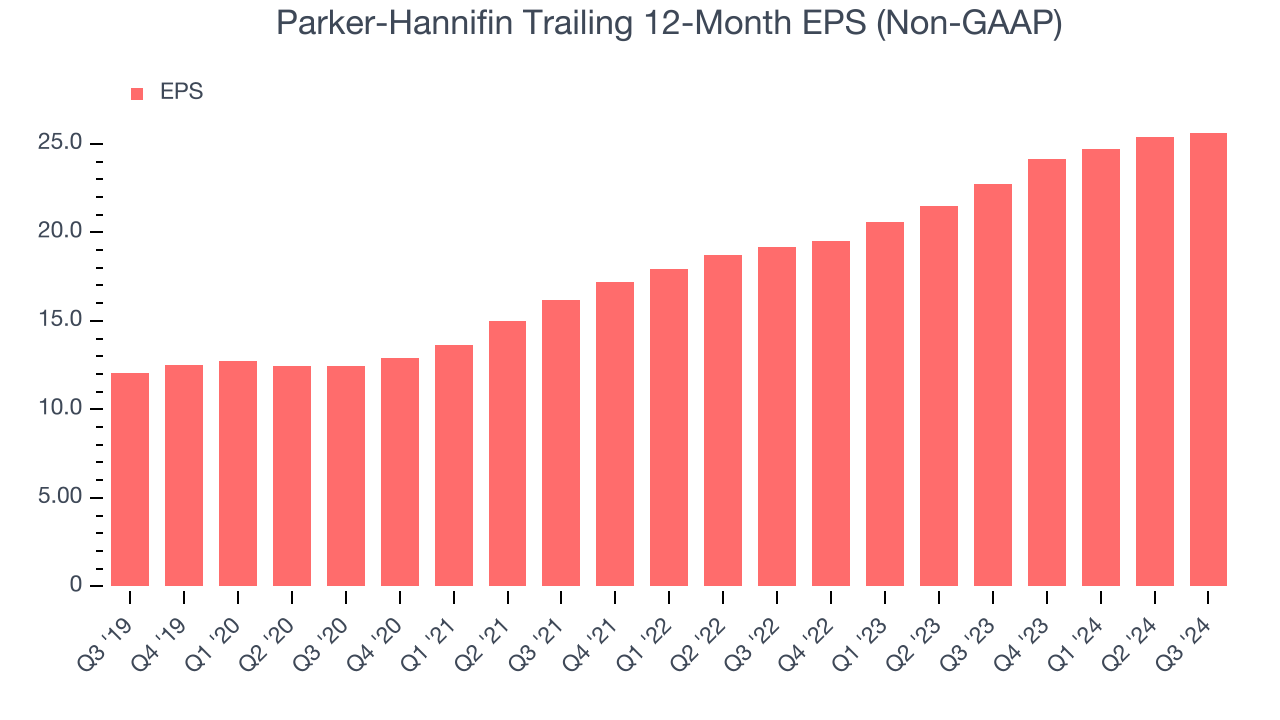

Earnings Per Share

Analyzing revenue trends tells us about a company’s historical growth, but the long-term change in its earnings per share (EPS) points to the profitability of that growth – for example, a company could inflate its sales through excessive spending on advertising and promotions.

Parker-Hannifin’s EPS grew at a spectacular 16.3% compounded annual growth rate over the last five years, higher than its 7.1% annualized revenue growth. This tells us the company became more profitable as it expanded.

We can take a deeper look into Parker-Hannifin’s earnings to better understand the drivers of its performance. As we mentioned earlier, Parker-Hannifin’s operating margin expanded by 6.5 percentage points over the last five years. This was the most relevant factor (aside from the revenue impact) behind its higher earnings; taxes and interest expenses can also affect EPS but don’t tell us as much about a company’s fundamentals.

Like with revenue, we analyze EPS over a shorter period to see if we are missing a change in the business.

For Parker-Hannifin, its two-year annual EPS growth of 15.6% is similar to its five-year trend, implying strong and stable earnings power.In Q3, Parker-Hannifin reported EPS at $6.20, up from $5.96 in the same quarter last year. This print was close to analysts’ estimates. Over the next 12 months, Wall Street expects Parker-Hannifin’s full-year EPS of $25.63 to grow by 7.4%.

Key Takeaways from Parker-Hannifin’s Q3 Results

We struggled to find many strong positives in these results as most metrics were in line while its EBITDA missed. Overall, this quarter could have been better. The stock traded down 2.8% to $607.17 immediately following the results.

Parker-Hannifin may have had a tough quarter, but does that actually create an opportunity to invest right now? What happened in the latest quarter matters, but not as much as longer-term business quality and valuation, when deciding whether to invest in this stock. We cover that in our actionable full research report which you can read here, it’s free.