Chip designer Allegro MicroSystems (NASDAQ: ALGM) met Wall Street’s revenue expectations in Q3 CY2024, but sales fell 32% year on year to $187.4 million. On the other hand, next quarter’s revenue guidance of $175 million was less impressive, coming in 13.9% below analysts’ estimates. Its GAAP loss of $0.18 per share was 680% below analysts’ consensus estimates.

Is now the time to buy Allegro MicroSystems? Find out by accessing our full research report, it’s free.

Allegro MicroSystems (ALGM) Q3 CY2024 Highlights:

- Revenue: $187.4 million vs analyst estimates of $187.6 million (in line)

- EPS: -$0.18 vs analyst estimates of -$0.02 (-$0.16 miss)

- EBITDA: $32.31 million vs analyst estimates of $30.94 million (4.4% beat)

- Revenue Guidance for Q4 CY2024 is $175 million at the midpoint, below analyst estimates of $203.2 million

- EPS (GAAP) guidance for Q4 CY2024 is $0.06 at the midpoint, beating analyst estimates by 120%

- Gross Margin (GAAP): 45.7%, down from 57.9% in the same quarter last year

- Inventory Days Outstanding: 158, down from 174 in the previous quarter

- Operating Margin: 2.2%, down from 26.5% in the same quarter last year

- EBITDA Margin: 17.2%, down from 37.1% in the same quarter last year

- Free Cash Flow Margin: 3%, down from 5.6% in the same quarter last year

- Market Capitalization: $4.86 billion

“We delivered results in-line with our commitments. Second quarter sales were $187 million, with sequential growth in both Automotive and Industrial and Other end markets. Non-GAAP EPS was $0.08, at the high end of our outlook,” said Vineet Nargolwala, President and CEO of Allegro.

Company Overview

The result of a spinoff from Sanken in Japan, Allegro MicroSystems (NASDAQ: ALGM) is a designer of power management chips and distance sensors used in electric vehicles and data centers.

Processors and Graphics Chips

The biggest demand drivers for processors (CPUs) and graphics chips at the moment are secular trends related to 5G and Internet of Things, autonomous driving, and high performance computing in the data center space, specifically around AI and machine learning. Like all semiconductor companies, digital chip makers exhibit a degree of cyclicality, driven by supply and demand imbalances and exposure to PC and Smartphone product cycles.

Sales Growth

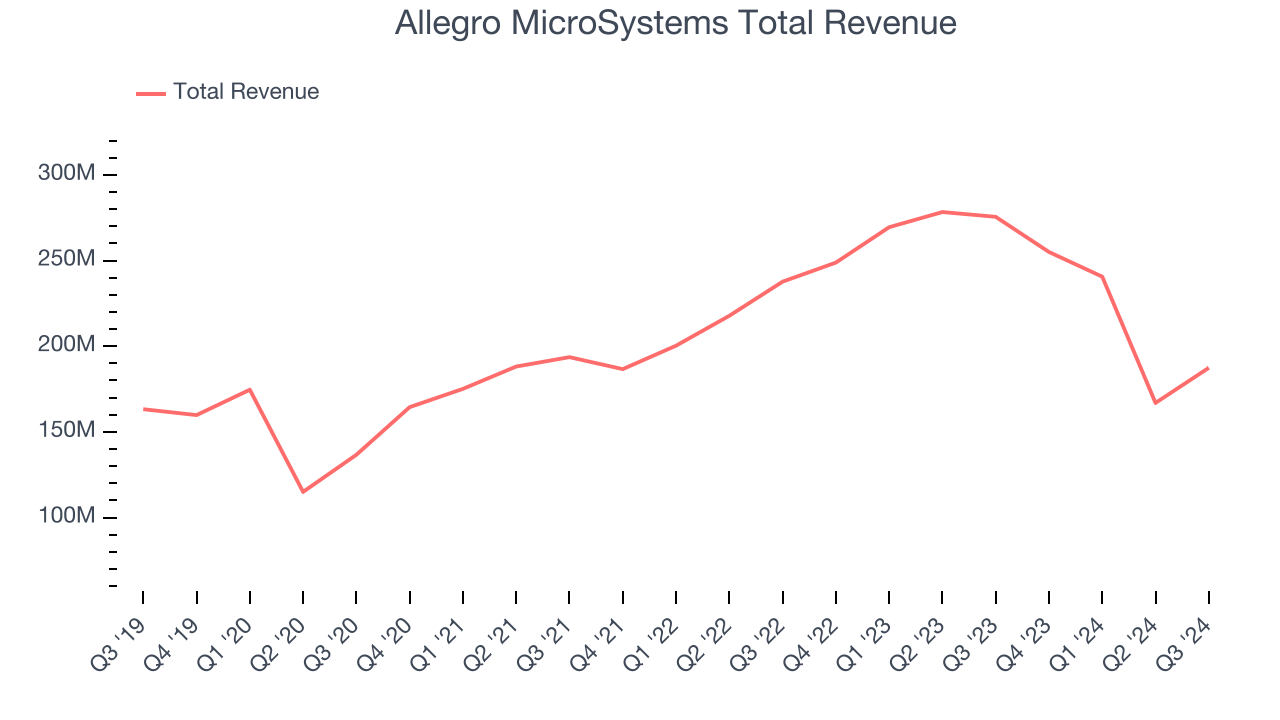

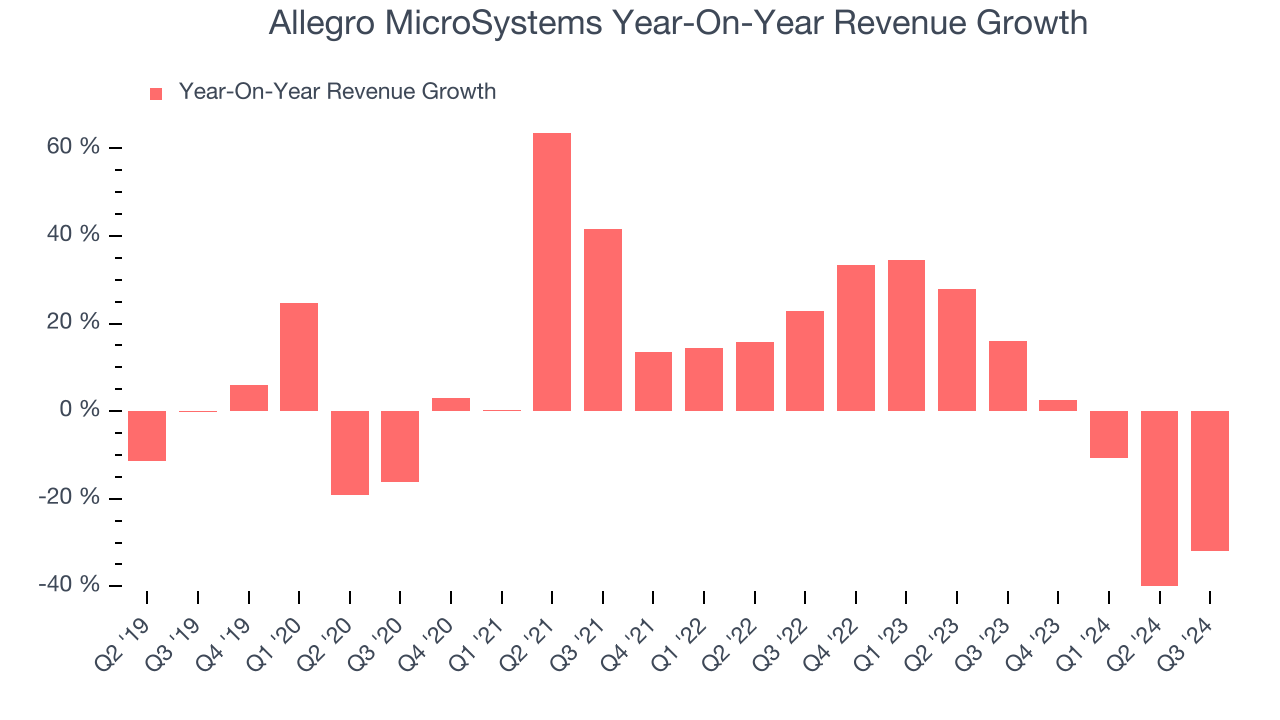

A company’s long-term performance can indicate its business quality. Any business can put up a good quarter or two, but many enduring ones grow for years. Unfortunately, Allegro MicroSystems’s 7.3% annualized revenue growth over the last five years was mediocre. This shows it couldn’t expand in any major way, a tough starting point for our analysis. Semiconductors are a cyclical industry, and long-term investors should be prepared for periods of high growth followed by periods of revenue contractions.

We at StockStory place the most emphasis on long-term growth, but within semiconductors, a half-decade historical view may miss new demand cycles or industry trends like AI. Allegro MicroSystems’s recent history shows its demand slowed as its revenue was flat over the last two years.

This quarter, Allegro MicroSystems reported a rather uninspiring 32% year-on-year revenue decline to $187.4 million of revenue, in line with Wall Street’s estimates. Management is currently guiding for a 31.4% year-on-year decline next quarter.

Looking further ahead, sell-side analysts expect revenue to grow 5.7% over the next 12 months, an improvement versus the last two years. Although this projection illustrates the market thinks its newer products and services will catalyze better performance, it is still below the sector average.

Unless you’ve been living under a rock, it should be obvious by now that generative AI is going to have a huge impact on how large corporations do business. While Nvidia and AMD are trading close to all-time highs, we prefer a lesser-known (but still profitable) semiconductor stock benefitting from the rise of AI. Click here to access our free report on our favorite semiconductor growth story.

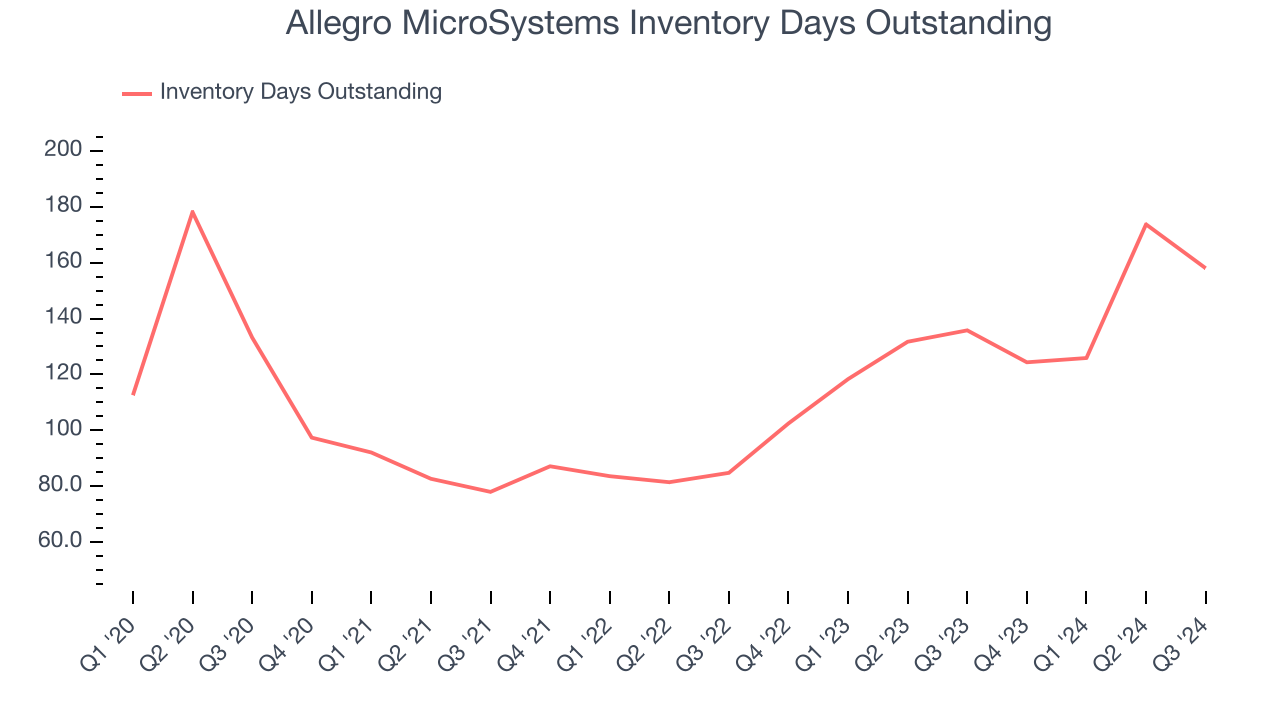

Product Demand & Outstanding Inventory

Days Inventory Outstanding (DIO) is an important metric for chipmakers, as it reflects a business’ capital intensity and the cyclical nature of semiconductor supply and demand. In a tight supply environment, inventories tend to be stable, allowing chipmakers to exert pricing power. Steadily increasing DIO can be a warning sign that demand is weak, and if inventories continue to rise, the company may have to downsize production.

This quarter, Allegro MicroSystems’s DIO came in at 158, which is 43 days above its five-year average. These numbers suggest that despite the recent decrease, the company’s inventory levels are higher than what we’ve seen in the past.

Key Takeaways from Allegro MicroSystems’s Q3 Results

We were impressed by Allegro MicroSystems’s optimistic EPS forecast for next quarter, which blew past analysts’ expectations. We were also excited its EPS outperformed Wall Street’s estimates. On the other hand, its revenue guidance for next quarter missed analysts’ expectations and its operating margin shrunk. Overall, this was a softer quarter. The stock remained flat at $22 immediately after reporting.

So should you invest in Allegro MicroSystems right now? The latest quarter does matter, but not nearly as much as longer-term fundamentals and valuation, when deciding if the stock is a buy. We cover that in our actionable full research report which you can read here, it’s free.