Kitchen product manufacturer Middleby (NYSE: MIDD) missed Wall Street’s revenue expectations in Q3 CY2024, with sales falling 3.9% year on year to $942.8 million. Its non-GAAP profit of $2.33 per share was also 5.9% below analysts’ consensus estimates.

Is now the time to buy Middleby? Find out by accessing our full research report, it’s free.

Middleby (MIDD) Q3 CY2024 Highlights:

- Revenue: $942.8 million vs analyst estimates of $996.6 million (5.4% miss)

- Adjusted EPS: $2.33 vs analyst expectations of $2.48 (5.9% miss)

- EBITDA: $213 million vs analyst estimates of $226.8 million (6.1% miss)

- Gross Margin (GAAP): 37.7%, in line with the same quarter last year

- Operating Margin: 18.4%, in line with the same quarter last year

- EBITDA Margin: 22.6%, in line with the same quarter last year

- Free Cash Flow Margin: 15.4%, down from 20.2% in the same quarter last year

- Organic Revenue fell 4.1% year on year, in line with the same quarter last year

- Market Capitalization: $7.55 billion

"We have continued to resiliently execute on our strategic initiatives focused on the launch of industry leading product innovations and differentiated go-to market capabilities, which have us uniquely positioned and are confident will drive long-term profitable growth. The pipeline of opportunities with customers and new product innovations continues to build, while customer engagement remains at an all-time high. We anticipate the challenging current industry macro-conditions will improve in 2025 and will lead into a multi-year recovery favorably supporting growth at all three of our foodservice segments,” said Tim FitzGerald, CEO of The Middleby Corporation.

Company Overview

Holding a Guinness World Record for creating the world’s fastest conveyor pizza oven, Middleby (NYSE: MIDD) is a food service and equipment manufacturer.

Professional Tools and Equipment

Automation that increases efficiency and connected equipment that collects analyzable data have been trending, creating new demand. Some professional tools and equipment companies also provide software to accompany measurement or automated machinery, adding a stream of recurring revenues to their businesses. On the other hand, professional tools and equipment companies are at the whim of economic cycles. Consumer spending and interest rates, for example, can greatly impact the industrial production that drives demand for these companies’ offerings.

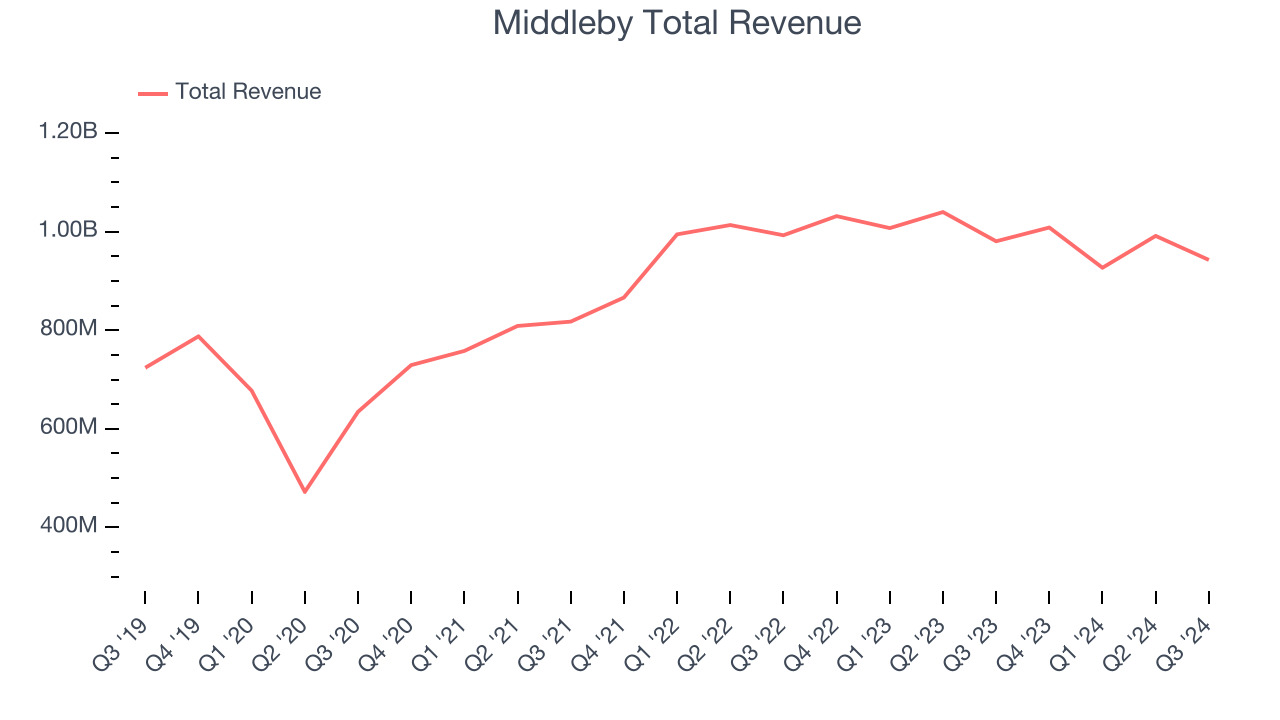

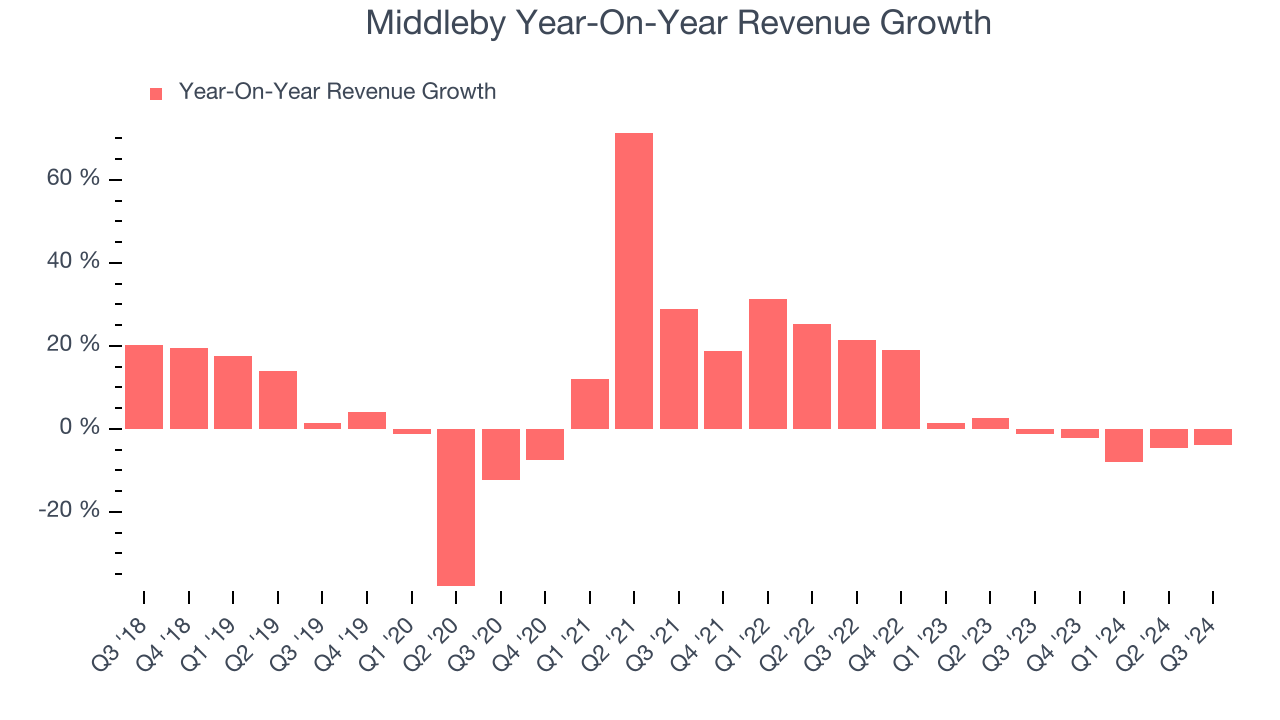

Sales Growth

A company’s long-term performance can give signals about its business quality. Even a bad business can shine for one or two quarters, but a top-tier one grows for years. Unfortunately, Middleby’s 5.7% annualized revenue growth over the last five years was tepid. This shows it failed to expand in any major way, a rough starting point for our analysis.

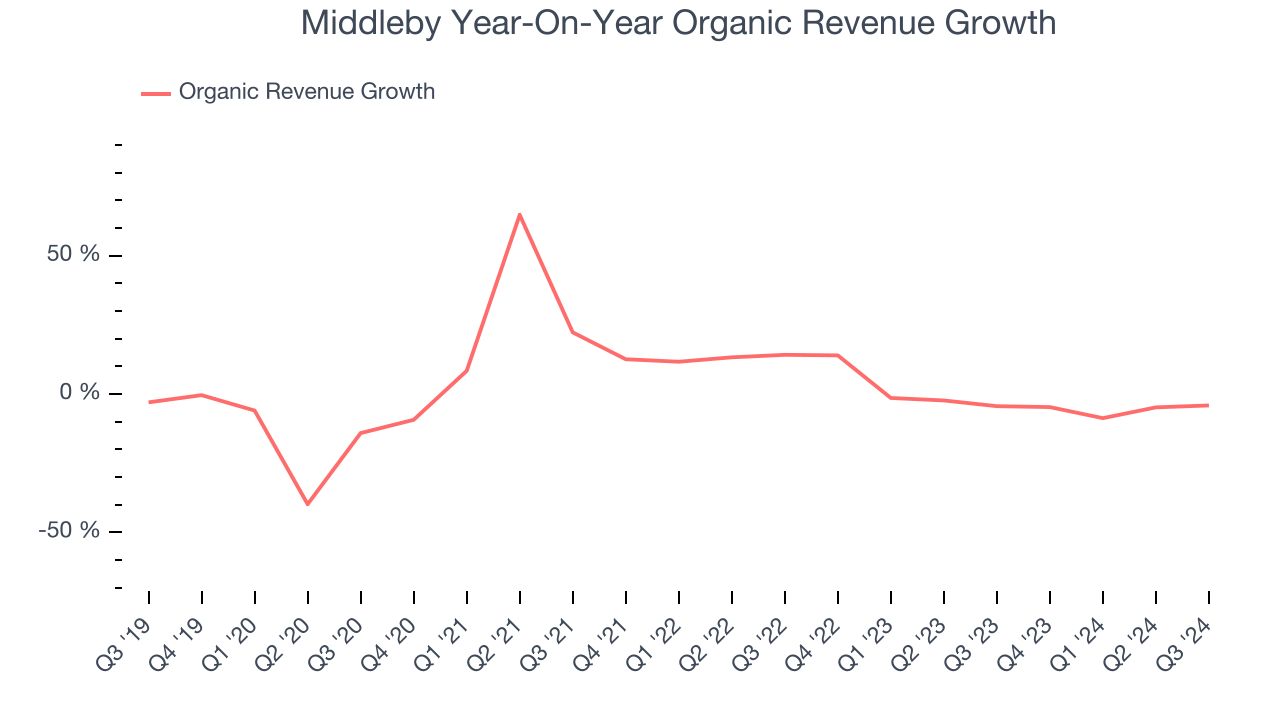

We at StockStory place the most emphasis on long-term growth, but within industrials, a half-decade historical view may miss cycles, industry trends, or a company capitalizing on catalysts such as a new contract win or a successful product line. Middleby’s recent history shows its demand slowed as its revenue was flat over the last two years.

Middleby also reports organic revenue, which strips out one-time events like acquisitions and currency fluctuations because they don’t accurately reflect its fundamentals. Over the last two years, Middleby’s organic revenue averaged 2% year-on-year declines. Because this number is lower than its normal revenue growth, we can see that some mixture of acquisitions and foreign exchange rates boosted its headline performance.

This quarter, Middleby missed Wall Street’s estimates and reported a rather uninspiring 3.9% year-on-year revenue decline, generating $942.8 million of revenue.

Looking ahead, sell-side analysts expect revenue to grow 5.5% over the next 12 months, an improvement versus the last two years. Although this projection indicates the market believes its newer products and services will fuel better performance, it is still below average for the sector.

Here at StockStory, we certainly understand the potential of thematic investing. Diverse winners from Microsoft (MSFT) to Alphabet (GOOG), Coca-Cola (KO) to Monster Beverage (MNST) could all have been identified as promising growth stories with a megatrend driving the growth. So, in that spirit, we’ve identified a relatively under-the-radar profitable growth stock benefitting from the rise of AI, available to you FREE via this link.

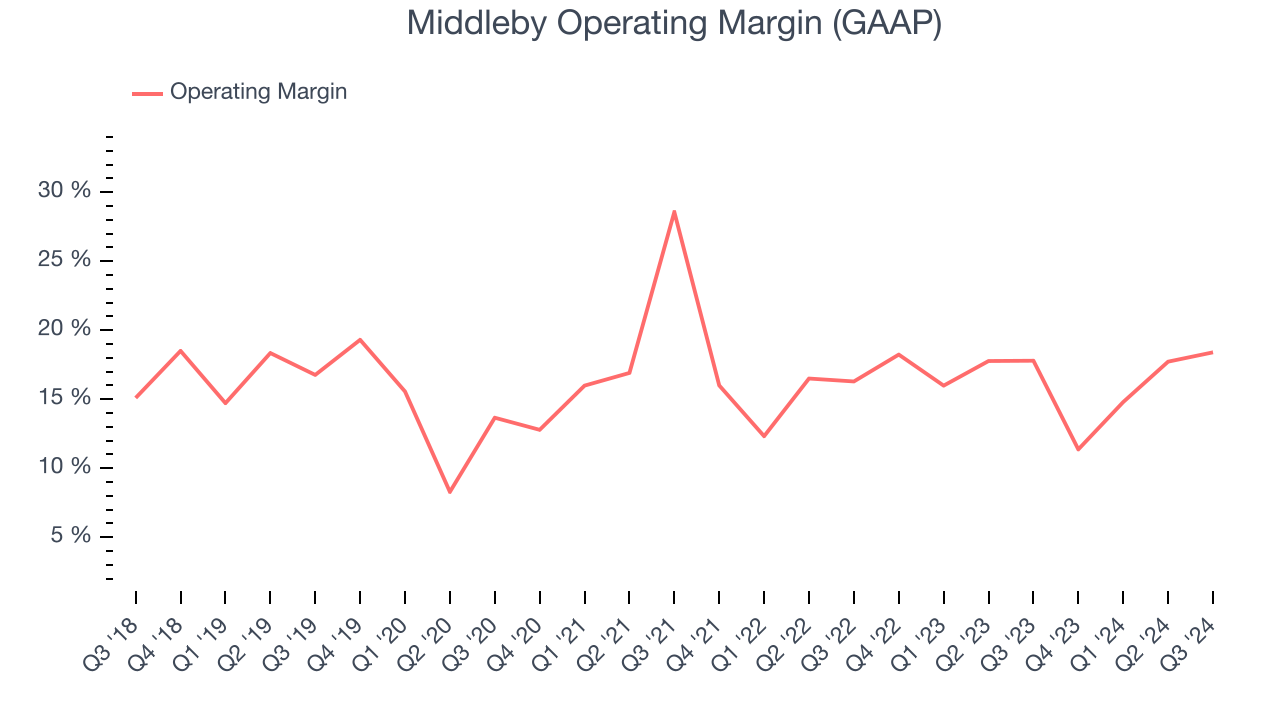

Operating Margin

Middleby has been a well-oiled machine over the last five years. It demonstrated elite profitability for an industrials business, boasting an average operating margin of 16.4%. This result isn’t surprising as its high gross margin gives it a favorable starting point.

Looking at the trend in its profitability, Middleby’s annual operating margin might have seen some fluctuations but has generally stayed the same over the last five years, highlighting the long-term consistency of its business.

In Q3, Middleby generated an operating profit margin of 18.4%, in line with the same quarter last year. This indicates the company’s cost structure has recently been stable.

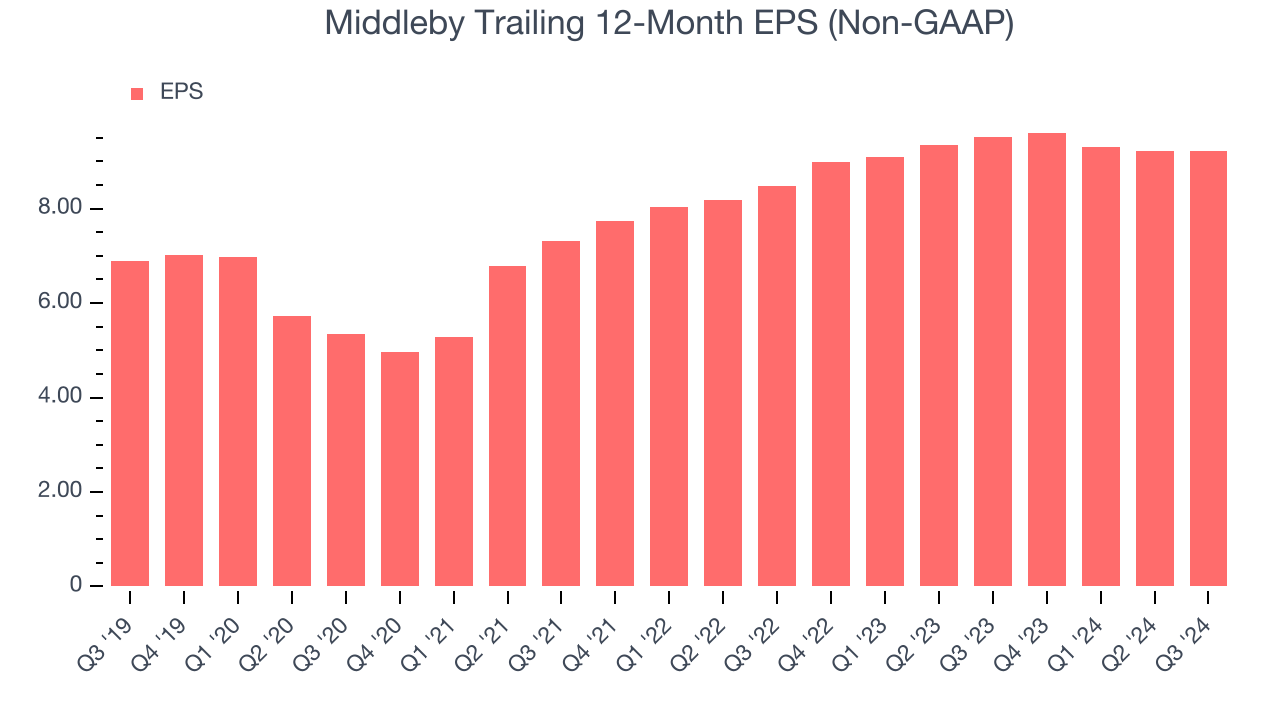

Earnings Per Share

Analyzing revenue trends tells us about a company’s historical growth, but the long-term change in its earnings per share (EPS) points to the profitability of that growth – for example, a company could inflate its sales through excessive spending on advertising and promotions.

Middleby’s unimpressive 6% annual EPS growth over the last five years aligns with its revenue performance. This tells us it maintained its per-share profitability as it expanded.

Like with revenue, we analyze EPS over a shorter period to see if we are missing a change in the business.

Although it wasn’t great, Middleby’s two-year annual EPS growth of 4.3% topped its flat revenue.In Q3, Middleby reported EPS at $2.33, in line with the same quarter last year. This print missed analysts’ estimates. Over the next 12 months, Wall Street expects Middleby’s full-year EPS of $9.23 to grow by 12.1%.

Key Takeaways from Middleby’s Q3 Results

We struggled to find many strong positives in these results as its revenue and EBITDA fell short of Wall Street’s estimates. Overall, this was a softer quarter. The stock remained flat at $140.60 immediately following the results.

So do we think Middleby is an attractive buy at the current price? What happened in the latest quarter matters, but not as much as longer-term business quality and valuation, when deciding whether to invest in this stock. We cover that in our actionable full research report which you can read here, it’s free.