Boat and marine products retailer MarineMax (NYSE: HZO) fell short of the market’s revenue expectations in Q3 CY2024, with sales falling 5.3% year on year to $563.1 million. Its non-GAAP profit of $0.24 per share was also 15.7% below analysts’ consensus estimates.

Is now the time to buy MarineMax? Find out by accessing our full research report, it’s free.

MarineMax (HZO) Q3 CY2024 Highlights:

- Revenue: $563.1 million vs analyst estimates of $576.9 million (2.4% miss)

- Adjusted EPS: $0.24 vs analyst expectations of $0.28 (15.7% miss)

- EBITDA: $33.54 million vs analyst estimates of $29.66 million (13.1% beat)

- Adjusted EPS guidance for the upcoming financial year 2025 is $2.30 at the midpoint, missing analyst estimates by 22.8%

- EBITDA guidance for the upcoming financial year 2025 is $165 million at the midpoint, below analyst estimates of $189.8 million

- Gross Margin (GAAP): 34.3%, in line with the same quarter last year

- Operating Margin: 4.8%, down from 5.8% in the same quarter last year

- EBITDA Margin: 6%, down from 7.2% in the same quarter last year

- Locations: 75 at quarter end, down from 81 in the same quarter last year

- Same-Store Sales fell 5% year on year (7.9% in the same quarter last year)

- Market Capitalization: $670.4 million

“Resilient is the word that captures the spirit of our team members, who have shown extraordinary dedication and perseverance in the face of the devastating storms that hit Florida and the southeast over the past month,” said Brett McGill, Chief Executive Officer and President of MarineMax.

Company Overview

Appropriately headquartered in Clearwater, Florida, MarineMax (NYSE: HZO) sells boats, yachts, and other marine products.

Boat & Marine Retailer

Retailers that sell boats and marine products sell products, sure, but they also sell an image and lifestyle to an often wealthier customer. Unlike a car–which many use daily to get to/from work and to run personal and family errands–a boat or yacht is certainly a discretionary, luxury, nice-to-have purchase. While there is online competition, especially for research and discovery, the boat and yacht market is still very brick-and-mortar based given the magnitude of the purchase and the logistical costs associated with moving these products over long distances.

Sales Growth

Reviewing a company’s long-term performance can reveal insights into its business quality. Any business can have short-term success, but a top-tier one sustains growth for years.

MarineMax is a small retailer, which sometimes brings disadvantages compared to larger competitors that benefit from economies of scale. On the other hand, it can grow faster because it’s working from a smaller revenue base and has more white space to build new stores.

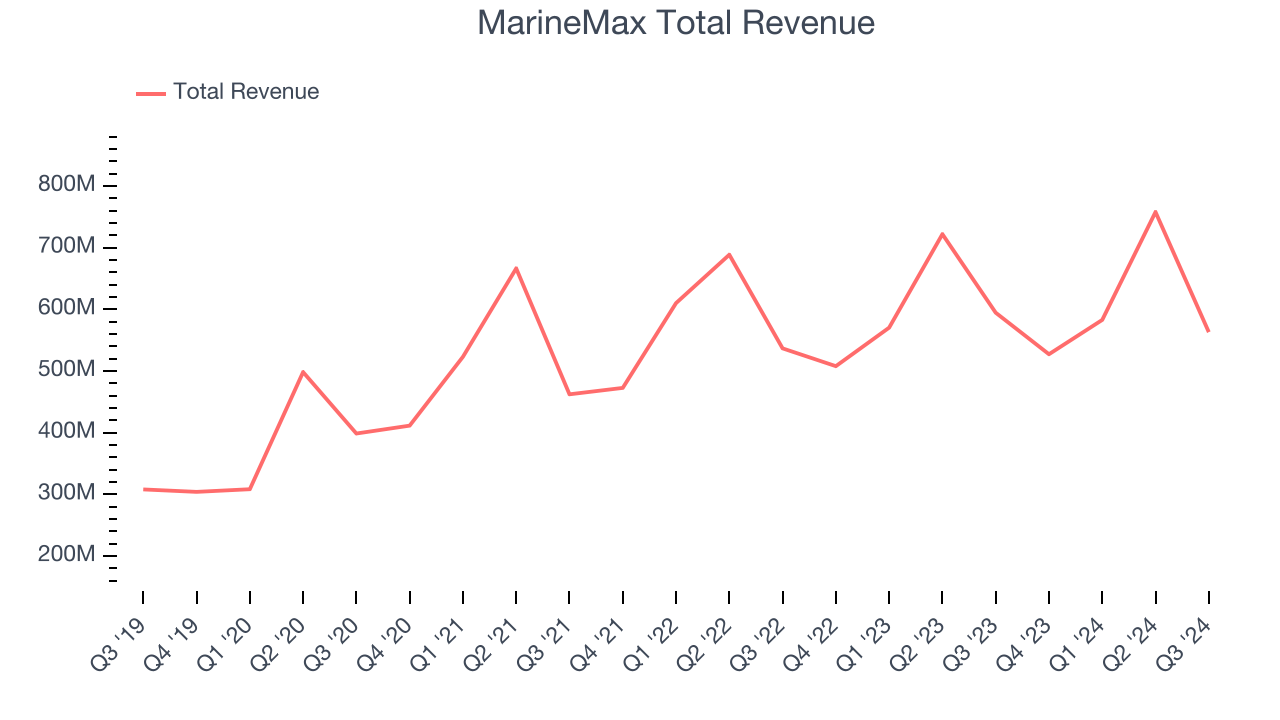

As you can see below, MarineMax’s 14.5% annualized revenue growth over the last five years (we compare to 2019 to normalize for COVID-19 impacts) was solid despite not opening many new stores.

This quarter, MarineMax missed Wall Street’s estimates and reported a rather uninspiring 5.3% year-on-year revenue decline, generating $563.1 million of revenue.

Looking ahead, sell-side analysts expect revenue to grow 4% over the next 12 months, a deceleration versus the last five years. Still, this projection is commendable and shows the market sees success for its products.

Today’s young investors won’t have read the timeless lessons in Gorilla Game: Picking Winners In High Technology because it was written more than 20 years ago when Microsoft and Apple were first establishing their supremacy. But if we apply the same principles, then enterprise software stocks leveraging their own generative AI capabilities may well be the Gorillas of the future. So, in that spirit, we are excited to present our Special Free Report on a profitable, fast-growing enterprise software stock that is already riding the automation wave and looking to catch the generative AI next.

Store Performance

Number of Stores

A retailer’s store count influences how much it can sell and how quickly revenue can grow.

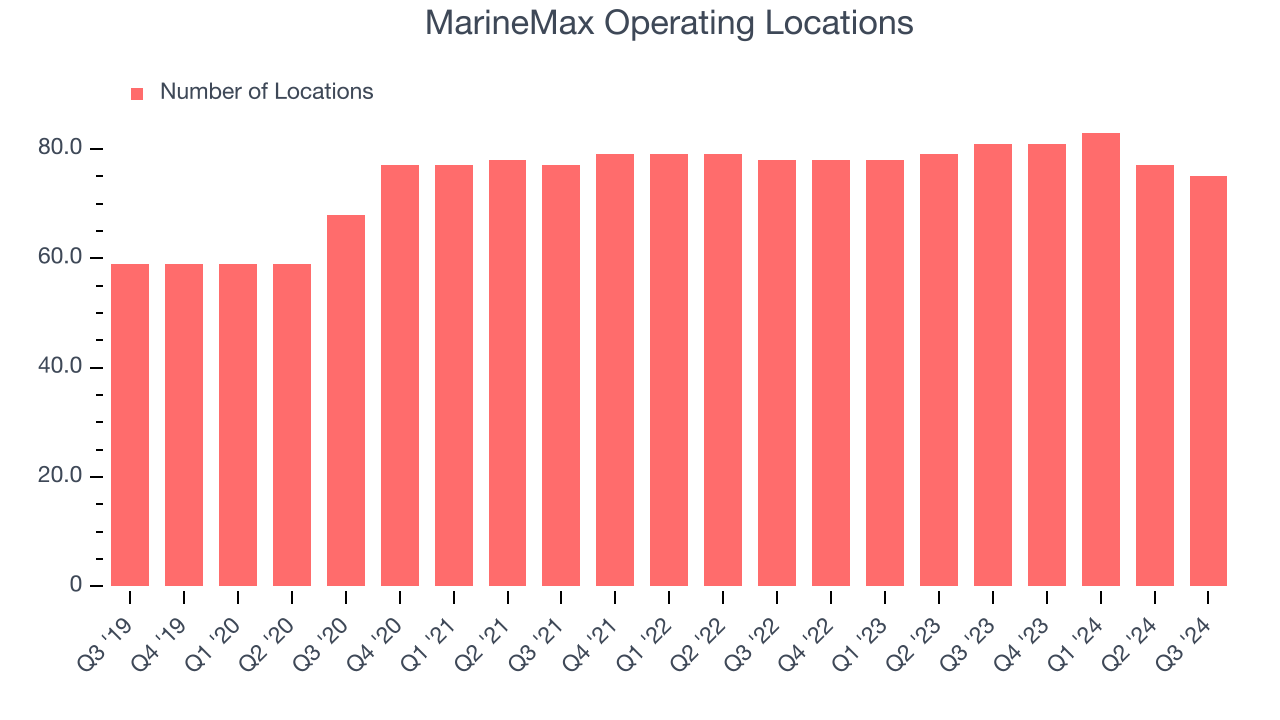

MarineMax listed 75 locations in the latest quarter and has kept its store count flat over the last two years while other consumer retail businesses have opted for growth.

When a retailer keeps its store footprint steady, it usually means demand is stable and it’s focusing on operational efficiency to increase profitability.

Same-Store Sales

The change in a company's store base only tells one side of the story. The other is the performance of its existing locations and e-commerce sales, which informs management teams whether they should expand or downsize their physical footprints. Same-store sales is an industry measure of whether revenue is growing at those existing stores and is driven by customer visits (often called traffic) and the average spending per customer (ticket).

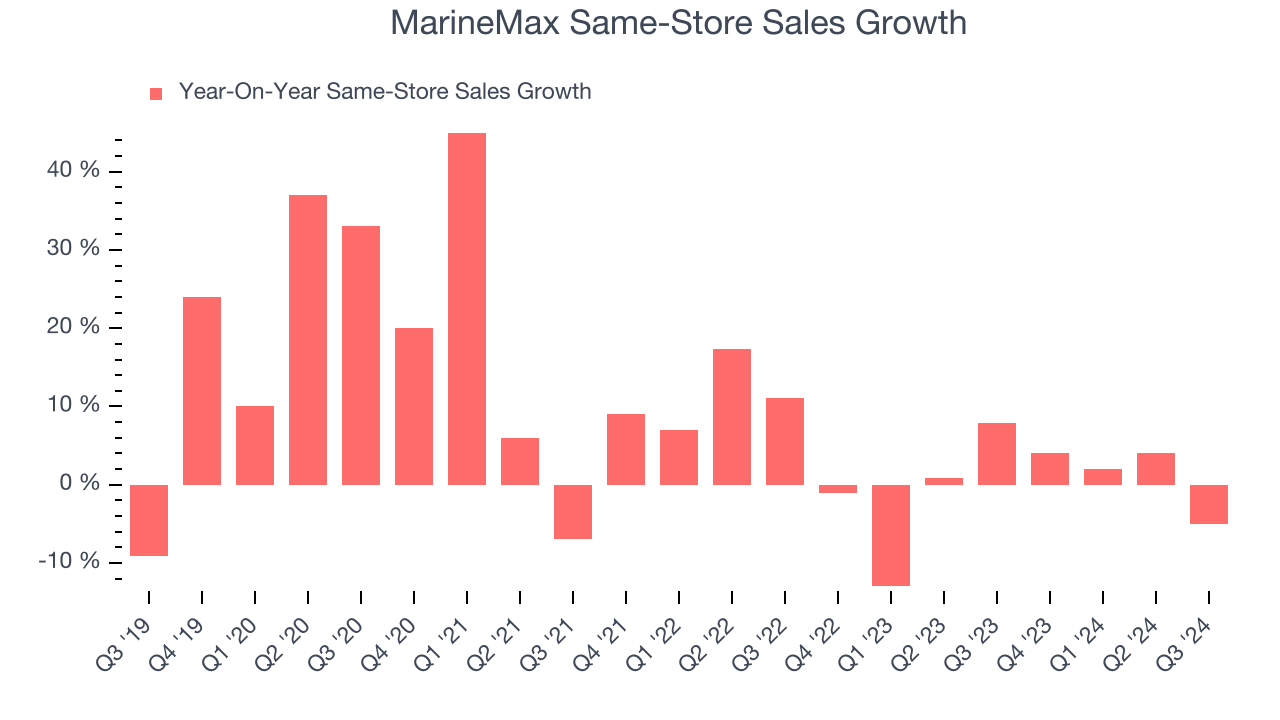

MarineMax’s demand within its existing locations has barely increased over the last two years as its same-store sales were flat. This performance isn’t ideal, and we’d be skeptical if MarineMax starts opening new stores to artifically boost revenue growth.

In the latest quarter, MarineMax’s same-store sales fell by 5% annually. This decline was a reversal from the 7.9% year-on-year increase it posted 12 months ago. We’ll keep a close eye on the company to see if this turns into a longer-term trend.

Key Takeaways from MarineMax’s Q3 Results

It was good to see MarineMax beat analysts' EBITDA expectations this quarter. On the other hand, its EBITDA forecast for the full year missed and its revenue fell short of Wall Street’s estimates. Overall, this quarter could have been better. The stock remained flat at $30.04 immediately following the results.

Is MarineMax an attractive investment opportunity right now? What happened in the latest quarter matters, but not as much as longer-term business quality and valuation, when deciding whether to invest in this stock. We cover that in our actionable full research report which you can read here, it’s free.