Beauty products company Estée Lauder (NYSE: EL) met Wall Street’s revenue expectations in Q3 CY2024, but sales fell 4.5% year on year to $3.36 billion. On the other hand, next quarter’s revenue guidance of $3.27 billion was less impressive, coming in 23.6% below analysts’ estimates. Its non-GAAP profit of $0.14 per share was 46.8% above analysts’ consensus estimates.

Is now the time to buy Estée Lauder? Find out by accessing our full research report, it’s free.

Estée Lauder (EL) Q3 CY2024 Highlights:

- Revenue: $3.36 billion vs analyst estimates of $3.37 billion (in line)

- Adjusted EPS: $0.14 vs analyst estimates of $0.10 (46.8% beat)

- Revenue Guidance for Q4 CY2024 is $3.27 billion at the midpoint, below analyst estimates of $4.28 billion

- Adjusted EPS guidance for Q4 CY2024 is $0.28 at the midpoint, below analyst estimates of $1.06

- Gross Margin (GAAP): 72.4%, up from 69.6% in the same quarter last year

- Operating Margin: -3.6%, down from 2.8% in the same quarter last year

- Free Cash Flow was -$811 million compared to -$703 million in the same quarter last year

- Organic Revenue fell 5% year on year (-11% in the same quarter last year)

- Market Capitalization: $31.26 billion

Fabrizio Freda, President and Chief Executive Officer said, “Our first quarter results are largely aligned with our outlook on an adjusted basis, despite the fact that the expected headwinds in China and Asia travel retail were greater than anticipated. Our Profit Recovery and Growth Plan drove gross margin expansion, which was partially offset by operating deleverage. Other pillars of our strategic reset also delivered promising initial results.

Company Overview

Named after its founder, who was an entrepreneurial woman from New York with a passion for skincare, Estée Lauder (NYSE: EL) is a one-stop beauty shop with products in skincare, fragrance, makeup, sun protection, and men’s grooming.

Personal Care

While personal care products products may seem more discretionary than food, consumers tend to maintain or even boost their spending on the category during tough times. This phenomenon is known as "the lipstick effect" by economists, which states that consumers still want some semblance of affordable luxuries like beauty and wellness when the economy is sputtering. Consumer tastes are constantly changing, and personal care companies are currently responding to the public’s increased desire for ethically produced goods by featuring natural ingredients in their products.

Sales Growth

A company’s long-term performance can indicate its business quality. Any business can put up a good quarter or two, but many enduring ones grow for years.

Estée Lauder is one of the larger consumer staples companies and benefits from a well-known brand that influences consumer purchasing decisions. However, its scale is a double-edged sword because there are only a finite number of major retail partners, placing a ceiling on its growth.

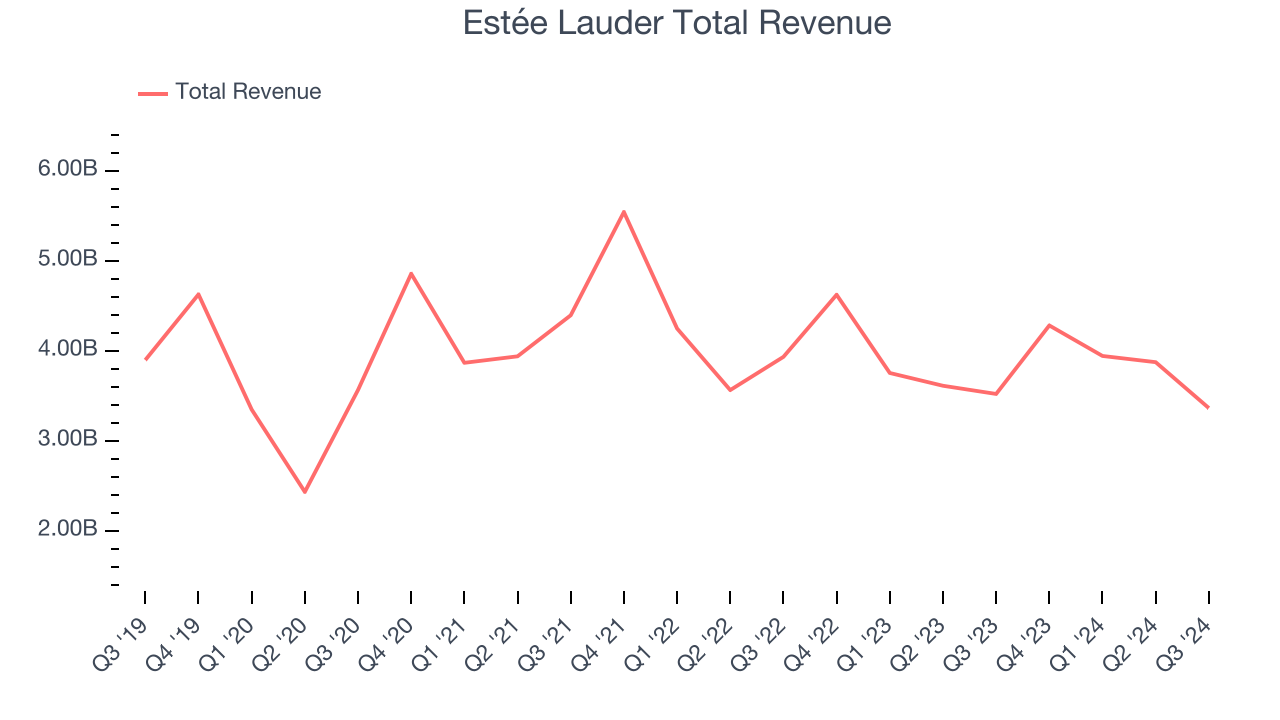

As you can see below, Estée Lauder’s demand was weak over the last three years. Its sales fell by 3.2% annually, showing demand was weak. This is a rough starting point for our analysis.

This quarter, Estée Lauder reported a rather uninspiring 4.5% year-on-year revenue decline to $3.36 billion of revenue, in line with Wall Street’s estimates. Management is currently guiding for a 23.5% year-on-year decline next quarter.

Looking further ahead, sell-side analysts expect revenue to grow 2.6% over the next 12 months, an acceleration versus the last three years. While this projection indicates the market thinks its newer products will fuel better performance, it is still below average for the sector.

Unless you’ve been living under a rock, it should be obvious by now that generative AI is going to have a huge impact on how large corporations do business. While Nvidia and AMD are trading close to all-time highs, we prefer a lesser-known (but still profitable) semiconductor stock benefitting from the rise of AI. Click here to access our free report on our favorite semiconductor growth story.

Organic Revenue Growth

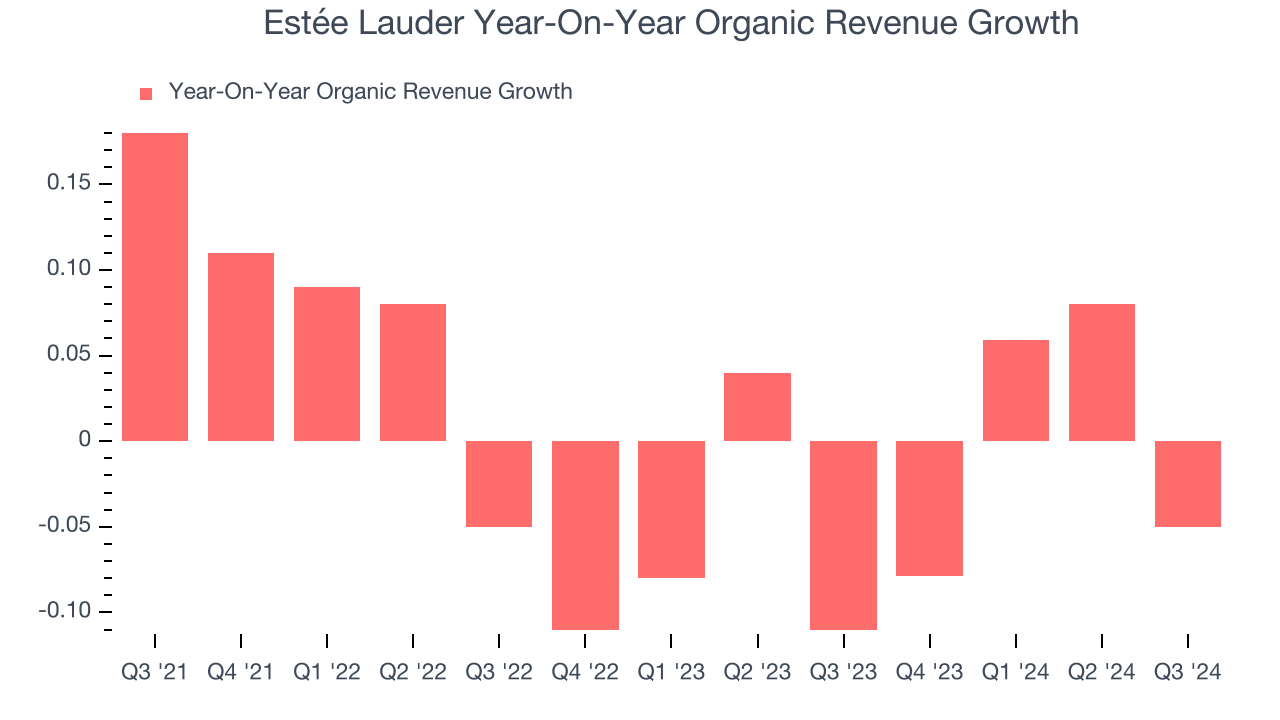

When analyzing revenue growth, we care most about organic revenue growth. This metric captures a business’s performance excluding the impacts of foreign currency fluctuations and one-time events such as mergers, acquisitions, and divestitures.

Estée Lauder’s demand has been falling over the last eight quarters, and on average, its organic sales have declined by 3.1% year on year.

In the latest quarter, Estée Lauder’s organic sales fell 5% year on year. This decrease was an improvement from the 11% year-on-year decline it posted 12 months ago. It’s always great to see a business improve its prospects.

Key Takeaways from Estée Lauder’s Q3 Results

Estée Lauder's organic revenue missed Wall Street’s estimates, although revenue was in line. Next quarter's revenue and EPS guidance were both below. Adding to the bad news, the company is reducing its dividend. Overall, this was a bad quarter. The stock traded down 12.8% to $76 immediately after reporting.

Estée Lauder may have had a tough quarter, but does that actually create an opportunity to invest right now? When making that decision, it’s important to consider its valuation, business qualities, as well as what has happened in the latest quarter. We cover that in our actionable full research report which you can read here, it’s free.