Fast food chain El Pollo Loco (NASDAQ: LOCO) met Wall Street’s revenue expectations in Q3 CY2024, but sales were flat year on year at $120.4 million. Its non-GAAP profit of $0.21 per share was 25.4% above analysts’ consensus estimates.

Is now the time to buy El Pollo Loco? Find out by accessing our full research report, it’s free.

El Pollo Loco (LOCO) Q3 CY2024 Highlights:

- Revenue: $120.4 million vs analyst estimates of $121 million (in line)

- Adjusted EPS: $0.21 vs analyst estimates of $0.17 ($0.04 beat)

- EBITDA: $15.45 million vs analyst estimates of $13.4 million (15.3% beat)

- Gross Margin (GAAP): 21.3%, up from 19% in the same quarter last year

- Operating Margin: 8.4%, down from 11.4% in the same quarter last year

- EBITDA Margin: 12.8%, in line with the same quarter last year

- Locations: 496 at quarter end, up from 492 in the same quarter last year

- Same-Store Sales rose 2.7% year on year (0.8% in the same quarter last year)

- Market Capitalization: $375.6 million

Liz Williams, Chief Executive Officer of El Pollo Loco Holdings, Inc., stated, “Our third quarter results reflect yet another step toward capturing the opportunity ahead of us to become the national fire-grilled chicken brand. More specifically, we drove top-line growth through a 2.7% increase in system-wide comparable sales; expanded restaurant-level margins by 230 basis points year-over-year to 16.7%; and continue to make great progress on reducing the cost of our prototype to stimulate future unit growth. As we look ahead, we are pleased with what we have accomplished thus far to develop a strong foundation, and we are well positioned to ignite further growth in 2025 and beyond.”

Company Overview

With a name that translates into ‘The Crazy Chicken’, El Pollo Loco (NASDAQ: LOCO) is a fast food chain known for its citrus-marinated, fire-grilled chicken recipe that hails from the coastal town of Sinaloa, Mexico.

Traditional Fast Food

Traditional fast-food restaurants are renowned for their speed and convenience, boasting menus filled with familiar and budget-friendly items. Their reputations for on-the-go consumption make them favored destinations for individuals and families needing a quick meal. This class of restaurants, however, is fighting the perception that their meals are unhealthy and made with inferior ingredients, a battle that's especially relevant today given the consumers increasing focus on health and wellness.

Sales Growth

Reviewing a company’s long-term performance can reveal insights into its business quality. Any business can have short-term success, but a top-tier one sustains growth for years.

El Pollo Loco is a small restaurant chain, which sometimes brings disadvantages compared to larger competitors benefitting from better brand awareness and economies of scale.

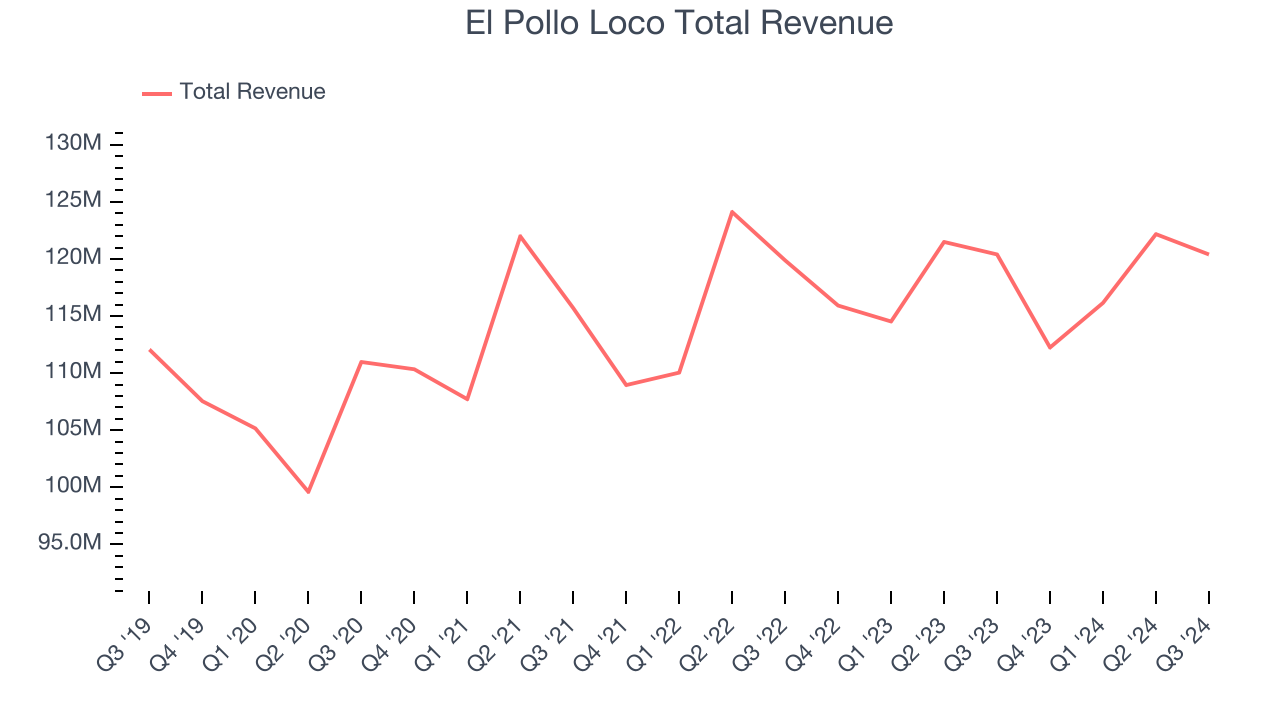

As you can see below, El Pollo Loco’s 1.3% annualized revenue growth over the last five years (we compare to 2019 to normalize for COVID-19 impacts) was weak, but to its credit, it opened new restaurants and increased sales at existing, established dining locations.

This quarter, El Pollo Loco’s $120.4 million of revenue was flat year on year and in line with Wall Street’s estimates.

We also like to judge companies based on their projected revenue growth, but not enough Wall Street analysts cover the company for it to have reliable consensus estimates.

Today’s young investors won’t have read the timeless lessons in Gorilla Game: Picking Winners In High Technology because it was written more than 20 years ago when Microsoft and Apple were first establishing their supremacy. But if we apply the same principles, then enterprise software stocks leveraging their own generative AI capabilities may well be the Gorillas of the future. So, in that spirit, we are excited to present our Special Free Report on a profitable, fast-growing enterprise software stock that is already riding the automation wave and looking to catch the generative AI next.

Restaurant Performance

Number of Restaurants

A restaurant chain’s total number of dining locations influences how much it can sell and how quickly revenue can grow.

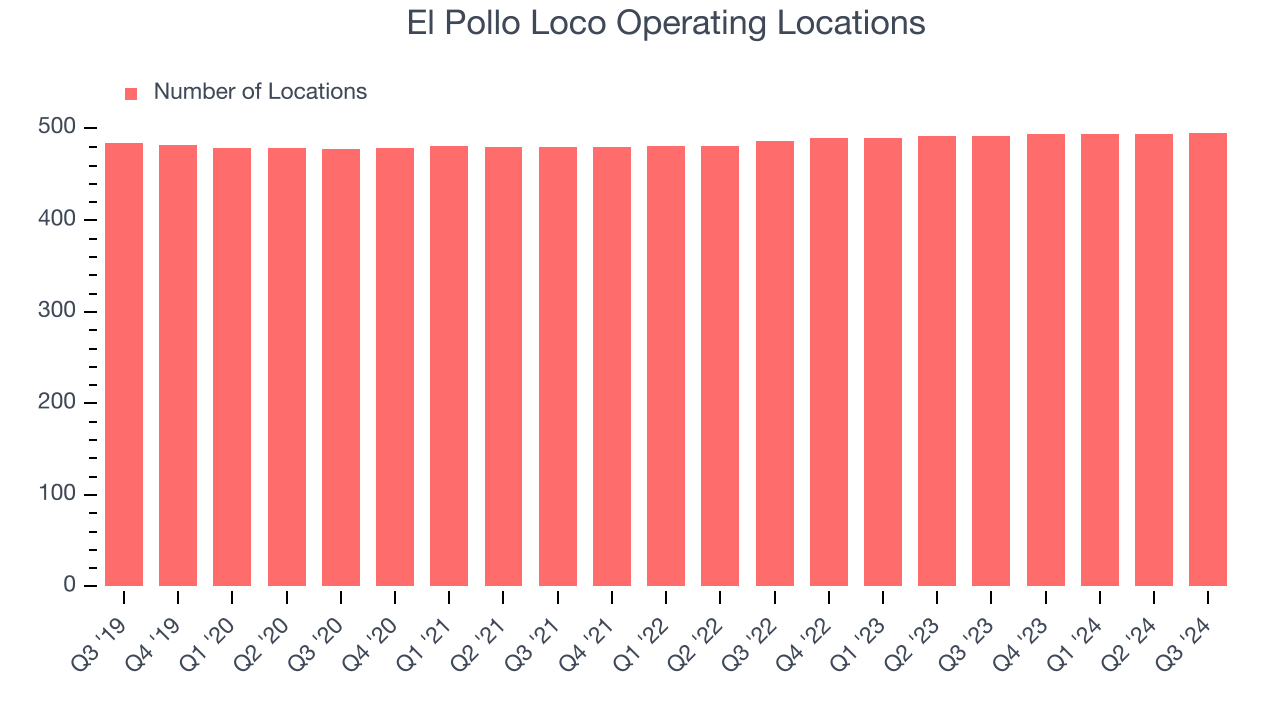

El Pollo Loco operated 496 locations in the latest quarter. It has generally opened new restaurants over the last two years and averaged 1.3% annual growth, faster than the broader restaurant sector.

When a chain opens new restaurants, it usually means it’s investing for growth because there’s healthy demand for its meals and there are markets where the concept has few or no locations.

Same-Store Sales

A company's restaurant base only paints one part of the picture. When demand is high, it makes sense to open more. But when demand is low, it’s prudent to close some locations and use the money in other ways. Same-store sales gives us insight into this topic because it measures organic growth for restaurants open for at least a year.

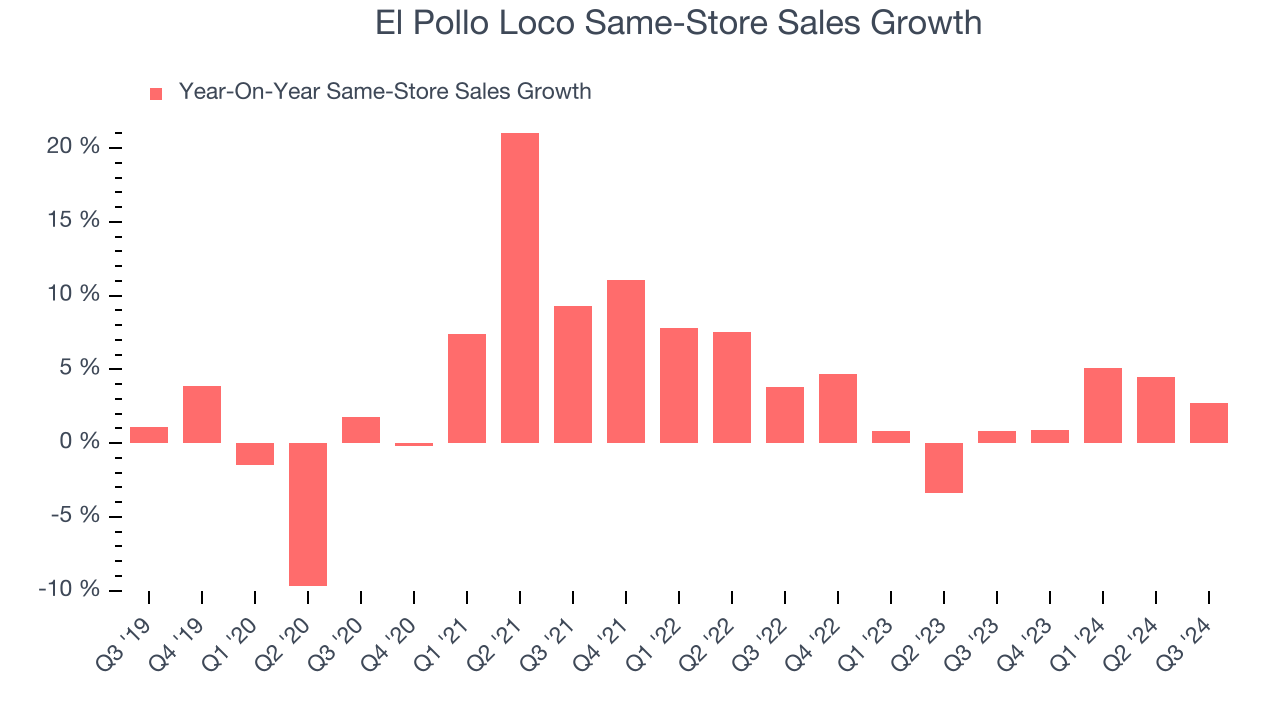

El Pollo Loco’s demand rose over the last two years and slightly outpaced the industry. On average, the company’s same-store sales have grown by 2% per year. This performance suggests its measured rollout of new restaurants could be beneficial for shareholders. When a chain has demand, more locations should help it reach more customers and boost revenue growth.

In the latest quarter, El Pollo Loco’s same-store sales rose 2.7% annually. This growth was an acceleration from the 0.8% year-on-year increase it posted 12 months ago, which is always an encouraging sign.

Key Takeaways from El Pollo Loco’s Q3 Results

We were impressed by how significantly El Pollo Loco blew past analysts’ EBITDA expectations this quarter. We were also excited its EPS outperformed Wall Street’s estimates. On the other hand, its revenue missed analysts’ expectations. Overall, we think this was a decent quarter with some key metrics above expectations. The stock traded up 4.7% to $12.76 immediately following the results.

El Pollo Loco had an encouraging quarter, but one earnings result doesn’t necessarily make the stock a buy. Let’s see if this is a good investment. The latest quarter does matter, but not nearly as much as longer-term fundamentals and valuation, when deciding if the stock is a buy. We cover that in our actionable full research report which you can read here, it’s free.