Specialized equipment manufacturer for infrastructure and vegetation management Alamo Group (NYSE: ALG) met Wall Street’s revenue expectations in Q3 CY2024, but sales fell 4.4% year on year to $401.3 million. Its GAAP profit of $2.28 per share was 7.4% below analysts’ consensus estimates.

Is now the time to buy Alamo? Find out by accessing our full research report, it’s free.

Alamo (ALG) Q3 CY2024 Highlights:

- Revenue: $401.3 million vs analyst estimates of $404.3 million (in line)

- EPS: $2.28 vs analyst expectations of $2.46 (7.4% miss)

- Gross Margin (GAAP): 25.1%, down from 27.2% in the same quarter last year

- Operating Margin: 6.9%, down from 11.9% in the same quarter last year

- Market Capitalization: $2.09 billion

Jeff Leonard, Alamo Group's President, and Chief Executive Officer commented, "Our financial results for the third quarter were largely in line with our expectations given the conditions prevalent in our markets. As we experienced in the second quarter, market activity across our two segments continued to diverge."

Company Overview

Expanding its markets through acquisitions since its founding, Alamo (NSYE:ALG) designs, manufactures, and services vegetation management and infrastructure maintenance equipment for governmental, industrial, and agricultural use.

Agricultural Machinery

Agricultural machinery companies are investing to develop and produce more precise machinery, automated systems, and connected equipment that collects analyzable data to help farmers and other customers improve yields and increase efficiency. On the other hand, agriculture is seasonal and natural disasters or bad weather can impact the entire industry. Additionally, macroeconomic factors such as commodity prices or changes in interest rates–which dictate the willingness of these companies or their customers to invest–can impact demand for agricultural machinery.

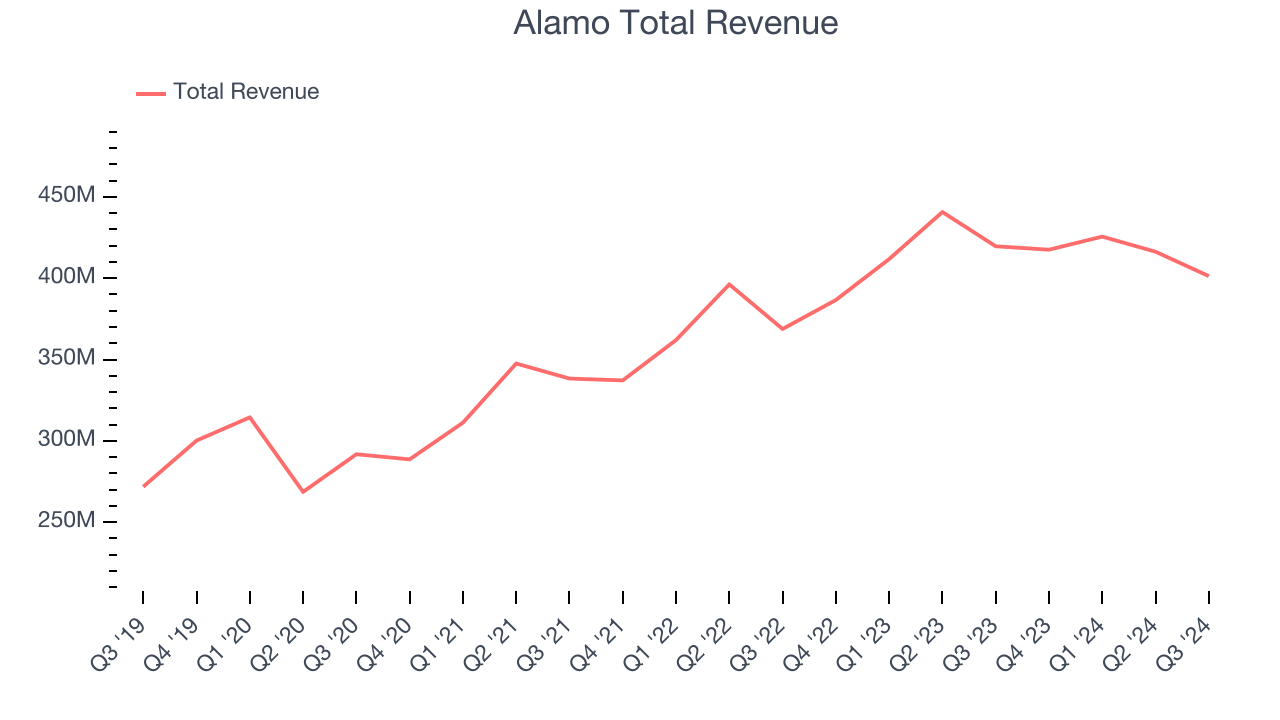

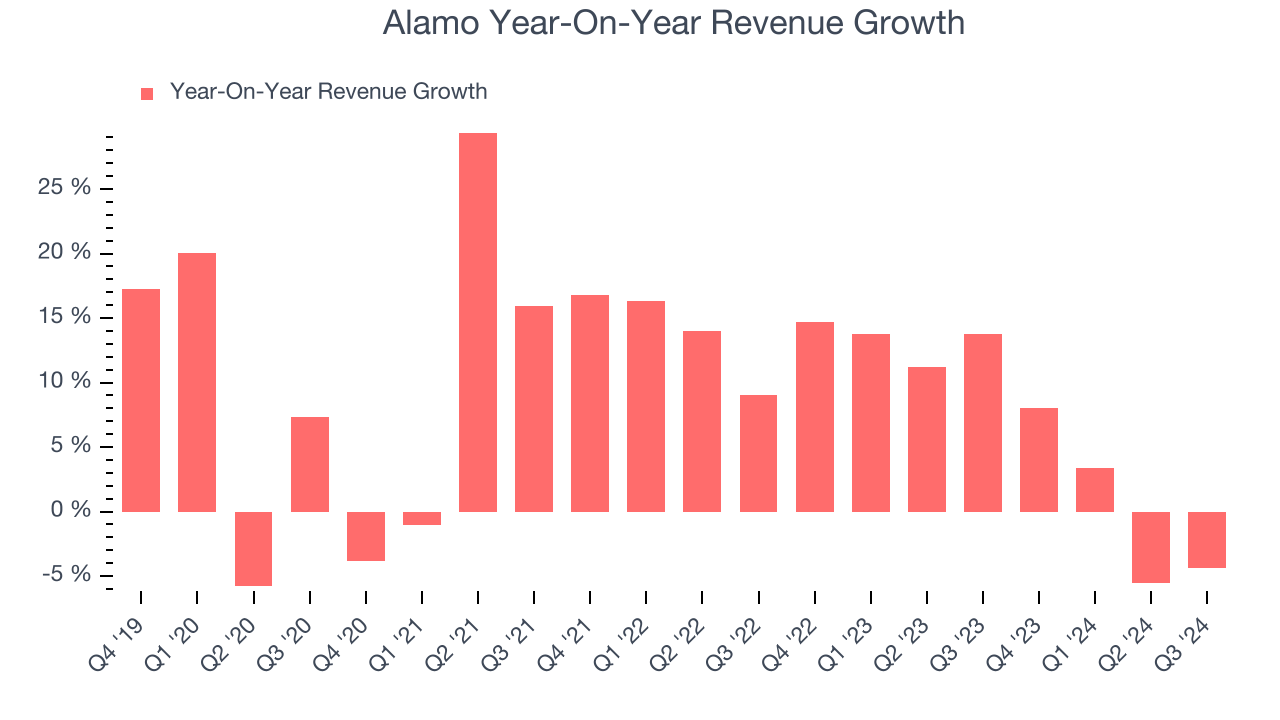

Sales Growth

A company’s long-term performance can indicate its business quality. Any business can put up a good quarter or two, but many enduring ones grow for years. Luckily, Alamo’s sales grew at a solid 9.1% compounded annual growth rate over the last five years. This is a useful starting point for our analysis.

We at StockStory place the most emphasis on long-term growth, but within industrials, a half-decade historical view may miss cycles, industry trends, or a company capitalizing on catalysts such as a new contract win or a successful product line. Alamo’s recent history shows its demand slowed as its annualized revenue growth of 6.5% over the last two years is below its five-year trend.

This quarter, Alamo reported a rather uninspiring 4.4% year-on-year revenue decline to $401.3 million of revenue, in line with Wall Street’s estimates.

Looking ahead, sell-side analysts expect revenue to grow 1.4% over the next 12 months, a deceleration versus the last two years. This projection is underwhelming and illustrates the market thinks its products and services will face some demand challenges.

When a company has more cash than it knows what to do with, buying back its own shares can make a lot of sense–as long as the price is right. Luckily, we’ve found one, a low-priced stock that is gushing free cash flow AND buying back shares. Click here to claim your Special Free Report on a fallen angel growth story that is already recovering from a setback.

Operating Margin

Alamo has done a decent job managing its cost base over the last five years. The company has produced an average operating margin of 9.7%, higher than the broader industrials sector.

Analyzing the trend in its profitability, Alamo’s annual operating margin rose by 1 percentage points over the last five years, as its sales growth gave it operating leverage.

In Q3, Alamo generated an operating profit margin of 6.9%, down 5 percentage points year on year. Since Alamo’s operating margin decreased more than its gross margin, we can assume it was recently less efficient because expenses such as marketing, R&D, and administrative overhead increased.

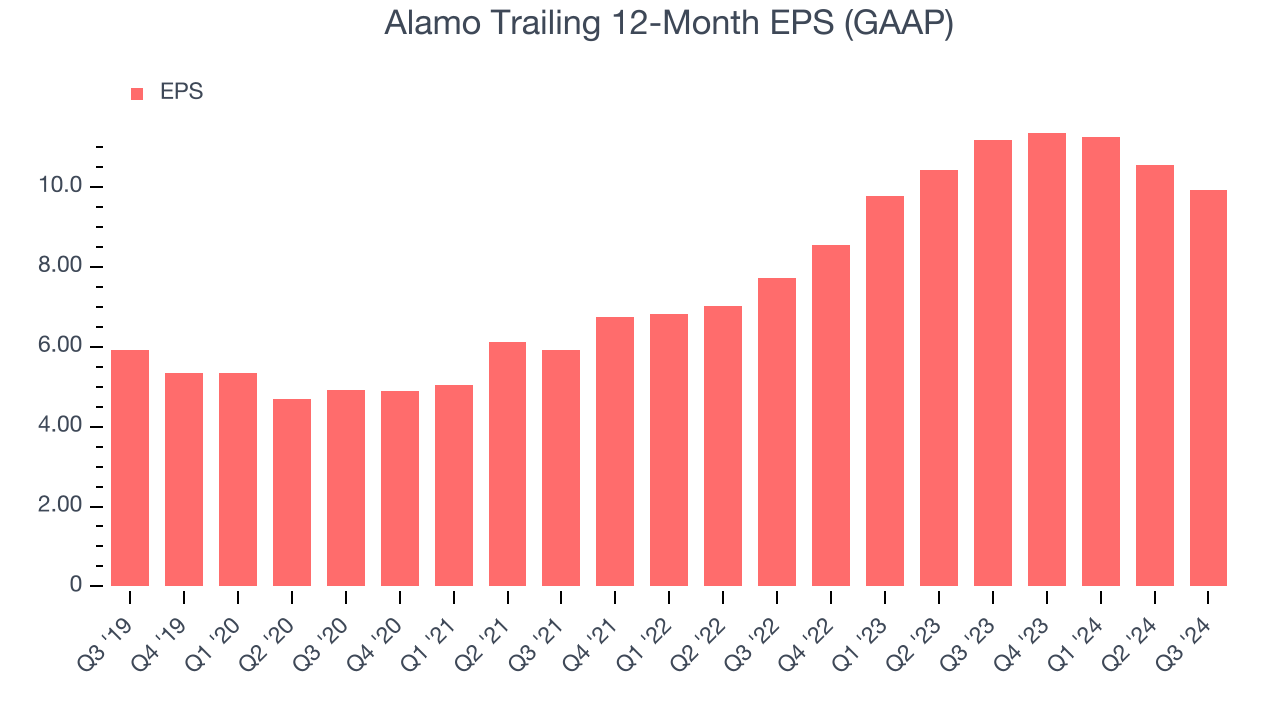

Earnings Per Share

We track the long-term change in earnings per share (EPS) for the same reason as long-term revenue growth. Compared to revenue, however, EPS highlights whether a company’s growth was profitable.

Alamo’s EPS grew at a solid 10.9% compounded annual growth rate over the last five years, higher than its 9.1% annualized revenue growth. This tells us the company became more profitable as it expanded.

We can take a deeper look into Alamo’s earnings to better understand the drivers of its performance. As we mentioned earlier, Alamo’s operating margin declined this quarter but expanded by 1 percentage points over the last five years. This was the most relevant factor (aside from the revenue impact) behind its higher earnings; taxes and interest expenses can also affect EPS but don’t tell us as much about a company’s fundamentals.

Like with revenue, we analyze EPS over a shorter period to see if we are missing a change in the business.

For Alamo, its two-year annual EPS growth of 13.4% was higher than its five-year trend. We love it when earnings growth accelerates, especially when it accelerates off an already high base.In Q3, Alamo reported EPS at $2.28, down from $2.91 in the same quarter last year. This print missed analysts’ estimates, but we care more about long-term EPS growth than short-term movements. Over the next 12 months, Wall Street expects Alamo’s full-year EPS of $9.93 to grow by 12.6%.

Key Takeaways from Alamo’s Q3 Results

We struggled to find many strong positives in these results as its EPS missed and its revenue was in line with Wall Street’s estimates. Overall, this was a softer quarter. The stock remained flat at $170.61 immediately following the results.

So do we think Alamo is an attractive buy at the current price? What happened in the latest quarter matters, but not as much as longer-term business quality and valuation, when deciding whether to invest in this stock. We cover that in our actionable full research report which you can read here, it’s free.