Cloud communications infrastructure company Twilio (NYSE: TWLO) reported Q3 CY2024 results beating Wall Street’s revenue expectations, with sales up 9.7% year on year to $1.13 billion. The company expects next quarter’s revenue to be around $1.16 billion, close to analysts’ estimates. Its non-GAAP profit of $1.02 per share was also 19.1% above analysts’ consensus estimates.

Is now the time to buy Twilio? Find out by accessing our full research report, it’s free.

Twilio (TWLO) Q3 CY2024 Highlights:

- Revenue: $1.13 billion vs analyst estimates of $1.09 billion (3.7% beat)

- Adjusted EPS: $1.02 vs analyst estimates of $0.86 (19.1% beat)

- Adjusted Operating Income: $182.4 million vs analyst estimates of $166.3 million (9.7% beat)

- Revenue Guidance for Q4 CY2024 is $1.16 billion at the midpoint, roughly in line with what analysts were expecting

- Adjusted EPS guidance for Q4 CY2024 is $0.98 at the midpoint, above analyst estimates of $0.87

- Gross Margin (GAAP): 51%, up from 50% in the same quarter last year

- Operating Margin: -0.4%, up from -10.5% in the same quarter last year

- Free Cash Flow Margin: 16.7%, down from 18.3% in the previous quarter

- Net Revenue Retention Rate: 105%, up from 102% in the previous quarter

- Customers: 320,000, up from 316,000 in the previous quarter

- Billings: $1.13 billion at quarter end, up 9% year on year

- Market Capitalization: $11.45 billion

Company Overview

Founded in 2008 by Jeff Lawson, a former engineer at Amazon, Twilio (NYSE: TWLO) is a software as a service platform that makes it really easy for software developers to use text messaging, voice calls and other forms of communication in their apps.

Communications Platform

The first shift towards voice communication over the internet (VOIP), rather than traditional phone networks, happened when the enterprises started replacing business phones with the cheaper VOIP technology. Today, the rise of the consumer internet has increased the need for two way audio and video functionality in applications, driving demand for software tools and platforms that enable this utility.

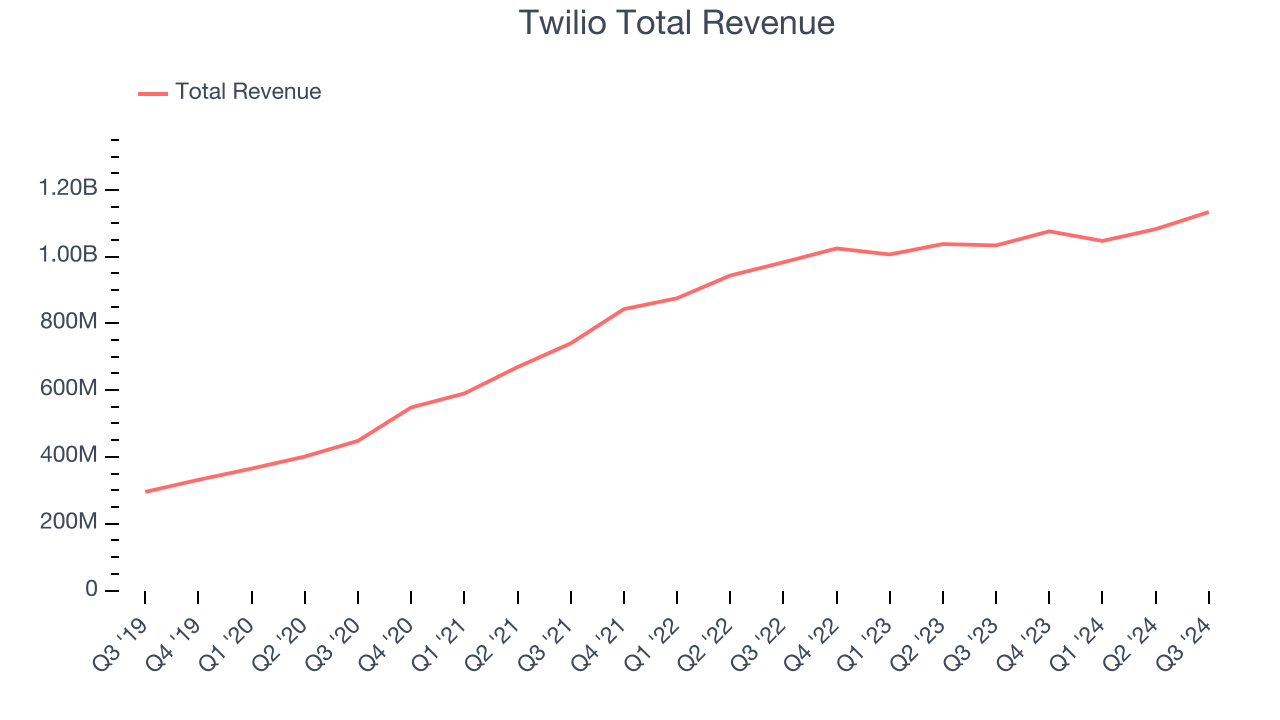

Sales Growth

A company’s long-term performance can indicate its business quality. Any business can put up a good quarter or two, but many enduring ones grow for years. Over the last three years, Twilio grew its sales at a mediocre 19.4% compounded annual growth rate. This shows it couldn’t expand in any major way, a tough starting point for our analysis.

This quarter, Twilio reported year-on-year revenue growth of 9.7%, and its $1.13 billion of revenue exceeded Wall Street’s estimates by 3.7%. Management is currently guiding for a 7.3% year-on-year increase next quarter.

Looking further ahead, sell-side analysts expect revenue to grow 5.9% over the next 12 months, a deceleration versus the last three years. This projection is underwhelming and shows the market thinks its products and services will face some demand challenges.

Unless you’ve been living under a rock, it should be obvious by now that generative AI is going to have a huge impact on how large corporations do business. While Nvidia and AMD are trading close to all-time highs, we prefer a lesser-known (but still profitable) semiconductor stock benefitting from the rise of AI. Click here to access our free report on our favorite semiconductor growth story.

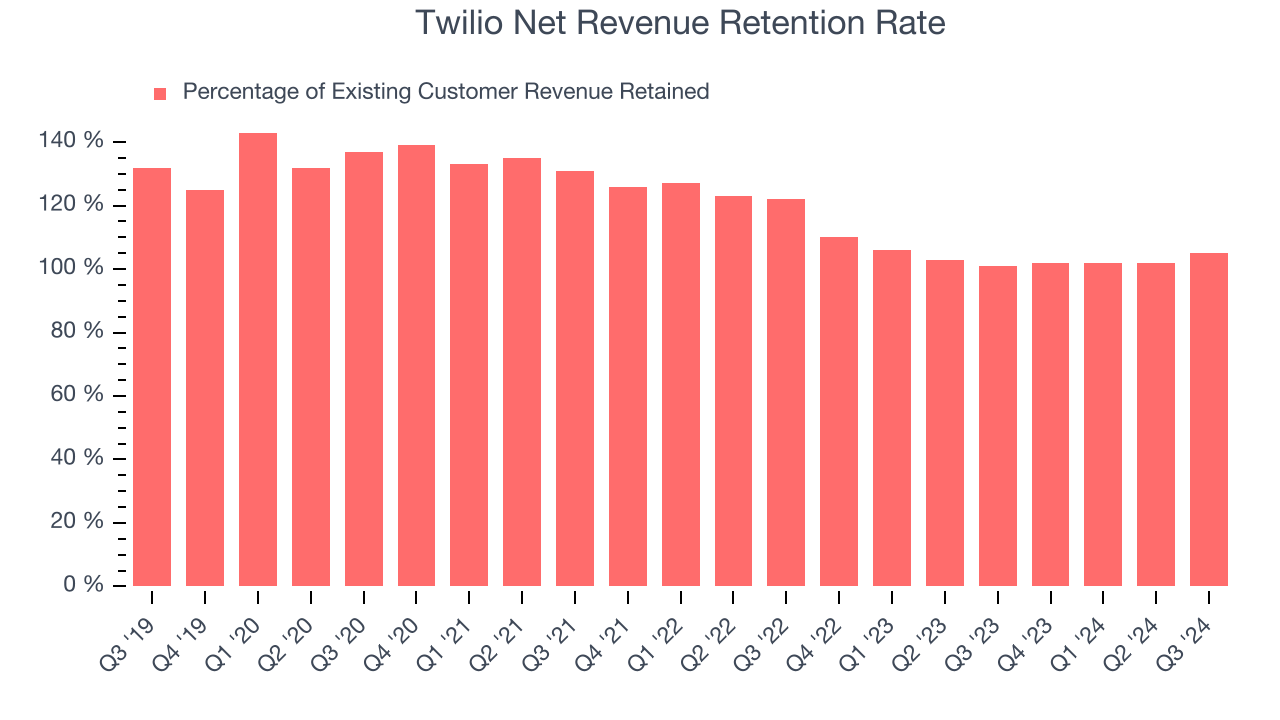

Customer Retention

One of the best parts about the software-as-a-service business model (and a reason why they trade at high valuation multiples) is that customers typically spend more on a company’s products and services over time.

Twilio’s net revenue retention rate, a key performance metric measuring how much money existing customers from a year ago are spending today, was 103% in Q3. This means that even if Twilio didn’t win any new customers over the last 12 months, it would’ve grown its revenue by 2.8%.

Trending up over the last year, Twilio has an adequate net retention rate, showing us that it generally keeps customers but lags behind the best SaaS businesses, which routinely post net retention rates of 120%+.

Key Takeaways from Twilio’s Q3 Results

We were impressed by Twilio’s optimistic EPS forecast for next quarter, which blew past analysts’ expectations. We were also excited its billings outperformed Wall Street’s estimates. Zooming out, we think this quarter featured some important positives. The stock traded up 7.3% to $75.70 immediately after reporting.

Indeed, Twilio had a rock-solid quarterly earnings result, but is this stock a good investment here? The latest quarter does matter, but not nearly as much as longer-term fundamentals and valuation, when deciding if the stock is a buy. We cover that in our actionable full research report which you can read here, it’s free.