Industrial conglomerate SPX Technologies (NYSE: SPXC) missed Wall Street’s revenue expectations in Q3 CY2024, but sales rose 7.8% year on year to $483.7 million. The company’s full-year revenue guidance of $1.99 billion at the midpoint also came in slightly below analysts’ estimates. Its non-GAAP profit of $1.39 per share was 2.5% above analysts’ consensus estimates.

Is now the time to buy SPX Technologies? Find out by accessing our full research report, it’s free.

SPX Technologies (SPXC) Q3 CY2024 Highlights:

- Revenue: $483.7 million vs analyst estimates of $499.6 million (3.2% miss)

- Adjusted EPS: $1.39 vs analyst estimates of $1.36 (2.5% beat)

- EBITDA: $104 million vs analyst estimates of $105.2 million (1.2% miss)

- The company dropped its revenue guidance for the full year to $1.99 billion at the midpoint from $2.00 billion, a 0.5% decrease

- Gross Margin (GAAP): 40.9%, up from 38.1% in the same quarter last year

- Operating Margin: 16.3%, up from 12.9% in the same quarter last year

- EBITDA Margin: 21.5%, in line with the same quarter last year

- Free Cash Flow Margin: 9%, up from 6.1% in the same quarter last year

- Market Capitalization: $7.37 billion

Company Overview

SPX Technologies (NYSE: SPXC) is an industrial conglomerate catering to the energy, manufacturing, automotive, and aerospace sectors.

Gas and Liquid Handling

Gas and liquid handling companies possess the technical know-how and specialized equipment to handle valuable (and sometimes dangerous) substances. Lately, water conservation and carbon capture–which requires hydrogen and other gasses as well as specialized infrastructure–have been trending up, creating new demand for products such as filters, pumps, and valves. On the other hand, gas and liquid handling companies are at the whim of economic cycles. Consumer spending and interest rates, for example, can greatly impact the industrial production that drives demand for these companies’ offerings.

Sales Growth

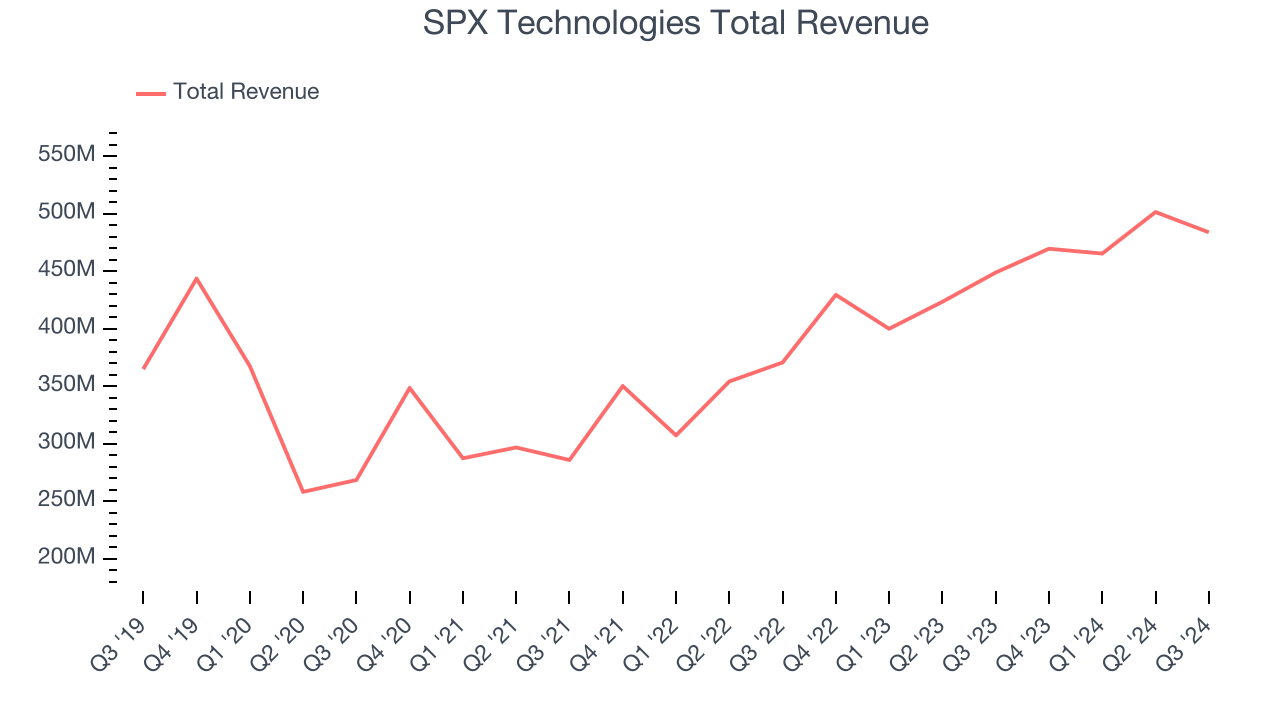

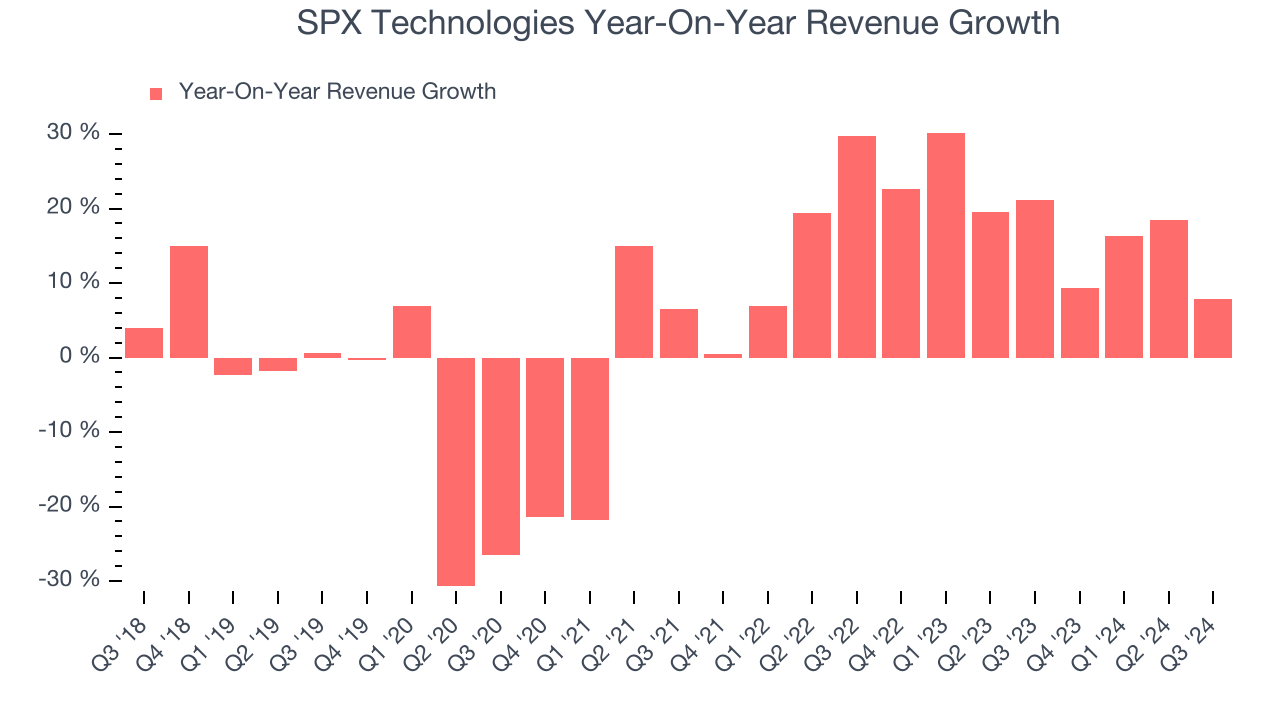

A company’s long-term performance is an indicator of its overall business quality. While any business can experience short-term success, top-performing ones enjoy sustained growth for multiple years. Unfortunately, SPX Technologies’s 4.7% annualized revenue growth over the last five years was tepid. This shows it failed to expand in any major way, a rough starting point for our analysis.

We at StockStory place the most emphasis on long-term growth, but within industrials, a half-decade historical view may miss cycles, industry trends, or a company capitalizing on catalysts such as a new contract win or a successful product line. SPX Technologies’s annualized revenue growth of 17.9% over the last two years is above its five-year trend, suggesting its demand recently accelerated.

This quarter, SPX Technologies’s revenue grew 7.8% year on year to $483.7 million, missing Wall Street’s estimates.

Looking ahead, sell-side analysts expect revenue to grow 8.3% over the next 12 months, a deceleration versus the last two years. This projection is still above the sector average and shows the market is factoring in some success for its newer products and services.

Here at StockStory, we certainly understand the potential of thematic investing. Diverse winners from Microsoft (MSFT) to Alphabet (GOOG), Coca-Cola (KO) to Monster Beverage (MNST) could all have been identified as promising growth stories with a megatrend driving the growth. So, in that spirit, we’ve identified a relatively under-the-radar profitable growth stock benefitting from the rise of AI, available to you FREE via this link.

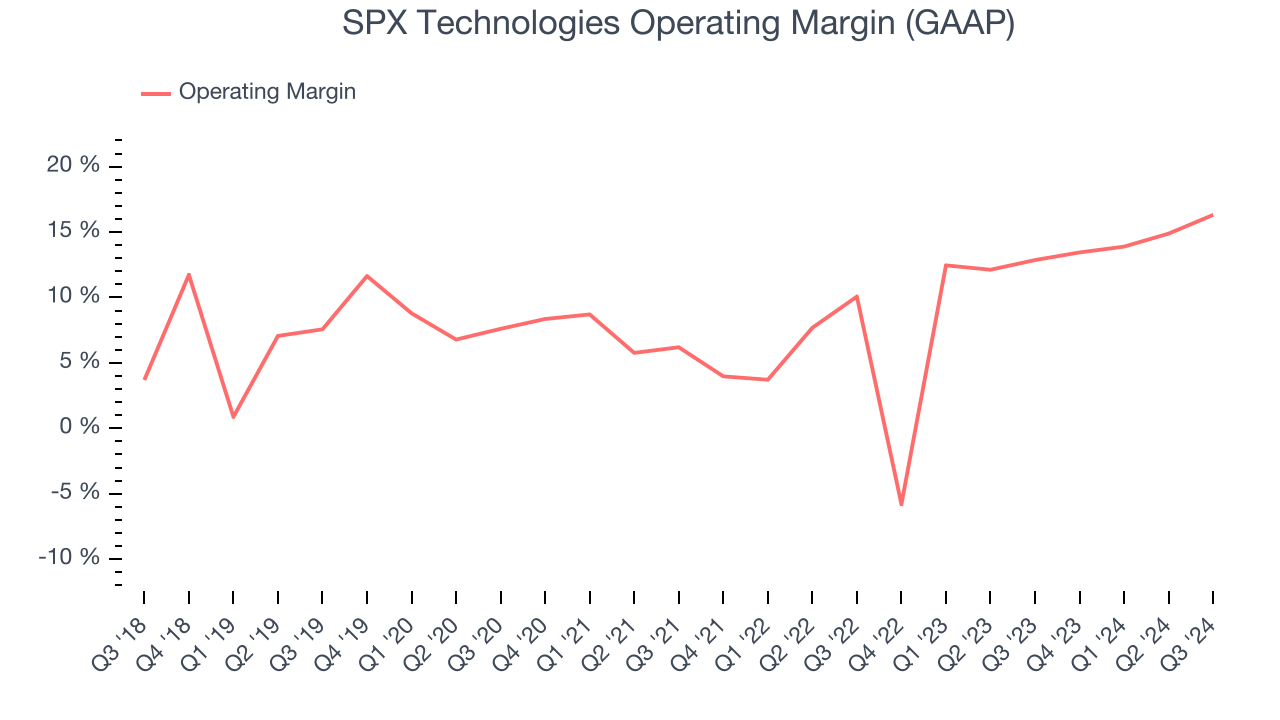

Operating Margin

SPX Technologies has done a decent job managing its cost base over the last five years. The company has produced an average operating margin of 9.5%, higher than the broader industrials sector.

Looking at the trend in its profitability, SPX Technologies’s annual operating margin rose by 5.5 percentage points over the last five years, showing its efficiency has meaningfully improved.

This quarter, SPX Technologies generated an operating profit margin of 16.3%, up 3.5 percentage points year on year. The increase was encouraging, and since its operating margin rose more than its gross margin, we can infer it was recently more efficient with expenses such as marketing, R&D, and administrative overhead.

Earnings Per Share

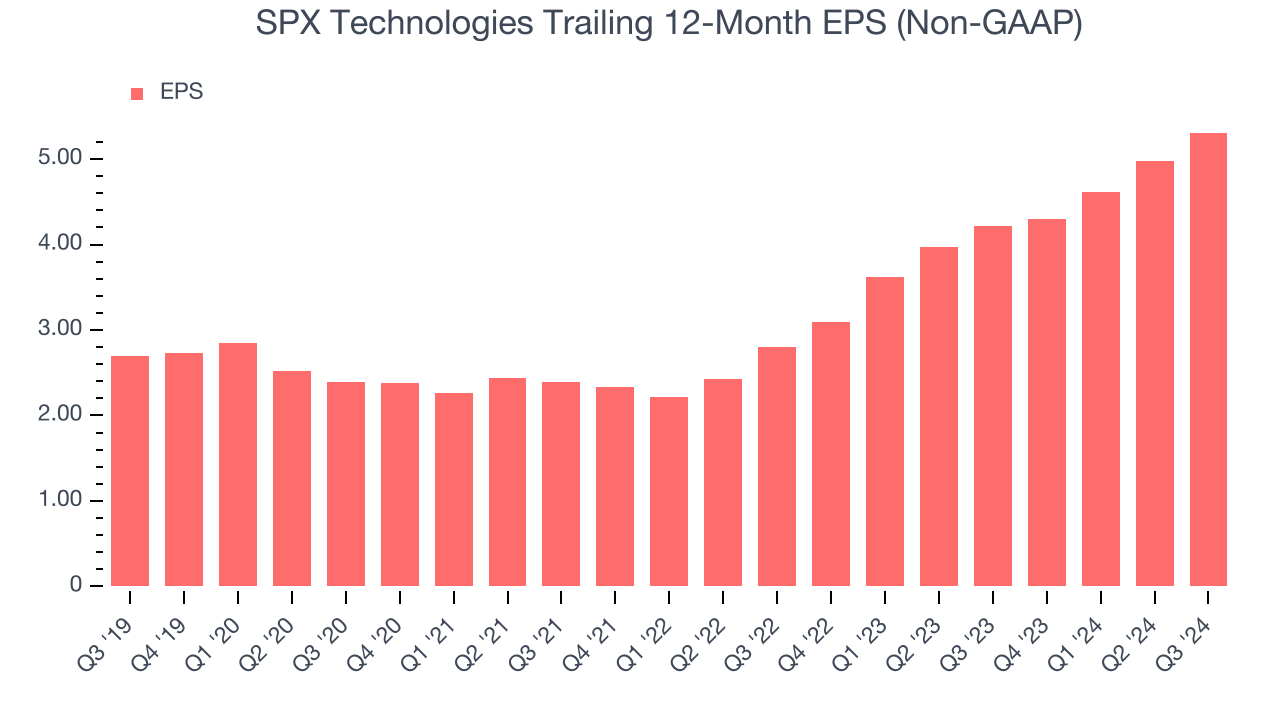

Analyzing revenue trends tells us about a company’s historical growth, but the long-term change in its earnings per share (EPS) points to the profitability of that growth – for example, a company could inflate its sales through excessive spending on advertising and promotions.

SPX Technologies’s EPS grew at a remarkable 14.5% compounded annual growth rate over the last five years, higher than its 4.7% annualized revenue growth. This tells us the company became more profitable as it expanded.

We can take a deeper look into SPX Technologies’s earnings quality to better understand the drivers of its performance. As we mentioned earlier, SPX Technologies’s operating margin expanded by 5.5 percentage points over the last five years. This was the most relevant factor (aside from the revenue impact) behind its higher earnings; taxes and interest expenses can also affect EPS but don’t tell us as much about a company’s fundamentals.

Like with revenue, we analyze EPS over a more recent period because it can give insight into an emerging theme or development for the business.

For SPX Technologies, its two-year annual EPS growth of 37.7% was higher than its five-year trend. We love it when earnings growth accelerates, especially when it accelerates off an already high base.In Q3, SPX Technologies reported EPS at $1.39, up from $1.06 in the same quarter last year. This print beat analysts’ estimates by 2.5%. Over the next 12 months, Wall Street expects SPX Technologies’s full-year EPS of $5.31 to grow by 11.5%.

Key Takeaways from SPX Technologies’s Q3 Results

We struggled to find many strong positives in these results as its revenue and EBITDA fell short of Wall Street’s estimates. It also lowered its full-year revenue guidance. Overall, this was a softer quarter. The stock traded down 5.4% to $150.39 immediately after reporting.

SPX Technologies’s earnings report left more to be desired. Let’s look forward to see if this quarter has created an opportunity to buy the stock. What happened in the latest quarter matters, but not as much as longer-term business quality and valuation, when deciding whether to invest in this stock. We cover that in our actionable full research report which you can read here, it’s free.