Chicken producer Pilgrim’s Pride (NASDAQ: PPC) missed Wall Street’s revenue expectations in Q3 CY2024, but sales rose 5.2% year on year to $4.58 billion. Its non-GAAP profit of $1.63 per share was 18.1% above analysts’ consensus estimates.

Is now the time to buy Pilgrim's Pride? Find out by accessing our full research report, it’s free.

Pilgrim's Pride (PPC) Q3 CY2024 Highlights:

- Revenue: $4.58 billion vs analyst estimates of $4.69 billion (2.2% miss)

- Adjusted EPS: $1.63 vs analyst estimates of $1.38 (18.1% beat)

- EBITDA: $660.4 million vs analyst estimates of $583.2 million (13.2% beat)

- Gross Margin (GAAP): 14.9%, up from 7.9% in the same quarter last year

- Operating Margin: 11.1%, up from 4.7% in the same quarter last year

- EBITDA Margin: 14.4%, up from 7.4% in the same quarter last year

- Free Cash Flow Margin: 7.3%, up from 3.8% in the same quarter last year

- Market Capitalization: $11.4 billion

“Throughout the quarter, we continued to emphasize operational excellence, diversify our portfolio and cultivate partnerships with Key Customers to drive value for the consumer. Our unrelenting focus on quality, service and innovation is reflected in our performance,” said Fabio Sandri, Pilgrim’s President and Chief Executive Officer.

Company Overview

Offering everything from pre-marinated to frozen chicken, Pilgrim’s Pride (NASDAQ: PPC) produces, processes, and distributes chicken products to retailers and food service customers.

Perishable Food

The perishable food industry is diverse, encompassing large-scale producers and distributors to specialty and artisanal brands. These companies sell produce, dairy products, meats, and baked goods and have become integral to serving modern American consumers who prioritize freshness, quality, and nutritional value. Investing in perishable food stocks presents both opportunities and challenges. While the perishable nature of products can introduce risks related to supply chain management and shelf life, it also creates a constant demand driven by the necessity for fresh food. Companies that can efficiently manage inventory, distribution, and quality control are well-positioned to thrive in this competitive market. Navigating the perishable food industry requires adherence to strict food safety standards, regulations, and labeling requirements.

Sales Growth

Examining a company’s long-term performance can provide clues about its business quality. Any business can put up a good quarter or two, but the best consistently grow over the long haul.

Pilgrim's Pride is larger than most consumer staples companies and benefits from economies of scale, enabling it to gain more leverage on fixed costs than its smaller competitors.

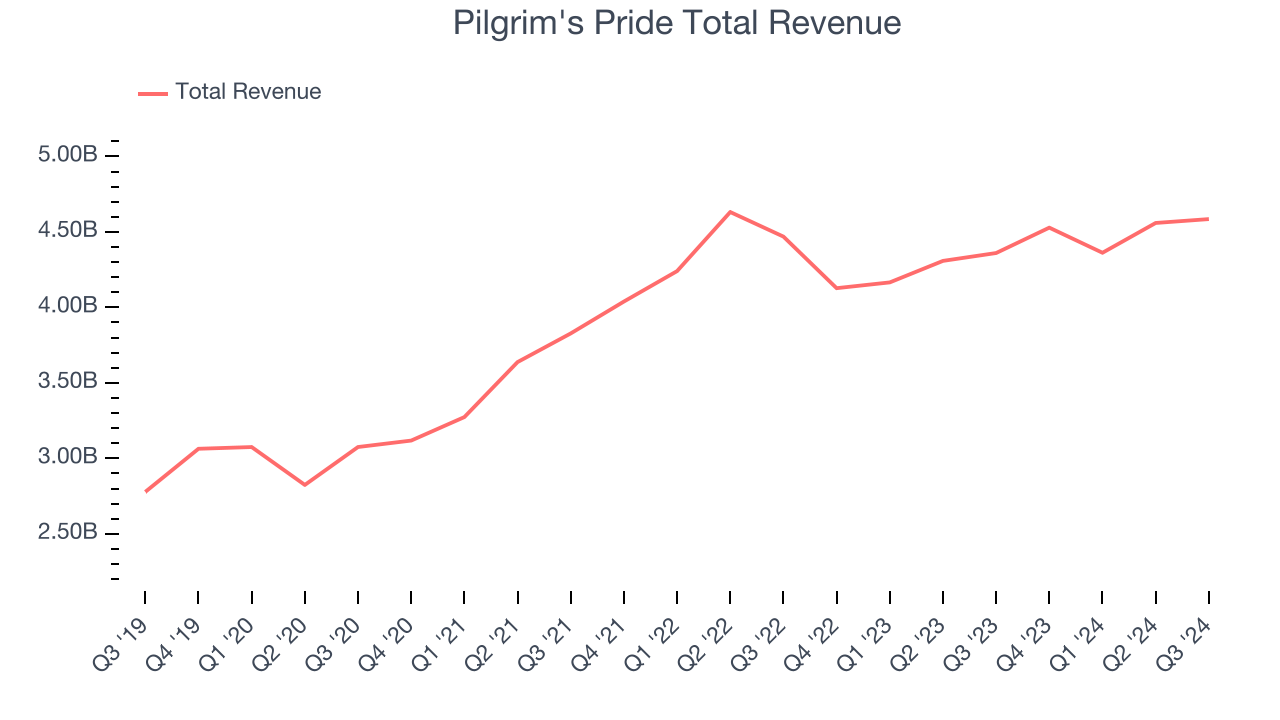

As you can see below, Pilgrim's Pride grew its sales at a decent 9.2% compounded annual growth rate over the last three years. This shows there was demand for its offerings, a useful starting point for our analysis.

This quarter, Pilgrim's Pride’s revenue grew 5.2% year on year to $4.58 billion, missing Wall Street’s estimates.

Looking ahead, sell-side analysts expect revenue to grow 1.9% over the next 12 months, a deceleration versus the last three years. This projection doesn't excite us and shows the market believes its products will see some demand headwinds.

When a company has more cash than it knows what to do with, buying back its own shares can make a lot of sense–as long as the price is right. Luckily, we’ve found one, a low-priced stock that is gushing free cash flow AND buying back shares. Click here to claim your Special Free Report on a fallen angel growth story that is already recovering from a setback.

Cash Is King

If you’ve followed StockStory for a while, you know we emphasize free cash flow. Why, you ask? We believe that in the end, cash is king, and you can’t use accounting profits to pay the bills.

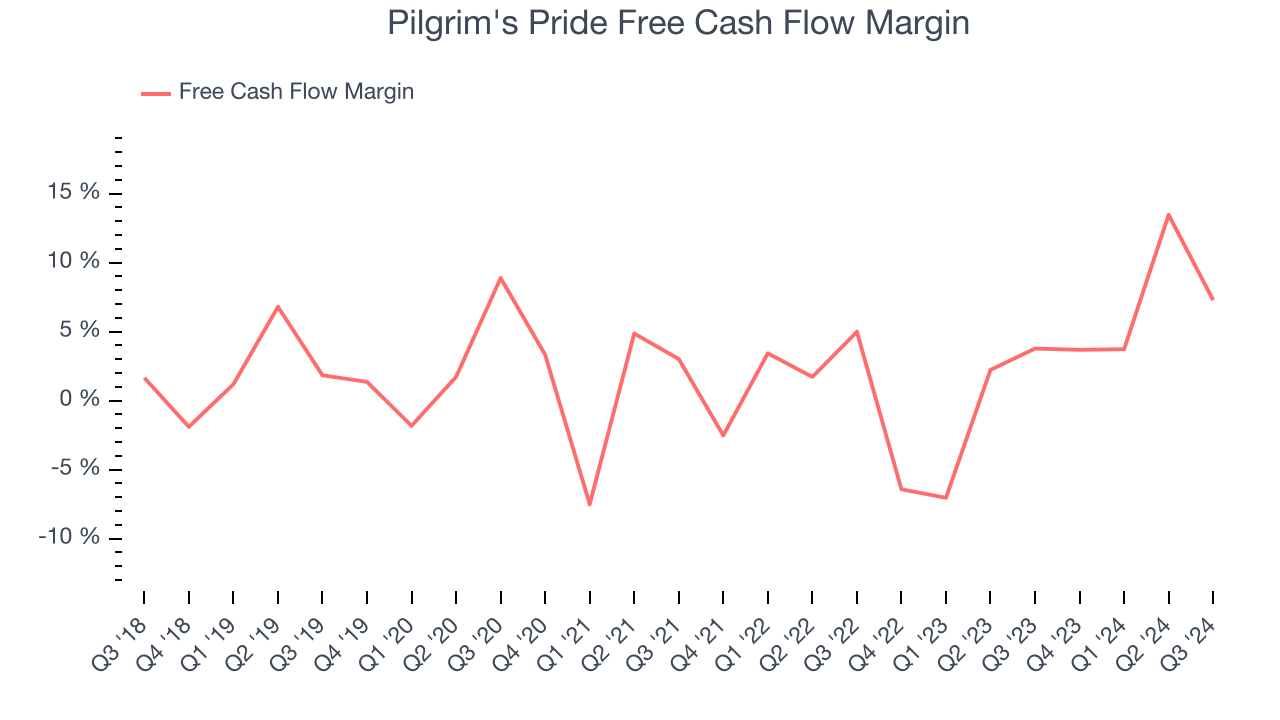

Pilgrim's Pride has shown weak cash profitability over the last two years, giving the company limited opportunities to return capital to shareholders. Its free cash flow margin averaged 2.8%, subpar for a consumer staples business.

Taking a step back, an encouraging sign is that Pilgrim's Pride’s margin expanded by 8.8 percentage points during that time. The company’s improvement shows it’s heading in the right direction, and because its free cash flow profitability rose more than its operating profitability, continued increases could signal it’s becoming a less capital-intensive business.

Pilgrim's Pride’s free cash flow clocked in at $334.2 million in Q3, equivalent to a 7.3% margin. This result was good as its margin was 3.5 percentage points higher than in the same quarter last year, building on its favorable historical trend.

Key Takeaways from Pilgrim's Pride’s Q3 Results

We were impressed by how significantly Pilgrim's Pride blew past analysts’ gross margin expectations this quarter. We were also excited its EBITDA outperformed Wall Street’s estimates. On the other hand, its revenue missed analysts’ expectations. Overall, we think this was a mixed quarter. The stock remained flat at $47.69 immediately after reporting.

So should you invest in Pilgrim's Pride right now? The latest quarter does matter, but not nearly as much as longer-term fundamentals and valuation, when deciding if the stock is a buy. We cover that in our actionable full research report which you can read here, it’s free.