Online marketplace Etsy (NASDAQ: ETSY) reported Q3 CY2024 results exceeding the market’s revenue expectations, with sales up 4.1% year on year to $662.4 million. Its GAAP profit of $0.45 per share was 15.4% below analysts’ consensus estimates.

Is now the time to buy Etsy? Find out by accessing our full research report, it’s free.

Etsy (ETSY) Q3 CY2024 Highlights:

- Revenue: $662.4 million vs analyst estimates of $652.4 million (1.5% beat)

- EPS: $0.45 vs analyst expectations of $0.53 (15.4% miss)

- EBITDA: $183.6 million vs analyst estimates of $177.3 million (3.6% beat)

- Gross Margin (GAAP): 72%, up from 70.3% in the same quarter last year

- Operating Margin: 13.1%, in line with the same quarter last year

- EBITDA Margin: 27.7%, in line with the same quarter last year

- Free Cash Flow Margin: 30.9%, up from 21.7% in the previous quarter

- Active Buyers: 96.71 million, in line with the same quarter last year

- Market Capitalization: $5.45 billion

"Our third quarter consolidated results came in roughly as anticipated, with some incremental pressure on Etsy marketplace year-over-year GMS, healthy growth in revenue, and continued strength in our adjusted EBITDA profitability," said CEO Josh Silverman.

Company Overview

Founded by a struggling amateur furniture maker Robert Kalin and his two friends, Etsy (NASDAQ: ETSY) is one of the world’s largest online marketplaces, focusing on handmade or vintage items.

Online Marketplace

Marketplaces have existed for centuries. Where once it was a main street in a small town or a mall in the suburbs, sellers benefitted from proximity to one another because they could draw customers by offering convenience and selection. Today, a myriad of online marketplaces fulfill that same role, aggregating large customer bases, which attracts commission-paying sellers, generating flywheel scale effects that feed back into further customer acquisition.

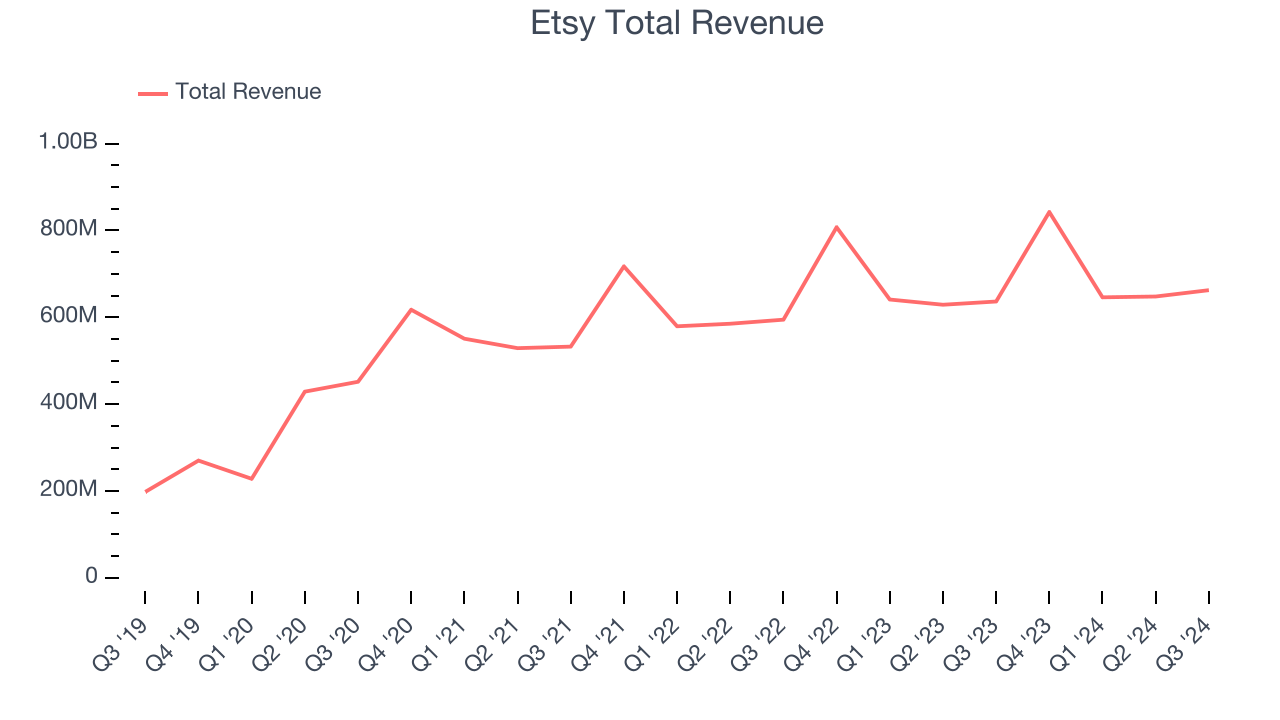

Sales Growth

A company’s long-term performance can give signals about its business quality. Even a bad business can shine for one or two quarters, but a top-tier one grows for years. Regrettably, Etsy’s sales grew at a tepid 7.9% compounded annual growth rate over the last three years. This shows it failed to expand in any major way, a rough starting point for our analysis.

This quarter, Etsy reported modest year-on-year revenue growth of 4.1% but beat Wall Street’s estimates by 1.5%.

Looking ahead, sell-side analysts expect revenue to grow 2.7% over the next 12 months, a deceleration versus the last three years. This projection doesn't excite us and shows the market thinks its products and services will face some demand challenges.

Here at StockStory, we certainly understand the potential of thematic investing. Diverse winners from Microsoft (MSFT) to Alphabet (GOOG), Coca-Cola (KO) to Monster Beverage (MNST) could all have been identified as promising growth stories with a megatrend driving the growth. So, in that spirit, we’ve identified a relatively under-the-radar profitable growth stock benefitting from the rise of AI, available to you FREE via this link.

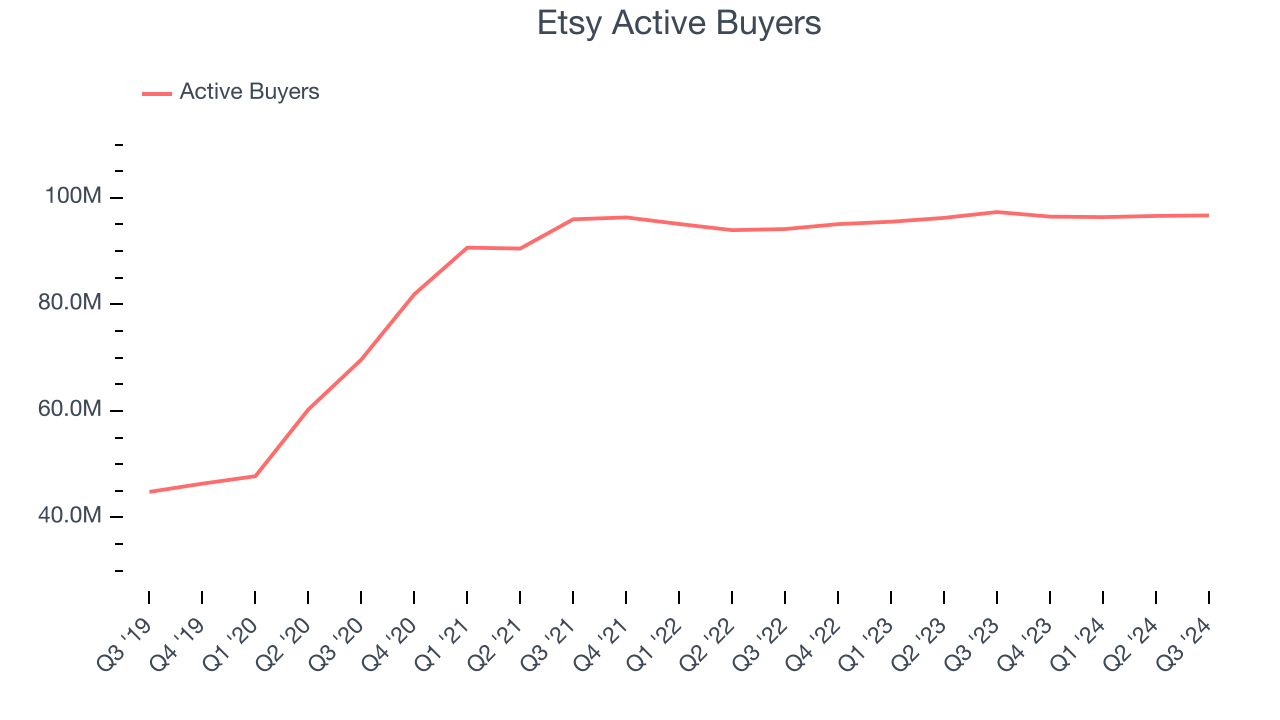

Active Buyers

Buyer Growth

As an online marketplace, Etsy generates revenue growth by increasing both the number of buyers on its platform and the average order size in dollars.

Etsy struggled to engage its active buyers over the last two years as they have been flat at 96.71 million. This performance isn't ideal because internet usage is secular. If Etsy wants to accelerate growth, it must enhance the appeal of its current offerings or innovate with new products.

Unfortunately, Etsy’s active buyers were once again flat year on year in Q3. The quarterly print was lower than its two-year result, suggesting its new initiatives aren’t moving the needle for buyers yet.

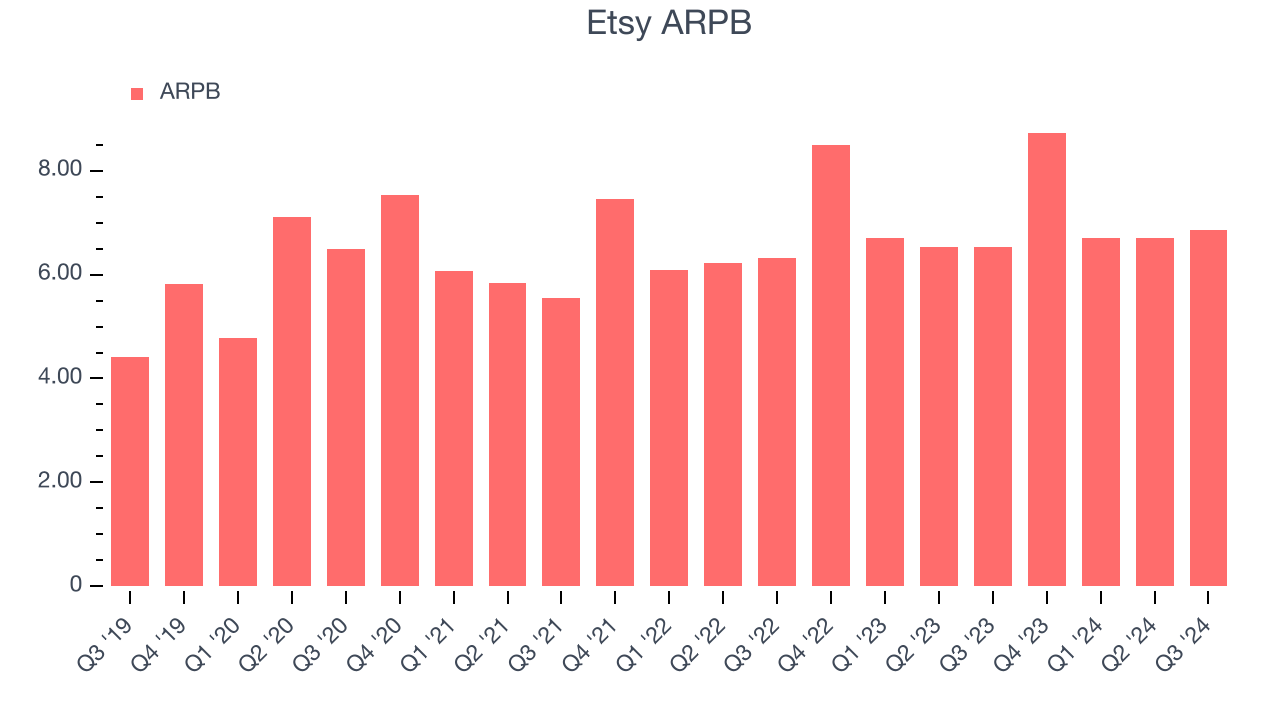

Revenue Per Buyer

Average revenue per buyer (ARPB) is a critical metric to track for consumer internet businesses like Etsy because it measures how much the company earns in transaction fees from each buyer. ARPB also gives us unique insights into a user’s average order size and Etsy’s take rate, or "cut", on each order.

Etsy’s ARPB growth has been decent over the last two years, averaging 5.3%. Although its active buyers were flat during this time, the company’s ability to increase monetization demonstrates its platform’s value for existing buyers.

This quarter, Etsy’s ARPB clocked in at $6.85. It grew 4.8% year on year, faster than its active buyers.

Key Takeaways from Etsy’s Q3 Results

It was good to see Etsy beat analysts’ revenue, EBITDA, and EPS expectations this quarter. Overall, this was a good quarter. The stock traded up 12.7% to $54.10 immediately following the results.

So should you invest in Etsy right now? The latest quarter does matter, but not nearly as much as longer-term fundamentals and valuation, when deciding if the stock is a buy. We cover that in our actionable full research report which you can read here, it’s free.