Aerospace and defense company Curtiss-Wright (NYSE: CW) reported revenue ahead of Wall Street’s expectations in Q3 CY2024, with sales up 10.3% year on year to $798.9 million. The company expects the full year’s revenue to be around $3.07 billion, close to analysts’ estimates. Its GAAP profit of $2.89 per share was also 7.6% above analysts’ consensus estimates.

Is now the time to buy Curtiss-Wright? Find out by accessing our full research report, it’s free.

Curtiss-Wright (CW) Q3 CY2024 Highlights:

- Revenue: $798.9 million vs analyst estimates of $757.7 million (5.4% beat)

- EPS: $2.89 vs analyst estimates of $2.69 (7.6% beat)

- The company lifted its revenue guidance for the full year to $3.07 billion at the midpoint from $3.04 billion, a 1.2% increase

- EPS (GAAP) guidance for the full year is $10.65 at the midpoint, beating analyst estimates by 1.1%

- Gross Margin (GAAP): 45.6%, up from 38.9% in the same quarter last year

- Operating Margin: 18.1%, in line with the same quarter last year

- Free Cash Flow Margin: 20.4%, up from 18.9% in the same quarter last year

- Market Capitalization: $13.56 billion

"Curtiss-Wright achieved strong third quarter results, highlighted by mid-teens revenue growth in our A&D end markets, a better-than-expected operational performance in our Defense Electronics segment and a 17% year-over-year increase in Adjusted diluted EPS," said Lynn M. Bamford, Chair and CEO of Curtiss-Wright Corporation.

Company Overview

Formed from a merger of 12 companies, Curtiss-Wright (NYSE: CW) provides a range of products and services to the aerospace, industrial, electronic, and maritime industries.

Aerospace

Aerospace companies often possess technical expertise and have made significant capital investments to produce complex products. It is an industry where innovation is important, and lately, emissions and automation are in focus, so companies that boast advances in these areas can take market share. On the other hand, demand for aerospace products can ebb and flow with economic cycles and geopolitical tensions, which can be particularly painful for companies with high fixed costs.

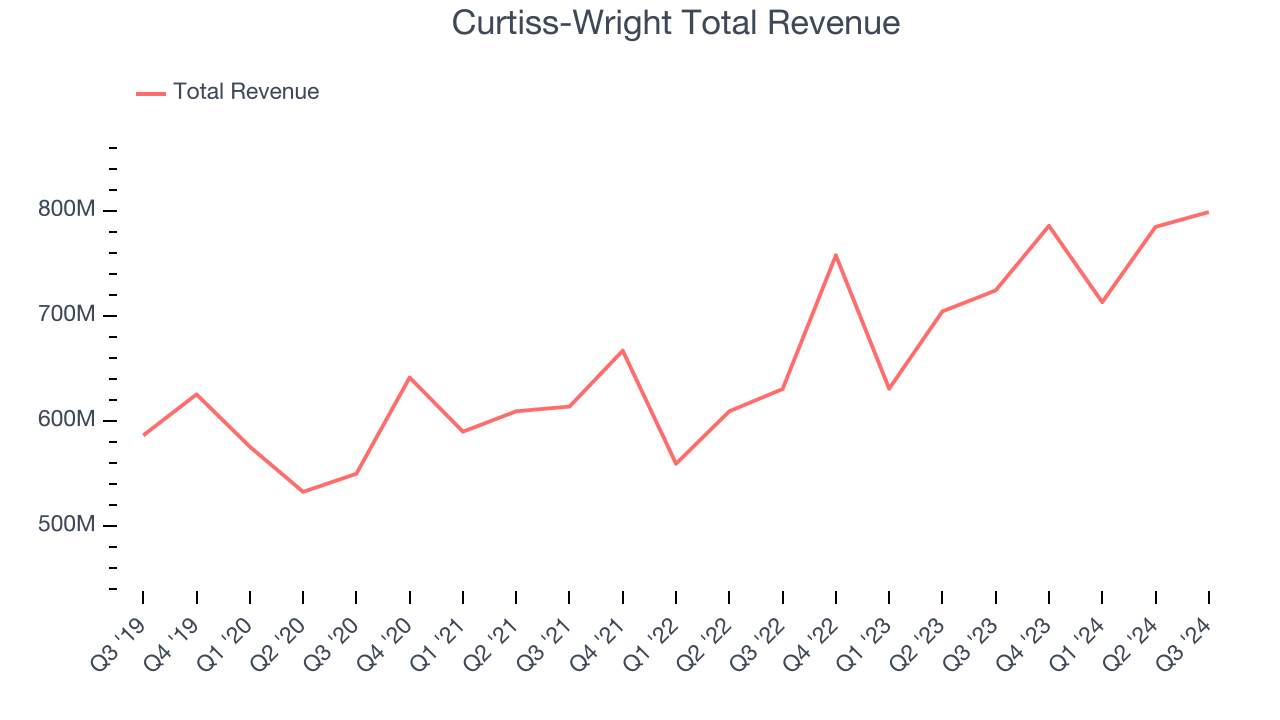

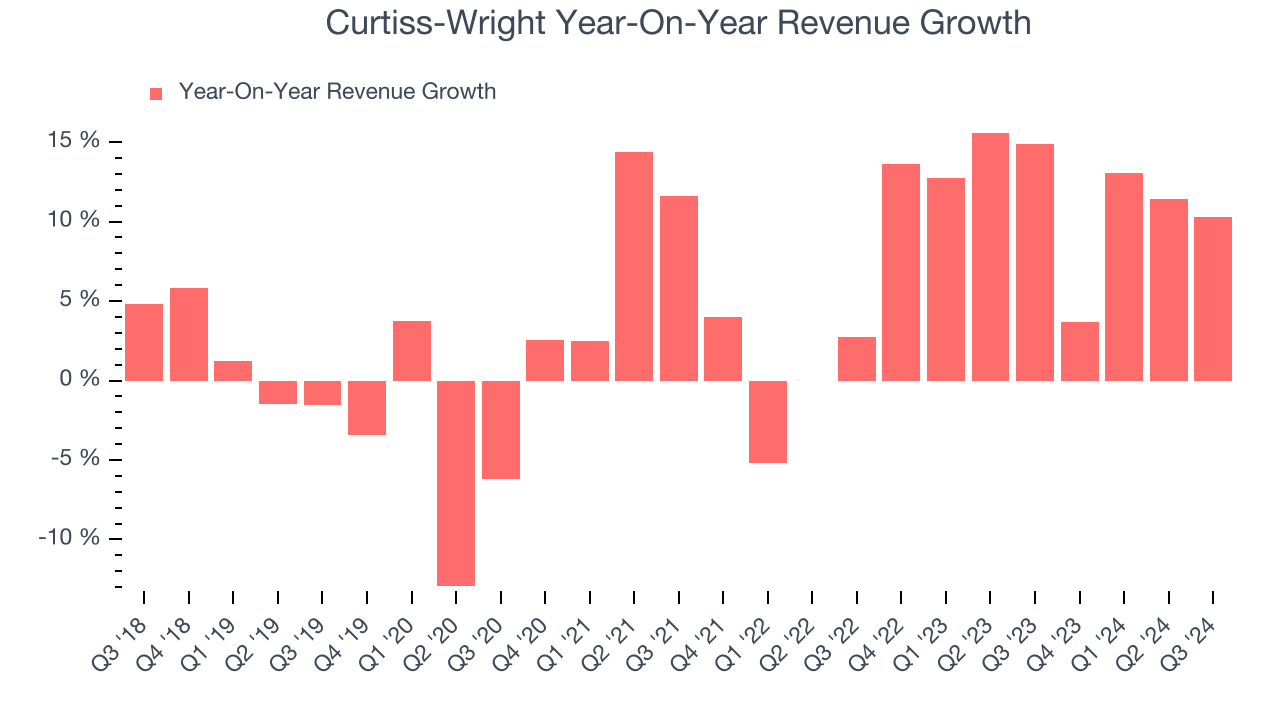

Sales Growth

Reviewing a company’s long-term performance can reveal insights into its business quality. Any business can have short-term success, but a top-tier one sustains growth for years. Over the last five years, Curtiss-Wright grew its sales at a tepid 5.1% compounded annual growth rate. This shows it failed to expand in any major way, a rough starting point for our analysis.

We at StockStory place the most emphasis on long-term growth, but within industrials, a half-decade historical view may miss cycles, industry trends, or a company capitalizing on catalysts such as a new contract win or a successful product line. Curtiss-Wright’s annualized revenue growth of 11.8% over the last two years is above its five-year trend, suggesting its demand recently accelerated.

Curtiss-Wright also breaks out the revenue for its most important segments, Product and Services, which are 85.6% and 14.4% of revenue. Over the last two years, Curtiss-Wright’s Product revenue (aerospace & defense technology) averaged 13.1% year-on-year growth while its Services revenue (testing, maintenance, consulting) averaged 6.4% growth.

This quarter, Curtiss-Wright reported year-on-year revenue growth of 10.3%, and its $798.9 million of revenue exceeded Wall Street’s estimates by 5.4%.

Looking ahead, sell-side analysts expect revenue to grow 3.7% over the next 12 months, a deceleration versus the last two years. This projection is underwhelming and illustrates the market believes its products and services will face some demand challenges. At least the company is tracking well in other measures of financial health.

When a company has more cash than it knows what to do with, buying back its own shares can make a lot of sense–as long as the price is right. Luckily, we’ve found one, a low-priced stock that is gushing free cash flow AND buying back shares. Click here to claim your Special Free Report on a fallen angel growth story that is already recovering from a setback.

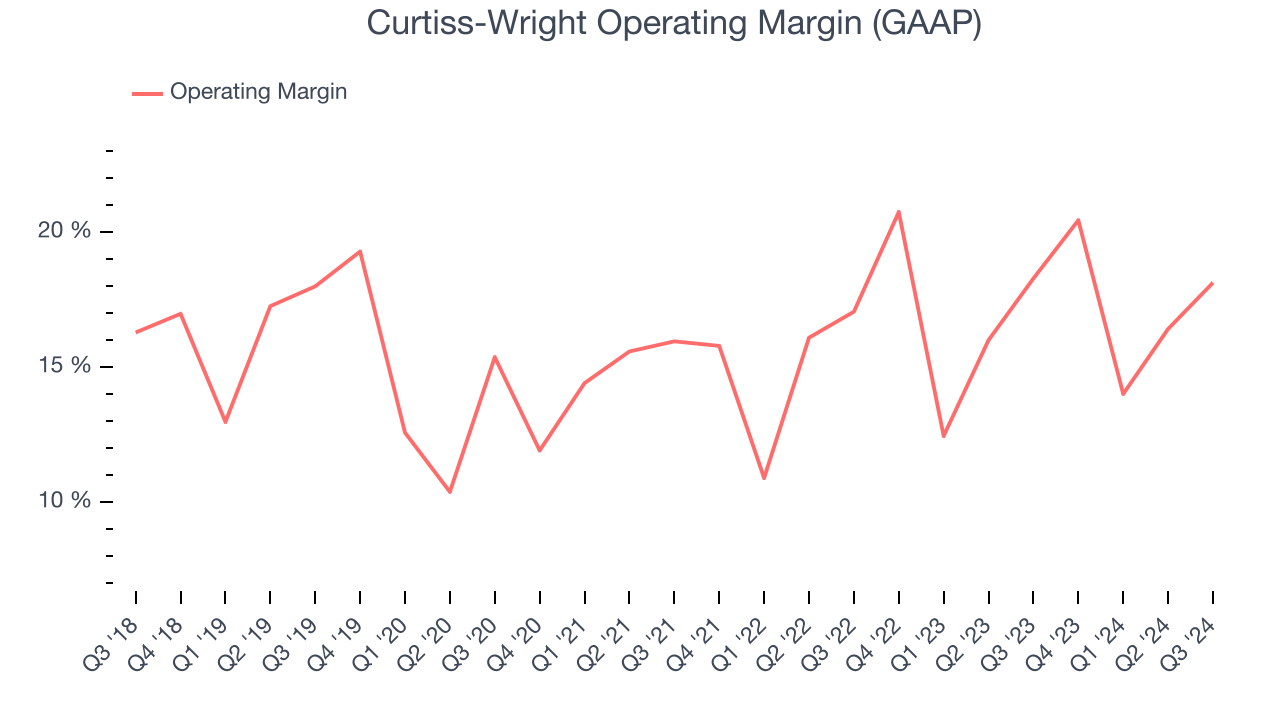

Operating Margin

Curtiss-Wright has been a well-oiled machine over the last five years. It demonstrated elite profitability for an industrials business, boasting an average operating margin of 15.8%.

Looking at the trend in its profitability, Curtiss-Wright’s annual operating margin rose by 2.8 percentage points over the last five years, showing its efficiency has improved.

This quarter, Curtiss-Wright generated an operating profit margin of 18.1%, in line with the same quarter last year. This indicates the company’s overall cost structure has been relatively stable.

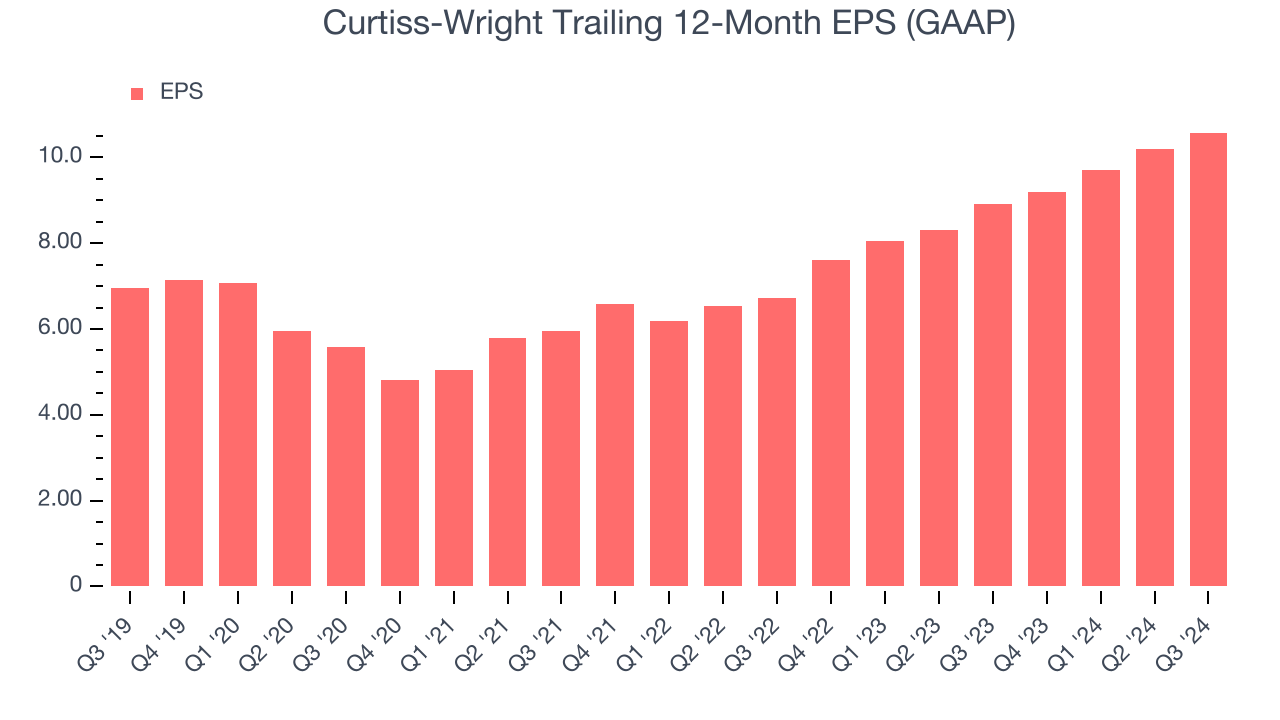

Earnings Per Share

We track the long-term change in earnings per share (EPS) for the same reason as long-term revenue growth. Compared to revenue, however, EPS highlights whether a company’s growth was profitable.

Curtiss-Wright’s EPS grew at a decent 8.7% compounded annual growth rate over the last five years, higher than its 5.1% annualized revenue growth. This tells us the company became more profitable as it expanded.

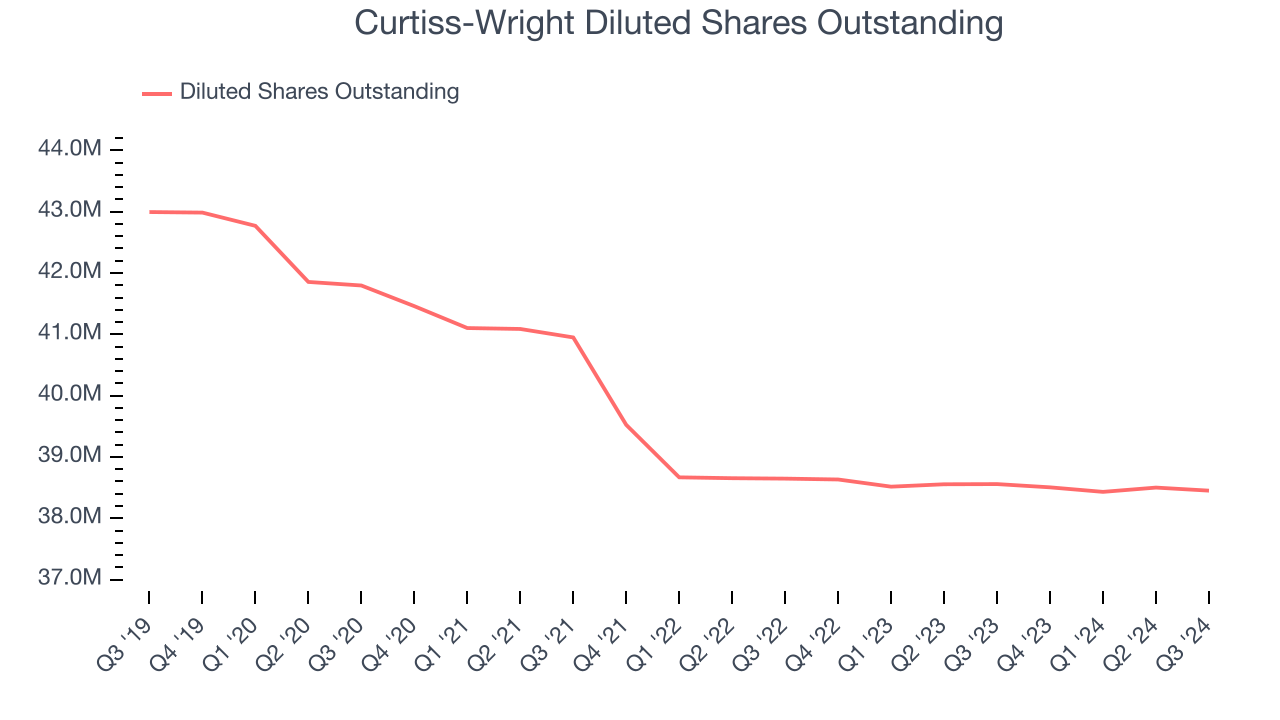

Diving into the nuances of Curtiss-Wright’s earnings can give us a better understanding of its performance. As we mentioned earlier, Curtiss-Wright’s operating margin was flat this quarter but expanded by 2.8 percentage points over the last five years. On top of that, its share count shrank by 10.6%. These are positive signs for shareholders because improving profitability and share buybacks turbocharge EPS growth relative to revenue growth.

Like with revenue, we analyze EPS over a more recent period because it can give insight into an emerging theme or development for the business.

For Curtiss-Wright, its two-year annual EPS growth of 25.3% was higher than its five-year trend. This acceleration made it one of the faster-growing industrials companies in recent history.In Q3, Curtiss-Wright reported EPS at $2.89, up from $2.51 in the same quarter last year. This print beat analysts’ estimates by 7.6%. Over the next 12 months, Wall Street expects Curtiss-Wright’s full-year EPS of $10.58 to grow by 7%.

Key Takeaways from Curtiss-Wright’s Q3 Results

We were impressed by how significantly Curtiss-Wright blew past analysts’ revenue expectations this quarter. We were also glad its full-year EPS guidance exceeded Wall Street’s estimates. Overall, we think this was a solid quarter with some key areas of upside. The stock remained flat at $353.74 immediately after reporting.

Curtiss-Wright put up rock-solid earnings, but one quarter doesn’t necessarily make the stock a buy. Let’s see if this is a good investment. What happened in the latest quarter matters, but not as much as longer-term business quality and valuation, when deciding whether to invest in this stock. We cover that in our actionable full research report which you can read here, it’s free.