Global electronics solutions provider Benchmark Electronics (NYSE: BHE) reported Q3 CY2024 results exceeding the market’s revenue expectations, but sales fell 8.6% year on year to $657.7 million. The company expects next quarter’s revenue to be around $660 million, close to analysts’ estimates. Its GAAP profit of $0.42 per share was also 9.6% above analysts’ consensus estimates.

Is now the time to buy Benchmark Electronics? Find out by accessing our full research report, it’s free.

Benchmark Electronics (BHE) Q3 CY2024 Highlights:

- Revenue: $657.7 million vs analyst estimates of $650 million (1.2% beat)

- EPS: $0.42 vs analyst estimates of $0.38 (9.6% beat)

- Revenue Guidance for Q4 CY2024 is $660 million at the midpoint, roughly in line with what analysts were expecting

- Gross Margin (GAAP): 10.1%, in line with the same quarter last year

- Operating Margin: 4.3%, in line with the same quarter last year

- EBITDA Margin: 6%, in line with the same quarter last year

- Free Cash Flow Margin: 4.4%, up from 2.5% in the same quarter last year

- Market Capitalization: $1.63 billion

"Our third quarter results represent the 16th consecutive quarter of non-GAAP operating margin expansion on a year-over-year basis. These results coupled with our focused working capital initiatives, has enabled us to deliver $245 million of positive free cash flow over the last 12 months," said Jeff Benck, Benchmark's President and CEO.

Company Overview

Based in Tempe, Arizona, Benchmark Electronics (NYSE: BHE) is a global provider of product design, engineering services, technology solutions, and manufacturing services.

Electrical Systems

Like many equipment and component manufacturers, electrical systems companies are buoyed by secular trends such as connectivity and industrial automation. More specific pockets of strong demand include Internet of Things (IoT) connectivity and the 5G telecom upgrade cycle, which can benefit companies whose cables and conduits fit those needs. But like the broader industrials sector, these companies are also at the whim of economic cycles. Interest rates, for example, can greatly impact projects that drive demand for these products.

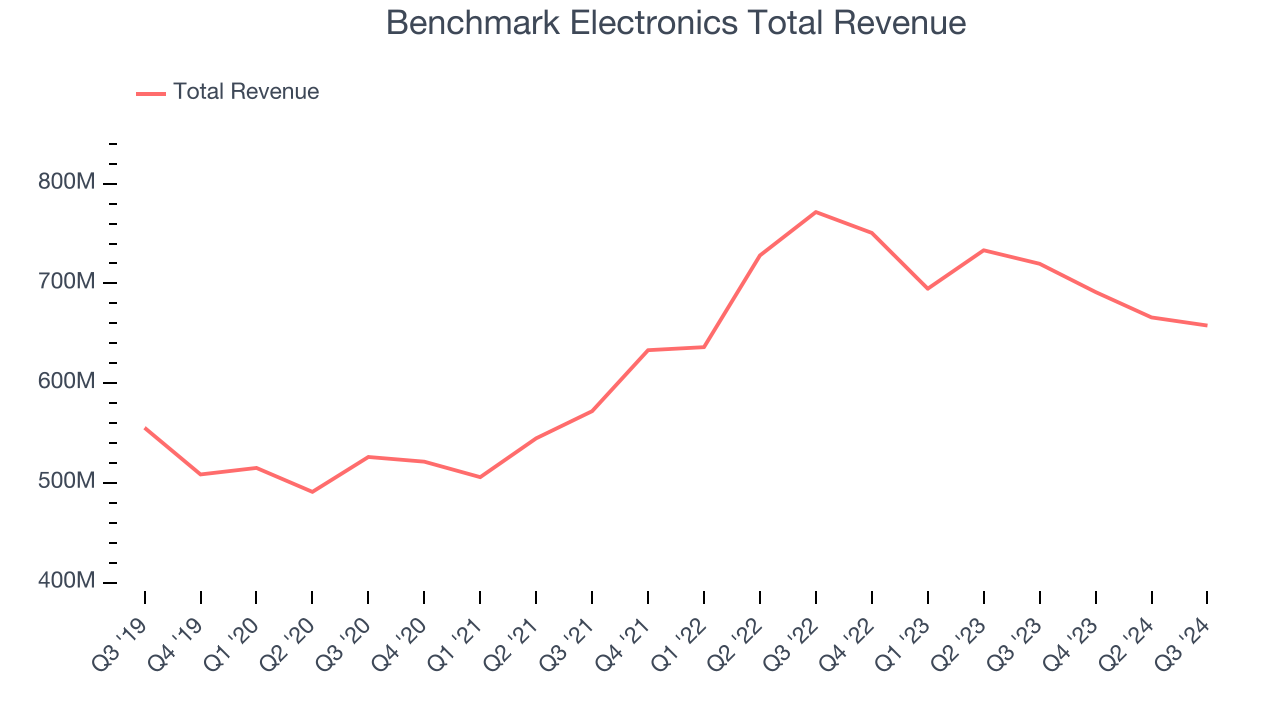

Sales Growth

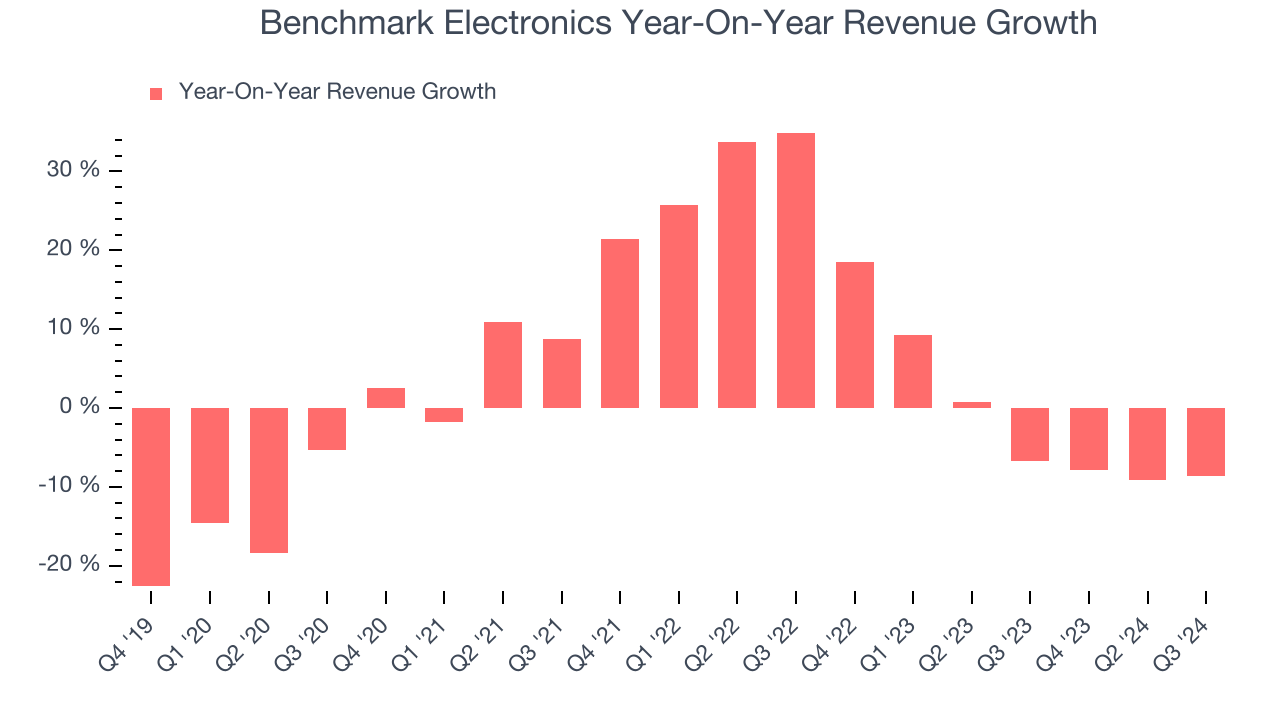

Examining a company’s long-term performance can provide clues about its business quality. Any business can put up a good quarter or two, but the best consistently grow over the long haul. Over the last five years, Benchmark Electronics grew its sales at a sluggish 2.7% compounded annual growth rate. This shows it failed to expand in any major way, a rough starting point for our analysis.

Long-term growth is the most important, but within industrials, a half-decade historical view may miss new industry trends or demand cycles. Benchmark Electronics’s history shows it grew in the past but relinquished its gains over the last two years, as its revenue fell by 6% annually. Benchmark Electronics isn’t alone in its struggles as the Electrical Systems industry experienced a cyclical downturn, with many similar businesses seeing lower sales at this time.

This quarter, Benchmark Electronics’s revenue fell 8.6% year on year to $657.7 million but beat Wall Street’s estimates by 1.2%. Management is currently guiding for a 4.5% year-on-year decline next quarter.

Looking further ahead, sell-side analysts expect revenue to grow 2.6% over the next 12 months, an improvement versus the last two years. While this projection indicates the market believes its newer products and services will catalyze better performance, it is still below average for the sector.

Here at StockStory, we certainly understand the potential of thematic investing. Diverse winners from Microsoft (MSFT) to Alphabet (GOOG), Coca-Cola (KO) to Monster Beverage (MNST) could all have been identified as promising growth stories with a megatrend driving the growth. So, in that spirit, we’ve identified a relatively under-the-radar profitable growth stock benefitting from the rise of AI, available to you FREE via this link.

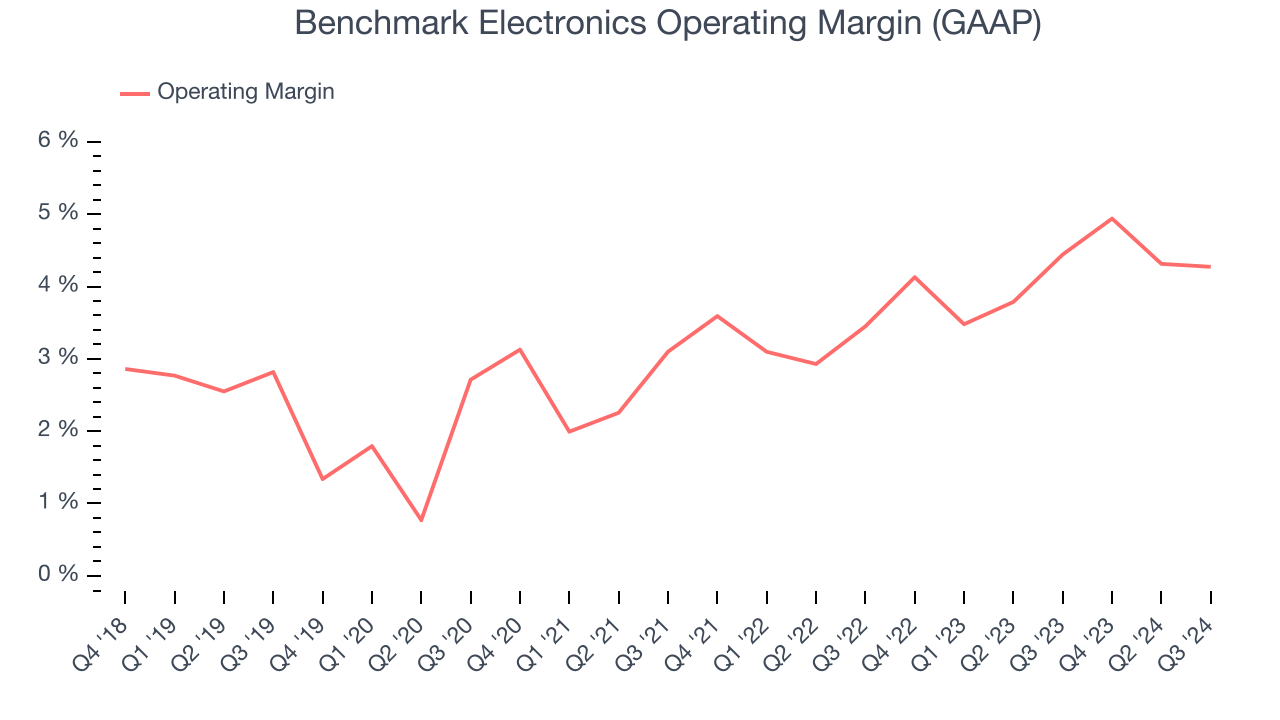

Operating Margin

Benchmark Electronics was profitable over the last five years but held back by its large cost base. Its average operating margin of 3.3% was weak for an industrials business. This result isn’t too surprising given its low gross margin as a starting point.

On the plus side, Benchmark Electronics’s annual operating margin rose by 2.9 percentage points over the last five years.

This quarter, Benchmark Electronics generated an operating profit margin of 4.3%, in line with the same quarter last year. This indicates the company’s cost structure has recently been stable.

Earnings Per Share

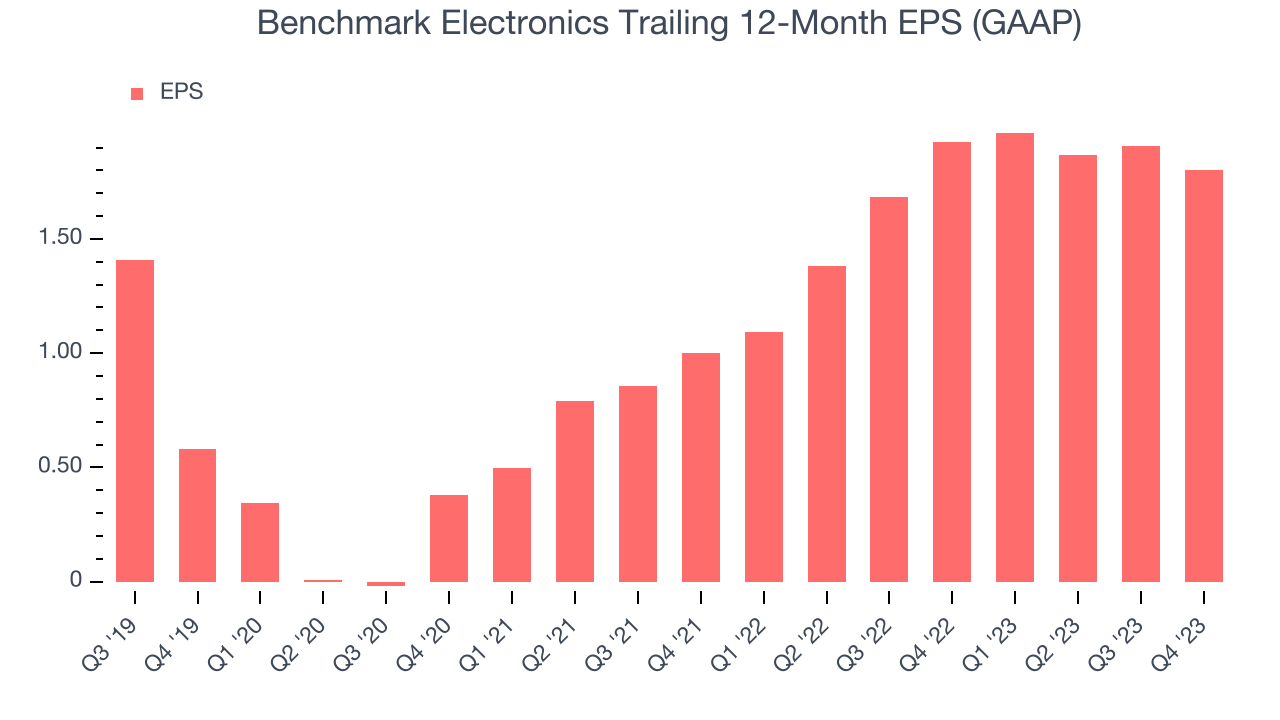

We track the long-term change in earnings per share (EPS) for the same reason as long-term revenue growth. Compared to revenue, however, EPS highlights whether a company’s growth was profitable.

Benchmark Electronics’s EPS grew at a remarkable 14.6% compounded annual growth rate over the last five years, higher than its 2.7% annualized revenue growth. This tells us the company became more profitable as it expanded.

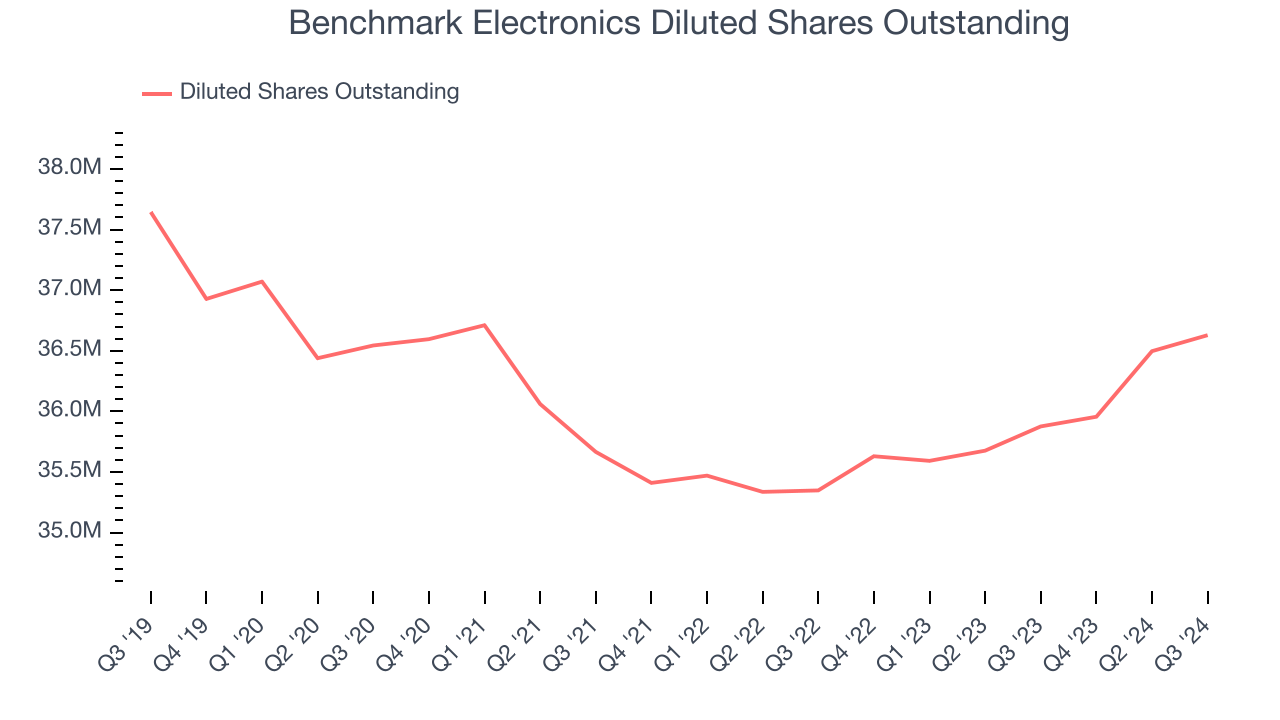

We can take a deeper look into Benchmark Electronics’s earnings quality to better understand the drivers of its performance. As we mentioned earlier, Benchmark Electronics’s operating margin was flat this quarter but expanded by 2.9 percentage points over the last five years. On top of that, its share count shrank by 2.7%. These are positive signs for shareholders because improving profitability and share buybacks turbocharge EPS growth relative to revenue growth.

Like with revenue, we analyze EPS over a shorter period to see if we are missing a change in the business.

For Benchmark Electronics, its two-year annual EPS declines of 8.7% mark a reversal from its (seemingly) healthy five-year trend. We hope Benchmark Electronics can return to earnings growth in the future.In Q3, Benchmark Electronics reported EPS at $0.42, down from $0.57 in the same quarter last year. Despite falling year on year, this print beat analysts’ estimates by 9.6%.

Key Takeaways from Benchmark Electronics’s Q3 Results

It was good to see Benchmark Electronics beat analysts’ EPS expectations this quarter. We were also glad its revenue outperformed Wall Street’s estimates. Overall, this quarter had some key positives. The stock traded up 2.9% to $46.73 immediately after reporting.

Sure, Benchmark Electronics had a solid quarter, but if we look at the bigger picture, is this stock a buy? We think that the latest quarter is only one piece of the longer-term business quality puzzle. Quality, when combined with valuation, can help determine if the stock is a buy. We cover that in our actionable full research report which you can read here, it’s free.