Online learning platform Udemy (NASDAQ: UDMY) reported Q3 CY2024 results beating Wall Street’s revenue expectations, with sales up 5.8% year on year to $195.4 million. On the other hand, the company expects next quarter’s revenue to be around $194.5 million, slightly below analysts’ estimates. Its non-GAAP profit of $0.07 per share was also 513% above analysts’ consensus estimates.

Is now the time to buy Udemy? Find out by accessing our full research report, it’s free.

Udemy (UDMY) Q3 CY2024 Highlights:

- Revenue: $195.4 million vs analyst estimates of $192.7 million (1.4% beat)

- Adjusted EPS: $0.07 vs analyst estimates of $0.01 ($0.06 beat)

- EBITDA: $11.56 million vs analyst estimates of $5.14 million (125% beat)

- Revenue Guidance for Q4 CY2024 is $194.5 million at the midpoint, below analyst estimates of $195.8 million

- Gross Margin (GAAP): 63%, up from 58.2% in the same quarter last year

- EBITDA Margin: 5.9%, up from 4.4% in the same quarter last year

- Free Cash Flow was -$11.36 million, down from $24.79 million in the previous quarter

- Monthly Active Buyers: 1.31 million

- Market Capitalization: $1.24 billion

“Udemy delivered solid third quarter results with revenue and adjusted EBITDA margin above the high end of our guidance ranges, and we achieved a new milestone of over $500 million in Udemy Business Annual Recurring Revenue,” said Greg Brown, Udemy’s President and CEO.

Company Overview

With courses ranging from investing to cooking to computer programming, Udemy (NASDAQ: UDMY) is an online learning platform that connects learners with expert instructors who specialize in a wide range of topics.

Consumer Subscription

Consumers today expect goods and services to be hyper-personalized and on demand. Whether it be what music they listen to, what movie they watch, or even finding a date, online consumer businesses are expected to delight their customers with simple user interfaces that magically fulfill demand. Subscription models have further increased usage and stickiness of many online consumer services.

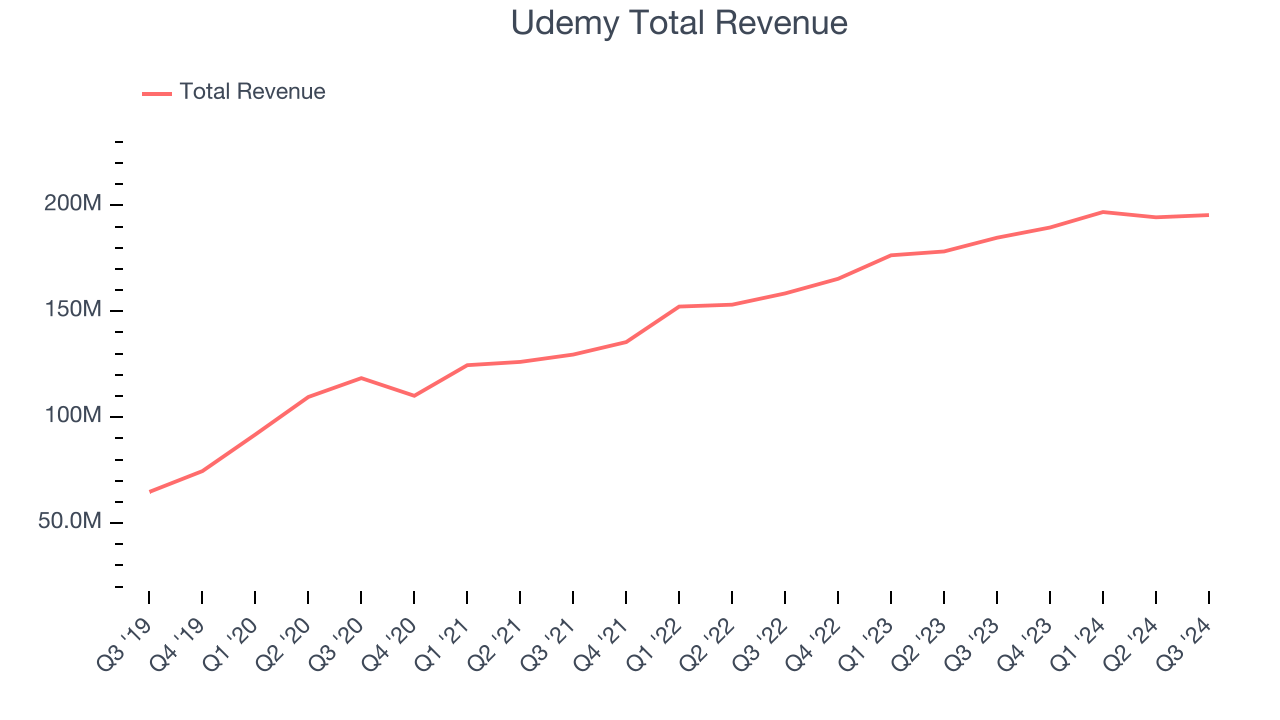

Sales Growth

Examining a company’s long-term performance can provide clues about its business quality. Any business can put up a good quarter or two, but the best consistently grow over the long haul. Over the last three years, Udemy grew its sales at a solid 16.5% compounded annual growth rate. This is a useful starting point for our analysis.

This quarter, Udemy reported year-on-year revenue growth of 5.8%, and its $195.4 million of revenue exceeded Wall Street’s estimates by 1.4%. Management is currently guiding for a 2.6% year-on-year increase next quarter.

Looking further ahead, sell-side analysts expect revenue to grow 6.5% over the next 12 months, a deceleration versus the last three years. This projection is underwhelming and indicates the market believes its products and services will face some demand challenges.

Today’s young investors won’t have read the timeless lessons in Gorilla Game: Picking Winners In High Technology because it was written more than 20 years ago when Microsoft and Apple were first establishing their supremacy. But if we apply the same principles, then enterprise software stocks leveraging their own generative AI capabilities may well be the Gorillas of the future. So, in that spirit, we are excited to present our Special Free Report on a profitable, fast-growing enterprise software stock that is already riding the automation wave and looking to catch the generative AI next.

Key Takeaways from Udemy’s Q3 Results

We were impressed by how significantly Udemy blew past analysts’ EBITDA and EPS expectations this quarter. We were also excited it added more buyers than anticipated. On the other hand, its revenue revenue guidance for next quarter missed Wall Street’s estimates. Overall, we think this was still a decent quarter with some key metrics above expectations. The stock traded up 6.1% to $8.98 immediately following the results.

Sure, Udemy had a solid quarter, but if we look at the bigger picture, is this stock a buy?When making that decision, it’s important to consider its valuation, business qualities, as well as what has happened in the latest quarter. We cover that in our actionable full research report which you can read here, it’s free.