Defense contractor Leidos (NYSE: LDOS) reported Q3 CY2024 results topping the market’s revenue expectations, with sales up 6.9% year on year to $4.19 billion. The company expects the full year’s revenue to be around $16.4 billion, close to analysts’ estimates. Its non-GAAP profit of $2.93 per share was also 45.4% above analysts’ consensus estimates.

Is now the time to buy Leidos? Find out by accessing our full research report, it’s free.

Leidos (LDOS) Q3 CY2024 Highlights:

- Revenue: $4.19 billion vs analyst estimates of $4.07 billion (3% beat)

- Adjusted EPS: $2.93 vs analyst estimates of $2.02 (45.4% beat)

- EBITDA: $596 million vs analyst estimates of $445.3 million (33.8% beat)

- The company slightly lifted its revenue guidance for the full year to $16.4 billion at the midpoint from $16.25 billion

- Management raised its full-year Adjusted EPS guidance to $9.90 at the midpoint, a 12.5% increase

- Gross Margin (GAAP): 18.2%, up from 15% in the same quarter last year

- Operating Margin: 12.3%, up from -8.6% in the same quarter last year

- EBITDA Margin: 14.2%, up from 11.5% in the same quarter last year

- Free Cash Flow Margin: 15.1%, down from 19% in the same quarter last year

- Backlog: $40.56 billion at quarter end, up 6.6% year on year

- Market Capitalization: $22.86 billion

"Continued improvement in operating performance across all segments drove excellent revenue growth, record margins for net income and adjusted EBITDA, substantial earnings growth, strong cash flow, and robust bookings," said Leidos Chief Executive Officer Tom Bell.

Company Overview

Formed through the split of IT services company SAIC, Leidos (NYSE: LDOS) offers technology and engineering solutions such as military training systems for the defense, civil, and health markets.

Defense Contractors

Defense contractors typically require technical expertise and government clearance. Companies in this sector can also enjoy long-term contracts with government bodies, leading to more predictable revenues. Combined, these factors create high barriers to entry and can lead to limited competition. Lately, geopolitical tensions–whether it be Russia’s invasion of Ukraine or China’s aggression towards Taiwan–highlight the need for defense spending. On the other hand, demand for these products can ebb and flow with defense budgets and even who is president, as different administrations can have vastly different ideas of how to allocate federal funds.

Sales Growth

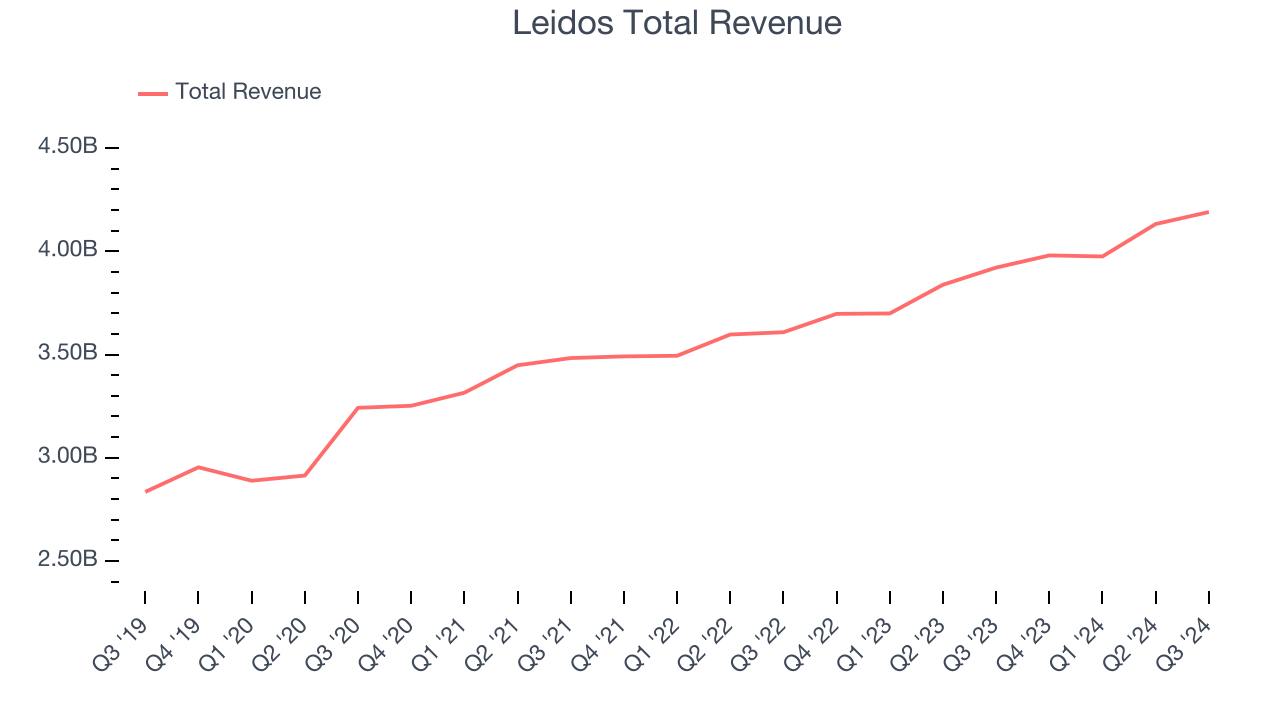

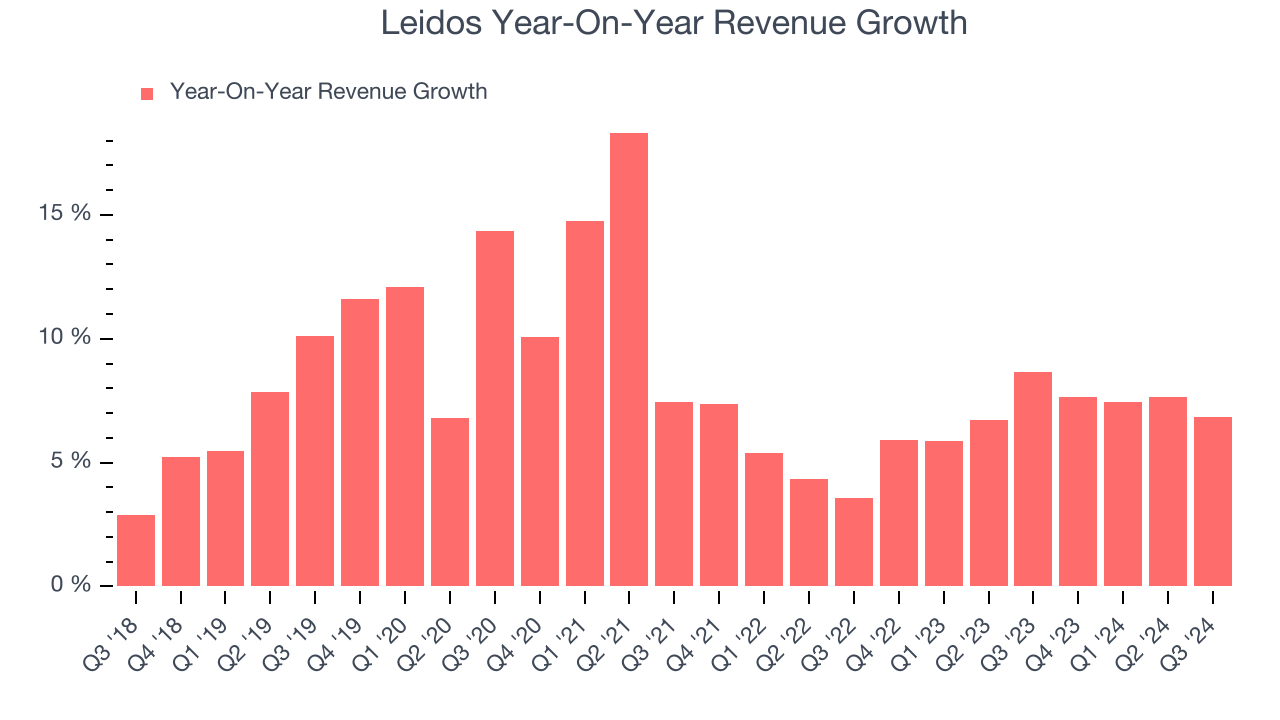

Reviewing a company’s long-term performance can reveal insights into its business quality. Any business can have short-term success, but a top-tier one sustains growth for years. Thankfully, Leidos’s 8.6% annualized revenue growth over the last five years was decent. This is a useful starting point for our analysis.

We at StockStory place the most emphasis on long-term growth, but within industrials, a half-decade historical view may miss cycles, industry trends, or a company capitalizing on catalysts such as a new contract win or a successful product line. Leidos’s recent history shows its demand slowed as its annualized revenue growth of 7.1% over the last two years is below its five-year trend.

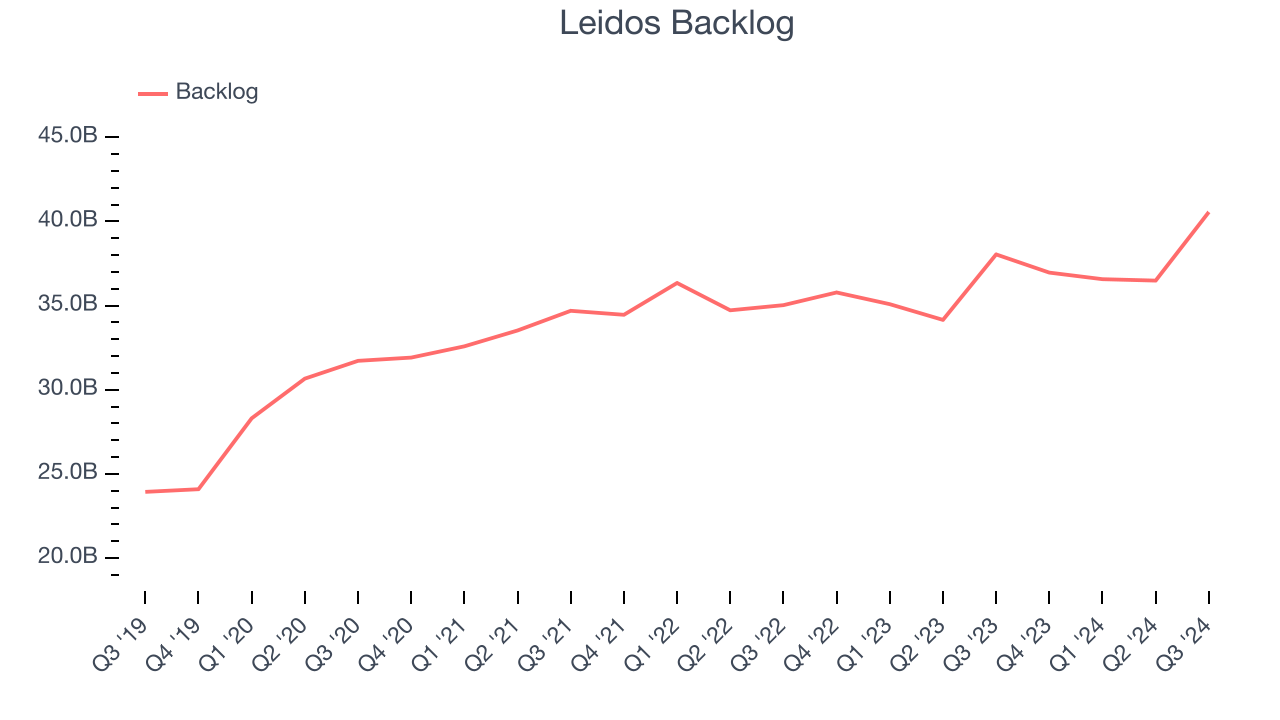

We can better understand the company’s revenue dynamics by analyzing its backlog, or the value of its outstanding orders that have not yet been executed or delivered. Leidos’s backlog reached $40.56 billion in the latest quarter and averaged 3.5% year-on-year growth over the last two years. Because this number is lower than its revenue growth, we can see the company hasn’t secured enough new orders to maintain its growth rate in the future.

This quarter, Leidos reported year-on-year revenue growth of 6.9%, and its $4.19 billion of revenue exceeded Wall Street’s estimates by 3%.

Looking ahead, sell-side analysts expect revenue to grow 3.2% over the next 12 months, a deceleration versus the last two years. This projection doesn't excite us and indicates the market believes its products and services will face some demand challenges.

Here at StockStory, we certainly understand the potential of thematic investing. Diverse winners from Microsoft (MSFT) to Alphabet (GOOG), Coca-Cola (KO) to Monster Beverage (MNST) could all have been identified as promising growth stories with a megatrend driving the growth. So, in that spirit, we’ve identified a relatively under-the-radar profitable growth stock benefitting from the rise of AI, available to you FREE via this link.

Operating Margin

Operating margin is an important measure of profitability as it shows the portion of revenue left after accounting for all core expenses–everything from the cost of goods sold to advertising and wages. It’s also useful for comparing profitability across companies with different levels of debt and tax rates because it excludes interest and taxes.

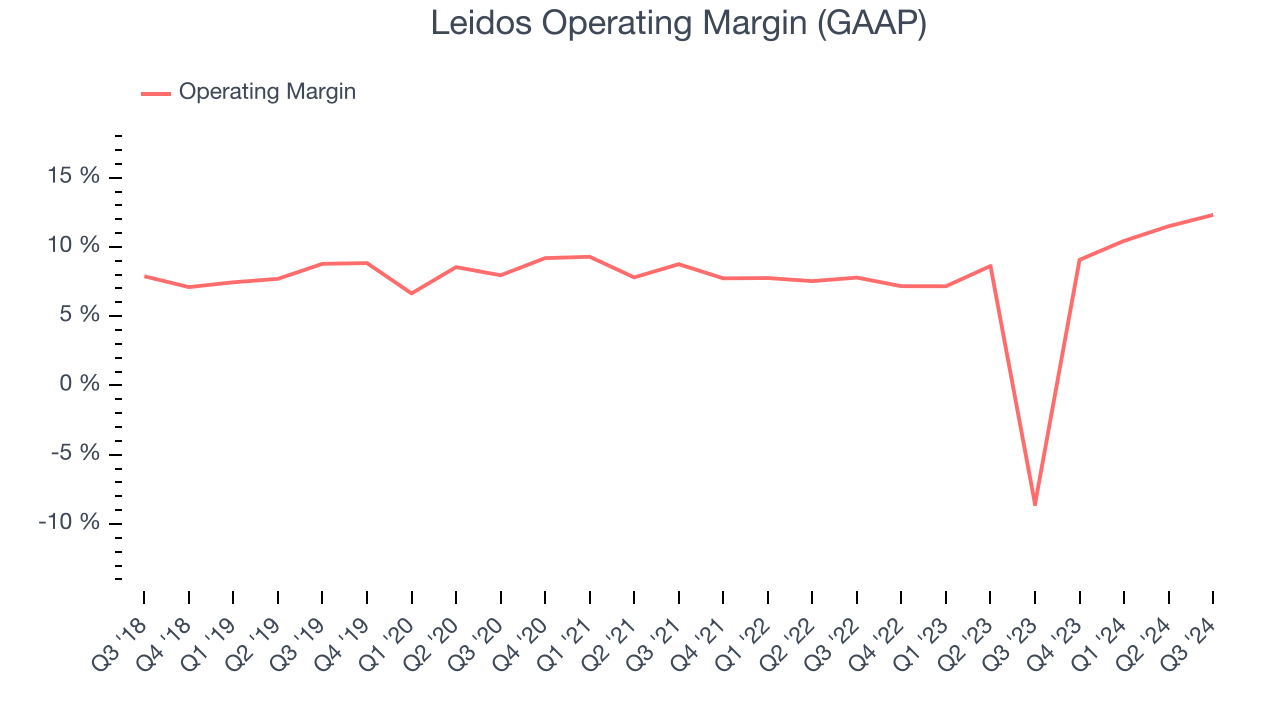

Leidos was profitable over the last five years but held back by its large cost base. Its average operating margin of 7.8% was weak for an industrials business.

On the bright side, Leidos’s annual operating margin rose by 2.9 percentage points over the last five years.

In Q3, Leidos generated an operating profit margin of 12.3%, up 20.9 percentage points year on year. This increase was a welcome development and shows it was recently more efficient because its expenses grew slower than its revenue.

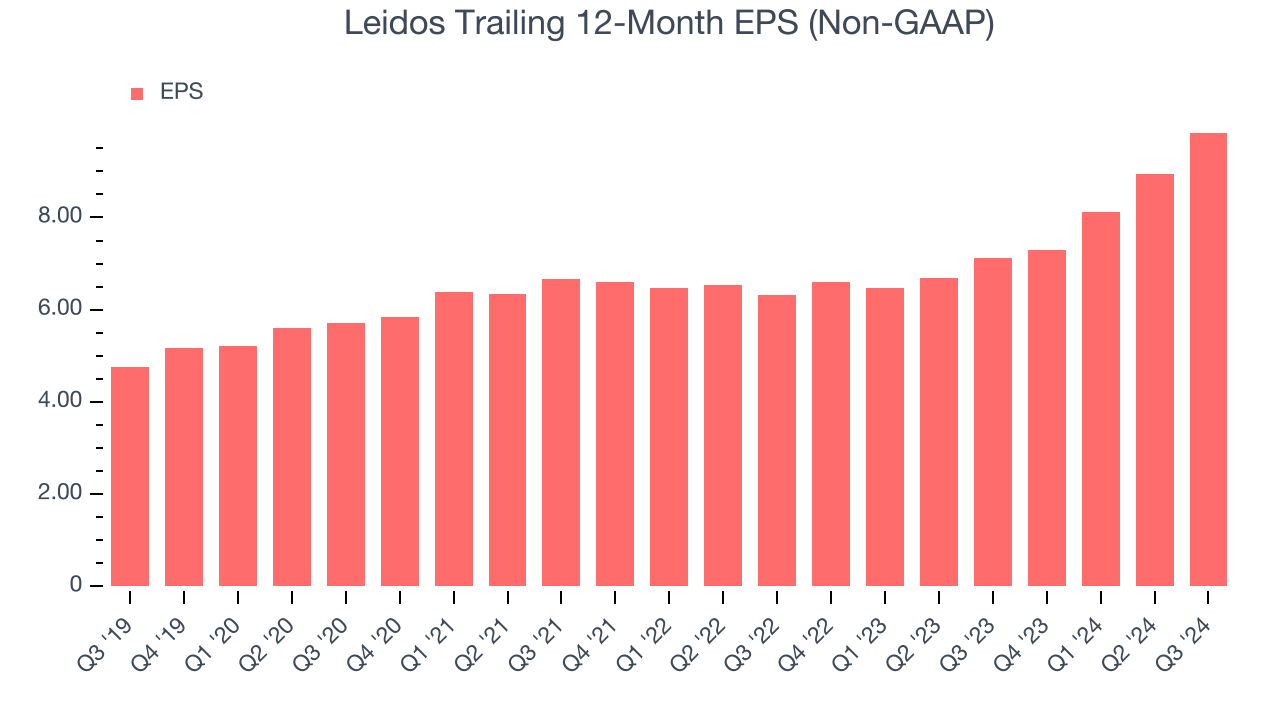

Earnings Per Share

We track the long-term change in earnings per share (EPS) for the same reason as long-term revenue growth. Compared to revenue, however, EPS highlights whether a company’s growth was profitable.

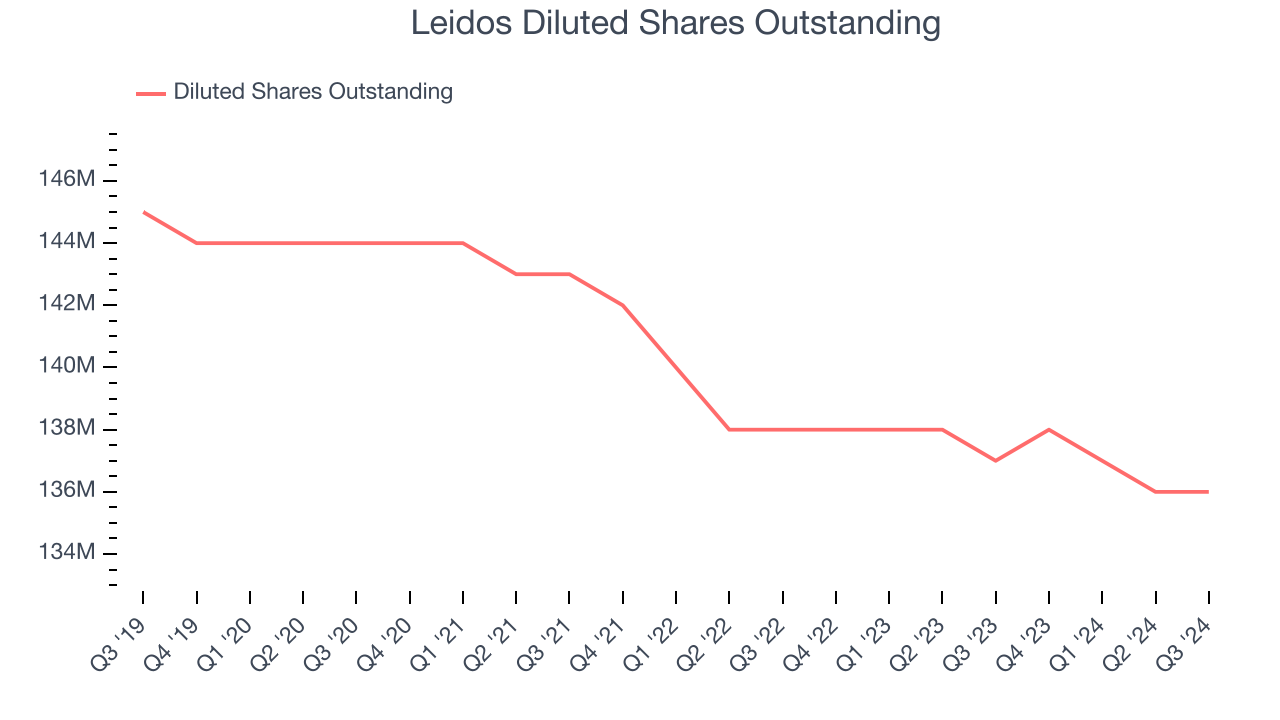

Leidos’s EPS grew at a spectacular 15.7% compounded annual growth rate over the last five years, higher than its 8.6% annualized revenue growth. This tells us the company became more profitable as it expanded.

Diving into Leidos’s quality of earnings can give us a better understanding of its performance. As we mentioned earlier, Leidos’s operating margin expanded by 2.9 percentage points over the last five years. On top of that, its share count shrank by 6.2%. These are positive signs for shareholders because improving profitability and share buybacks turbocharge EPS growth relative to revenue growth.

Like with revenue, we analyze EPS over a more recent period because it can give insight into an emerging theme or development for the business.

For Leidos, its two-year annual EPS growth of 24.8% was higher than its five-year trend. We love it when earnings growth accelerates, especially when it accelerates off an already high base.In Q3, Leidos reported EPS at $2.93, up from $2.03 in the same quarter last year. This print easily cleared analysts’ estimates, and shareholders should be content with the results. Over the next 12 months, Wall Street expects Leidos’s full-year EPS of $9.84 to shrink by 7.7%.

Key Takeaways from Leidos’s Q3 Results

We were impressed by how significantly Leidos blew past analysts’ backlog expectations this quarter. We were also excited its revenue and EPS outperformed Wall Street’s estimates. Full year guidance was raised as icing on the cake. Zooming out, we think this quarter featured some important positives. The stock traded up 3.7% to $176 immediately following the results.

Leidos may have had a good quarter, but does that mean you should invest right now?If you’re making that decision, you should consider the bigger picture of valuation, business qualities, as well as the latest earnings. We cover that in our actionable full research report which you can read here, it’s free.