Engineered components manufacturer for critical industries ITT Inc. (NYSE: ITT) met Wall Street’s revenue expectations in Q3 CY2024, with sales up 7.7% year on year to $885.2 million. Its non-GAAP profit of $1.46 per share was 1.8% above analysts’ consensus estimates.

Is now the time to buy ITT? Find out by accessing our full research report, it’s free.

ITT (ITT) Q3 CY2024 Highlights:

- Revenue: $885.2 million vs analyst estimates of $883.9 million (in line)

- Adjusted EPS: $1.46 vs analyst estimates of $1.43 (1.8% beat)

- EBITDA: $242.6 million vs analyst estimates of $192 million (26.4% beat)

- Management slightly raised its full-year Adjusted EPS guidance to $5.83 at the midpoint

- Gross Margin (GAAP): 35.5%, up from 34% in the same quarter last year

- Operating Margin: 23.5%, up from 17.4% in the same quarter last year

- EBITDA Margin: 27.4%, up from 21.2% in the same quarter last year

- Free Cash Flow Margin: 14%, down from 18% in the same quarter last year

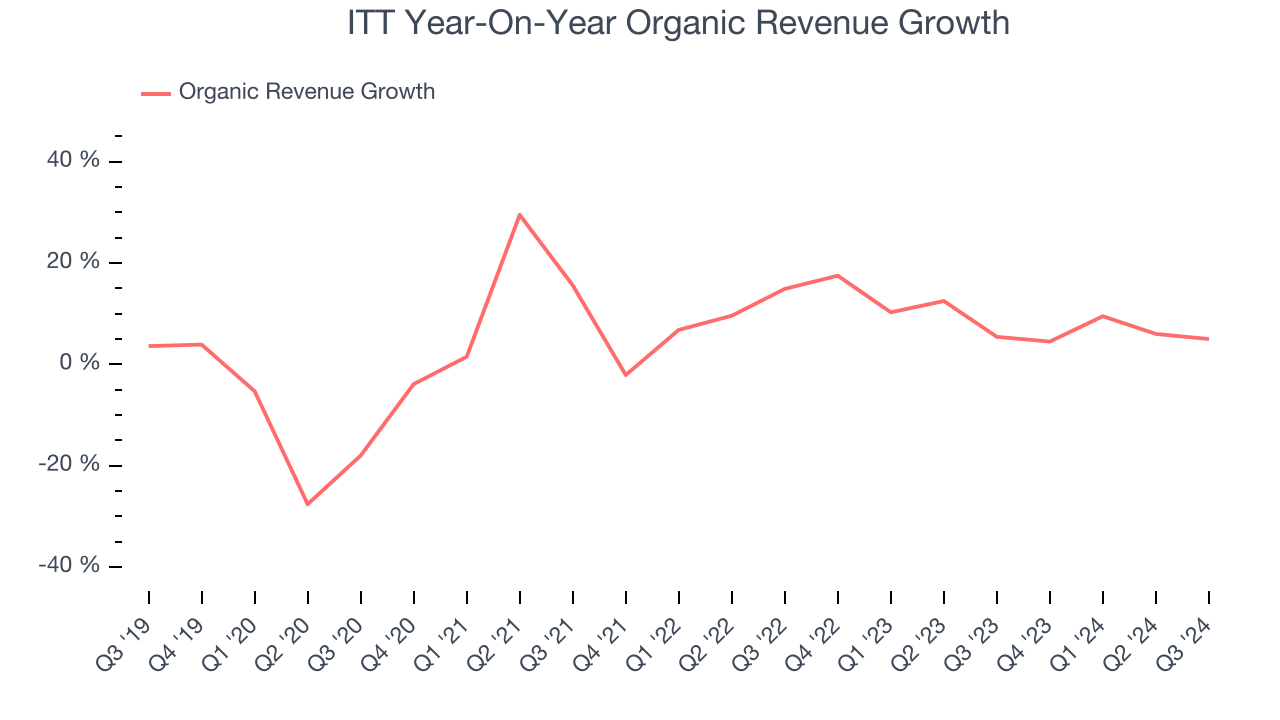

- Organic Revenue rose 5% year on year, in line with the same quarter last year

- Market Capitalization: $11.81 billion

As a result of our strong performance thus far, we are raising the midpoint of our full year EPS outlook. Excluding the temporary acquisition amortization, we are driving to over $6 of earnings in 2024 on the strength of our execution and outperformance. This organic value creation should continue with mid-teens orders growth this quarter, leading to a record ending backlog of $1.7 billion. Our growing backlog and ramping contributions from acquisitions give us a strong foundation for long term growth, whilst we keep on building a robust M&A pipeline with higher growth and higher margin businesses,” said ITT’s Chief Executive Officer and President Luca Savi.

Company Overview

Playing a crucial role in the development of the first transatlantic television transmission in 1956, ITT (NYSE: ITT) provides motion and fluid handling equipment for various industries

Gas and Liquid Handling

Gas and liquid handling companies possess the technical know-how and specialized equipment to handle valuable (and sometimes dangerous) substances. Lately, water conservation and carbon capture–which requires hydrogen and other gasses as well as specialized infrastructure–have been trending up, creating new demand for products such as filters, pumps, and valves. On the other hand, gas and liquid handling companies are at the whim of economic cycles. Consumer spending and interest rates, for example, can greatly impact the industrial production that drives demand for these companies’ offerings.

Sales Growth

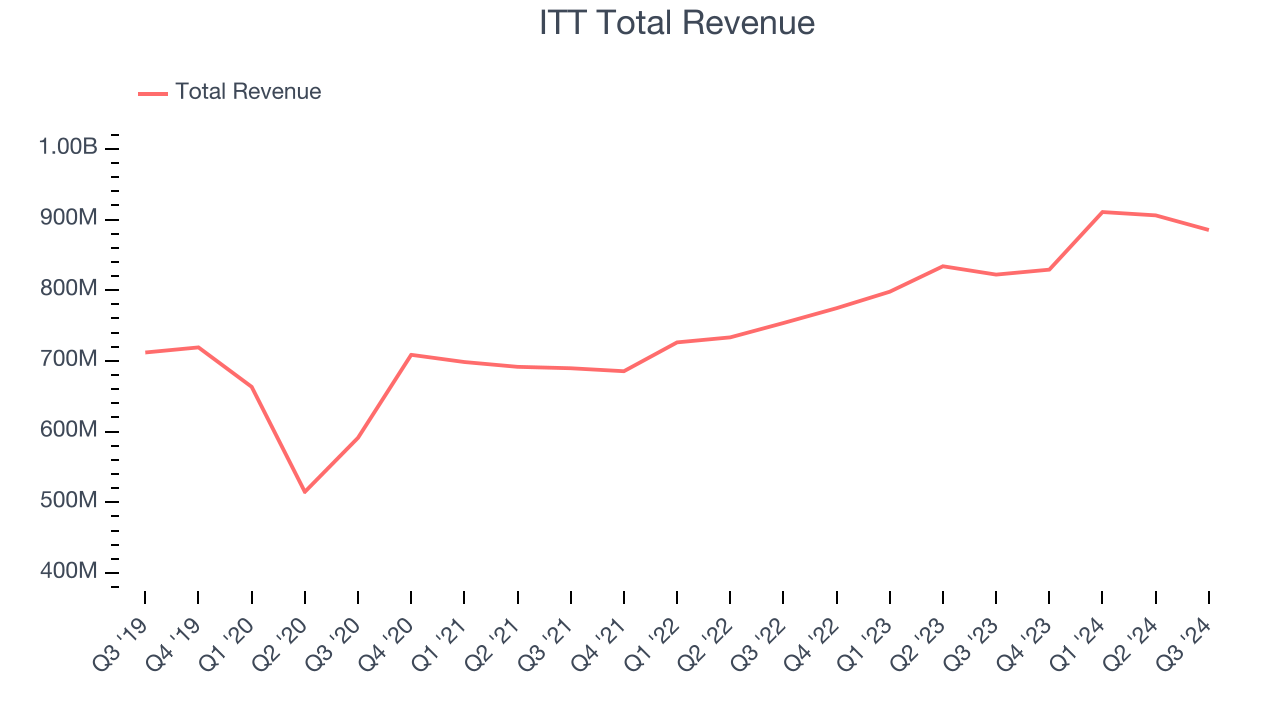

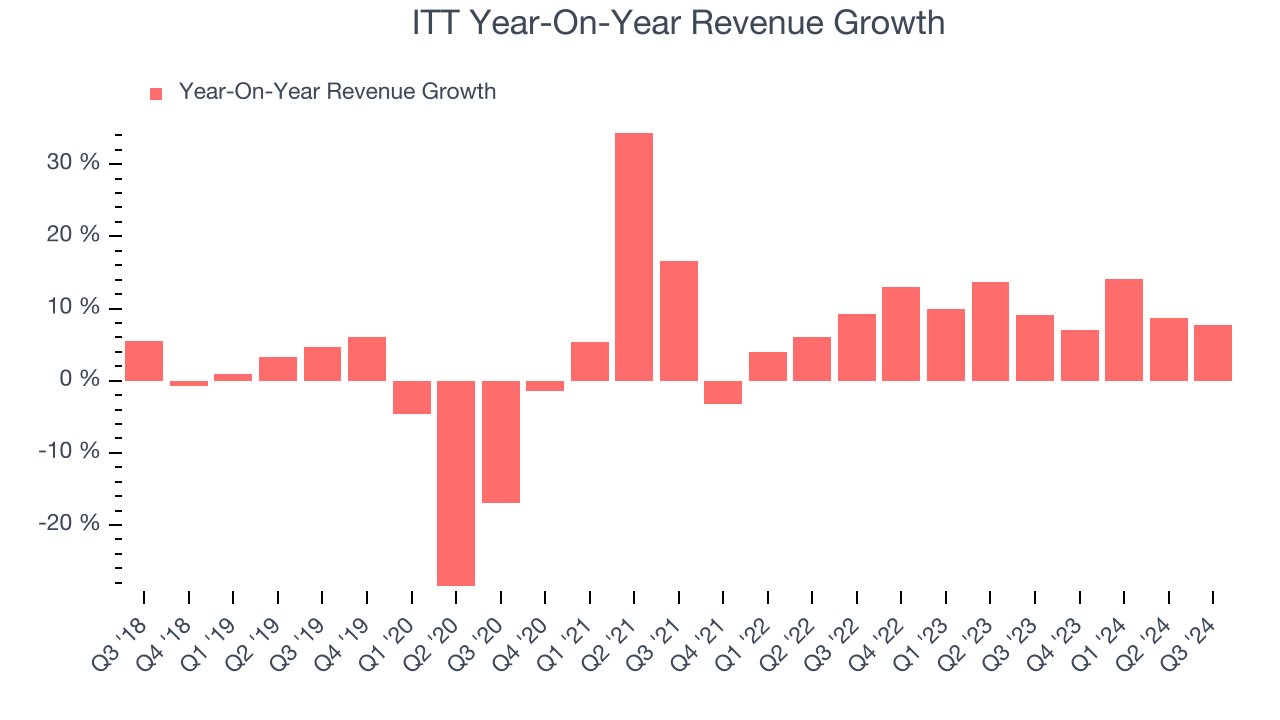

A company’s long-term performance can indicate its business quality. Any business can put up a good quarter or two, but many enduring ones grow for years. Regrettably, ITT’s sales grew at a tepid 4.7% compounded annual growth rate over the last five years. This shows it failed to expand in any major way, a rough starting point for our analysis.

We at StockStory place the most emphasis on long-term growth, but within industrials, a half-decade historical view may miss cycles, industry trends, or a company capitalizing on catalysts such as a new contract win or a successful product line. ITT’s annualized revenue growth of 10.4% over the last two years is above its five-year trend, suggesting its demand recently accelerated.

We can better understand the company’s sales dynamics by analyzing its organic revenue, which strips out one-time events like acquisitions and currency fluctuations because they don’t accurately reflect its fundamentals. Over the last two years, ITT’s organic revenue averaged 8.8% year-on-year growth. Because this number is lower than its normal revenue growth, we can see that some mixture of acquisitions and foreign exchange rates boosted its headline performance.

This quarter, ITT grew its revenue by 7.7% year on year, and its $885.2 million of revenue was in line with Wall Street’s estimates.

Looking ahead, sell-side analysts expect revenue to grow 6.6% over the next 12 months, a deceleration versus the last two years. This projection is underwhelming and illustrates the market thinks its products and services will face some demand challenges. At least the company is tracking well in other measures of financial health.

Here at StockStory, we certainly understand the potential of thematic investing. Diverse winners from Microsoft (MSFT) to Alphabet (GOOG), Coca-Cola (KO) to Monster Beverage (MNST) could all have been identified as promising growth stories with a megatrend driving the growth. So, in that spirit, we’ve identified a relatively under-the-radar profitable growth stock benefitting from the rise of AI, available to you FREE via this link.

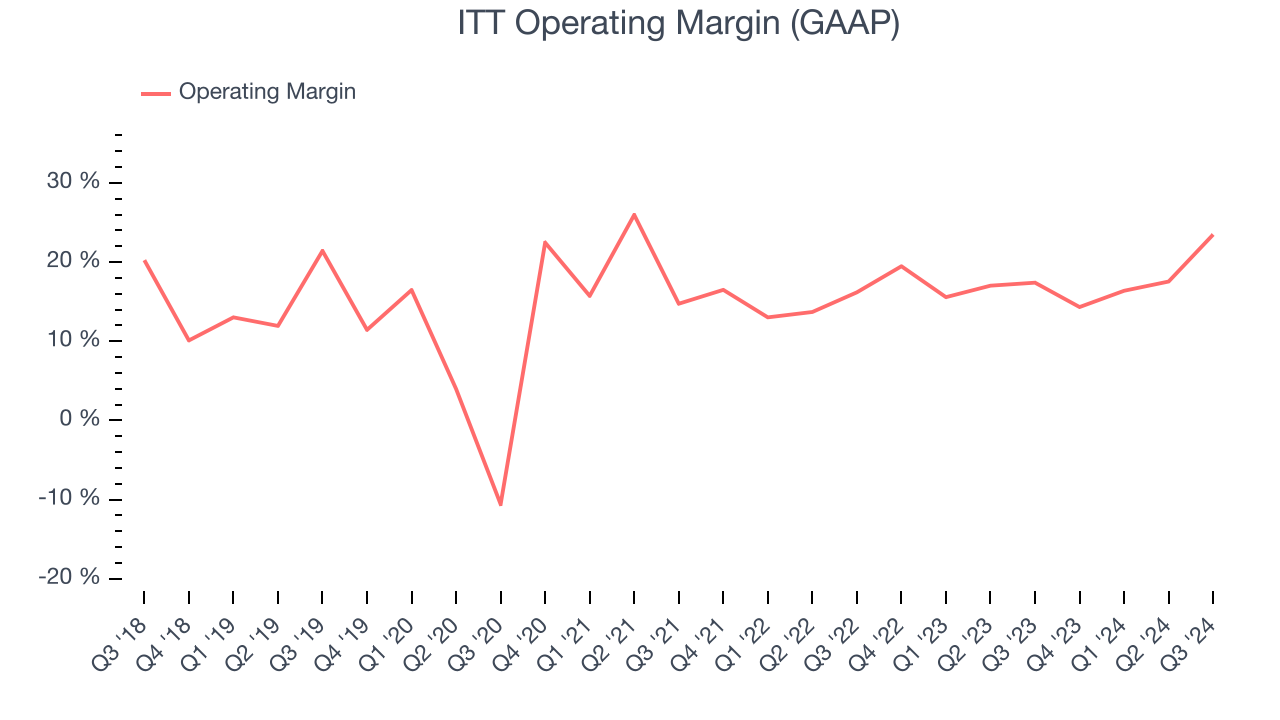

Operating Margin

Operating margin is one of the best measures of profitability because it tells us how much money a company takes home after procuring and manufacturing its products, marketing and selling them, and, most importantly, keeping them relevant through research and development.

ITT has been an optimally-run company over the last five years. It was one of the more profitable businesses in the industrials sector, boasting an average operating margin of 15.6%.

Analyzing the trend in its profitability, ITT’s annual operating margin rose by 12 percentage points over the last five years, showing its efficiency has meaningfully improved.

This quarter, ITT generated an operating profit margin of 23.5%, up 6.1 percentage points year on year. The increase was solid, and since its operating margin rose more than its gross margin, we can infer it was recently more efficient with expenses such as marketing, R&D, and administrative overhead.

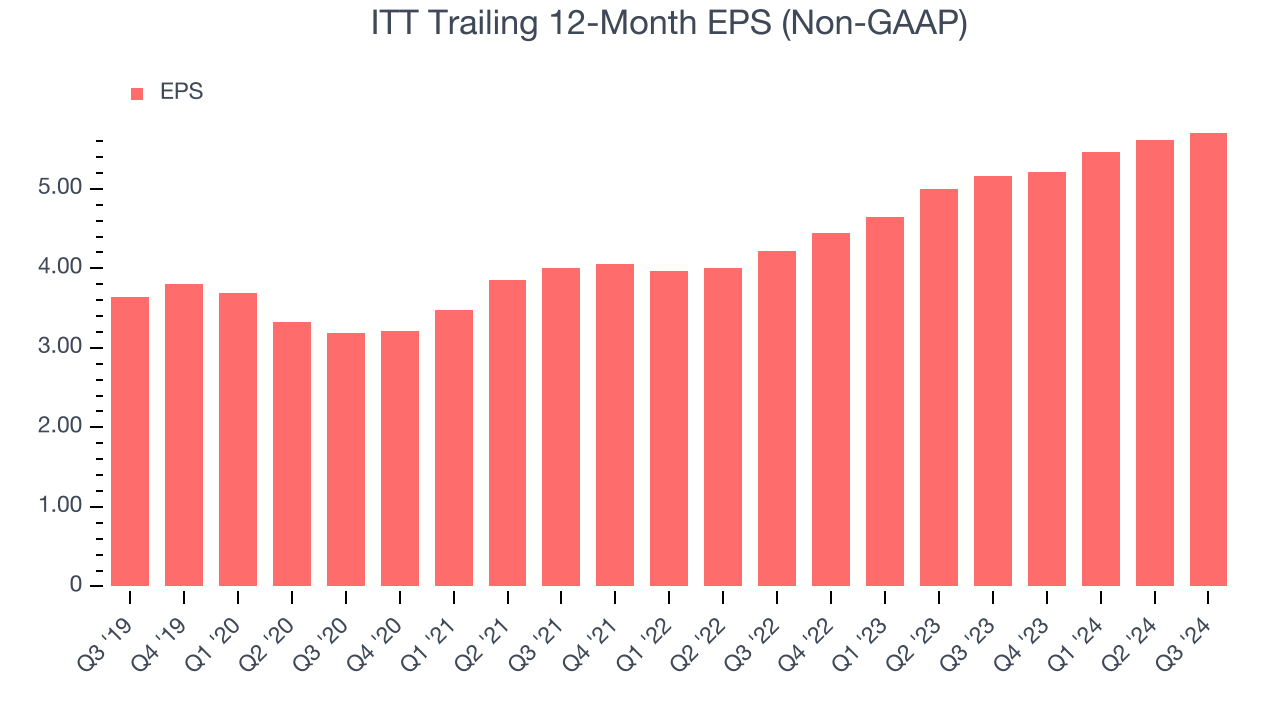

Earnings Per Share

We track the long-term change in earnings per share (EPS) for the same reason as long-term revenue growth. Compared to revenue, however, EPS highlights whether a company’s growth was profitable.

ITT’s EPS grew at a decent 9.4% compounded annual growth rate over the last five years, higher than its 4.7% annualized revenue growth. This tells us the company became more profitable as it expanded.

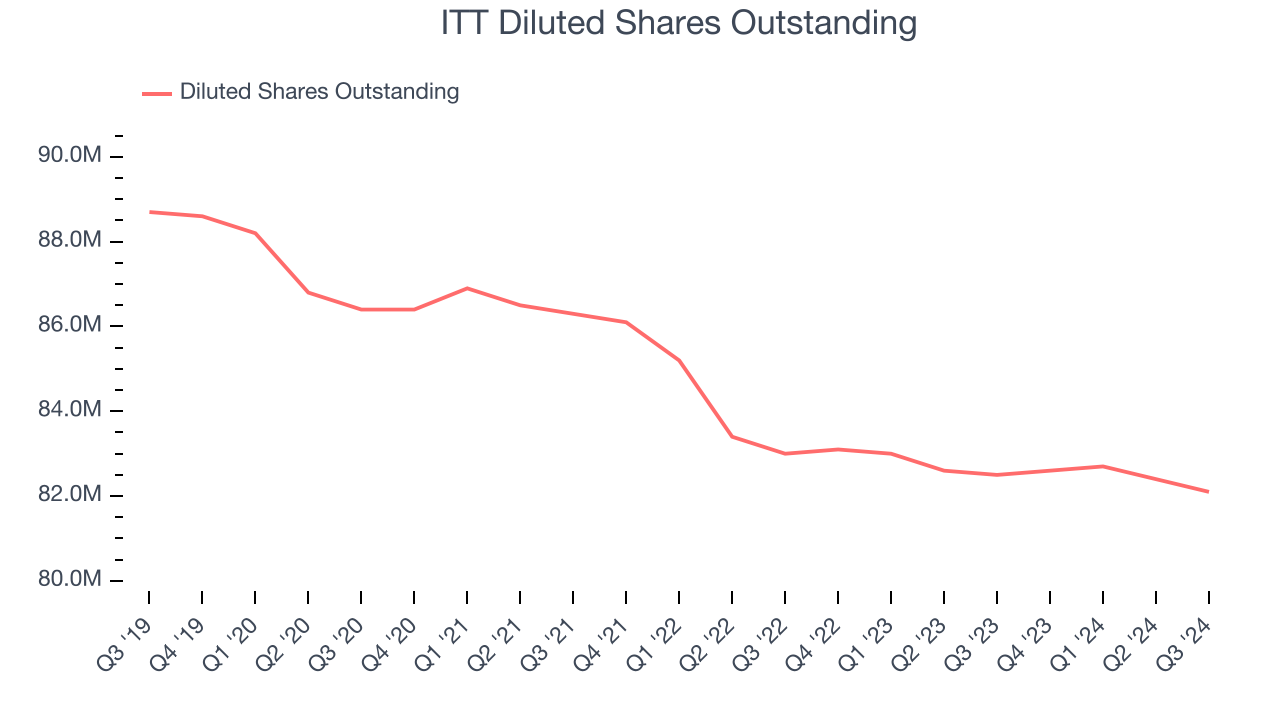

Diving into ITT’s quality of earnings can give us a better understanding of its performance. As we mentioned earlier, ITT’s operating margin expanded by 12 percentage points over the last five years. On top of that, its share count shrank by 7.4%. These are positive signs for shareholders because improving profitability and share buybacks turbocharge EPS growth relative to revenue growth.

Like with revenue, we analyze EPS over a more recent period because it can give insight into an emerging theme or development for the business.

For ITT, its two-year annual EPS growth of 16.4% was higher than its five-year trend. This acceleration made it one of the faster-growing industrials companies in recent history.In Q3, ITT reported EPS at $1.46, up from $1.37 in the same quarter last year. This print beat analysts’ estimates by 1.8%. Over the next 12 months, Wall Street expects ITT’s full-year EPS of $5.71 to grow by 10.9%.

Key Takeaways from ITT’s Q3 Results

We were impressed by how significantly ITT blew past analysts’ EBITDA expectations this quarter. We were also glad management slightly raised its full-year EPS guidance. On the other hand, its organic revenue missed. Overall, this quarter had some key positives. The stock remained flat at $145 immediately following the results.

Is ITT an attractive investment opportunity at the current price?What happened in the latest quarter matters, but not as much as longer-term business quality and valuation, when deciding whether to invest in this stock. We cover that in our actionable full research report which you can read here, it’s free.