Freight delivery company Heartland Express (NASDAQ: HTLD) missed Wall Street’s revenue expectations in Q3 CY2024, with sales falling 11.9% year on year to $259.9 million. Its GAAP loss of $0.12 per share was also 1,027% below analysts’ consensus estimates.

Is now the time to buy Heartland Express? Find out by accessing our full research report, it’s free.

Heartland Express (HTLD) Q3 CY2024 Highlights:

- Revenue: $259.9 million vs analyst estimates of $268.4 million (3.2% miss)

- EPS: -$0.12 vs analyst estimates of -$0.01 (-$0.11 miss)

- EBITDA: $37.82 million vs analyst estimates of $47.24 million (19.9% miss)

- Gross Margin (GAAP): 27.3%, up from 25.3% in the same quarter last year

- Operating Margin: -2.7%, in line with the same quarter last year

- EBITDA Margin: 14.6%, in line with the same quarter last year

- Market Capitalization: $893.3 million

Heartland Express Chief Executive Officer Mike Gerdin commented on the quarterly operating results and ongoing initiatives of the Company, "Our consolidated operating results for the three and nine months ended September 30, 2024, continue to be hampered by a challenging freight environment. This prolonged recessionary period continues to be driven by a combination of lower freight demand and excess truck capacity in the marketplace. This significant imbalance of supply and demand for trucking services began in the back half of 2022, continued in 2023, and through September 30, 2024 we did not see meaningful or sustained improvements in the freight environment. We believe that the last four quarters of this current freight cycle are arguably the worst four consecutive quarters experienced in the trucking industry over the Company’s 45+ year history. As a result, our trucking assets have been underutilized. However, in October we have begun to see encouraging signs pointing to the early stages of a potential recovery in freight demand, but we do not expect impactful improvement until 2025."

Company Overview

Founded by the son of a trucker, Heartland Express (NASDAQ: HTLD) offers full-truckload deliveries across the United States and Mexico.

Ground Transportation

The growth of e-commerce and global trade continues to drive demand for shipping services, especially last-mile delivery, presenting opportunities for ground transportation companies. The industry continues to invest in data, analytics, and autonomous fleets to optimize efficiency and find the most cost-effective routes. Despite the essential services this industry provides, ground transportation companies are still at the whim of economic cycles. Consumer spending, for example, can greatly impact the demand for these companies’ offerings while fuel costs can influence profit margins.

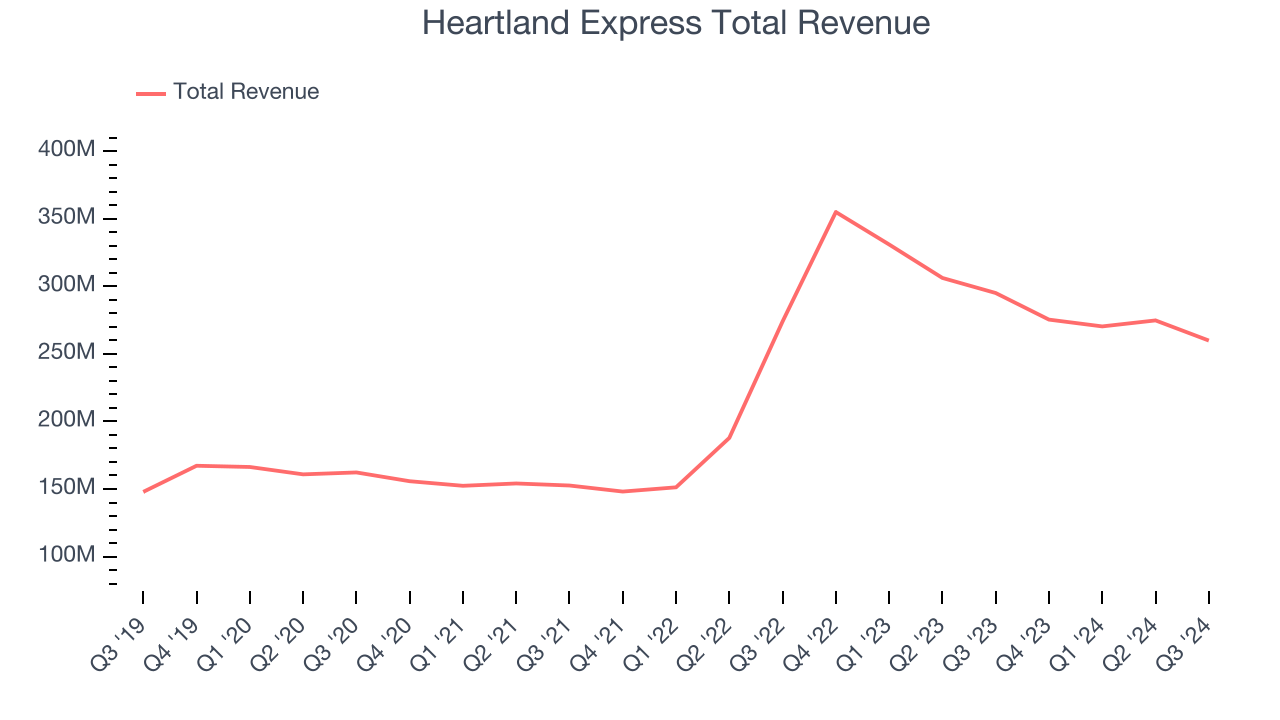

Sales Growth

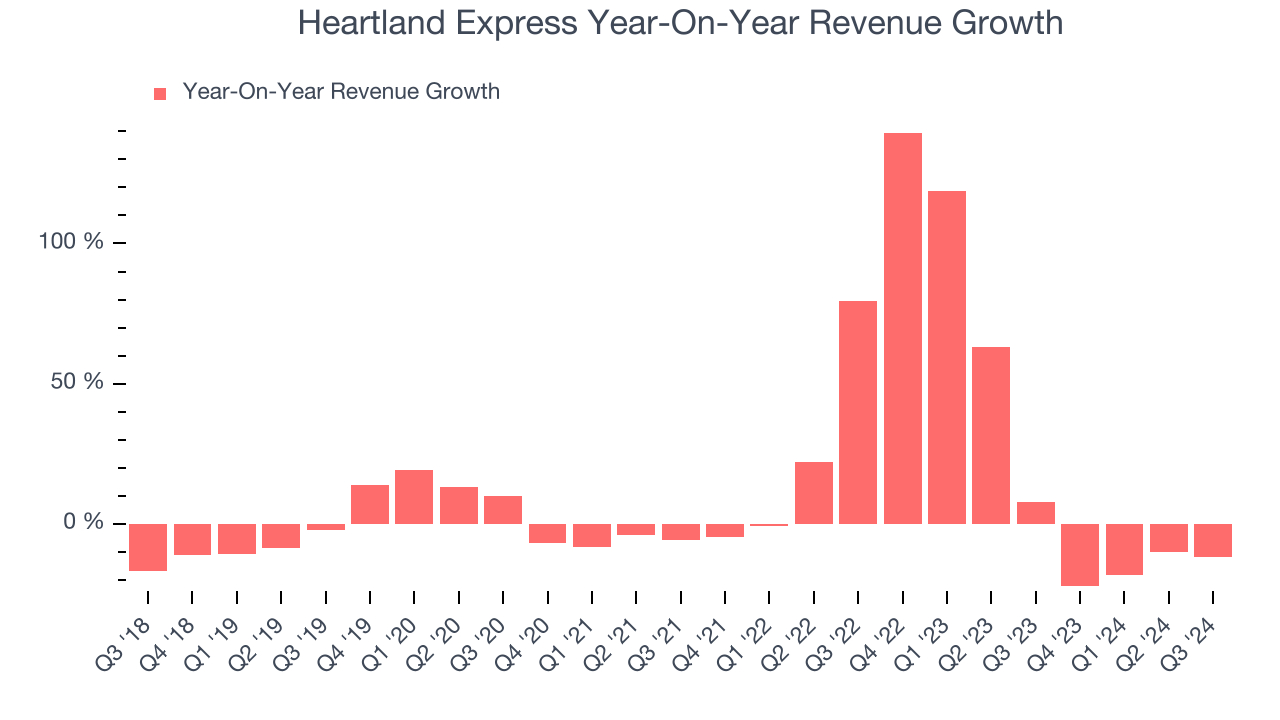

Examining a company’s long-term performance can provide clues about its business quality. Any business can put up a good quarter or two, but the best consistently grow over the long haul. Over the last five years, Heartland Express grew its sales at an excellent 13.4% compounded annual growth rate. This is a useful starting point for our analysis.

Long-term growth is the most important, but within industrials, a half-decade historical view may miss new industry trends or demand cycles. Heartland Express’s annualized revenue growth of 19.1% over the last two years is above its five-year trend, suggesting its demand was strong and recently accelerated. Heartland Express recent history stands out, especially when considering many similar Ground Transportation businesses faced declining sales because of cyclical headwinds.

This quarter, Heartland Express missed Wall Street’s estimates and reported a rather uninspiring 11.9% year-on-year revenue decline, generating $259.9 million of revenue.

We also like to judge companies based on their projected revenue growth, but not enough Wall Street analysts cover the company for it to have reliable consensus estimates.

When a company has more cash than it knows what to do with, buying back its own shares can make a lot of sense–as long as the price is right. Luckily, we’ve found one, a low-priced stock that is gushing free cash flow AND buying back shares. Click here to claim your Special Free Report on a fallen angel growth story that is already recovering from a setback.

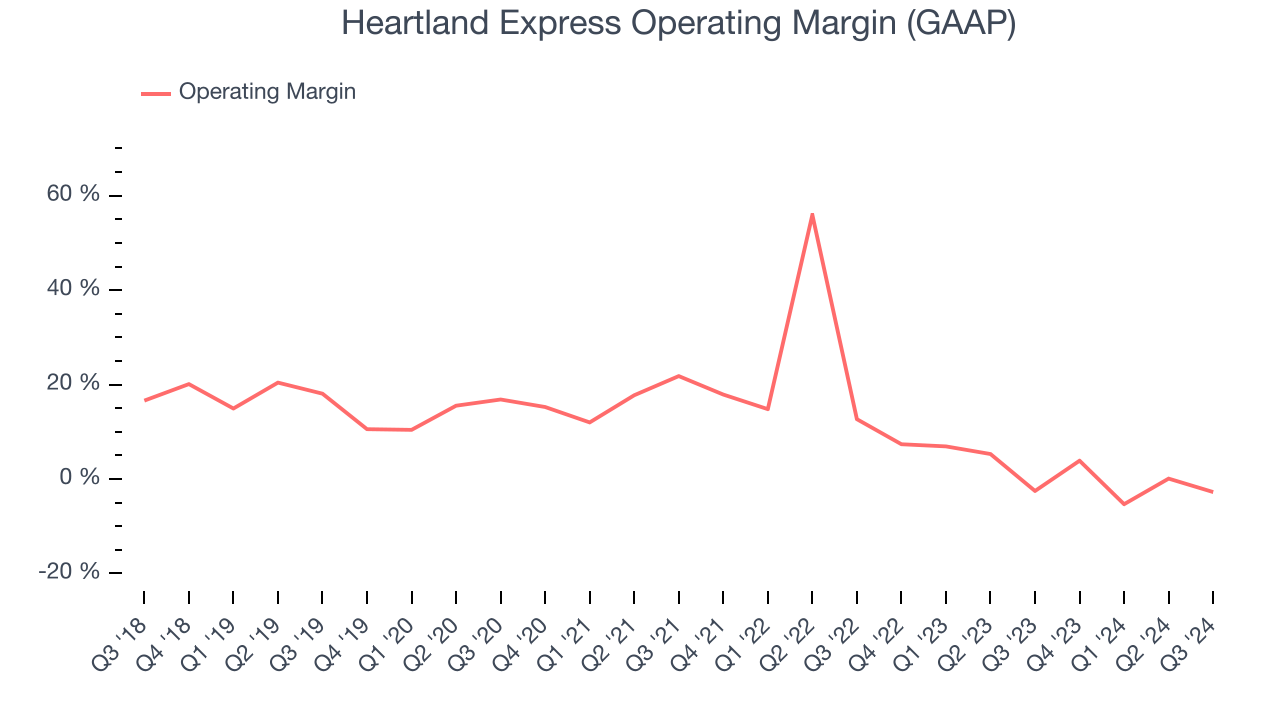

Operating Margin

Operating margin is a key measure of profitability. Think of it as net income–the bottom line–excluding the impact of taxes and interest on debt, which are less connected to business fundamentals.

Heartland Express has done a decent job managing its cost base over the last five years. The company produced an average operating margin of 9.7%, higher than the broader industrials sector.

Analyzing the trend in its profitability, Heartland Express’s annual operating margin decreased by 14.3 percentage points over the last five years. Even though its margin is still high, shareholders will want to see Heartland Express become more profitable in the future.

This quarter, Heartland Express generated an operating profit margin of negative 2.7%, in line with the same quarter last year. This indicates the company’s cost structure has recently been stable.

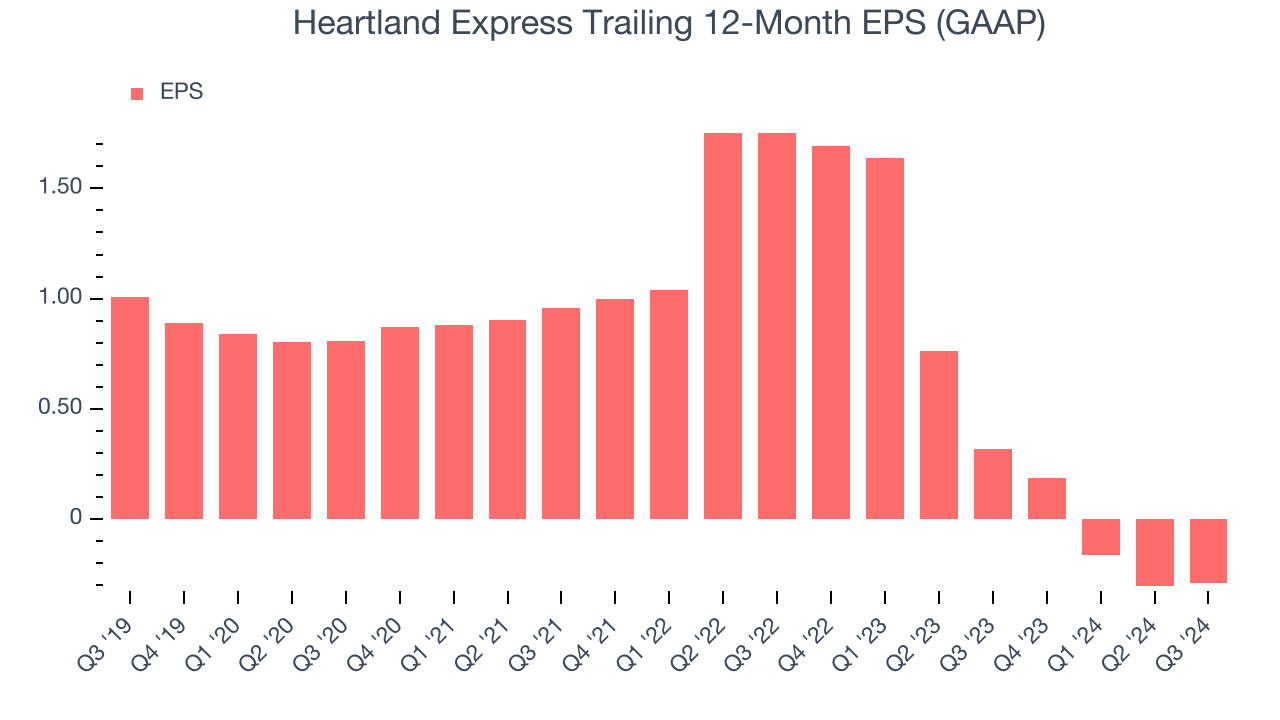

Earnings Per Share

We track the long-term change in earnings per share (EPS) for the same reason as long-term revenue growth. Compared to revenue, however, EPS highlights whether a company’s growth was profitable.

Sadly for Heartland Express, its EPS declined by 18% annually over the last five years while its revenue grew by 13.4%. This tells us the company became less profitable on a per-share basis as it expanded.

We can take a deeper look into Heartland Express’s earnings to better understand the drivers of its performance. As we mentioned earlier, Heartland Express’s operating margin was flat this quarter but declined by 14.3 percentage points over the last five years. This was the most relevant factor (aside from the revenue impact) behind its lower earnings; taxes and interest expenses can also affect EPS but don’t tell us as much about a company’s fundamentals.

Like with revenue, we analyze EPS over a more recent period because it can give insight into an emerging theme or development for the business.

For Heartland Express, its two-year annual EPS declines of 47.2% show it’s continued to underperform. These results were bad no matter how you slice the data.In Q3, Heartland Express reported EPS at negative $0.12, up from negative $0.14 in the same quarter last year. Despite growing year on year, this print missed analysts’ estimates. Over the next 12 months, Wall Street is optimistic. Analysts forecast Heartland Express’s full-year EPS of negative $0.29 will reach break even.

Key Takeaways from Heartland Express’s Q3 Results

We struggled to find many strong positives in these results. Its revenue unfortunately missed and its EBITDA fell short of Wall Street’s estimates. Overall, this was a softer quarter. The stock traded down 2.5% to $11.10 immediately after reporting.

Heartland Express’s latest earnings report disappointed. One quarter doesn’t define a company’s quality, so let’s explore whether the stock is a buy at the current price. If you’re making that decision, you should consider the bigger picture of valuation, business qualities, as well as the latest earnings. We cover that in our actionable full research report which you can read here, it’s free.